What Is AMEX/DSNB and Can You Remove It From Your Credit Report?

Published on: 01/06/2023

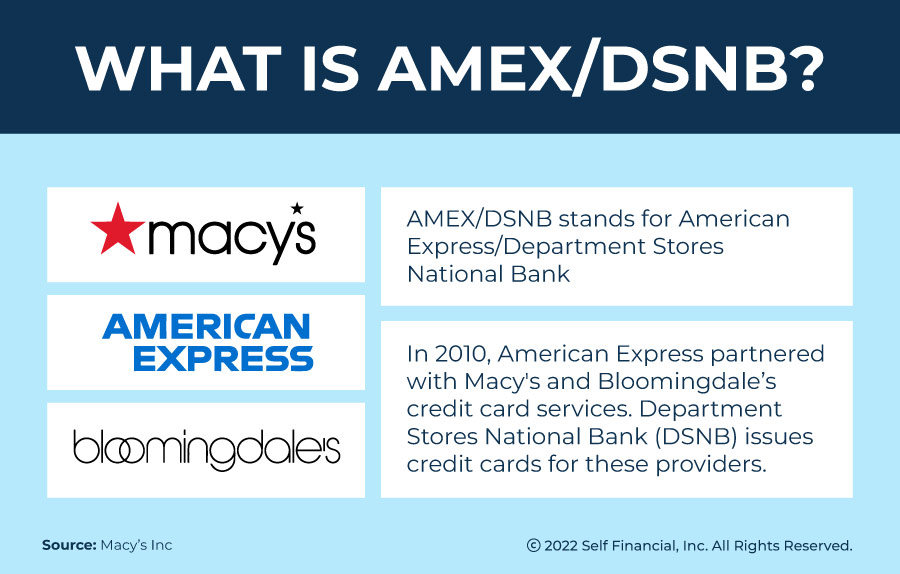

AMEX/DSNB stands for American Express/Department Store National Bank, a credit card issuer for retailers.[1] As a borrower, you may think AMEX/DSNB indicates that you have an American Express credit card. However, if you’ve applied for a credit card at retailers like Macy’s or Bloomingdale’s, AMEX/DSNB might appear on your credit report.

If DSNB made a soft inquiry into your credit to prequalify you for a Macy’s or Bloomingdale’s American Express card, were an authorized user on someone else’s account or have a closed account, AMEX/DSNB might appear on your credit report.

In this guide, we explain what AMEX/DSNB is, how it affects your credit report and how it may be possible to remove it from your credit report.

Table of contents:

- What is AMEX/DSNB on my credit report?

- How does AMEX/DSNB affect your credit score?

- Why is AMEX/DSNB on your credit report?

- How to remove AMEX/DSNB from your credit report

- How to check your credit report for free

What is AMEX/DSNB on my credit report?

In 2010, American Express partnered with Macy’s, Inc. as a provider of credit card services for Macy’s and Bloomingdale’s stores through the Department Stores National Bank (DSNB).[2] The cards are co-branded with American Express, but issued by the DSNB, a subsidiary of Citibank — hence, the name AMEX/DSNB.

AMEX/DSNB issues store-specific retailer credit cards. However, they offer a broader range for purchases than most retailer credit cards allow. For example, if you have a Macy’s store card, you can generally only use it for purchases at Macy’s. A Macy’s American Express card, on the other hand, can be used for general purchases.

If you see AMEX/DSNB on your credit report, you likely either have a current or past, closed account with them, have applied for one, or you’re an authorized user on someone’s account. However, if it’s not listed as a tradeline but is listed in the inquiry section on your credit report, that means that DSNB has checked, or placed an inquiry, on your credit.

How does AMEX/DSNB affect your credit score?

Any credit card application can affect your credit score, and AMEX/DSNB is no different. When you apply for a credit card, you authorize the issuer to perform an inquiry, or credit check, to get a copy of your credit report from the credit bureaus.[3]

Credit inquiries come in two forms: hard inquiries and soft inquiries. AMEX/DSNB performs a hard inquiry when you apply for the card, reviewing your credit report to determine if they’ll give you a new line of credit. A hard inquiry stays on your credit report for two years.

