How to Remove Covington Credit from Your Credit Report

Published on: 02/05/2023

If you spot Covington Credit on your credit report or receive phone calls from them asking to repay a certain debt, you may be wondering how to make it all stop. If your credit report reflects a false or incorrect collection account balance from Covington Credit, you can take steps to remove it. In this post, we explain just who Covington Credit is and how to remove inaccurate items involving Covington Credit from your credit report.

What is Covington Credit?

Covington Credit is a financial services provider that offers short-term personal loans to people who don’t typically qualify for most types of credit. Although Covington Credit is a loan company, not a debt collection agency, this operation also serves as its own debt collector.[1]

Contact information:

- Website: www.mymoneytogo.com/covington-credit/

- Phone number: 1-866-413-1836

- Headquarters address: 101 N. Main St., Ste. 600, Greenville, SC 29601

- Mailing address: P.O. Box 1947, Greenville, SC 29602

Covington Credit is a lender that operates under a company called Heights Finance.[2] Covington Credit is part of the four lenders that make up the MyMoneyToGo family of consumer finance companies which has a strong online presence as well as 300 branches across Alabama, Georgia, Oklahoma, South Carolina, Tennessee and Texas.[1]

Heights Finance is accredited by the Better Business Bureau (BBB) with a rating of A+, which is the highest rating the BBB provides. To be a BBB-accredited business, the BBB determines that a business has met certain accreditation standards, including making a good faith effort to find a solution to consumer complaints.[3]

As of December 2021, Curo Group Holdings recently acquired Heights Finance, the former parent organization of Covington Credit, Southern Finance and Quick Credit.[4] Curo is a publicly traded company that has been in the short-term loan industry since 1997.

Although Covington Credit isn’t a collection agency, it collects on the loans and other products it sells to its customers. In this arrangement, the company serves as both the original creditor and its own debt collector when clients fail to make payments on the schedule they agreed to.

Will Covington Credit sue or garnish your wages?

If Covington Credit sues you in court and receives a judgment against you, it may have legal grounds to garnish your wages or freeze your bank account, depending on the state in which you live. However, some federal benefits directly deposited into your account, such as Social Security and VA benefits, may be protected against garnishment.[5]

If you have been sued by Covington Credit but believe you are not responsible for the debt, you may want to seek advice from an attorney or law firm specializing in collections cases.[6]

