How Payment History Impacts Your Credit Score

Published on: 09/21/2022

Your payment history records both the late and on-time payments you make to creditors and is one of the most influential factors in calculating your credit score. Credit scoring models are designed to predict if a borrower will default on a credit obligation, like a personal loan or credit card payment. So your payment history helps to demonstrate your creditworthiness, including how reliable you are making on-time payments.

This article helps you understand how to improve your payment history on a credit report so that you have the best chance of raising your credit score.

Table of contents

- What is payment history?

- When are late payments reported to the credit bureaus?

- How much do late payments affect your credit score?

- How long does a late payment stay on your credit report?

- How to improve your payment history

What is payment history?

Your payment history records if you’ve made timely payments on your accounts. It influences your credit score more than any other factor. However, FICO® and VantageScore, two of the biggest credit scoring models, weigh it slightly differently. Your payment history is worth 35% of your FICO® score and 41% of your VantageScore® 3.0.[1], [2]

The five factors in your FICO® Score calculation are:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mix and types of credit (10%)[2]

The six factors in your VantageScore® 3.0 calculation include:

- Payment history (41%)

- Depth of credit (20%)

- Credit utilization (20%)

- Balances (11%)

- Recent credit (6%)

- Available credit (2%)[1]

As you can see, FICO and VantageScore use similar factors to determine credit scores, but weigh them and assign points differently. VantageScore also has larger score ranges, meaning that a score too low to be considered “good” by FICO® may be considered “good” by VantageScore.[1], [2]

Regardless of the credit scoring model, your payment history impacts your credit score the most.

Items that do affect your payment history

Several factors can influence whether or not you have a good or bad payment history, including:

- On-time payments: Your payment history shows the amount of debts you have paid on time, across all accounts, including credit cards, loans, mortgages and other lines of credit.

- Past due items: The number of late payments or missed payments you have, across all credit accounts, and how late they are, factor into your credit score. Your credit history also reflects how often you’ve had past-due items.

- Delinquencies or collections: Your payment history takes into account the amount of available credit you use, how much you still owe on delinquent accounts, or accounts that have been sent to collections, as well as how overdue these accounts are.

- Lawsuits, bankruptcies, charge-offs, foreclosures and wage attachments: Though considered serious, older and smaller amounts can create less of an impact than recent and larger amounts. However, public record information, like bankruptcies, stay on your credit report for seven to ten years.[2]

The type of credit accounts you use also affects your payment history. Credit accounts considered in payment history include:

- Credit cards

- Retail accounts

- Installment loans, like auto loans and student loans

- Consumer finance company accounts

- Mortgage loans[3]

Items that may affect your payment history

In addition to monthly payments on lines of credit or loans, you may have other common, recurring bill payments. Some bills that aren’t always, but may be factored into your payment history, include:

- Rental payments: Paying rent can have a positive impact on your credit, if your landlord tracks your payments through a third-party service.

- Utility accounts: While unpaid utility bills can have a negative impact on your payment history, your on-time payments can also have a positive impact, if you track your payments through a third-party service

Items that don’t affect your payment history

Some payments you make may not affect your payment history at all. Whether or not a payment or debt counts towards your payment history hinges on whether it gets reported to credit bureaus and how it is reported. Items that don’t affect your payment history include:

- Debit card purchases: Though debit cards can be used for many of the same purchases as credit cards, banks do not report the activity of your debit card to any credit bureau. Using your debit card takes money directly from your bank account, like using cash — the bank doesn’t extend credit to you through your debit card. The same applies to payments made with checks or cash.

- Business loans: A business loan may not impact your personal credit score, because businesses, like individuals, have their own credit reporting and scores. If you personally guaranteed the loan or structured your business as sole proprietorship, however, a business loan can have a direct relationship to your personal credit and may impact your payment history.[6]

