How Can Piggybacking Credit Impact Your Credit Score?

Published on: 06/21/2022

Key Takeaways

- Credit card piggybacking is when someone with an established credit history adds another person as an authorized user on a credit card account.

- The account holder alone is liable for payments, so they are responsible for charges made by the authorized user.

- Credit card piggybacking may positively impact the authorized user if the account holder has excellent credit but will negatively impact the authorized user's credit score if the account holder doesn't have good credit habits.

If you’re trying to build credit from scratch, it can feel like an uphill battle: You need good credit to qualify for better loan terms and credit cards, but if you don’t have any credit, you could be stuck between a rock and a hard place.[1]

There are a few things you could consider.

One option may be becoming an authorized user on an account with a positive payment history. This is known as piggybacking credit because you “piggyback” on another person’s established credit history.[2]

Parents may add children to their credit card accounts in order to help them start building credit at an early age, as young as 13 years old.[3] Depending on the creditor’s terms of agreement, there may be restrictions to when children can be added to a credit card account. Adults may also be able to piggyback off of partners, friends, or parents accounts to help improve their credit score.

Piggybacking credit isn’t the only way to establish credit, and it may have advantages — as well as potential drawbacks — which we will explore in this article.

How does piggybacking credit work?

Credit piggybacking occurs when someone with an established credit history adds another person as an authorized user on a credit card account. The credit card issuer may report the activity on the account to the three major credit bureaus (Equifax, Experian and TransUnion), where it will appear on both the account holder’s and the authorized user’s credit histories.[4]

If the account owner manages this specific account well, that may be reflected on the authorized user’s credit report too. It will then be used in determining the authorized user’s credit score.

It’s important that the account holder has good credit habits, pays bills on time and has low credit utilization rates. If they don’t, piggybacking may have a negative impact on the authorized user’s credit score.

The impact piggybacking credit has also depends on the bank and scoring model. Some banks may not report authorized users – they are only required to report joint account holders. Even if they do, certain credit scoring models, like the widely used FICO 8Ⓡ, have adjusted their calculations to reduce the impact that piggybacking may have on your credit score.[5]

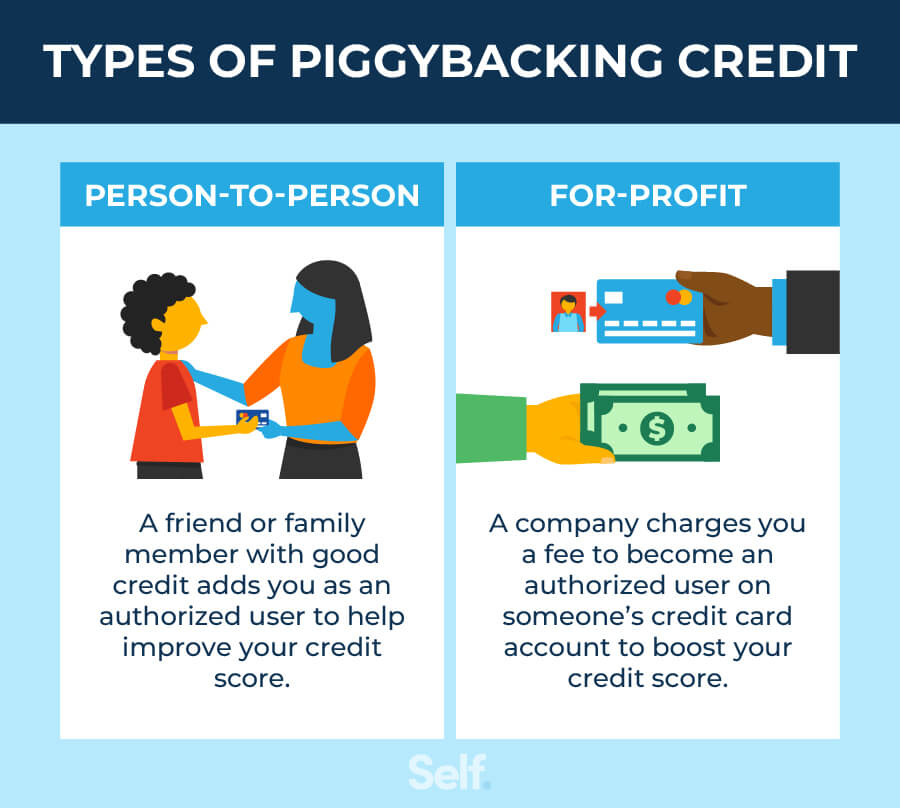

Person-to-person piggybacking

Person-to-person piggybacking is the type of arrangement described above. A cardholder requests that the credit card issuer add someone such as a family member or close friend to their account. This can boost the authorized user’s credit, especially if the account holder maintains their account.

