Does Breaking a Lease Hurt Your Credit?

Published on: 11/20/2025

Various circumstances may require you to break your lease early, such as relocating for a new job, caring for a family member, or financial hardship.

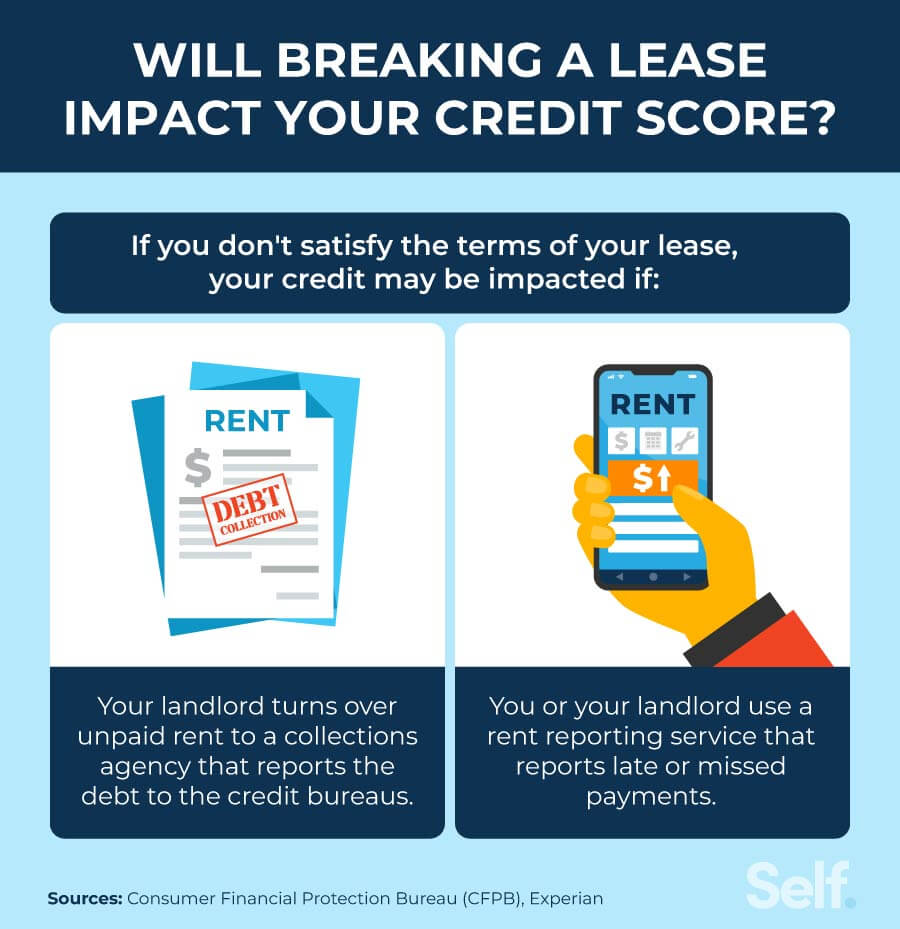

In most cases, breaking a house or apartment lease doesn’t directly affect your credit. If you satisfy the terms of your lease agreement, an early termination won’t appear on your credit report. However, if you incur debt from unpaid rent or early termination fees, your landlord or property manager may send it to a collections agency, which may negatively impact your credit.[1]

In this article, we explain how a broken lease might affect your credit, how to minimize the impact, and when you may be able to break a lease without affecting your credit.

Key points

- Ending a lease early will not usually appear on your credit report if you meet the terms of your agreement.

- Unpaid rent or fees that go to collections may be reported to credit bureaus, which can negatively affect your score.

- State laws and lease terms may provide exceptions such as military service, unsafe housing, or domestic violence that allow you to end a lease without penalty.

What are the consequences of breaking a lease?

If you break a lease for a reason that isn’t legally protected, you may face some financial consequences that impact your credit. Breaking a lease affects your credit if you don’t pay what you owe to your landlord. After attempting to collect that debt, your landlord could sue you for your unpaid rent or other money you owe, such as fees for early termination or damages, and turn your debt over to a collections agency. These actions may impact your credit.

Breaking a lease could also affect your future rental opportunities because future landlords may require a letter of recommendation from your previous landlord. A broken lease could also appear on a tenant screening report, which might affect whether or not a future landlord agrees to rent to you.