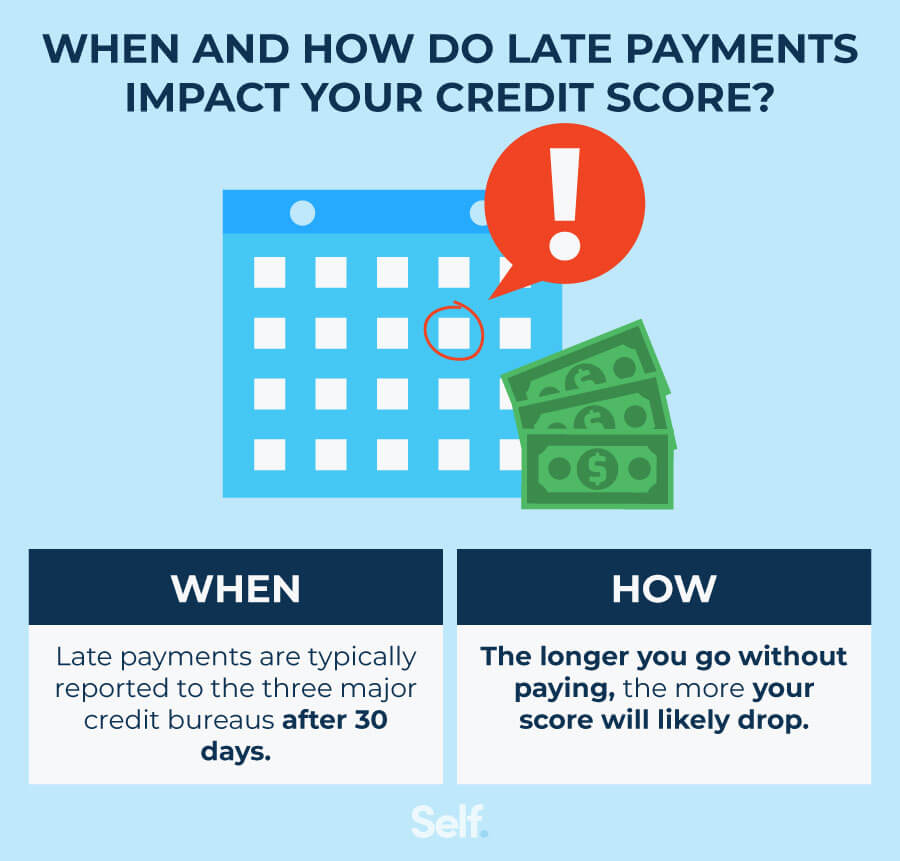

When are late payments reported to the credit bureaus?

Generally, late payments do not impact your credit history and score until you are at least 30 days late. You may be charged penalties or late fees well before then, but, if you make the full payment before the 30 days pass, most lenders will not report it as a late payment to the credit bureaus.[7]

A single late payment can cause a significant drop in your credit score. Having multiple late payments, or letting them go unpaid for longer times, can impact your credit score dramatically.[7]

How much do late payments affect your credit score?

Your credit score doesn’t weigh all late payments equally. How long ago your late payment occurred and how severe the late payment was both help determine the impact a late payment has on your credit score and credit history. For example, a 30-day late payment will likely have less of an impact than a 120-day late payment.[8]

Your credit history is unique. The choices you make with your finances — whether good or bad — impact your FICO® score. So your score can change and vary based on how you handle your credit and how you have used credit previously.[9]

As mentioned, how much your credit score is impacted depends on multiple factors including time elapsed, the severity of the late payment and credit history.

How long does a late payment stay on your credit report?

After you miss a payment and it becomes 30 days late, your creditor may report your late payment to a credit bureau. This late payment stays on your report for seven years, but the exact effect a late payment has on your credit score depends on your own credit history.[8]

How to improve your payment history

Improving your payment history can seem like a daunting task, especially if you have bad credit from defaulted payments or insufficient history. However, because your payment history makes up such a large part of your credit score, you might consider the following products and strategies that may help repair your payment history:

- Secured credit card: With a secured credit card, you make a deposit that equals your credit limit. Then you can use the card to make purchases, but your deposit doesn’t pay your balance. You still need to make payments, and those payments get reported to the credit bureaus. Your deposit acts as collateral and reduces the risks involved for the lender.

- Credit builder loans: Taking out a credit builder loan helps you to build credit history, but it works differently than traditional installment loans. Instead of getting your lump sum and paying it back in installments, you make your payments first, which are put into a certificate of deposit (CD) or savings account, and you get your lump sum (minus interest and fees) as soon as all of your payments are made. Your payments get reported to the credit bureaus.

- Get current on late payments: Paying off late payments as soon as possible stops them from continuing to harm your credit score, and puts you back on the road to recovery.

- Pay on time: Late or missed payments can incur fees as soon as the day after they are due. While late payments may not be reported until after they are 30 days late, those late payments once reported can harm your credit score from the moment they are reported to credit bureaus. Safeguard your credit by setting up automatic payments and paying at least your minimum monthly payment, so that you never miss a payment.

- Dispute incorrect information: Sometimes creditors misreport or report inaccurate information. Check your credit reports frequently and notify your lender or the major credit bureaus of any errors you find so that they do not unfairly impact your score.

- Communicate with creditors: It is generally better to communicate with creditors about debts, especially if communication has already started. Some creditors may reduce interest rates or work with you to get you back on track if you explain why you were unable to pay on time, and some may be open to negotiating repayment plans.

A low credit score may look like an impossible obstacle to overcome. While it does require work, time and attention to improve, you can regain control of your finances. The sooner you begin taking these steps, the sooner you will find your way back to good credit, and we are here to help you every step of the way. Our tools are designed to get you back on the right track and keep you there, to help you achieve the balance and stability you deserve.

Disclaimer: FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

Sources

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed on April 27, 2022.

- FICO. “What's in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed on April 27, 2022.

- Capital One. “How Does Payment History Affect Your Credit Scores?” https://www.capitalone.com/learn-grow/money-management/payment-history/. Accessed on April 27, 2022.

- Experian. “What Happens to Your Credit When You Default on a Business Loan?” https://www.experian.com/blogs/ask-experian/what-happens-if-you-default-on-small-business-loan/. Accessed on April 27, 2022.

- Equifax. “When Does a Late Credit Card Payment Show Up on Credit Reports?” https://www.equifax.com/personal/education/credit-cards/when-late-credit-card-payments-post/. Accessed on April 27, 2022.

- Experian. “Can One 30-Day Late Payment Hurt Your Credit?” https://www.experian.com/blogs/ask-experian/can-one-30-day-late-payment-hurt-your-credit-score/. Accessed on April 27, 2022.

- FICO. “FICO Consumer Credit Inquiry Infographic,” https://www.myfico.com/static/doc/education/FICO_Consumer_Credit_Activity_Infographic.pdf. Accessed on April 27, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).