For-profit piggybacking

Since the primary cardholder can add anyone to their account as an authorized user, some people may be willing to profit from this arrangement.[6] Each credit card account has a tradeline, which includes all the important information about the account in one place.[7]

With for-profit piggybacking, you essentially rent a place on the cardholder’s tradeline for credit-boosting purposes (you don’t get a card). This arrangement lasts for a specified period, after which you will be removed from the tradeline. But while you’re there, you could see your credit score improve.[2]

For-profit credit piggybacking can be risky because you’re paying to become an authorized user on a credit card for a stranger’s account. You may not know whether that person has good credit and by failing to make payments on the account, you may damage yours. Furthermore, for-profit piggybacking services may be discounted by some, including FICO®, which has taken steps to reduce its effectiveness by tweaking its scoring formulas.[5]

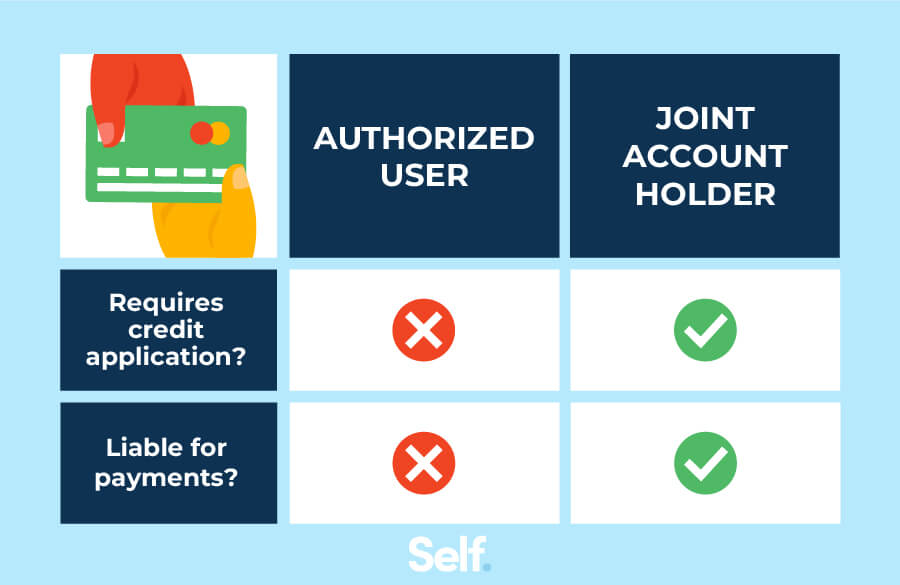

Piggybacking vs. joint account holder

It can be easy to confuse piggybacking with being a joint account holder, but they’re two very different things. Here are some key differences.

Piggybacking

- You are not subject to a credit check when you apply.[2]

- The account owner is solely responsible for paying the bills and the lender cannot come after the authorized user to make payments.[2]

- Your credit activity will appear on the account and will be reflected on both users’ credit reports.[8]

- The primary cardholder can remove an authorized user account without permission at any time simply by contacting the credit card issuer, either online or by phone.[9]

Joint account holder

- Both cardholders must go through a credit check for the card to be approved. If one of the applicants has bad credit, it could lead to the application being denied.[10]

- Both cardholders share responsibility for paying the bill, and if one fails to do so, the other can be pursued by bill collectors if the lender charges-off the account and sells the account to a debt collection agency. Learn more about what a charge-off means.[11]

- Both account holders apply for the card together, and one cannot simply remove the other by contacting the issuer.[10]

- As with a piggybacked account, both cardholders will see activity from the card appear on their credit reports and reflected in their credit scores.[11]

How can piggybacking help your credit score?

Piggybacking credit can help or hurt the authorized user’s credit score, depending on the primary cardholder's payment history. The authorized user account will now show up on the primary cardholder’s account tradeline.

The authorized user may be able to improve their credit score in several ways. For one thing, they may benefit from the primary cardholder’s payment history, if it has been consistent. If the cardholder has a low credit utilization ratio (the amount owed on the card divided by the credit limit debt), the authorized user will likely benefit from this, as well. Payment history counts for 35% of a person’s FICO® Score*, and credit utilization counts for 30%: They’re two of the most important factors when it comes to how a credit score is calculated.[12]

If the account has been open for a while, that can help too, because the length of a person’s credit history counts for 15% of their score.[12]

If done correctly, piggybacking credit can help improve an authorized user’s credit score, which can increase the likelihood that they’ll be approved for future loans and lines of credit. It can also improve their chances of obtaining favorable interest rates on credit cards when approved for new credit.

How can piggybacking hurt your credit score?

If the primary account holder doesn’t make their payments, your payment history, and therefore your credit score, can be negatively impacted. Also, if the account holder has a high credit utilization ratio, you might further damage your credit score.

