Reasons To Avoid A Long-Term Auto Loan

Published on: 09/06/2022

Instead of softening the blow of rising vehicle prices, long-term auto loans mask the overall financial cost of your loan, despite the appeal of lower monthly payments.

According to Consumer Financial Protection Bureau (CFPB), the total balance on all consumer auto loans hit over $1.4 trillion in 2022.[1] While the average new vehicle loan amount went up nearly 12%, increasing from $35,385 to $39,540. In response, lenders and car dealerships have begun offering longer-term auto loans to make it more affordable for people.[2]

In this article, you can better understand how a long-term loan affects the overall cost of your vehicle and whether a long-term loan makes sense for your financial situation.

Table of contents

- How long can you get a car loan for?

- Drawbacks of long-term car loan

- Is a long-term auto loan a good idea?

- How your credit score impacts auto loan interest

- Long-term auto loan alternatives

- Choose a car that fits your budget

How long can you get a car loan for?

You can get a car loan for a period of anywhere from 2 to 9 years (24 to 96 months). The length of an auto loan can vary from one lender or car dealership to the next, but a the average loan term for a new vehicle is 69.50 months and the average loan term for a used vehicle is 67.65 months.[2]

Even though 72- and 84-month auto loans have become more common than shorter-term loans, most car dealers consider anything longer than 60 months to be a long-term car loan. Here’s a breakdown of short-term versus long-term car loan durations:

Short-term car loans:

- 24 Months

- 36 Months

- 48 Months

Long-term car loans:

- 60 Months

- 72 Months

- 84 Months

- 96 Months

Drawbacks of long-term car loans

Most car buyers want lower monthly car payments. Although extending your loan over a longer term reduces your monthly payment, your auto loan length can affect the total cost of your loan and possibly the value of your car. The following reasons help explain why a loan length of more than 60 months may not make sense as part of your overall financial goals.

1 - Higher interest charges

Longer loans often come with higher interest rates than shorter-term loans. Even though you may enjoy lower monthly payments, the higher rate means you end up paying more in total interest. If you have a lower credit score, car loan interest rates can increase further.

2 - You may owe more than the car is worth

With long-term auto loans, you may not be paying down your principal enough to stay above market value. You may end up owing more on your car than what the car is worth, referred to as “negative equity” or being “upside down” on your loan.

If you have negative equity and you decide to sell your car, you risk owing money to the lender, and if your car becomes totaled in an accident, the money you get from the car insurance company may not cover the remainder of your auto loan. In both cases, you end up paying loan payments for a car you no longer have access to.

3 - Unexpected expenses over the length of the loan

Regardless of how well your car maintains its value and reliability, unexpected expenses can affect your finances over the life of the loan. Your ability to pay your loan could be impacted by unexpected costs, such as medical bills, or a change in your job situation that decreases your income.

4 - Car depreciation

Although some cars hold their value better than others, both new and used cars lose their value as they age, known as depreciation. Not all cars lose value at the same rate, but, on average, new cars lose 40 percent of their value after five years.[3]

If you decide to trade in your vehicle or sell it, you may find yourself upside down on your loan, owing more than what it's worth. In this case, you have to make up the difference between the remainder of your loan and the value of your car.[4]

Is a long-term auto loan a good idea?

