How Much Will a Secured Credit Card Build My Score?

Published on: 08/26/2024

Once approved, unlike a traditional credit card your credit limit is secured by making an initial deposit into a savings account or certificate of deposit that is used as collateral or security for the card. Generally, the credit limit on your card equals the amount of your security deposit. While both types of credit cards — secured and the traditional, unsecured — can hurt or help your credit score (depending on how responsibly you use them), secured cards have one key advantage: Even people with bad credit can often qualify to open them.

For that reason, individuals with a poor credit score or no credit history may opt for secured credit cards to rebuild or build credit from scratch. In this post, we walk you through the factors determining how a secured credit card affects your credit score and what you can do to elevate your credit score with a secured card.

Table of contents

- How much can you build your credit score with a secured credit card?

- How does a secured credit card build credit?

- How fast do secured cards build credit?

- Can a secured credit card hurt my credit score?

- Can you qualify for a secured credit card with a low credit score?

- How to choose a secured credit card

- Does a secured credit card build credit faster than an unsecured card?

- Tips for building credit with a secured credit card

- Should you consider a secured credit card?

How much can you build your credit score with a secured credit card?

In short, it depends. How much a secured card can build your credit score varies based on several factors, so the exact number depends significantly on your unique financial situation. The following factors play a large role in determining your FICO® credit score [1] :

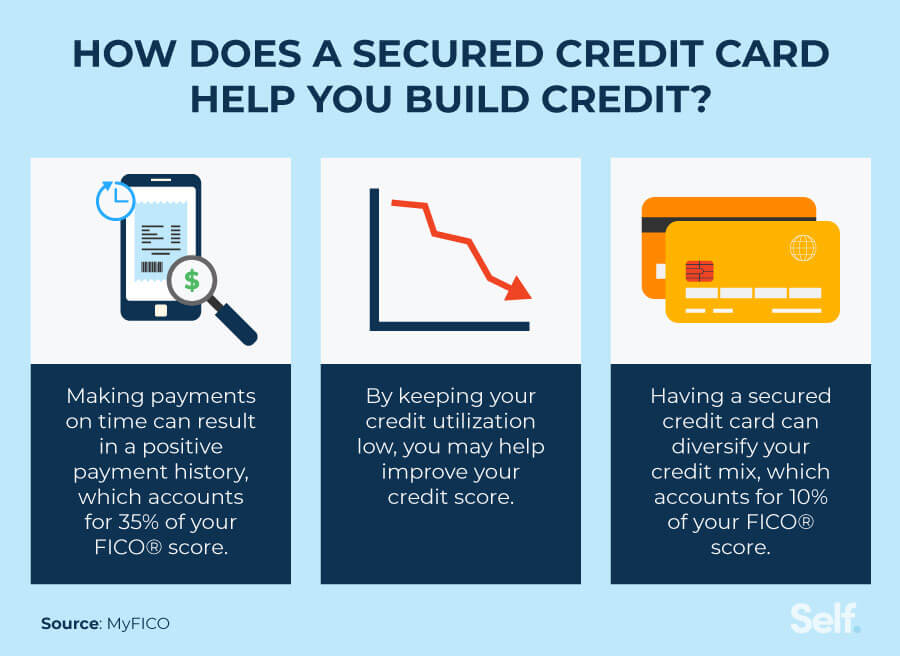

Payment history: Payment history makes up the single biggest factor (35%) in determining your FICO® score. If you want your secured card to lift your credit score, remember to make your monthly payment on time. If you pay your bill late or do not make at least the minimum payment your credit score may likely go down.

Credit utilization: How much of your available credit you use (your credit utilization ratio) determines 30% of your credit score. If you use too much of your credit line in relation to your credit limit and maintain high credit card balances, banks may look at you as a higher-risk borrower.

Length of credit history: FICO® scores also consider your account history — the age of your oldest and newest accounts, the average age of your accounts and when you last used certain accounts — in determining your credit score. As a general rule, good credit scores favor longer account histories.

Credit mix: Having a diverse mix of credit types, such as credit cards, car loans, mortgages and retail accounts, counts for about 10% of your FICO® score. While you don’t need to have every type of credit, variety may help your credit score.

