What Are Derogatory Marks and How Do I Remove Them?

Published on: 09/28/2021

Derogatory marks are negative items on your payment history. They can be caused by a variety of things including failing to pay a utility bill or missing payments on a loan. It takes years for derogatory marks to be removed from your credit report, so it’s important to know what causes them and how to avoid them.

How do derogatory marks impact my credit score?

Negative information is passed along to the three major credit reporting agencies (Experian, TransUnion and Equifax) and can lower your credit score as compiled by FICO® and VantageScore.

Worse, negative marks can pile up over time. Each missed payment will count against you, and as they accumulate, they can put you in danger of even more bad credit in the form of things like foreclosure and repossession.

Regardless, the more payments you miss, the more it will hurt your credit, whether you’re talking about payments to credit card companies, on personal loans, or to a mortgage lender.

How long do derogatory marks stay on your credit report?

Typically, derogatory marks can stay on your credit history for seven years. Chapter 7 bankruptcy can stay on your credit report for up to ten years.

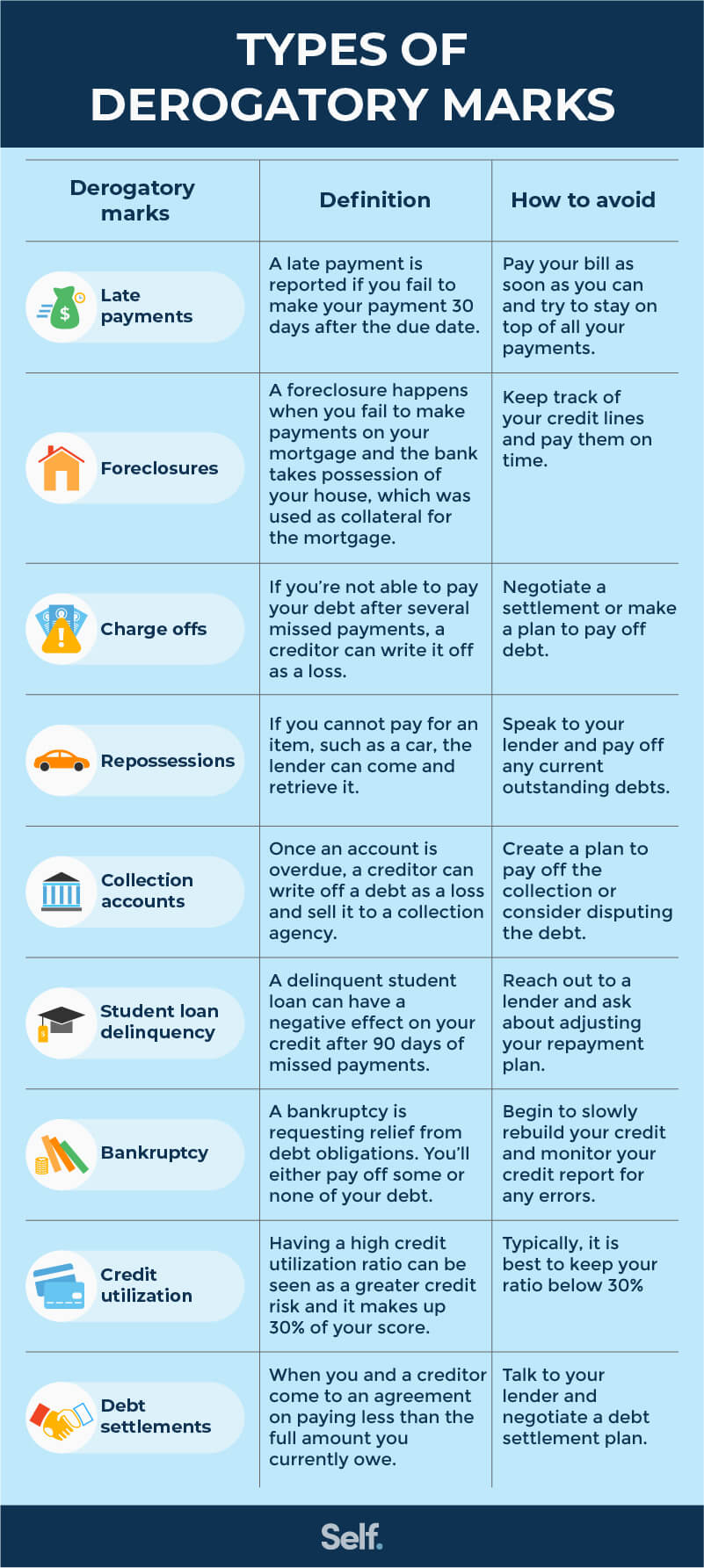

Types of derogatory marks

You can build good credit by making your payments on time. That’s the biggest chunk (35%) of your FICO® score. Conversely, missing payments is the most common way of damaging your credit score. In fact, missing payments is the key factor that results in most derogatory marks. The following list explains different types of derogatory marks that may appear on a credit report.

