What Is a Guarantor on a Lease?

Published on: 10/03/2025

A guarantor on a lease is someone who takes on the financial liability of the lease for an apartment or other rental without living at the property. They pay the rent payments in the event the renter can’t or won’t pay them. Guarantors help people who may not have enough credit history (or any at all) apply for and get rentals they might not have qualified for on their own.

Usually, a guarantor is someone you know very well, like a close friend or family member. In any case, a guarantor has to be someone with good credit and financial stability, enough to help you cover your rent payments in the event that you can’t pay them. Although the guarantor doesn’t live with you or have a right to live at the property, that person is responsible for making the monthly rent payments if you don’t.[1]

Guarantors may also be required when borrowers need one when applying for loans or other credit products. In this article, we focus specifically on rent and leases — how having a lease guarantor works, how to find a good guarantor and how to rent without one, even if you have a limited credit history.

Key points

- A guarantor on a lease is someone who does not live in the property but agrees to take financial responsibility for rent if the tenant cannot pay.

- Landlords may require a guarantor when applicants have limited credit history, unstable income, or no prior rental history.

- Unlike a cosigner, a guarantor does not have the right to occupy the property but is still legally responsible for covering missed payments.

What makes a good guarantor?

A guarantor is someone who takes on the financial responsibility of a lease. That means they need to be able to fulfill those financial obligations in the event that you can’t. A good guarantor fills in the gaps where you may be lacking in the eyes of the landlord. If you or your guarantor don’t pay the rent you owe, the guarantor can be sued.[1]