However, if your rental agreement contains a termination clause, you might be able to leave early under certain conditions, and your agreement will outline what breaking a lease will cost you. For example, a landlord might charge an early termination fee or keep your security deposit. [1]

When your lease doesn’t have a termination clause, your ability to break it or the consequences you might face when you do will depend on the state in which you live. Laws vary by state, so be sure to check tenant rights laws in your state. If your state doesn’t have information from this source, check with a local attorney who specializes in tenant disputes to understand the consequences of breaking a lease that doesn’t include a special termination clause.

How does breaking a lease impact your credit?

Landlords typically don’t report rent payments to credit bureaus, so breaking a lease won’t automatically affect your credit if you satisfy the terms of your lease agreement.[1] However, if you or your landlord report your rental payment history using a rent reporting service, any late or missing payments might be reflected in your credit report.[2]

If you break a lease and the landlord turns the unpaid debt over to a collections agency, that company is likely to report the account to credit bureaus, which could affect your credit.[1] Collection accounts factor into your payment history, the most influential credit scoring factor. Payment history makes up 35% of your FICO® Score[3] and 40% of your VantageScore®[4].

Ultimately, how much breaking a lease impacts your credit depends on your personal financial situation and what credit scoring model is used to calculate your score.

How long do collections stay on your credit report?

Collections accounts typically stay on your credit report for seven years from the date of delinquency, or the date they were first reported late. Negative items have less impact on your credit score as they get older, but don’t completely fall off until the seven-year mark is up.[5]

Paying off collections debt could cause your credit score to increase, decrease or not change at all. How your score is impacted depends on the other information in your credit history.[6] To prevent debt from going to collections in the first place, pay what you owe on time and as agreed.

When can you legally break your lease?

