What is Available Credit and How Does It Differ From Credit Limit?

Published on: 01/12/2022

It’s worthwhile to understand available credit, especially as it compares to your credit limit. The more available credit you have in relation to your credit limit, the lower your credit utilization ratio will be, which is a positive signal to lenders.

What is available credit?

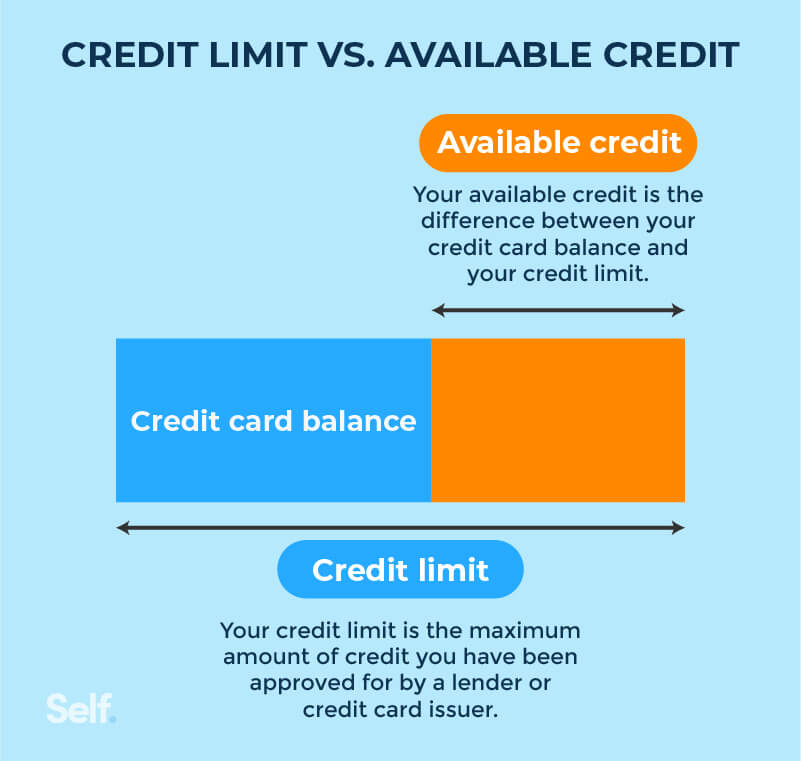

Your available credit is the amount of money you have available to spend on your credit card. You can determine how much available credit you have by subtracting how much you owe from your credit limit.

Your credit limit is the maximum amount of money you can borrow when you receive the card.

Available credit vs. credit limit

When you get a credit card, you’re given a credit limit. Your credit limit is the total amount you can spend on that card. As you use your card, your available credit changes though your credit limit does not. (There are times your credit limit can change, but we'll touch on that below.)

If you use your card to pay for a $500 television, your credit limit will still be $2,000, but your available credit will be $1,500.

Credit cards are the most well-known form of revolving credit. Revolving credit doesn’t operate like an installment loan, such as a car loan, in which you’re loaned a fixed amount and make the same-sized payment each month. As you pay down an installment loan, the amount you owe decreases.

In contrast, you can free up more credit by making larger payments (up to the total amount you owe) on a revolving credit account. The amount you owe can rise if you don't make full payments and make new purchases, accruing more interest.

In short, your credit limit is the amount of credit a lender or credit card issuer approved you to use. And your available credit is the difference between your credit card balance and your credit limit.

How your available credit can impact your credit score

How much of your total credit limit you’re using is a major factor in your credit score. That's because borrowers who tend to max out their credit cards are more likely to struggle with making debt payments to their lender(s).

Credit scoring companies pay attention to how much of your credit limit you're using. They rely on a ratio called the credit utilization rate. This figure is calculated by dividing your current card balance by its credit limit. For example, if you have a $4,000 account balance on a card with a $5,000 limit, your credit utilization rate is 80%.

Credit scoring models consider your credit utilization for each individual credit card, as well as all of your credit cards combined. The higher your utilization rate, the more it could impact your FICO® score negatively. The same goes if you have a personal line of credit.

Both the FICO® Score and VantageScore® credit scoring systems give significant weight to how you handle revolving credit. More specifically, they are sensitive to credit utilization.

Suppose you have a home equity line of credit or HELOC. In that case, however, the amount of available credit you use won't be considered in your credit utilization rate.