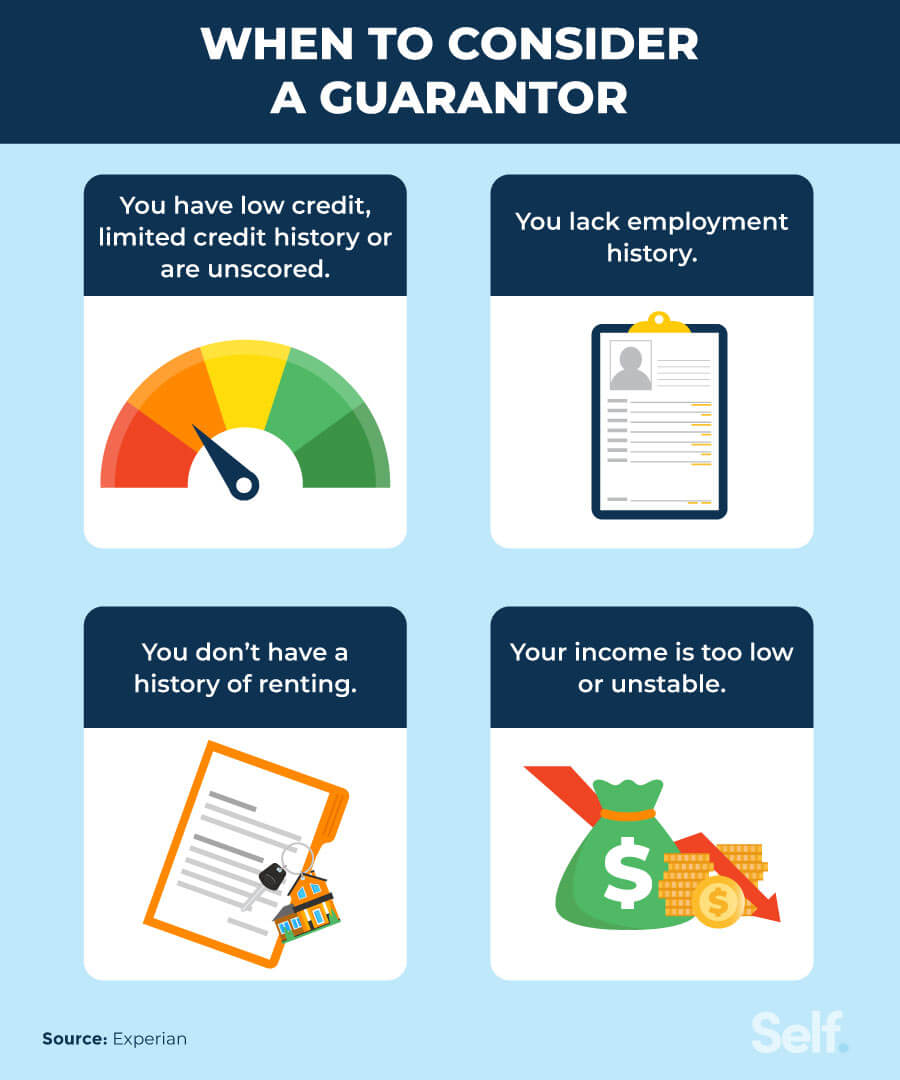

When should you consider a guarantor?

Some landlords have qualifications for potential renters that may be hard to meet. You might want to consider finding a guarantor if you struggle with any of the following.

- If you have low credit, limited credit history or are unscored: Having limited credit history or poor credit can be a barrier to getting a rental. A guarantor with good credit history and a good credit score helps make up where you might fall short. Students and young adults often fall into this category, with many rentals geared towards students requiring a guarantor as additional collateral.

- If you have a lack of employment history: Many landlords and property managers require pay stubs, bank statements or other proof of income as part of a rental application to ensure you’re able to pay rent. If you have unstable or no employment history, a guarantor might be a good option.[2]

- If you don’t have a history of renting: Many landlords like to see solid rental history on an application, making it especially hard for first-time renters to get approved. Sometimes, landlords will use a tenant screening service to check for what they might consider red flags, like past evictions. A guarantor might help in a case like this because it helps make up for where a landlord could perceive you to be unreliable when it comes to paying rent.[2]

- If your income is too low: In addition to general proof of income, some landlords might have specific income requirements for renters. [2]

Narrowing Down On A Potential Guarantor

If you think a lease guarantor might be a good option, here are the steps to take to find one.

1. Take an honest look at your finances

Even though the guarantor is financially responsible for the lease in the event you can’t pay rent, you don’t want to rely on them entirely. The guarantor is just helping you get the lease, and should be there as a backup or safety net. Make sure that you can afford to make on-time rent payments each month on your own.

Having a good sense of where you stand financially also helps determine what you need from a guarantor. For example, if you have bad credit or negative items on your credit report, like past delinquencies or collection accounts, but can otherwise make your rental payments on time, finding a guarantor with good credit to vouch for you can help balance things out.[3]

2. Gather proof of your ability to pay

When you’re ready to ask someone to be your guarantor, you’ll want to show them that they can rely on you. Provide your potential guarantor with proof that you would be able to pay rent on time, like proof of a stable income or job or that you’re up to date on regular bills. That way, they won’t have to worry about having to make up missed payments on your rent.

3. Ask a close friend or loved one to be your guarantor

It’s best to have a guarantor who is also someone you’re close to and trust. A close friend or family member with stable finances is generally a good choice.

Since you already have a close relationship, it might be easier to talk about where you are in your financial life and how their guarantee will help you achieve your financial goals. For example, you could express that you’re aware of how putting them in a position where they have to make up your payments could harm your relationship, and you don’t want that to happen.

4. Reiterate that you understand it’s important to make on-time payments

You’re asking a lot of your potential guarantor — they’re putting their finances and creditworthiness on the line for you. If you don’t make your payments, you risk damaging their financial health. Be sure to reassure them that not only are you aware of this risk, but that you also fully intend to pay your rent in full and on time, so that nothing happens to hurt their finances.

Even if you have a guarantor, missed payments could potentially hurt your credit score if there is a default or it goes to collections, so it’s very important to manage your lease responsibly regardless.[4]

The person you ask to be your guarantor needs to be able to trust you. Though they’re there to help, and understand there’s some risk in being involved, you should be responsible to make all payments yourself, just as you would if you were renting independently.

Guarantor vs. cosigner

Guarantors and cosigners are similar, and both are involved in a rental agreement. However, each role has its own rights and requirements. Namely, a cosigner has the right to occupy the property, while a guarantor does not. Here’s how the key differences break down between the two.[1]

| Guarantor | Cosigner | |

|---|---|---|

| Responsible for repayments | Yes | Yes |

| Right to occupy | No | Yes |

| Shares equal responsibility of making payments | No | Yes |

Guarantor alternatives

If you aren’t sure whether or not you need a guarantor for your new apartment or home or are struggling to find a guarantor, here are some other options to consider.