New credit: About 10% of your score involves the number of accounts you have recently opened. If you open several new accounts in a short period of time, lenders may see you as a credit risk.

A number of other factors can negatively affect your credit score, including bankruptcies, car repossessions, settlements, foreclosures and excessive hard credit inquiries.[2]

How does a secured credit card build credit?

When used correctly, secured credit cards can help you build credit and lift your credit score. Use the following tips for building credit, whether through a secured or unsecured credit card:

Make your payments on time. When you consistently make on-time payments on your secured credit card account, the major credit bureaus receive positive information about your account. For more information on the importance of making payments on time, check out payment history and how it impacts your credit.[3]

Keep your credit utilization low. Cardholders who continually keep their credit utilization ratio (CUR) low — your CUR refers to the balance of your revolving credit divided by your total credit limit—– may build positive credit. While the recommended percentage varies, a credit utilization ratio of about 30%, generally keeping it below 10% (and consistently paying bills on time) can help you build and maintain a good FICO® Score.[4]

Diversify your credit mix. If you already have another credit product (such as a student loan), a secured card may help you diversify your credit mix, which might positively impact your credit score.[5]

How fast do secured cards build credit?

Once you’ve learned how to use a secured credit card to build credit, you may wonder how long it takes to lift your credit score. This, too, varies based on several factors:

How often your lender reports the information to the credit bureaus: Although you probably want to see instant results, you must wait until the lender begins reporting your secured credit card account to the bureaus before you see an impact to your score. Since most accounts don’t report until after the first billing cycle, you may need to wait at least a month or two before checking your credit report for the new secured credit card.[6]

The credit scoring model: Different credit companies have different credit scoring formulas. Some may calculate a credit score within a month of opening your first credit account, while others may require up to six months of activity before generating a score.[6]

Any negative marks that may have damaged your credit score: Negative information may stay on your credit report for years, making a credit score increase happen more slowly, but the impact of negative marks should lessen over time. While hard credit inquiries disappear after 2 years, a Chapter 7 bankruptcy can affect your score for up to 10 years, but like any other negative marks, the impact to your score lessens as time goes by.[7]

After you open a secured credit card, continue to follow healthy credit habits such as paying your bills on time, minimizing your credit utilization and avoiding opening multiple new accounts at once. Healthy credit habits and a healthy dose of patience may help you see a positive impact on your credit score.[8]

Can a secured credit card hurt my credit score?

Just as secured credit cards can build your credit score when used responsibly, they can damage your credit score. If the due date continually slips your mind and you miss payments, your credit score could suffer.[8] You may also have to pay fees for late payments.

Can you qualify for a secured credit card with a low credit score?

Backed by collateral in the form of a cash deposit, secured credit cards are often seen as less risky to the lender. They tend to have less strict approval requirements, which generally makes them more easily available to individuals with low credit scores

How to choose a secured credit card

While all secured credit cards require a deposit, not all secured cards are the same. If you want to use a secured card to build credit, choose one that works for your current financial situation.

Check for any hidden fees. When your finances are tight, don’t forget to read the fine print for any hidden fees that could cost you. Some secured cards may have expensive monthly maintenance fees, annual fees or even application fees.[9]

Check if the credit card company reports to all three credit bureaus. If your goal is to build credit, make sure your secured credit card company reports account activity to the three major reporting bureaus.

See if you can afford the security deposit. You should only open a secured card if you can afford the security deposit. Typically you will see minimum requirements of between $50 and $300 for a secured credit card. [9]

Compare the APR between each card. Be sure to take a careful look and compare the current rates between each secured credit card you look at. Because secured cards tend to carry higher interest rates, find one with the lowest rate, especially if you carry a balance.[9]

While opening a secured card may help your credit score in the long run, don’t forget that certain lenders may still pull your credit report resulting in a hard inquiry that can cause your score to drop slightly. So your best option, if you don’t want to have an impact to your credit score, is to look for a lender that does not pull a hard credit inquiry for a secured credit card. [10]

Does a secured credit card build credit faster than an unsecured card?

A secured credit card won’t necessarily help you build credit faster than an unsecured one. However, if you have a low credit score or no credit history, you’ll likely find it easier to be accepted for a secured credit card, meaning the process of building up your credit may go more smoothly.

