What Credit Score Does A Cosigner Need?

Published on: 10/26/2022

Although lender requirements vary, a cosigner generally needs a credit score that is at least considered "very good," which usually means at least 670 or better.[1] A cosigner can help someone with a bad credit score or no credit get all types of loans — from personal loans or lines of credit to student loans and auto loans, but a cosigner takes on some of the risk if that account goes into default.[2]

If you’re wondering whether you need a cosigner or wondering if you should be a cosigner yourself, this post offers details on what it means for both. You can explore the advantages and disadvantages of getting a cosigner or being one as well as understand cosigner requirements. Cosigning depends on individual circumstances, and this post helps you determine if cosigning works for your financial situation.

Table of contents

- What is a cosigner?

- Cosigner requirements

- Cosigning pros and cons

- When do you need a cosigner for a loan?

- Alternatives to a cosigner

What is a cosigner?

A cosigner has equal responsibility for a loan along with the primary borrower. That means if a loan goes into default, the lender can pursue repayment from both the primary borrower and the cosigner. A cosigner may be needed on everything from personal loans to credit cards to rental agreements.[2] [3]

How cosigning a loan affects your credit score

Cosigning a loan may improve your credit score. Since the debt appears on your credit report as well as the borrower’s, on-time payments may reflect well on your credit history and could make a positive impact on your credit score. Similarly, the new account gets added to your credit mix and, depending on the type of account, it could show that you can manage different types of credit.[2] [3]

On the other hand, cosigning a loan may hurt your credit score. If the borrower makes late payments or defaults, those negative items appear on your record as well.[2] [3]

Cosigner requirements

In the next sections, we explain the different requirements for someone to be a cosigner on all types of loans. Lenders have different requirements depending on a number of factors, such as the type of loan, so the individual situations can vary. However, you can expect to see these general guidelines when cosigning for anything.

Credit score

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit. Keep in mind that if you’re cosigning for someone, the primary borrower probably doesn’t have great credit to begin with or a credit history at all, so the lender needs someone with particularly strong credit to make the risk worthwhile.[1]

Documentation

Cosigners for student loans or personal loans typically need to verify their address, provide a Social Security number, income documentation including pay stubs, bank account information and tax documents.[4] Cosigners for mortgage loans typically need the same documentation and a bit more, including a list of debts, a list of assets and may need to prove their relationship to the borrower. In both cases, lenders will pull the cosigner’s credit report as well.[5]

Proof of identification

Lenders require cosigners to prove their identification with basic identifying documents like a driver’s license or passport, as well as require proof of a Social Security number. Lenders may also require documents that prove the cosigner’s relationship to the borrower.[5]