1. Late payments

Late payments won’t appear as derogatory marks on your credit report if you’re just a few days past due. But if you fail to make your payment within 30 days of the due date, your bill becomes delinquent and begins to have a negative impact on your credit score.

Sometimes, late payments are incorrectly reported or may appear on your credit report due to fraud. In such cases, you’ll want to dispute the derogatory mark so you can have the mistaken late payment removed from your credit history.

Even if it’s already 30 days past due, you should resolve the debt as soon as possible to avoid another negative mark when 60 days have passed — and worse trouble down the road. Your lender can write off or charge off bad debt by selling it to a collection agency if you let your payments become seriously delinquent.

Lenders and debt collectors can go to court and obtain a civil judgment against you, and you could find your wages or bank account garnished to pay the debt.

2. Foreclosures

The term “foreclosure” typically applies to mortgaged property. A foreclosure occurs when you’ve failed to make mortgage payments on a loan and it goes into default, typically after a period of several months. The foreclosure process averages 830 days in length, but that figure can differ greatly depending on what state you’re in.[1]

A foreclosure is allowed because the property — often a home — acts as collateral on the portion of the loan that remains unpaid.

A foreclosure can damage your credit score by 85-160 points. If a foreclosure was reported in error on your credit report, it’s important to work toward getting the mistaken foreclosure removed as soon as possible. If it’s accurate, however, there’s not much you can do: It will remain on your credit report for seven years.[2]

3. Charge-offs

A charge-off occurs when a creditor basically gives up on trying to collect a debt and “charges it off” as uncollectible. But that doesn’t mean you’re off the hook. Typically, the lender will sell your debt to a collection agency, which will continue trying to collect what you owe — you just owe it to someone else now.

In the meantime, the charge-off hurts your credit score, although most of the damage has already been done by the missed payments that got you to that point. A charge-off usually occurs after 120 to 180 days, which means you’ll have missed four to six payments by then and your credit report already will have taken repeated “hits.” See our related article about how to remove a charge-off from your credit report.

4. Repossessions

A repossession is similar to a foreclosure. In both cases, a lender is taking back something you’ve stopped making payments on, but in this case, it’s a vehicle instead of a home or property.

While a foreclosure generally takes time, a repossession can occur relatively quickly. Some states allow repossessions after just a single missed payment, and without providing any notice. If you miss a car payment, you should contact the lender as soon as possible to see if you can come up with a payment plan.[3] If you can’t, you may be forced to relinquish the vehicle.

A repossession will also appear in the public records portion of your credit report, which consists of records on file with courts. Meanwhile, the late payments that led to the repossession will create derogatory marks on your credit report and hurt your credit score.

5. Collection accounts

While both foreclosure and repossession involve defaults on secured loans (secured by collateral), other types of loans are unsecured. That means the loan was granted without the borrower putting up any collateral. In cases where these loans go into default, they are often sold to a collection agency. This often happens after a charge-off (see above), or a lender may have its own collections department to handle these delinquent accounts.

If a defaulted loan is sold to a collection agency, the collection account can show up on your credit report, and this can have a serious negative effect on your credit scores.

6. Student loan delinquency

Unlike other late payments, which go into delinquency and are reported to credit bureaus after 30 days, past-due payments on student loans don’t get reported until they’re 90 days late. That’s when they will begin to affect your credit score. See our related article about disputing student loans on credit reports

However, if you default on a student loan, you’ll be responsible for repaying the entire sum immediately. At that point, you’re no longer eligible for deferments or for any further student aid in the future. You can be taken to court, your wages can be garnished, and you may be responsible for court costs and attorney’s fees. Tax refunds and other federal benefits may also be withheld as a Treasury offset.[4]

That’s why it’s important to contact the organization that handles billing for your student loan. Some student loans are issued by the government, while others are made by private organizations.

7. Bankruptcy

Bankruptcy is a process undertaken in federal court to resolve a borrower’s debts and give them a clean slate, but it isn’t without consequences. Bankruptcy can give a borrower, whether it’s an individual or a business, a chance to be free of debt.