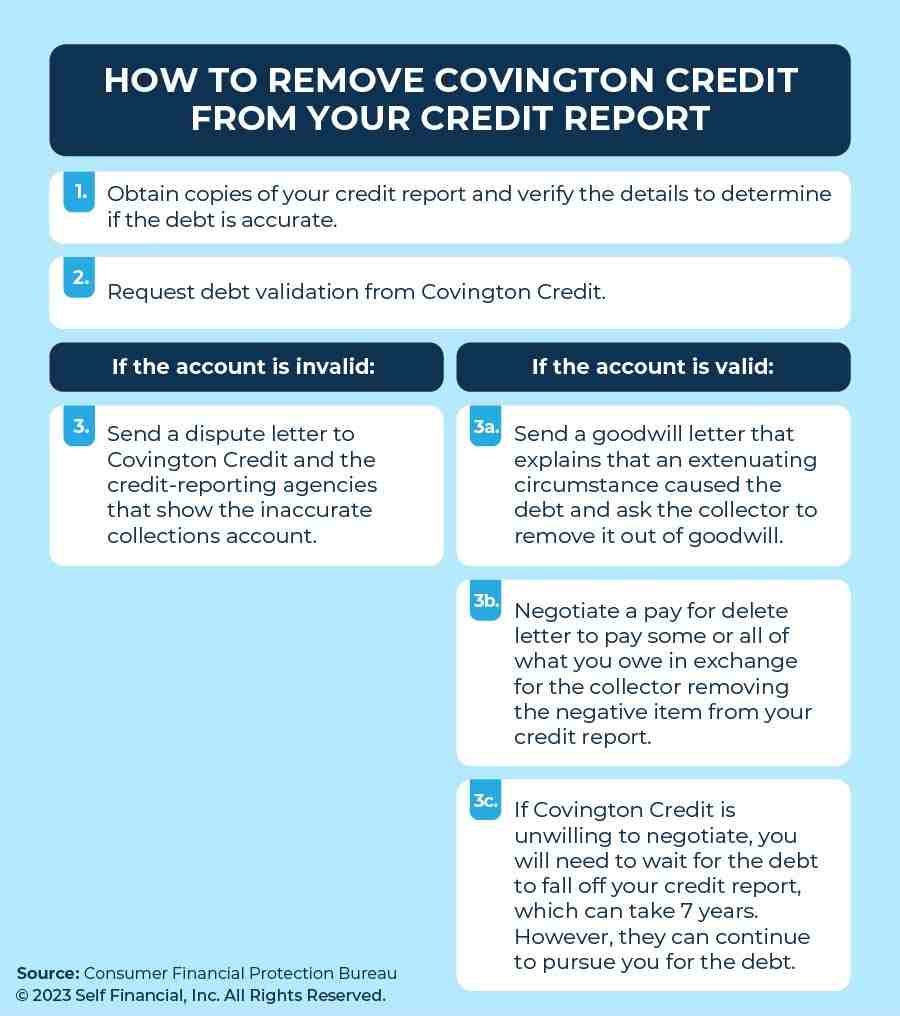

How to remove Covington Credit from your credit report

Each delinquent debt reported on your credit report can impact your credit score, so you can try removing a collections account or a debt that is listed in error on your credit report by following the steps below.

Request debt validation

If you have been contacted about a debt you owe, request a debt validation letter from Covington Credit. In the letter, ask the company to send you proof that you owe the debt and ask for verification of the amount and all the details regarding the debt.

Under the Fair Debt Collection Practices Act (FDCPA), collectors are required to send you a debt validation notice within five days of their first contact with you.[7] This letter should include the date that the debt turned delinquent as well as all information that connects the debt to you.

After you receive a letter from Covington Credit with the information you requested, review the details and record any errors you see.

Obtain copies of your credit reports

You should also verify which bureaus the collection account was reported to by requesting a copy of each of your credit reports from the three major credit bureaus (Equifax, Experian and TransUnion. You can also get a free copy once a year at annualcreditreport.com to check your credit.

If the debt is inaccurate, dispute it

If debt validation letter doesn’t prove that you owe the debt or the company does not provide you with proof of debt, you can write a dispute letter to Covington Credit and any of the three major credit reporting agencies that listed the debt in error. Submit with the letter any evidence that you don’t owe the debt and request that the collection be removed from your credit report.

Upon receiving the validation letter, you have 30 days to send a dispute letter with specific information about your grounds for disputing the debt. The Federal Trade Commission offers a sample dispute letter online that you can use as a template.[8]

If the debt is accurate, negotiate a settlement, a pay for delete or goodwill removal

If the validation letter does prove that you owe the debt listed, you can offer to negotiate a settlement or installment plan to close the collection account. Closing a collection account through a negotiated settlement may be better than leaving it unpaid and open, just waiting for it to drop off your credit record.

Only inaccuracies can be disputed and removed, so the only other options for removing accurate debt from your credit report is to negotiate a pay for delete or request a goodwill removal. While you may negotiate one of these successfully, bear in mind that debt collectors furnish data according to the Fair Credit Reporting Act (FCRA), which means they are obligated to report accurate debts. Even if they agree to a pay for delete or goodwill deletion, they may not follow through with it and can still report the debt.

Pay for delete

Once you’ve received notice of the debt you owe, you can try to negotiate a pay for delete, asking Covington Credit to remove the debt from your credit reports in exchange for you paying off the agreed-upon debt amount. Through this method, you would request a pay for delete, in writing, asking Covington Credit to accept the payment amount you are able, or willing, to pay to have the debt removed. However, debt collection companies may deny your request, and even if they do accept it, they can’t remove the negative mark from the original creditor and are under no obligation to remove the collection from your credit history.[9]

Even if the account still appears on your credit report, it’s beneficial to pay your debt because some credit scoring models do not penalize you for paid collections. These include FICO® 9, VantageScore® 3.0 and VantageScore® 4.0.[10]