If you haven’t applied for credit through AMEX/DSNB, but you see them on your report, it could be from a soft inquiry. One way soft inquiries appear on your report is from lenders performing a pre-screening of your credit to possibly make you promotional offers. Although you can view the soft inquiries on your credit report, soft inquiries don’t impact your credit score.[3]

Having and using a credit card issued by AMEX/DSNB can also affect your credit score in the ways that any credit card or line of credit can. It touches on all the major credit scoring factors[4]:

- Payment history: Late payments and missed payments on your Macy’s or Bloomingdale’s credit card can affect your credit history and impact your score. On-time payments offer a favorable effect on your credit.

- Amounts owed: If you use a lot of your available credit, it may indicate to lenders that you’re higher risk.

- Length of credit history: Keeping your Macy’s or Bloomingdale’s credit card account open and using it responsibly can help you build positive credit history.

- Credit mix: FICO® will consider your Macy’s or Bloomingdale’s credit card as a credit account, potentially adding to the mix of your existing accounts.

- New credit: New credit may temporarily lower your credit score, but if you need new credit, aim to keep your new accounts to a minimum and open them gradually over time.

Why is AMEX/DSNB on your credit report?

AMEX/DSNB could appear on your credit report for several reasons, including these possibilities.

You were prequalified for a Macy’s or Bloomingdale’s credit card

If you’ve received a prequalified credit card offer from Macy’s or Bloomingdale’s, AMEX/DSNB may have performed a soft inquiry on your credit report. However, a prequalified offer isn't the only reason AMEX/DSNB may appear on your credit report. It may have conducted a soft inquiry but not extended you an offer, or it may have used a soft inquiry when considering whether to give you a credit increase or whether to keep your account open. Regardless of the reason for the soft inquiry, it won’t impact your credit score.[5]

Prequalification offers don’t usually result in hard inquiries until or unless you confirm with the lender that you want to move forward in the review process.

You recently applied for a Macy’s or Bloomingdale’s credit card

If you’ve applied for a Macy’s or Bloomingdale’s American Express card, you’ll likely see AMEX/DSNB on your credit report because DSNB is the credit card issuer for those retailers. The credit card application process involves a hard inquiry to determine your creditworthiness.

You have closed a Macy’s or Bloomingdale’s account

Even if you closed your Macy’s credit card account, closed accounts that were never late can still remain on your credit report for up to 10 years from the date it was closed.[6]

Accounts in good standing (with a history of on-time payments) can be a positive part of your credit history even when they’re closed. Accounts with a history of negative information, such as late payments, collections, or bankruptcy, are likely to negatively impact your credit score, and generally stay on your credit report for 7 years with some bankruptcies remaining on your credit report for 10 years.[7]

In some cases, the lender may close your credit account, most commonly due to long periods of inactivity.[8]

You are an authorized user on a Macy’s or Bloomingdale’s credit account

If a family member added you as an authorized user on their Macy’s or Bloomingdale’s credit card account, that account may show up on your credit report.[9]

Being an authorized user may affect your credit positively or negatively, depending on how you and the primary user use the card. As an authorized user, you’re allowed to use the card, but you aren’t legally obligated to make payments. If the primary user doesn’t make the payments, however, or has a high credit utilization ratio, your credit could be affected too. Your credit utilization ratio (also known as “CUR”) is the total revolving debt divided by your total revolving credit limit. Your CUR makes up 30% of your credit utilization of your FICO® score — by having a high CUR, it could indicate to your lender that you may be borrowing more than you need. According to FICO®, experts suggest maintaining a CUR of 30% or below, but staying close to 10% gives you the best chance of positively impacting your credit score.[10]

You are a victim of identity theft

If you’ve never been contacted by or applied for any credit accounts with AMEX/DSNB, someone may have opened a credit account under your name without your permission, an indicator of identity theft.[11]

If you discover an entry from AMEX/DSNB on your credit report that you don’t recognize, you can contact Macy’s or Bloomingdale’s, as well as one of the credit reporting bureaus that made the inquiry (Experian, Equifax or TransUnion) to report the issue. You may also want to report it to the Federal Trade Commission (FTC) and police.