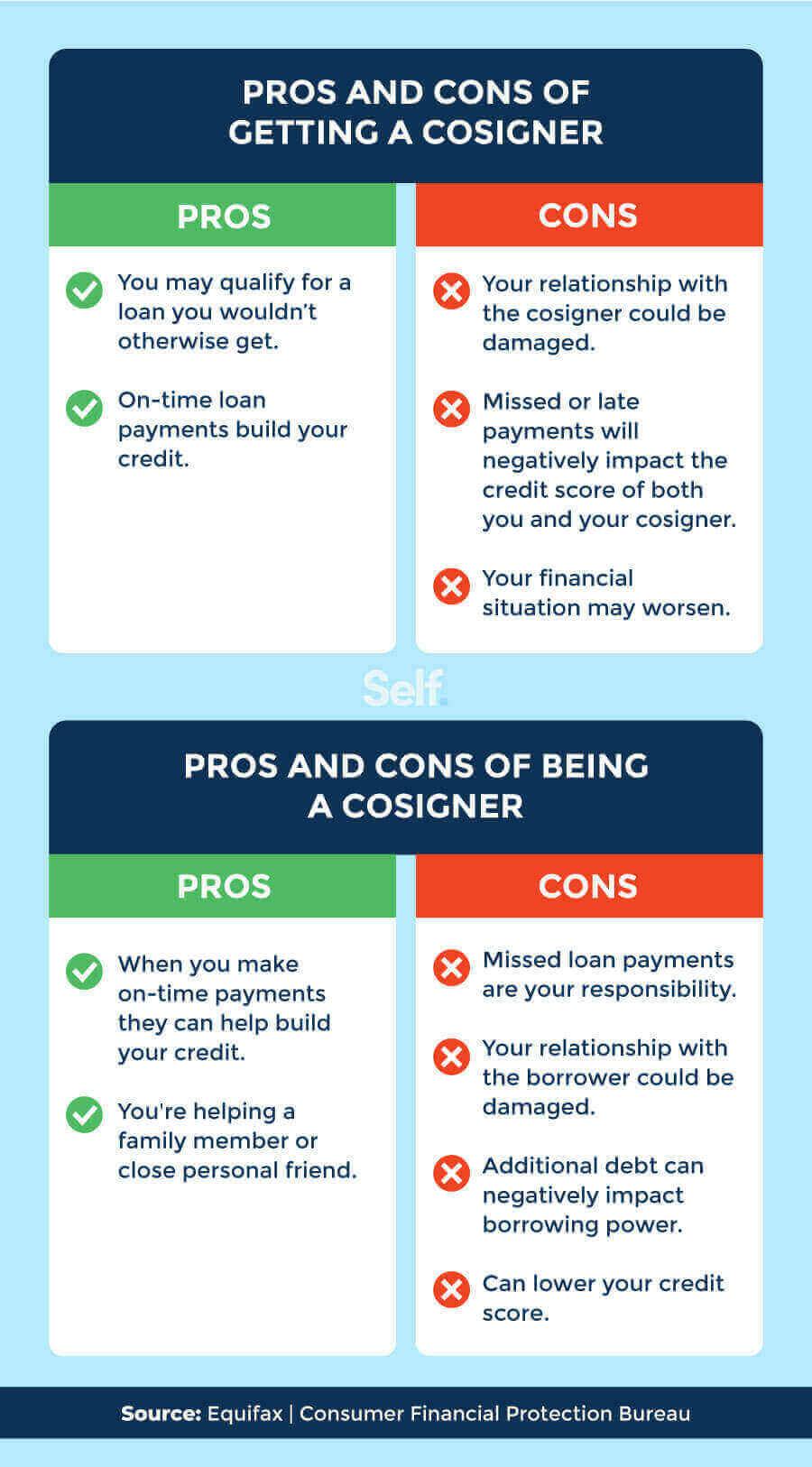

Cosigning pros and cons

Cosigning offers both risks and rewards, so you should consider this responsibility carefully before entering into this arrangement. Consider some of the pros and cons of both having a cosigner and being a cosigner to help you decide if either option works for you.

Getting a cosigner for a loan

If you’re getting a cosigner for a loan, the benefits can be enormous, but you should also consider the downsides.

Pros:

- Helps with loan approval: If you have a poor credit score, a cosigner’s good credit score helps to balance yours and gives you a better chance of approval.

- Helps build your credit: By getting a cosigner, you can get access to credit you couldn’t before, allowing you the chance to build better credit and reap the credit-building rewards of on-time payments. As you are a co-borrower, your payments will be reported to the major credit bureaus, so it’s in your best interest to consistently make payments on time.

[6]

Cons:

- Negative impact on the relationship with the cosigner: If, for whatever reason, you aren’t able to pay back the loan or you go into default, it will hurt the cosigner’s credit, which may in turn hurt your personal relationship with the cosigner.

- Can lower your credit score: If you get a cosigner to get credit you really can’t afford, you’re setting yourself up for missed payments and possible default, which could negatively impact your credit score even further.

- Can worsen your financial situation: If you’re struggling with money, don’t look at getting a cosigner as a way out. While it may help you in the short term, if you have deeper financial issues, it may only result in getting you into a bigger debt hole while dragging a family member or friend along with you.

[6]

Cosigning a loan

If you’re the one cosigning, carefully consider all the pros and cons, which are quite different from those of the primary borrower.

Pros:

- Can improve your credit: If you already make on-time payments, the on-time payments the primary borrower makes on this loan helps you maintain a positive credit history. If this is a new type of credit for your profile, adding this new debt changes your credit mix. With on-time payments, this addition to your credit mix can show potential lenders that you can handle different types of credit.[3]

- Helps a family member or close personal friend build credit: Chances are, you didn’t get into this situation to build your own credit score — you wanted to help a friend or family member. It can be rewarding to see that person build credit and improve their life as a result of your cosigning.[3] [6]

Cons:

- Negative impact on the relationship with the borrower: Entering into financial arrangements with friends and family is risky, and if that friend or family member misses payments or defaults on the agreements, your relationship may suffer.