Goodwill removal

Another way to try and remove Covington Credit from your credit score is with a goodwill letter. The letter explains why the debt occurred and provides proof that this was an extenuating circumstance to your otherwise consistent payment history. For example, you lost your job or had a medical emergency.[11]

Like a pay for delete, a goodwill letter is not an official strategy and is not guaranteed to work. The Federal Trade Commission states that if negative information is accurate, it will simply take time to go away.[12]

Understand your rights

Understanding your rights under the FDCPA helps you navigate accounts sent to collections. Creditors cannot be abusive, unfair or deceptive. You can report any problems with debt collection to the Federal Trade Commission, the Consumer Finance Protection Bureau or your state’s attorney general.

Under the FDCPA, debt collectors cannot [13]:

- Threaten customers with actions they cannot legally perform

- Represent themselves falsely (such as pretending to be a law firm)

- Use obscene language when communicating with consumers

- Publish names on a list of alleged debtors

- Call you before 8 a.m. or after 9 p.m. in your time zone unless you give them permission

- Contact you at work without your permission

If you plan to dispute a debt, notify the debt collector in writing within 30 days of being notified of the debt to ask for verification. You should send your request via certified mail so there is a record the creditor received it. In response to your written request, the agency must cease debt collection efforts while it confirms the validity of the obligation. Because records are easily mixed up, debt collectors have to mail the name and address of the original creditor to you. You can use this information to determine if you actually owe this debt.[14]

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Covington Credit. https://www.mymoneytogo.com/covington-credit/. Accessed on June 1, 2022.

- Better Business Bureau. “Heights Finance.” https://www.bbb.org/us/sc/greenville/profile/consumer-finance-companies/heights-finance-0673-12002497/complaints. Accessed on June 1, 2022.

- Better Business Bureau. “Exclusive Programs and Services.” https://www.bbb.org/get-accredited. Accessed on October 21, 2022.

- Curo Group Holdings. “Curo Completes Acquisition of Heights Finance.” https://ir.curo.com/news-releases/2021/12-28-2021-210524312. Accessed June 1, 2022.

- Consumer Financial Protection Bureau. “Can a debt collector garnish my bank account or my wages?” https://www.consumerfinance.gov/ask-cfpb/can-a-debt-collector-garnish-my-bank-account-or-my-wages-en-1439/. Accessed on May 26, 2022.

- Consumer Financial Protection Bureau. “How do I find a lawyer or attorney to represent me in a lawsuit by a creditor or debt collector?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-find-a-lawyer-or-attorney-to-represent-me-in-a-lawsuit-by-a-creditor-or-debt-collector-en-1433/. Accessed on September 26, 2022.

- Federal Trade Commission. “Debt Collection FAQs”. https://consumer.ftc.gov/articles/debt-collection-faqs. Accessed on June 1, 2022.

- Federal Trade Commission. “Sample Letter Disputing Errors on Credit Reports to the Business that Supplied the Information.” https://consumer.ftc.gov/articles/sample-letter-disputing-errors-credit-reports-business-supplied-information. Accessed October 21, 2022.

- Forbes. “Pay For Delete: Learn About This Collection Removal Strategy.” https://www.forbes.com/advisor/credit-score/pay-for-delete/. Accessed October 21, 2022.

- Experian. “Can Paying off Collections Raise Your Credit Score?” https://www.experian.com/blogs/ask-experian/can-paying-off-collections-raise-your-credit-score/. Accessed October 21, 2022.

- Credit Karma. “Goodwill letters: What you need to know.” https://www.creditkarma.com/advice/i/goodwill-letter. Accessed October 21, 2022.

- Federal Trade Commission. “Fixing Your Credit FAQs.” https://consumer.ftc.gov/articles/fixing-your-credit-faqs. Accessed October 21, 2022.

- Consumer Financial Protection Bureau. “What is an Unfair Practice by a Debt Collector?” Debt Collection.” https://www.consumerfinance.gov/ask-cfpb/what-is-an-unfair-practice-by-a-debt-collector-en-1401/. Accessed on June 1, 2022.

- Federal Trade Commission. “Fair Debt Collection Practices Act.” https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text. Accessed on June 1, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).