It can take three to six months or longer to build your credit score for the first time when using a secured credit card. However, the time it takes to build up a good credit score will vary depending on things like your current debt, payment history, and debt-to-income ratio. [11]

Tips for building credit with a secured credit card

The following tips will help you make the most out of your effort to build credit and lift your score with a secured credit card.

Make all your payments on time

Research shows that your payment history is the strongest predictor that you will repay your debts. Because payment history is a major factor in calculating your credit score, don’t underestimate the importance of paying your bills on time. If you’re looking to bump your credit, avoid making late payments.[3]

Avoid applying for multiple credit cards at once

To protect your credit score, try to avoid applying for multiple credit cards at once. Each application results in a hard inquiry on your credit report. Too many hard pulls from multiple credit cards in a short period of time can damage your credit score — especially if you already have a limited or negative credit history. So while a secured card may indeed help your credit score, try to space out your new accounts when possible.

Regularly check your credit report

Credit monitoring and becoming very familiar with your credit report can be another way to help elevate your credit score. Once you open a secured credit card, review your credit report at least once a year to make sure your payments are reported to the credit bureaus. You are entitled to a free weekly credit report from all three credit reporting companies (Experian, TransUnion and Equifax) at annualcreditreport.com.

Additionally, some credit card issuers provide free credit monitoring tools so you can stay on top of changes to your score. For example, you can check your VantageScore® 3.0 score, as a Self member. Keep in mind your score may differ depending on the scoring model used. Regardless of the credit score you check, credit monitoring helps you understand if your efforts are having a positive impact.

Keep your credit utilization low

To potentially help lift your credit score, consider keeping your credit utilization rate — the amount of available credit you currently use compared to your credit limit — on the low side. A credit utilization rate of under 30% but ideally around 10% could indicate to lenders that you’re managing your credit responsibly. As an added bonus, you can also avoid overspending and increasing credit card debt by minimizing your credit use.

There is no set point where your credit utilization becomes bad, but at 30% it will begin to have a more noticeable negative impact on your score. [13]

Consider increasing your credit limit

Because credit utilization is such an important factor in credit scoring, you may consider increasing your credit limit when possible. Secured credit cards typically have low credit limits of just a few hundred dollars. In that case, you may go above the recommended credit utilization rate without even thinking about it. For example, with an initial deposit of only $100, you’d need to keep your expenditures under $30 to avoid potentially hurting your credit score. Some credit cards allow you to increase your credit limit by adding to your initial deposit. Others may offer increases for other reasons, such as making on-time payments for a specified period of time.[14]

Should you consider a secured credit card?

Secured credit cards offer an attractive option for people with bad credit or no credit history. With account approval and credit limits determined by a cash deposit rather than creditworthiness, secured cards can help you build or rebuild credit.

Sources

- MyFICO.com. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score.

- Experian. “How Long Does It Take for Information to Come Off Your Credit Reports?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-information-to-come-off-your-report/#s2.

- MyFICO.com. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history.

- MyFICO.com. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be.

- MyFICO.com. “What Does Credit Mix Mean?” myfico.com/credit-education/credit-scores/credit-mix.

- Experian. “How Long Does It Take to Get a Credit Score After Opening an Account?” https://www.experian.com/blogs/ask-experian/how-long-after-getting-first-credit-account-will-score-created.

- Experian. “How Long Does It Take to Rebuild Credit?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-rebuild-credit.

- Experian. “ How to Use a Secured Credit Card.” https://www.experian.com/blogs/ask-experian/how-to-use-a-secured-credit-card.

- MyFICO. “What Should You Look for in a Secured Credit Card?” https://www.myfico.com/credit-education/blog/secured-credit-card-tips.

- Experian. “Is There a Hard Pull on My Credit When I Apply for a Credit Card?” https://www.experian.com/blogs/ask-experian/is-there-a-hard-pull-on-credit-cards-if-i-apply/.

- CapitalOne, “How Long Does It Take to Build Credit?” https://www.capitalone.com/learn-grow/money-management/how-long-to-build-credit/.

- myFICO. ”Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries.

- Experian. “What is a Credit Utilization Rate?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization-rate.

- Experian. “What Is a Secured Credit Card?” https://www.experian.com/blogs/ask-experian/what-is-a-secured-credit-card/.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).