What to Know About Self’s Unsecured Credit Limit Increase

Published on: 02/09/2021

If you’re familiar with Self, you may have already experienced the benefits of having a Credit Builder Account, or gained access to your own Self Visa® credit card.

But does the Self credit card become unsecured? In response to Self builders' feedback, we’ve added a third way for you to keep building your credit.

If you qualify, you could gain access to an unsecured credit limit increase on your existing Self secured credit card.

Here’s what you need to know about the latest addition.

In this article

- What is Self’s unsecured credit limit increase?

- Who can get it and how is it different from the secured card?

- Why does a credit limit increase matter and how could it help me build credit?

- How to get started + where to go to learn more

What is Self’s unsecured credit limit increase and how is it different from the secured credit card?

Watch this short video or read on to find out more.

Unlike credit that is secured by a deposit or piece of property (think secured card or home loan, for example), unsecured credit is secured only by your credit history and financial background.

The secured credit card at Self has a security deposit that is equal to your credit limit, and is secured by money you already paid into your Credit Builder Account.

For example:

If you paid $300 into your Credit Builder Account, and set aside $200 for the deposit on your secured card, your credit limit on that card is $200.

Once unsecured credit is added to your Self card though, your credit limit will be higher than your security deposit.

For example:

Once unsecured credit is added, you may have a security deposit of $200 but a credit limit of $275.

Otherwise, you’ll keep the same Self card the whole time, using it and paying it like you always have. Just with a higher credit limit.

Download the Self app to track your progress towards the Self Visa® Credit Card.

Who can get the unsecured credit limit increase at Self?

Unlike other credit cards, where you apply and then may or may not get approved (dinging your credit with a hard inquiry in the process), we automatically add unsecured credit to your card if you qualify. We then send you a note to let you know.

Just like with the Self Credit Builder Account and Self Visa credit-builder card, there is no hard credit pull to qualify for the unsecured credit limit increase at Self.

While we do review your credit history, we do a soft credit inquiry instead, which doesn’t impact your credit score. We still look at things like your income and behaviors on other credit accounts outside of Self too.

Learn about the difference between hard and soft credit inquiries here.

To qualify for the unsecured credit limit increase on your Self credit card, you must:

- Share your income with us. We’re required by law to review your ability to repay debt on a regular basis. Meaning? We have to know your income to evaluate whether you qualify for an unsecured credit limit increase.

- Have the Self secured card for at least 6 months or more. Only after at least 6 months or more of having your Self Visa® Credit Card will we review your credit and account history to see if you qualify for an unsecured credit limit increase.

- Have your Self account(s) in good standing. While your Self accounts must be in good standing, there’s plenty of other criteria we look at too. Your behavior across all your credit accounts (not just at Self) matters.

- Meet several other requirements too. While this list provides some direction, there are tons of other criteria we look at too, and an unsecured credit limit increase is not guaranteed.

Note: there is no application for the unsecured credit limit increase at Self. If you qualify, you’ll be notified.

Want to stay in the loop to see if you qualify for an unsecured credit limit increase? Download the app on iOS or Google Play and enable push notifications.

If not, we’ll also email you. Please add Self to your contacts to make sure the message doesn’t end up in your spam folder by accident.

Why does a credit limit increase matter and how could it help me build my credit?

Credit usage is a major factor in your credit score, and is a snapshot of how much of your total credit limit you use at a given point in time. It looks at both your usage on individual credit cards and your usage across all your credit cards.

Many experts recommend keeping your credit usage under 30%, though under 10% is better if possible, according to data from FICO.

There are two basic ways to lower your credit utilization:

- Keep your spending on your credit card(s) low or pay your balance down regularly.

- Increase your credit limit(s).

By offering the chance to increase your credit limit, the goal is to help make lowering your credit utilization as easy as possible for you, so you can keep building your credit.

There’s a big but here though…

If your credit limit increases, and you increase your credit card balance relative to the limit increase, the limit increase may not help you.

But:

If you keep your spending on the credit card the same or lower, or pay your balance down regularly, and your credit limit increases, you may see your credit score increase too.

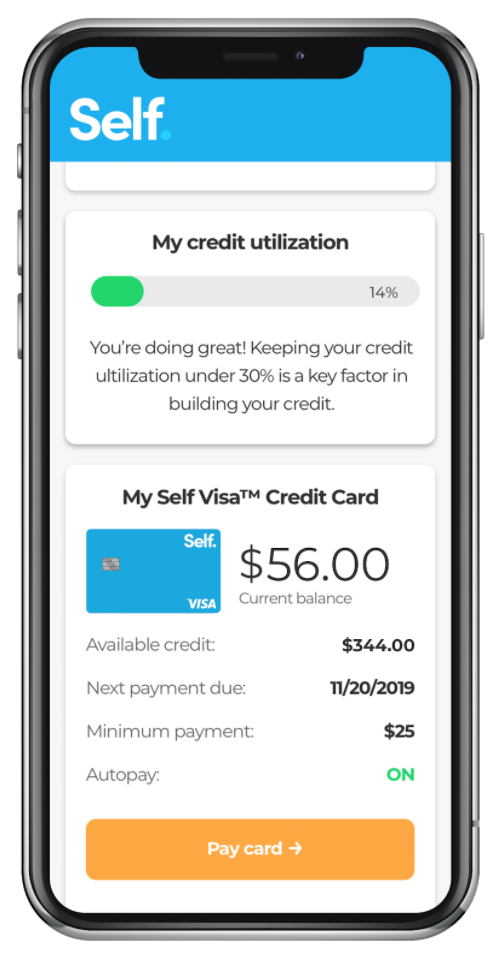

Track your credit usage in the Self app

To start building credit, you can now track your credit utilization on your Self card directly in the Self app.

As your balance increases or decreases on your card, we give you feedback on whether it may help your credit to pay your balance down.

Just download the app and log in to your Self credit card account today to view the tracker feature and track your usage.

Here’s a glimpse at what the credit utilization tracker looks like in action:

How do I get started and where can I go to learn more?

Self currently offers a three-step credit-building plan. Everyone has to start with step one.

Here’s how Self’s Credit Builder Plan works:

Step 1: Start with a Credit Builder Account.

Step 2: Over time, you could gain access to the Self credit card with a credit limit secured by your Credit Builder Account savings progress. Using this card responsibly could lead to future secured credit limit increases on the same card.

To be eligible for the chance to have a secured credit card through Self, you'll need an active Credit Builder Account in good standing, 3 on-time payments, $100 or more in savings progress after interest and fees, and satisfy income requirements. This criteria is subject to change.

Learn how to get the Self Visa® secured credit card here.

Step 3: Potentially get an unsecured credit limit increase on the Self credit card you already have.

If you successfully manage your Credit Builder Account and secured card with Self for a least 6 months or more, you may qualify for an unsecured credit limit increase on your Self Visa® Credit Card.

Our hope is this 3-step plan gives you a clear path to access and build your credit, so you can focus on building the life of your dreams.

Have more questions about Self’s unsecured credit limit increase? Check out our FAQs.

*All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or Atlantic Capital Bank, N.A. Member FDIC, Equal Housing Lender.

The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender.*

About the author

Lauren Bringle is an Accredited Financial Counselor® and Content Marketing Manager with Self Financial – a financial technology company with a mission to help people build credit and savings.