Even if they make their payments, some banks may not report authorized users, meaning the cardholder’s positive or negative credit history would not impact the authorized user’s credit score.[13]

How can I become an authorized user?

You can become an authorized user by asking a cardholder to add you to their account. If they agree, they can then add you by calling the credit card issuer or through a mobile app. Some cards allow authorized users to be added for free, but others charge a fee.[14]

What are the risks to account owners and authorized users?

While there may be potential benefits, both authorized users and account owners face risks if they enter into this kind of arrangement.

Account owner

- The account holder alone is liable for payments, so they can wind up responsible for charges made by the authorized user if that person has a card linked to the account.[8]

- The account holder may be responsible for paying fees associated with adding an authorized user to the account.[8]

Authorized user (piggybacker)

- Because the piggybacker isn’t responsible for making payments, they’ll need to rely on the account owner to do so.[8]

- If the primary cardholder misses payments or runs up a high credit utilization ratio, that could reflect poorly on the authorized user’s credit, as well.[9]

Other ways to build credit

If the piggybacking option isn’t available to you or you don’t like the risks associated with it, there may be other ways for you to start building credit.

- Secured credit card: Secured credit cards allow you to apply for a line of credit in exchange for a deposit as collateral. If you maintain your account in good standing for a period of time, your credit may increase and you may be rewarded with additional available credit without increasing your deposit. Alternatively, the issuer may convert your secured card to an unsecured account, removing the need for collateral and refunding your deposit.

- Credit builder loan: Self’s credit builder account allows you to choose from four options the payment term and dollar amount that best fit your budget. Making on-time payments can help build your credit history and your savings. Once you’ve paid off your account, you can access the savings, minus any fees and interest.

Other credit building strategies may include starter credit cards with low credit limits and student cards that may have higher interest rates but are available to students without a long credit history.

Weigh your options

Piggybacking on an established cardholder’s account by becoming an authorized user is one way of trying to establish credit and potentially help your score increase. It may not be the only way to establish credit or your only credit repair option, but it may be worth considering if you know someone with a good credit score who may be willing to let you piggyback credit on their account to help you with building credit.

It’s important to know the pros and cons of this kind of arrangement going in. If you’re comfortable with the potential risks and see the potential benefits of doing so, it could be the right choice for you.

Disclaimer: FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

Sources

- Experian. “Why Do You Want A Good Credit Score?” https://www.experian.com/blogs/ask-experian/why-would-you-want-a-good-credit-score/. Accessed June 10, 2022.

- Experian. “What Is Piggybacking Credit?” https://www.experian.com/blogs/ask-experian/what-is-piggybacking-credit/. Accessed June 10, 2022.

- Experian. “When Should My Child Get a Credit Card?” https://www.experian.com/blogs/ask-experian/when-should-my-child-get-a-credit-card/. Accessed June 10, 2022.

- Federal Reserve Board. “Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs,” https://www.federalreserve.gov/pubs/feds/2010/201023/201023pap.pdf. Accessed February 28, 2022.

- FICO. “FICO 8 Credit Score Available at All Three National Credit Reporting Agencies,” https://www.fico.com/en/newsroom/fico-8-credit-score-available-all-three-national-credit-reporting-agencies. Accessed February 28, 2022.

- Experian. “What Rights Do You Have As an Authorized User on a Credit Card?” https://www.experian.com/blogs/ask-experian/what-rights-do-you-have-as-an-authorized-user/. Accessed June 10, 2022.

- Experian. “What Are Tradelines and How Do They Affect You?” https://www.experian.com/blogs/ask-experian/what-are-tradelines/. Accessed February 28, 2022.

- U.S. News & World Report. “Authorized Users: The Pros and Cons,” https://money.usnews.com/credit-cards/articles/authorized-users-the-pros-and-cons. Accessed June 10, 2022.

- Experian. “Removing Yourself as an Authorized User Could Help Your Credit,” https://www.experian.com/blogs/ask-experian/will-removing-myself-as-an-authorized-user-help-my-credit. Accessed June 10, 2022.

- CNET. “What to consider when getting a joint credit card,” https://www.cnet.com/personal-finance/credit-cards/should-my-partner-and-i-get-a-joint-credit-card/. Accessed June 21, 2022.

- Chase. “Do joint credit cards affect both credit scores?” https://www.chase.com/personal/credit-cards/education/build-credit/do-joint-credit-cards-affect-both-credit-scores. Accessed June 21, 2022.

- myFICO. “What’s in my FICO Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed June 10, 2022.

- CNBC. “Does being an authorized user on someone else’s credit card actually build your credit score?” https://www.cnbc.com/select/does-being-an-authorized-user-affect-your-credit-score/. Accessed June 10, 2022.

- Experian. “Credit Card Authorized User: What You Need to Know,” https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user/. Accessed February 28, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).