- Financial responsibilities for missed payments: If the lender starts calling because your friend or family member missed a payment, they’ll call you as well and can even pursue the debt through legal avenues.

- Can limit cosigner’s borrowing power: If you’re looking to take out loans, cosigning for someone else’s loans may hurt your chances of getting approved since lenders see you have already taken out more credit.

- May lower credit score: If the primary borrower isn’t doing a great job with making payments on time (or is defaulting on the loan), it will ding your credit score as well as theirs.

[6]

When do you need a cosigner for a loan?

You need a cosigner when you don’t have a good enough credit score or not enough credit history to qualify for a loan or other forms of credit, such as credit card. Sometimes your credit may be in good shape, but you don’t meet the income requirements or your lender may have particularly high standards for loan approval. Just carefully consider the advantages and disadvantages to getting a cosigner as well as whether you can take on the debt before attempting to get one.[7]

Alternatives to a cosigner

If you don’t want to risk relationships with friends or family members by having them cosign for you or you just aren’t able to find anyone willing to cosign, consider the alternatives:[8]

- Peer-to-peer (P2P) lenders: You don’t need perfect credit to use this form of financial technology. With peer-to-peer lending, people can lend directly to another person without going through a bank. You still go through a credit check, and the better your credit score, the better your interest rate. Although you have no guarantee of approval, if you do get approved, you can use the loan in a variety of ways. P2P lending may help you get an unsecured loan after financial institutions have refused other loan applications.

- Credit unions: You can often find better rates and terms with loans offered through credit unions. Although credit unions still look at your credit and other factors for qualification, as a member, you may have a better opportunity to qualify here than at traditional banks. Many credit unions cater to groups such as the military, teachers, labor unions and more, and even if you aren’t a member of the group affiliated with a credit union, you may be able to join for a small fee.[9]

- Rebuild your credit: Consider trying to rebuild your credit so that you don’t have to rely on anyone else. Get a free credit report from the three credit reporting agencies to see where your credit currently stands. Then you may consider a credit builder loan or a secured credit card to start building a positive credit history.

Weigh your options

Cosigning has many benefits but also perils, consider the factors carefully. While a cosigner can immediately help you qualify for loans or approval for an apartment, it also can place the cosigner at significant financial risk — and potentially risk your relationship.

Likewise, if you’re thinking about becoming a cosigner, you should make sure the person you’re cosigning for is completely trustworthy and will make payments on time. After all, you’re protecting not only your finances, but your relationship to that person as well.

Sources

- Experian. "What Credit Score Does a Cosigner Need?" https://www.experian.com/blogs/ask-experian/what-credit-score-does-a-cosigner-need/. Accessed May 31, 2022.

- Federal Trade Commission. "Cosigning a Loan FAQs," https://consumer.ftc.gov/articles/cosigning-loan-faqs. Accessed May 31, 2022.

- Experian. "How Does Cosigning Affect Your Credit?" https://www.experian.com/blogs/ask-experian/how-does-cosigning-affect-your-credit/. Accessed May 31, 2022.

- Rocket Loans. “Getting A Personal Loan With A Cosigner,” https://www.rocketloans.com/learn/personal-loan-basics/personal-loan-with-cosigner. Accessed October 11, 2022.

- Chase. "What you need to know before cosigning a mortgage loan," https://www.chase.com/personal/mortgage/education/financing-a-home/cosigning-a-mortgage-loan. Accessed May 31, 2022.

- Equifax. "The Pros and Cons of Cosigning Loans," https://www.equifax.com/personal/education/loans/cosigning-loans-pros-cons/. Accessed May 31, 2022.

- Forbes. "How To Find A Co-Signer For A Loan," https://www.forbes.com/advisor/personal-loans/how-to-find-a-cosigner/. Accessed May 31, 2022.

- Investopedia. "Top Alternatives to a Co-signer," https://www.investopedia.com/articles/personal-finance/020215/top-alternatives-cosigner.asp. Accessed May 31, 2022.

- Forbes. “Credit Union Personal Loans: A Cheaper Way To Borrow,” https://www.forbes.com/advisor/personal-loans/credit-union-personal-loans/. Accessed October 11, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).