“Despite some misreporting on the issue, and the fact that both are considered “revolving” debts, HELOCs are not counted when credit scoring models calculate the revolving utilization ratio on your credit card accounts, as a HELOC is not considered a credit card account. Therefore, the fear that a heavily utilized HELOC may negatively impact your credit scores in the same way a nearly maxed-out credit card account might is unfounded,” Equifax and FICO® credit expert and author John Ulzheimer writes.[1]

How your utilization rate affects your credit score can change from month to month. For example, if you have a high rate one month, then consolidate your credit card debt with a personal loan or pay down a high credit balance, your credit score could bounce back as soon as that activity is reported.

How much available credit should you use?

Many credit experts recommend keeping your credit utilization rate below 30%. Still, there's no hard-and-fast rule or threshold where your credit score will plummet once you breach it.

Instead, it’s best to simply keep your utilization rate as low as possible. There are a couple ways you can do this successfully each month, especially with credit cards:

- Use the card sparingly: The easiest way is to use your card a little each month and pay it off in full to build a positive payment history. However, if you want to take advantage of credit card rewards, you won't earn much this way.

- Make multiple monthly payments: Suppose you use your credit card regularly but have a low credit limit. In that case, making several payments during the month may be a good tactic. That way, you can ensure you never max out your credit limit and reduce the chance that your reported utilization will be high.

What happens if you go over your credit limit?

There are consequences when you go over your credit limit. You might have to pay an over-the-limit fee if you opt in to this option. However, not all credit cards allow you to exceed the limit.[2]

The over-the-limit fee can’t be larger than the amount by which you’ve exceeded your limit.[3] If you’re $25 over, for example, your fee may be $25. The overall fee typically can’t exceed $35 no matter how far over the company lets you go.[4]

Besides fees, there's another good reason to avoid going over - or even coming close to - your credit limit. The amount you owe on your credit cards counts for 30% of your FICO® score (the second-most important of five factors considered).

If you owe $5,400 on three cards with a total credit limit of $6,000, your credit utilization ratio is 90%. That isn’t good for your credit score; experts say you should keep that ratio under 30%, and the people with the best credit scores have a ratio of 10% or less.[5]

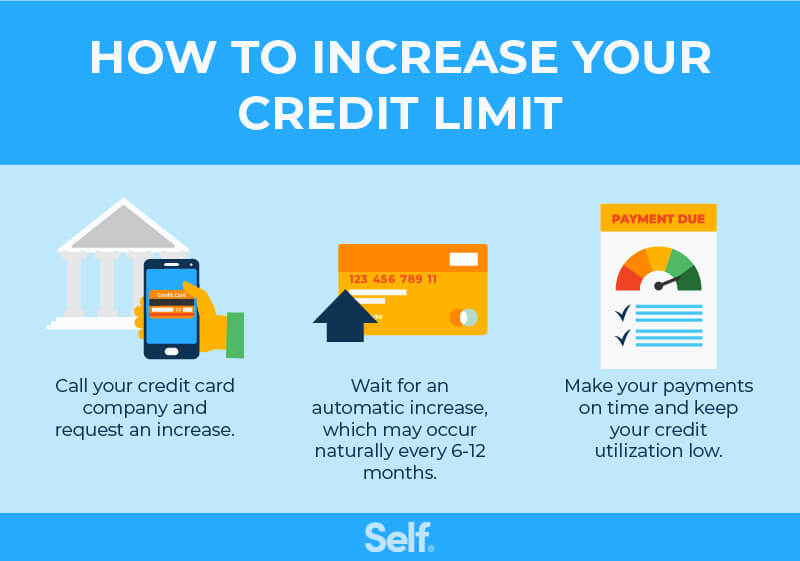

##How to increase your credit limit

One way to increase your available credit is to increase your credit limit. The other is to make credit card payments, freeing up more available credit. So, how do you increase your credit limit?

Call your credit card company and request a credit limit increase

You can request a credit limit increase, but to qualify, you may need to have accumulated between six and 12 months of on-time payments and remained under your credit limit.[6]

Some companies allow you to request a credit increase online. Still, it's usually better to contact the company by phone to ask a representative any questions you may have and obtain information about the process.

The company will want to know your personal information, including your name, address, and Social Security number. They’ll also likely ask you for details such as your monthly and yearly gross household income, your monthly housing payment (rent or mortgage), and information on your employment.