How to remove AMEX/DSNB from your credit report

You can only remove items from your credit report that were made in error. You can’t remove items just because they are negative if those items are accurate. If AMEX/DSNB is on your credit report due to a reporting error or because of identity theft, you should report the issue and try to have the entry removed.[12]

An account with negative information, such as late payments, collections, or bankruptcies, remains on your credit report for 10 years for Chapter 7 bankruptcies after the date the bankruptcy was filed and 7 years for Chapter 13 bankruptcies (again, after the bankruptcy was filed). All other negative information remains on your credit report for seven years after the date of the first time you were delinquent.[13]

If you need to remove AMEX/DSNB from your credit report, here are the steps you can take.

Obtain copies of your credit report to see which bureau the debt was reported to

You can request your credit report once per year for free from each of the major credit bureaus, through AnnualCreditReport.com. You can also check your credit report for a small fee any time you like with any of the three major credit bureaus (Experian, Equifax and TransUnion).

For inaccuracies, send a dispute letter

If you believe the information on your credit report is inaccurate, you can send a dispute letter to the credit bureaus.[14] The Consumer Finance Protection Bureau (CFPB) provides contact information, dispute forms and letter templates, as well as guidelines for how to approach each of the major credit bureaus.[15]

Monitor your credit

Keeping an eye on your credit report is one of the best ways to ensure that you’re on the right track and to help you spot errors on your credit report. Monitoring your credit regularly helps you avoid surprises when you’re ready to apply for a loan or credit card. Be sure to request a free credit report every 12 months through AnnualCreditReport.com and check out a credit report example to better understand what is getting reported so you can spot errors that need to be removed.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- OCC. “Department Stores National Bank,” https://www.occ.gov/static/cra/craeval/Oct08/24622.pdf. Accessed August 16, 2022.

- Macy’s, Inc. “Macy’s, Inc. and American Express Announce New Co-Brand Card Partnership,” https://www.macysinc.com/news-media/press-releases/detail/285/macys-inc-and-american-express-announce-new-co-brand. Accessed August 16, 2022.

- FICO®. “How Do Credit Inquiries Affect Your Credit Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed August 16, 2022.

- FICO®. “How Are FICO Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed August 16, 2022.

- myFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed August 16, 2022.

- Experian. “Removing Closed Accounts in Good Standing,” https://www.experian.com/blogs/ask-experian/removing-closed-good-standing-accounts-from-report/. Accessed August 16, 2022.

- Experian. “Why Are Closed Accounts Hurting My Credit?” https://www.experian.com/blogs/ask-experian/why-are-closed-accounts-hurting-credit. Accessed August 16, 2022.

- Equifax. “What You Should Know About Inactive Credit Card Accounts,” https://www.equifax.com/personal/education/credit-cards/inactive-credit-card-account-closed/. Accessed August 16, 2022.

- Experian. “Credit Card Authorized User: What You Need to Know,” https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user/. Accessed August 16, 2022.

- myFICO®. “What is Amounts Owed?“ https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed November 10, 2022.

- FICO®. “How to Protect Yourself from Identity Theft,” https://www.myfico.com/credit-education/identity-theft. Accessed August 16, 2022.

- FICO®. “How to Fix Errors on Your Credit Report,” https://www.myfico.com/credit-education/credit-reports/fixing-errors. Accessed August 16, 2022.

- TransUnion. “How Long Do Closed Accounts Stay on My Credit Report?” https://www.transunion.com/blog/credit-advice/how-long-do-closed-accounts-stay-on-credit-report. Accessed August 16, 2022.

- Consumer Financial Protection Bureau. “SAMPLE LETTER: Credit Report Dispute,” https://files.consumerfinance.gov/f/documents/092016_cfpb__CreditReportingSampleLetter.pdf. Accessed August 16, 2022.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed August 16, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).