What Does APR Mean and How Does It Work?

Published on: 09/09/2024

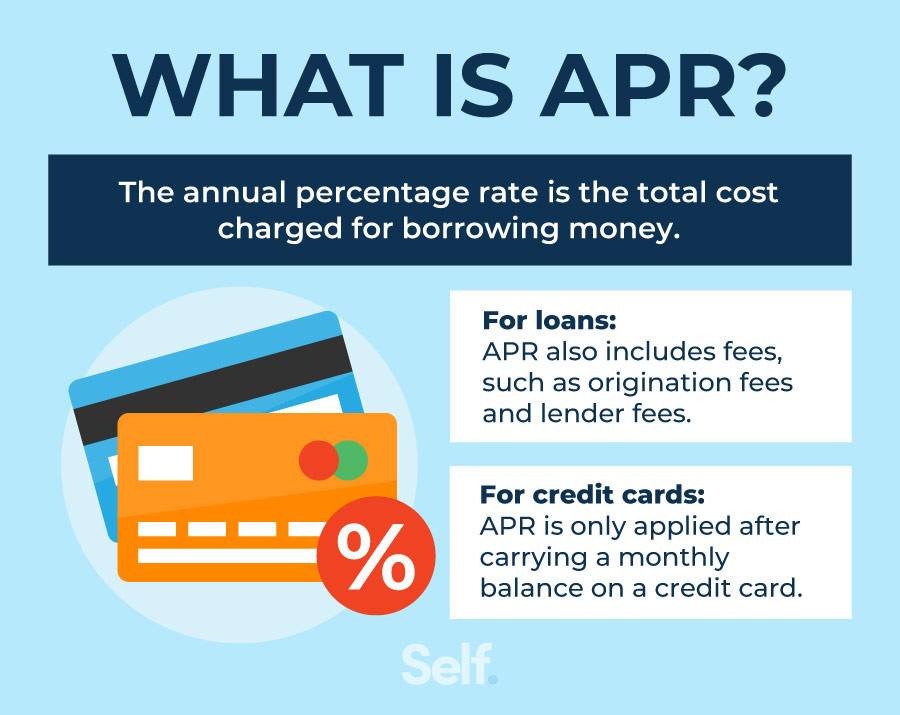

APR means annual percentage rate, and this refers to the actual cost you pay each year to borrow money. This rate includes interest and it may include applicable fees. It is expressed as a percentage.[1] Whether you’re applying for credit cards or taking out loans, the APR determines the cost of borrowing.

According to the Truth in Lending Act (TILA), lenders must disclose your APR before you’re obligated to pay so that you know the total cost you’re paying to borrow money.[2] This post helps you determine the true cost of that loan or credit card, distinguish between different types of APRs, and learn how to manage your credit to reduce high APRs.

Table of contents

- How does APR work in simple terms?

- How to calculate APR

- What impacts your APR?

- APR vs. APY

- APR vs. interest rate

- Types of APR

- How to reduce high APRs

- What is a good APR?

How does APR work in simple terms?

APR works differently based on the financial product. Loans and credit cards both calculate and apply APR in different ways:

- Loans: With loans, APR includes the interest and all other fees associated with the loan, providing you with the true cost of the loan. The type of loan, such as a mortgage or auto loan, determines what fees get calculated into your APR.[3]

- Credit cards: The APR for credit card companies includes only the interest rate and not any other fees, such as the card’s annual fee. If you pay off your entire credit card balance on time every month, the credit card company doesn’t charge you any interest. However, if you carry a balance from month to month, the credit card company charges you interest at the end of each billing period based on the APR.[3]

How to calculate APR?

When you calculate your APR, you can put the daily cost of your credit into concrete terms. Using an APR calculation, you can see just how much interest you might be paying each day or each month, helping you better understand how that loan or credit card impacts your finances.

The following section provides a sample calculation for APR on a credit card, but it may help to know these concepts first:

- Compound interest: Credit of all kinds typically requires interest on the amount you’ve borrowed, but you can also owe interest on top of the interest you’ve accumulated, which is compound interest. Interest can compound daily, monthly, quarterly, twice a year or annually.[4] This compounding effect impacts your periodic rate.

- Periodic rate: You need to know your periodic rate to calculate your APR. You can calculate your periodic rate by dividing the annual interest rate by the number of periods that your interest compounds during the year. If the interest on your credit card compounds monthly, you can divide the annual percentage rate by 12 to find your periodic rate.[5]

- APR calculation: You can calculate your APR by multiplying the loan’s periodic interest rate by the number of intervals in a year — days, months or quarters — in which the rate was applied.[6]

APR example for credit cards

You may have an easier time calculating the APR on a credit card because you just apply the interest rate to your balance, but calculating both your monthly and daily interest allows you to see exactly what the balance on your credit card is costing you each day and each month.