And it never hurts to ask, right? Well, that’s not entirely true. If you ask and the lender needs to check your credit, it might count as a hard inquiry. If you’re unsure, check with your credit card company first.

The good news is that the damage is likely to be short-lived because a hard pull usually doesn’t affect your credit score for more than 12 months.

Wait for an automatic increase

Asking can be a quick way to increase your credit limit. But if you're in good standing with your bank, lenders may increase your credit limit automatically. This may occur if you use your credit card responsibly or if you've recently updated your income.

Some credit card companies will give you the option to accept an increase. Others will increase your credit limit automatically.

Keep your credit utilization ratio low

Remember, the total of your balances on credit cards and personal lines of credit determines your credit utilization ratio.

The good news is you can affect your credit utilization rate every month depending on how much you spend and how much you pay back.

Make payments on time

Your credit utilization ratio is important, but your payment history counts for an even bigger chunk of your FICO® score. At 35%, payment history is the single biggest factor in determining your FICO® score.

Payment history is less important in determining your VantageScore because they view your credit mix as being most important. Still, payment history ranks as the third-most-important factor in determining your VantageScore. Nonetheless, FICO® remains the system that's most often referenced by financial institutions and other lenders.

Monitor your payments by keeping close track of your credit card statements. By using your credit cards mindfully and paying your bills on time, you’ll be building your credit history with the three consumer credit bureaus: Experian, TransUnion, and Equifax.

Don't assume that making your payments on time will guarantee excellent credit, even if you have a good credit mix and low credit utilization ratio. Errors can still occur on credit reports and may do so in more than one-third of cases.[7] Such errors can damage your credit report, and so can fraud, so it’s essential to stay on top of your credit by ordering a free copy of your credit report at annualcreditreport.com.

Have multiple credit cards

Getting a new credit card can reduce your credit utilization because it will raise your overall credit limit: You’ll have additional credit with a zero balance on that card to start.

But you should guard against the temptation to use multiple cards as an excuse to spend more freely. Credit cards aren’t free money. If you get a second or third card to boost your credit utilization ratio and then spend upward toward that limit as well, you’re defeating the purpose. Applying for a credit card also counts as a hard pull, which can temporarily lower your credit score.

Before getting another credit card, ask yourself a few questions:

- Why are you applying?

- What are your personal finance goals?

- How will it affect your credit?

- Will it be easier or harder to make your payments on time?

Know your available credit

Understanding the concept of available credit is vital for anyone with a credit card account. As a cardholder, knowing your available credit can help you control your finances and maintain your debt at manageable levels. That way, you can keep building credit by maintaining a low credit utilization ratio.

Doing this can position you for a future in which the loans you really need are approved at the lowest interest rates possible.

Sources

- The Simple Dollar. “How Does a HELOC Affect Your Credit Score?” https://www.thesimpledollar.com/loans/home-equity/how-a-home-equity-line-impacts-your-credit/. Accessed September 9, 2021

- CNBC. “What happens if you try to spend more than your credit limit,” https://www.cnbc.com/select/exceeding-credit-limit/. Accessed September 2, 2021.

- CNBC. “8 common credit card fees and how to avoid them,” https://www.cnbc.com/select/how-to-avoid-common-credit-card-fees/. Accessed September 2, 2021.

- Public Law 111-24—May 22, 2009. “Credit Card Accountability Responsibility and Disclosure Act of 2009,” https://www.ftc.gov/sites/default/files/documents/statutes/credit-card-accountability-responsibility-and-disclosure-act-2009-credit-card-act/credit-card-pub-l-111-24_0.pdf. Accessed September 2, 2021.

- Time. “What Is the Credit Utilization Ratio?” https://time.com/nextadvisor/credit-cards/credit-utilization-ratio/. Accessed September 2, 2021.

- U.S. News. “How to Increase Your Credit Limit (Without Harming Your Score),” https://creditcards.usnews.com/articles/how-to-increase-your-credit-limit-without-harming-your-score. Accessed September 2, 2021.

- Consumer Reports. “More Than a Third of Volunteers in a Consumer Reports Study Found Errors in Their Credit Reports,” https://www.consumerreports.org/credit-scores-reports/consumers-found-errors-in-their-credit-reports-a6996937910/. Accessed September 2, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.