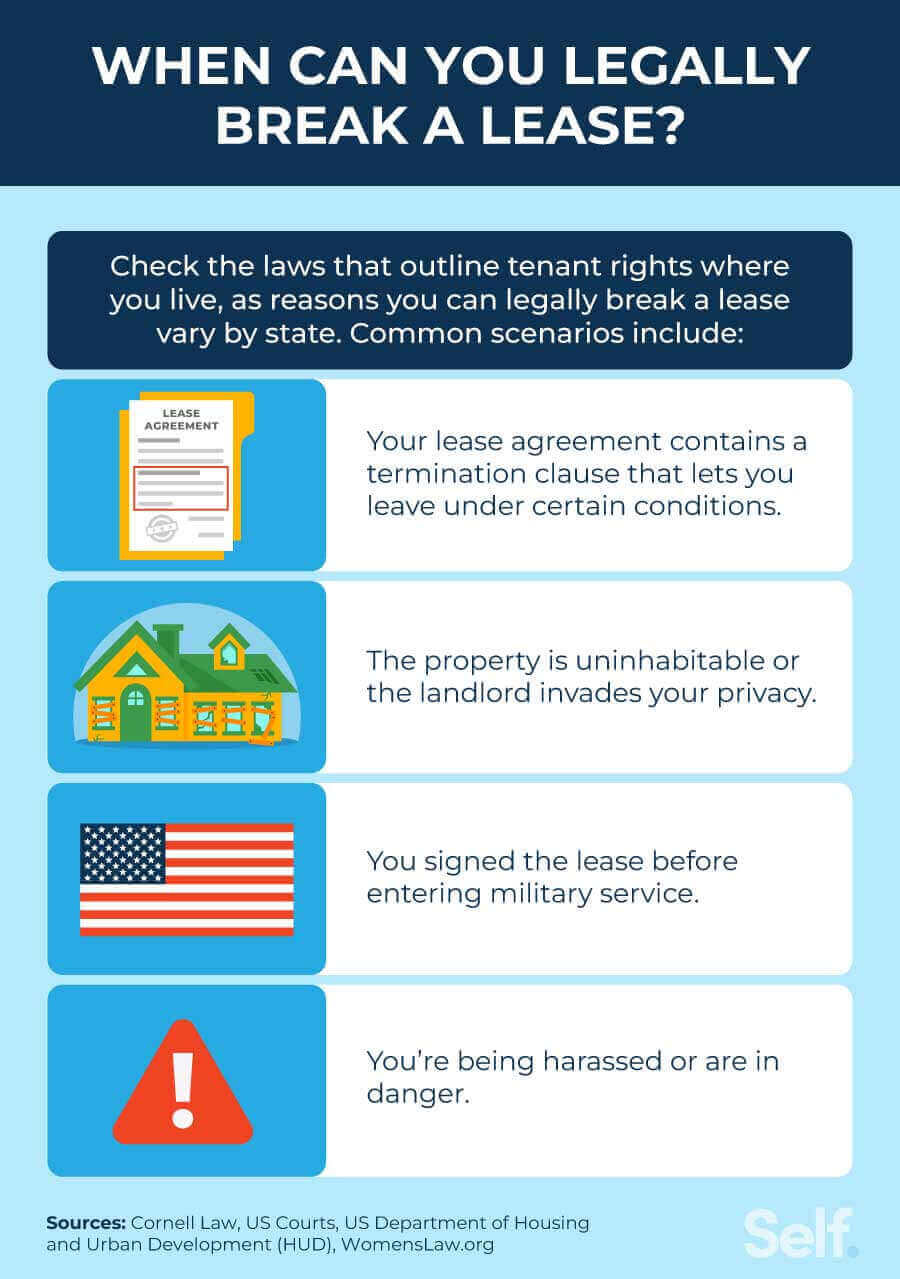

In addition to an early termination clause that legally allows you to break your lease, there are some circumstances where you may be able to break a lease without penalty.

For all of these circumstances, local laws vary by state, so if you’re seriously considering breaking your lease, consult with a tenant rights lawyer who can review your lease and offer legal advice.

The landlord didn’t fulfill their obligations

If your landlord doesn’t fulfill their obligation to you as a renter, you may be able to legally break your lease. This includes if the property is uninhabitable or if the landlord invades your privacy.

In most jurisdictions in the U.S., leases for residential properties typically include an “implied warranty of habitability,” which requires property owners to make sure the property is habitable, or safe to live in. They have this responsibility in addition to making regular repairs, as specified by most leases.[7]

If your landlord takes actions that interfere with the tenant’s “covenant of quiet enjoyment,” such as interfering with your use of the home or failing to resolve a problem that impacts your quality of life, you may be able to claim a “constructive eviction”[8] and move out without the obligation to pay your remaining rent.

You’re entering military service

If you signed your lease before entering military service, you may be able to legally terminate it once you enter the military. Under the Servicemembers Civil Relief Act (SCRA) an active duty service member may terminate a residential lease if they are transferred after the lease is made.[9]

You’re being harassed or are in danger

If you’re being harassed or are in danger, you may be able to terminate your lease early. Many states have early lease termination laws for survivors of domestic violence, including victims of sexual assault, stalking and harassment.

To see how these laws apply in your state, you can check WomensLaw.org for housing protections for domestic violence survivors. Just click on your state and then click the link to “Selected” statutes for your states or a link specific to housing to see if your state has protections in place.

Other situations specific to each state

Because tenant rights laws vary by state, you may be able to legally break your lease for other reasons. For example, in some states, if you need to break your lease, landlords have to make reasonable efforts to find a new tenant, and you may only have to pay rent while the property is vacant.

You can check your rights via the U.S. Department of Housing and Urban Development (HUD) by visiting your state’s department page.

How to end your lease early

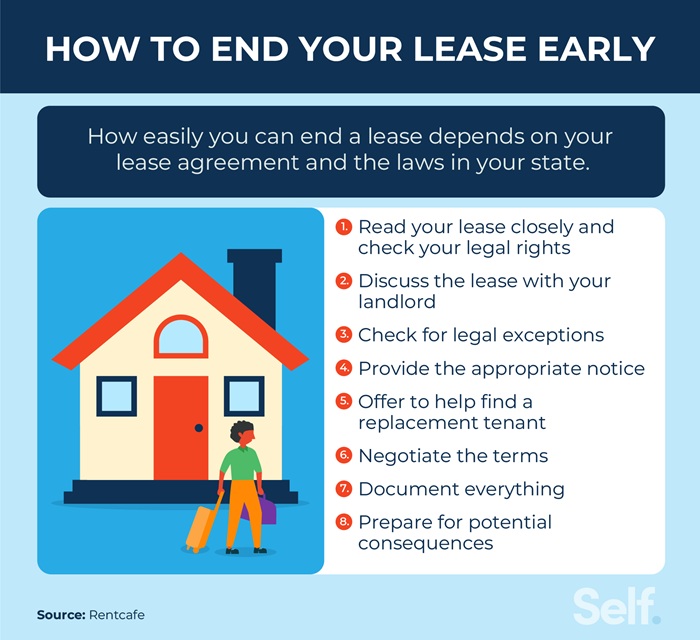

If you need to break your lease, following these steps may help you break it without hurting your credit or impacting your personal finances.