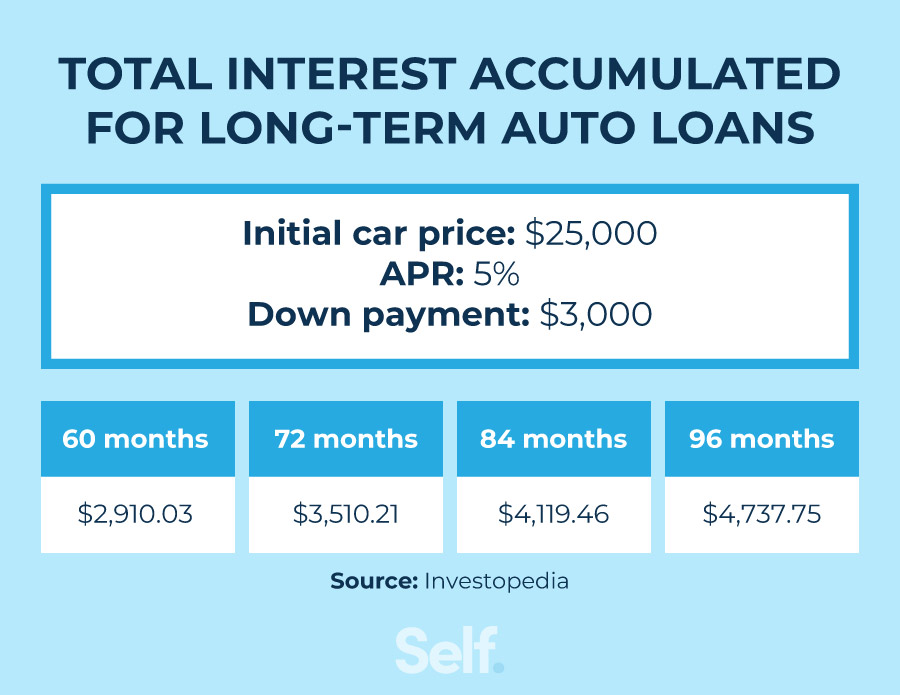

While you may have smaller monthly payments, a longer-term auto loan will cost you hundreds of dollars more in total interest than a short-term loan.[5]

How your credit score impacts auto loan interest

People who have a higher credit score may receive better car loan terms (low-interest financing) on a car purchase. If you’re considering a long-term auto loan, this can help reduce the overall cost of your car purchase. Keep in mind, however, that regardless of credit score, more total interest still accumulates over time with a longer-term loan.[6]

Long-term auto loan alternatives

If you’re purchasing a car, you can find ways to reduce your monthly car payments that don’t involve long-term loans. From saving up for a larger down payment to looking for a lower interest rate, these sections explain the auto loan alternatives you can consider.

Choose a less expensive or used car

Because new cars depreciate more quickly during the first year, you may want to consider a used car. By selecting a used car, the bulk of the depreciation has already occurred and the total amount of the car will be lower, which may give you more room to make a larger down payment compared to the price of the car.

Secure a lower interest rate

You may be able to refinance your loan to a better term. If your credit has improved, you may have a chance to obtain a lower interest rate, which could reduce the amount of your monthly payment. Shop around for the best interest rates or contact your bank to see if you can get preapproved for an auto loan before going to the dealership.

Save up for a bigger down payment

The more money you can save for a bigger down payment, the smaller your monthly payments will be, which can make your car payments more manageable. In addition, you pay less in total interest over the life of your loan. Owing less makes it easier to pay off your car loan early.[7]

The table below shows an example of how reducing your loan size by $5,000 could lower your monthly payment.

Lease instead of buying a car

If you want a new car, leasing a car may be an option that secures lower monthly payments. Typically, the manufacturer’s warranty covers a leased vehicle, and leasing may also allow you to drive a more upscale model.[8]

Although leasing allows you to enjoy a new car leasing does have its drawbacks, such as limits on the number of miles you can drive and additional charges when you turn in the leased vehicle.[8]

Choose a car that fits your budget

Whether you’re already in a long-term loan, struggling to make car payments or find yourself upside down on your car loan, you may have options to lower your interest rate or monthly payment.

If you’re looking to get a new car loan, shop around — both for a car that fits your budget and a loan that fits your financial plan, and consider tools offered by Self for building credit, which can help you qualify for a good interest rate whether you buy or lease your next new vehicle.

Sources

- Consumer Financial Protection Bureau. “Rising car prices means more auto loan debt.” https://www.consumerfinance.gov/about-us/blog/rising-car-prices-means-more-auto-loan-debt/. Accessed. July 18, 2022.

- Experian. “Credit unions amass largest share of the automotive finance market in five years” https://www.experianplc.com/media/latest-news/2022/credit-unions-amass-largest-share-of-the-automotive-finance-market-in-five-years/. Accessed July 18, 2022.

- iSeeCars. “Top 10 Cars That Hold Their Value Best” https://www.iseecars.com/cars-that-hold-their-value-study#:~:text=iSeeCars%20found%20that%20the%20average,to%2049.1%20percent%20in%202020. Accessed. July 18, 2022.

- Experian. “What Is Depreciation on a Car and Why Does It Matter?” https://www.experian.com/blogs/ask-experian/what-is-depreciation-on-a-car/. Accessed April 27, 2022.

- Investopedia. “How Interest Rates Work on Car Loans” https://www.investopedia.com/articles/personal-finance/061615/how-interest-rates-work-car-loans.asp. Accessed July 18, 2022.

- CapitalOne. “How Does Your Credit Score Affect Your Interest Rate?” https://www.capitalone.com/learn-grow/money-management/how-credit-score-affects-apr-interest-rate/. Accessed April 27, 2022.

- Experian. “How Much of a Down Payment Should You Make on a Car?” https://www.experian.com/blogs/ask-experian/what-is-depreciation-on-a-car/. Accessed July 18, 2022.

- Consumer Reports. “Leasing vs. Buying a New Car,” https://www.consumerreports.org/buying-a-car/leasing-vs-buying-a-new-car-a9135602164/. Accessed April 27, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).