The following calculations include a daily balance for purchases only. If you take out a cash advance or transfer a balance, each may have a different APR and daily periodic rate and will be calculated differently. Check your credit card agreement for specifics regarding how your issuer handles these items.

To calculate your daily and monthly credit card APR using average daily balance, follow these steps — we will use Janice as an example. She is carrying a $3,000 credit card balance from purchases and her interest rate is 24.74%:

- Find your daily periodic rate. Divide your interest rate by 365. In Janice’s case this looks like: 24.74%/365 = 0.00067.

- Apply the periodic rate to your balance. Multiply your balance by the answer from step 1. In Janice’s case, this looks like: $3,000 x 0.00067 = $2.03.

The answer to step 2 reflects the daily amount of interest charged on your balance. To see how much you're charged in a month you adjust the second step:

- Find your daily periodic rate. Divide your interest rate by 365. In Janice’s case this looks like: 24.74%/365 = 0.00067.

- Apply the periodic rate to both the number of days in your billing cycle and your balance. Multiply the answer from step 1 by the days in your billing cycle (typically 30) and then by your total balance. For Janice, this looks like: 0.00067 x 30 x $3,000 = $60.3.

What impacts your APR?

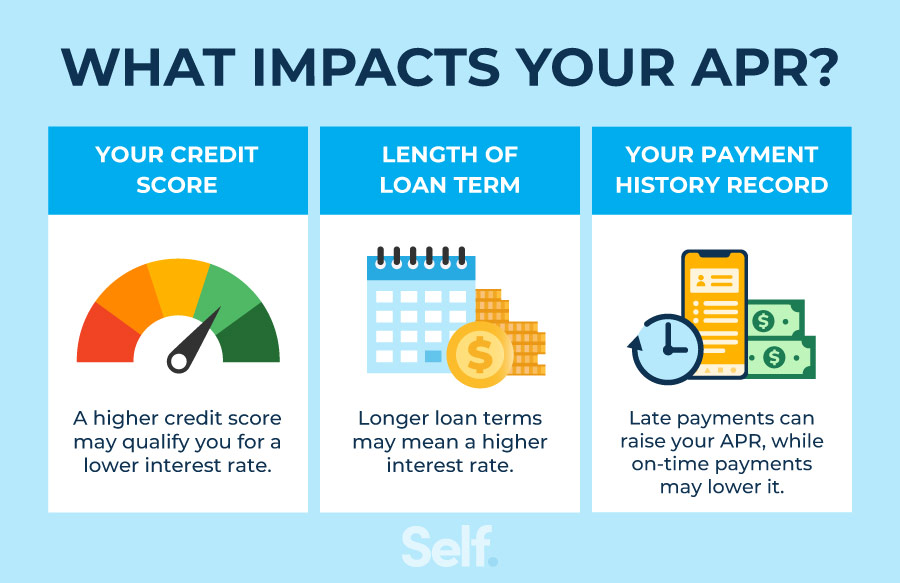

Although banks and lenders consider several factors when determining your APR, some of the most important factors that can affect your APR include the following.

Although banks and lenders consider several factors when determining your APR, some of the most important factors that can affect your APR include:

- Credit score: A higher score usually can qualify you for a lower interest rate on credit cards and loans.[7]

- Loan term: A longer loan term typically has a higher interest rate, and because the term is longer, you will typically end up paying more interest.

- Payment history: Late payments may raise your APR for future loans, while more on-time payments may lower it.

APR vs APY

Although they often get confused, APR and APY (annual percentage yield) mean two very different things. APR refers to what you pay each year to borrow money. By contrast, APY is the interest — including compounding — that you receive on savings and investments in various financial products and accounts. You may see APY also called EAR (earned annual interest).[8]

APR vs interest rate

You may have noticed on a mortgage, for instance, that your APR looks higher than your interest rate on a loan. Your interest rate refers only to the charge against your principal on a loan, but your APR also includes the fees you pay to take out the loan, such as broker’s fees, mortgage fees, or closing fees. For credit cards, the APR and the interest rate are the same thing.[8]

Types of APR

If you understand the concept of APR, that helps you know the total cost you end up paying on a loan or credit card (if you carry a balance). However, you might also want to know how different kinds of APR work. APR is applied differently depending on the type of credit you’re using and what you’re using the money for. Some examples of different types of APR include:

- Fixed-rate APR: If you have a fixed APR, your interest rate won’t change over the life of the loan.