However, bankruptcies can be very damaging to your credit report and can remain on your credit history for seven to 10 years. Bankruptcies fall into three categories: Chapter 7 bankruptcies, in which assets are liquidated to pay creditors; Chapter 11, which can allow for reorganizations; and Chapter 13 bankruptcy, which reduces debt and sets up payment plans — known as “wage earner’s plans” — over three to five years.[4]

8. High credit utilization ratio

A high credit utilization ratio can also create derogatory marks on your credit score. The ratio, generally expressed as a percentage, is calculated by adding up the balance on all your credit cards and dividing it by your total credit limit. So if you have two credit cards with balances of $200 and $400, and credit limits of $1,000 and $800, respectively, you’d divide $600 by $1800 and come up with a 33% credit utilization ratio.

It’s considered a good idea to keep your ratio below 30%, but one study showed that consumers with credit scores above 750 (in the “very good” to “excellent” range on the FICO chart) use less than 10% of their available credit.[6]

9. Debt settlements

Settling a debt will get a creditor off your back and resolve the debt, but it will still affect your credit score. This is because your credit report will reflect that you paid less than the full amount.

Still, settling an account is better than not paying anything, and if you can’t afford to pay the full amount, writing a debt settlement letter in an attempt to negotiate a deal you and the lender can both accept may be a good option.

How to remove derogatory items from your credit report

Derogatory items can only be removed from your credit report if they’re incorrect. But errors do happen, and fraud is committed, so it’s important to be on the lookout for mistakes on your credit report and do what you can to resolve them.

Dispute credit report errors

Keep up to date on your credit status by ordering a free credit report at annualcreditreport.com. Check it thoroughly to see if you notice anything that appears suspicious, such as a delinquent charge you don’t recall making on your credit card.

You can dispute any errors you find by mailing a letter to the credit reporting agency. Include your contact information and identify the specific nature of the error. Include copies of paperwork, such as signed receipts, that document your case, as well as dates, amounts, and other relevant information. State your reason for disputing the item(s) and the information you want to have corrected.[7]

The reporting agencies must investigate your dispute and forward your documents to the company that reported the information. If you are found to be in the right, that company will have to contact all the credit reporting agencies with the correct information so it can be updated.[6]

Wait for each derogatory item to fall off your credit report

If it turns out no error has been made, the best thing to do is to stick it out until the derogatory mark expires.

In the meantime, improve your credit by making consistent on-time payments, understanding how credit scores are calculated, maintaining a low credit utilization ratio, avoiding too many requests for new credit, and reviewing your credit reports regularly.

Send a goodwill letter

If you still have a late payment or delinquency on your credit report but have since paid the debt, you can write your creditor what’s known as a goodwill letter asking to have the derogatory mark removed. The creditor is under no obligation to do so, but may consider it in hardship cases (a lost job, medical expense, etc.) or as an act of — as the name implies — goodwill.

Alternatively, you can also offer to pay to have the mark deleted by writing a “pay for deletion” letter. Again, the creditor is under no obligation to accept your offer, but it’s worth trying.

How to build credit after a derogatory mark?

After you’ve received a derogatory mark, it’s not the end of the world. Even if you can’t have it removed, you could still raise your credit score over time by making on-time payments, avoiding “hard” credit inquiries, paying off debt so you have more room on your credit cards, and taking steps to work with lenders.

It’s also important to know what debt to pay off first, such as revolving debt and high-interest loans.

The bottom line

Derogatory marks do hurt your credit score, and some can be more damaging than others. The more payments you miss, the more hits your credit will take.

The best things you can do are stay on top of your personal finances, make sure there aren’t any errors on your credit report, keep your credit manageable, maintain a good credit mix, and work with your creditors if you get in trouble.

And, again, make your payments on time, because that’s the biggest part of your credit score.

The better your credit, the more likely you are to be approved for loans and get favorable interest rates, which can save you a lot of money in the long run.

Sources

- Investopedia. “What Is Foreclosure?” https://www.investopedia.com/terms/f/foreclosure.asp. Accessed August 12, 2021.

- FICO. “Research Looks at How Mortgage Delinquencies Affect Scores,” https://www.fico.com/blogs/research-looks-how-mortgage-delinquencies-affect-scores. Accessed September 27, 2021.

- Consumer Financial Protection Bureau. “If I can’t make my auto loan payments, will my vehicle be repossessed?” https://www.consumerfinance.gov/ask-cfpb/if-i-cant-make-my-auto-loan-payments-will-my-vehicle-be-repossessed-en-857/. Accessed August 12, 2021.

- Federal Student Aid. “Student Loan Delinquency and Default,” https://studentaid.gov/manage-loans/default. Accessed August 12, 2021.

- Investopedia. “What is Bankruptcy?” https://www.investopedia.com/terms/b/bankruptcy.asp. Accessed August 12, 2021.

- CNBC. “What is a credit utilization rate and how to calculate yours,” https://www.cnbc.com/select/what-is-credit-utilization-rate/. Accessed August 12, 2021.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed August 12, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).