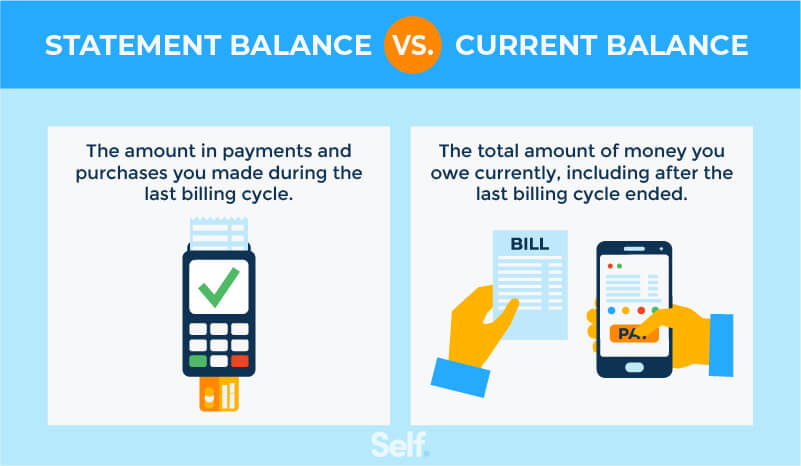

Statement Balance vs. Current Balance: What’s the Difference?

Published on: 01/07/2022

Have you ever thought you’d paid off your credit card only to find a balance above zero still showing?

That’s because the balance that shows up on your monthly statement may not always be the same as your current balance. Whether your statement balance and your current balance differ depends largely on when you’ve made purchases.

Here’s how it works: If charges you made on your credit card haven't been posted yet when you receive your statement, that statement won’t reflect your current balance. However, if you’ve paid your credit card statement balance in full, you won’t have to worry about paying interest on the rest as long as you pay it all off by your next due date.

What is my statement balance?

Your statement balance reflects purchases you’ve made on your credit card during the most recent billing cycle plus any unpaid balance that’s carried over from previous billing cycles.

What is a billing cycle, exactly?

Billing cycles typically vary between 28 and 31 days, but can be as little as 20 days or as long as 45. Your statement balance is created on the final day of your billing cycle, also known as the statement closing date.

Under the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) of 2009, a cardholder has a minimum of 21 days to pay the statement balance starting from the day your credit card billing cycle ends to the payment due date.[1] This is known as a “grace period,” during which no interest is paid on any new purchases you’ve made. These new purchases would be reflected in your current balance, but not on your statement balance.

Creditors are not required to offer a grace period, but if one is included in their plan, it can’t be less than 21 days.[1] You should therefore know what your plan entails before you sign up.

What is my current balance?

Your current balance is everything you owe. It includes whatever appears on your statement balance plus any new charges made after your last billing cycle ended.

Or, if you’ve paid off your statement balance in full, it will include only those new charges.

If you only use your credit card occasionally, there may not be any discrepancy between your current balance and your statement balance. However, if you use your credit card for everyday purchases such as groceries, chances are your current balance will be different.

As mentioned above, credit card companies that offer a grace period must give you at least 21 days to pay what you owe before interest starts accruing on any new purchases. There’s one notable exception to this rule: Cash advances have no grace period and begin accruing interest immediately. So if you’ve taken out a cash advance, it’s a good idea to pay your full current balance as soon as possible.

Cash advances aside, to avoid paying interest on your current balance, pay the entire balance off before the end of the grace period.

Should I pay my statement balance or my current balance?

At minimum, you should pay your statement balance.

If there’s a difference between your statement balance and current balance, the items included in your current balance will appear on the next statement. As long as you pay your credit card bill in full on your next statement date, you won’t incur interest.

Keep in mind that any balance you have on your card counts toward your overall credit utilization ratio (see below), which affects your credit score. To lower your credit utilization ratio or increase your available credit, you may want to pay your current balance.

How can I avoid interest charges on my statement balance?

If you don’t pay your statement balance in full by the due date of each billing cycle, the interest you owe will start to build. You can avoid this by setting up automatic payments from your bank account. You’ll be given the option to choose a specific amount, but many companies also offer “statement balance” as an option to select.

Of course, you may not be able to pay off the entire balance on your credit card bill every month, and if so, you may have to live with paying some interest on your account. Autopay can still help you, though. By selecting a specific amount to pay by your due date each month, you can avoid late payments and late fees.

This is important because a missed payment can damage your credit score. If a payment is more than 30 days late, it will be reported as delinquent to the three major credit bureaus. Negative marks such as these can stay on your credit report for seven years and impact your credit score.

This is why it’s a good idea to make your payments on time, even if you’re only making the minimum payment rather than the total amount. It’s always better to pay more than the minimum amount, because the more you pay, the less interest will accrue.

Another advantage to paying as much as you can afford is that doing so will keep you well below your credit limit. Keeping the amount you owe as low as possible in relation to your credit limit could help your credit score. We’ll explain why next.

How do my balances impact my credit score?

One major factor in your credit score is known as your credit utilization ratio. Under the FICO® credit scoring system, this accounts for 30% of your credit score.

Your credit utilization ratio is the amount of total credit card debt divided by your total credit limit on all your credit card accounts. For example, if you had three credit cards with a total balance of $1,500 and a combined credit limit of $5,000, your credit utilization ratio would be 1,500 divided by 5,000, or 30%.

Most experts suggest keeping your credit utilization rate at 30% or less, with 10% or less being optimum. Using your credit card wisely will also help you maintain a significant amount of available credit, so it’s there if you need it.

Your statement balance can affect your credit score by being too high in relation to your credit limit, but your current balance can affect it, too.

If your current balance is higher than your statement balance, and you’re making only partial payments on your statement balance every month, more interest will accumulate. This creates a higher credit utilization ratio and affects your credit score.

Pay your balance in full for better credit

Paying off your statement balance can help you keep your credit utilization ratio low and may boost your credit as a result.

The principle works whether you’ve got a long credit history or need to build your credit from the ground up.

If you need to build or rebuild credit, consider Self's secured credit card for building credit from Self. You secure a card by having $100 or more in savings progress, making at least three on-time monthly payments, and keeping your account in good standing.

Sources

- Federal Trade Commission. “Credit Card Accountability Responsibility and Disclosure Act of 2009,” https://www.ftc.gov/sites/default/files/documents/statutes/credit-card-accountability-responsibility-and-disclosure-act-2009-credit-card-act/credit-card-pub-l-111-24_0.pdf. Accessed September 10, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.