- Variable APR: In this case, the interest rate fluctuates over time based on a benchmark rate, such as the prime rate. You can check your credit or loan agreement to see how your variable rate gets calculated. An increase in the APR increases your interest charges as the variable rate rises and may raise the minimum payment you have to make.

- Purchase APR: You get charged this interest rate when you make new purchases with a credit card and do not pay your balance in full each month.

- Balance transfer APR: This interest rate applies only to credit cards and any new balance transfers you add to them. Unlike purchases, balance transfers start accruing interest immediately. You may be able to get a low introductory interest rate, or even 0% interest for six months or a year, but you’ll also likely be charged a fee that amounts to 3% to 5% of the transfer amount. (That fee is not included in the balance transfer APR.)[3]

- Introductory APR: This type of APR is typically for credit cards, some credit card issuers offer 0% APR for a limited period of time as an inducement to apply for their card or transfer an existing balance. The 0% introductory rate typically lasts for six or 12 months (sometimes longer) before increasing to a higher APR.[3]

- Cash advance APR: Another APR used only with credit cards, this kind of APR kicks in if you take out a cash advance, which you can typically do at an ATM. But the rate you’ll pay will be higher than what you’d be charged for a purchase or even a balance transfer. Plus, as with a balance transfer, interest starts to accrue immediately.[3]

- Penalty APR: Typically used with credit cards, you may be charged this kind of APR when you’re late with a credit card payment, typically by 60 days or more.[3]

How to reduce high APRs

If you’re paying a high APR on your credit card or loan, you might be able to use the following ways to reduce that rate.

Build your credit score

If you build your credit score, you may receive better APRs from new lenders than you would with a lower score, which means paying less interest on new credit products.

Pay on time

You may be able to receive a lower APR if you have made on-time payments throughout the lifetime of your account. These on-time payments will also show up on your credit report, which can build your overall credit score.

Negotiate with your lender

If your current rate is high, you can negotiate with your lender to see if you’re able to reduce it. To increase your chances, you should always make your monthly payments by the due date and work to lift your credit score.

What is a good APR to start at?

A good APR for a credit card is one below the average interest rate. Typically, applicants with higher credit scores will receive a better (lower) APRs. According to the Federal Reserve, the average interest rate for U.S. credit cards was approximately 14.51% at the end of 2021.[9]

Build your credit

When you’re thinking about borrowing money, you don’t have to make decisions on your own. Self is here to guide you through your financial journey and elevate your personal finances. By opening a Credit Builder Account you can take your first steps toward building credit.

A Credit Builder Account is a loan in which the proceeds are held in a bank-held certificate of deposit (CD). Each on-time monthly payment builds credit history and adds to your savings. Your payments are reported to the three credit bureaus, Experian, Equifax, and TransUnion. Once you’ve paid off your Credit Builder Account, your CD unlocks and the money is yours (minus fees and interest).

Sources

- Consumer Financial Protection Bureau. “What is the difference between an interest rate and the Annual Percentage Rate (APR) in an auto loan?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-an-interest-rate-and-the-annual-percentage-rate-apr-in-an-auto-loan-en-733/.

- Consumer Financial Protection Bureau. “What is a Truth-in-Lending Disclosure? When do I get to see it?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-truth-in-lending-disclosure-when-do-i-get-to-see-it-en-787/.

- Experian. “What Is APR and How Does It Affect Me?” https://www.experian.com/blogs/ask-experian/what-is-apr/.

- CNBC. “Understanding this financial term can save you thousands of dollars over time,” https://www.cnbc.com/select/compound-interest/.

- Investopedia. “Periodic Interest Rate,” https://www.investopedia.com/terms/p/periodic_interest_rate.asp.

- Investopedia. “Annual Percentage Rate (APR),” https://www.investopedia.com/terms/a/apr.asp.

- CNBC. “How do lenders decide your APR? These are the most important factors,” https://www.cnbc.com/select/what-factors-lenders-consider-when-determining-apr/.

- Forbes. “What Does ‘APR’ Mean On Loans And Credit Cards?,” https://www.forbes.com/uk/advisor/credit-cards/what-does-apr-mean/.

- Investopedia. “Average Credit Card Interest Rate,” https://www.investopedia.com/average-credit-card-interest-rate-5076674.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).