- Build or rebuild credit: Working on building or rebuilding your credit takes time, but it would help you meet lease qualifications in the future without needing a guarantor. Rebuilding credit is slightly different from starting from scratch, since you have an established score and are trying to build it, so the amount of time that it takes to repair your credit can vary.

- Wait until your credit score populates: If you’re unscored, your FICO® score won’t generate until you’ve had an active credit account for at least six months.[5] If you’re able to wait and manage your credit responsibly, you might find that your credit is good enough to rent once it populates.

- Shop for cheaper rentals you might qualify for on your own: Generally, you may want to make sure your income each month is enough to pay not only your rent, but also your other expenses. Trying to rent an apartment that exceeds three times your monthly income might not be the best option. A less expensive apartment will have lower income requirements. If you’re really set on renting an apartment you don’t exactly qualify for, the landlord might be open to it if you’re willing to pay a higher security deposit or multiple months’ rent upfront.

- Wait and save up: Similar to your credit score, if your income is the issue, taking the time to save up until you have a good amount of savings in your bank account makes it easier to rent in the future.

Credit building habits

Whether you’re new to credit or repairing your credit, you can build credit through responsible habits. Having good credit helps make you more financially independent, so you don’t have to rely on someone such as a guarantor.

Here are some credit-building habits you can start using today:

- Become an authorized user: Similar to working with a guarantor, becoming an authorized user on a trusted person’s credit account, who has good credit, could help build your credit by association. Make sure you select someone who has had the account for a while, pays on time, and has a low credit utilization ratio (total revolving debt divided by total revolving credit limits).

- Pay bills on time: Payment history is one of the most important credit scoring factors, making up 35% of your FICO® score.[4] Making payments on all credit accounts on time each month has a positive effect on your credit, especially over time.

- Keep your credit utilization ratio low: Using too much of your available credit can not only make it more difficult to repay what you owe, but it also affects your credit utilization ratio (CUR). Generally, a CUR between 10% and 30% can help you maintain a good FICO credit score, but experts suggest keeping it under 10% for the most positive impact.[6]

- Monitor your credit: One of the best ways to get a sense of your financial health is to keep tabs on your credit. The three major credit bureaus (Experian, Equifax and TransUnion) now offer free credit reports weekly on through AnnualCreditReport.com.

- Consider a secured loan: A credit builder loan works less like a traditional loan and more like a savings account. Although a credit builder loan helps you to build credit history, it works differently from traditional installment loans. Instead of getting your lump sum after you sign your agreement and paying it back in installments, your funds are put into a certificate of deposit (CD) or savings account, you make your monthly payments and you get your lump sum (minus interest and fees) as soon as all of your payments are made. Your payments get reported to the credit bureaus.

- Take out a secured credit card: A secured credit card requires a cash deposit upfront as collateral, typically placed in a savings account or certificate of deposit (CD). To obtain a secured credit card, you apply and, once approved, you then must put down a cash security deposit, which acts as your credit limit. Then you can use the card to make charges up to the amount you deposited and pay your bill each month. Those payments get reported to the credit bureaus.

Sources

- LeaseRunner. “What Is a Guarantor for an Apartment?” https://www.leaserunner.com/blog/what-is-a-guarantor-for-an-apartment. Accessed on September 4, 2025.

- Kiplinger. “What Is a Guarantor?” https://www.kiplinger.com/real-estate/what-is-a-guarantor. Accessed on September 4, 2025.

- Investopedia. “What Is a Guarantor? Definition, Examples, and Responsibilities,” https://www.investopedia.com/terms/g/guarantor.asp. Accessed January 24, 2023.

- myFICO. “How Payment History Impacts Your Credit Score,” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed January 24, 2023.

- myFICO. “What are the minimum requirements for a FICO® score?” https://www.myfico.com/credit-education/faq/scores/fico-score-requirements. Accessed January 24, 2023.

- myFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed January 24, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).