1. Read your lease closely and check your legal rights

Read your lease carefully to check for an early termination or “lease break” clause. This section should outline any fees, notice requirements, or rent obligations if you leave early. If no clear guidance is provided, you’ll likely need to negotiate directly with your landlord.[10]

2. Discuss the lease with your landlord

After reviewing your lease, speak with your landlord or property manager to explain your situation. Open communication can help you explore options such as lease termination fees, subletting, or finding a new tenant. A cooperative approach increases the chance of reaching a solution that avoids penalties.[10]

3. Check for legal exceptions

In some cases, you may be legally allowed to break your lease without facing penalties. These situations include:

- Active-duty military service – You may be able to terminate your lease if you receive deployment or relocation orders.

- Unsafe living conditions – If the landlord doesn’t resolve serious safety issues, you may be allowed to move out early.

- Domestic violence protections – Some state laws let survivors break a lease if safety is at risk.

Check your lease and local tenant laws to see if any of these apply to your situation.[10]

4. Provide the appropriate notice

Most leases require written notice before you move out — typically 30 or 60 days. Even if it’s not required, a written notice can help maintain a professional relationship and reduce the chance of disputes.

Include your planned move-out date and a short explanation. Keep a copy of the notice for your records and maintain polite, factual language throughout.[10]

5. Offer to help find a replacement tenant

If permitted by your lease and local laws, offering to assist in finding a new tenant may be beneficial. Doing so could reduce the financial impact on both parties and may help the landlord re-rent the property faster. Most states require landlords to make a reasonable effort to re-rent the unit; however, your cooperation may encourage a smoother transition.[10]

6. Negotiate the terms

If your lease does not outline a clear early termination policy, you may need to negotiate the terms of your exit. Landlords may agree to alternatives, such as a fixed number of rent payments or covering advertising costs, to avoid legal complications. Always ensure any agreement is put in writing. Written documentation helps clarify expectations around fees, timelines, and other conditions.[10]

7. Document everything

Keep a detailed record of your communications with the landlord. This includes copies of your written notice, responses, and any formal agreements. If your lease break is related to legal issues, such as habitability concerns, document the supporting evidence. This may include dated photos, written complaints, or inspection results.[10]

8. Prepare for potential consequences

Breaking a lease can negatively impact your rental history and credit, particularly if you leave without settling outstanding balances. Paying owed rent or fees promptly can help reduce this risk. Aim to leave the property in good condition. Clean thoroughly, fix minor damage, and follow proper move-out procedures to maintain a positive rental reference.[10]

How paying rent may positively impact your credit

Paying rent can positively impact your credit score if you use third-party rent reporting services to report positive rental history to the three credit bureaus (Experian, Equifax and TransUnion).

These services charge different fees for subscriptions and report to different bureaus. Be sure to assess the pros and cons of each service you consider and choose the one that works best for your needs. Some you sign up for yourself, while others require your landlord to enroll.

How your credit may affect your rental opportunities

Landlords may consider your credit score when deciding whether to approve your rental application.[11] Also, if you have collections debt from unpaid rent, your credit score might be negatively affected, which could be an issue if your landlord does a credit check.

Monitor your credit so that you can review what potential landlords or lenders might see. You are entitled to one free credit report each year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. These reports are available through AnnualCreditReport.com.

No matter what your financial situation is, Self has the resources to address your needs at every stage. Whether you’re looking to build good credit or repair bad credit, the information and tools Self offers can help you understand how to navigate your choices and how those impact your credit.

Sources

- Experian. “Can I Break a Lease Early?” https://www.experian.com/blogs/ask-experian/break-lease-early/. Accessed January 20, 2023.

- Consumer Financial Protection Bureau. “Could late rent payments or problems with a landlord be in my credit report?” https://www.consumerfinance.gov/ask-cfpb/could-late-rent-payments-or-problems-with-a-landlord-be-in-my-credit-report-en-1815/. Accessed January 20, 2023.

- myFICO®. “How are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed January 20, 2023.

- VantageScore®. “The Complete Guide to Your VantageScore®,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed January 20, 2023.

- myFICO®. “Chapter 7 & 13: How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed January 20, 2023.

- myFICO®. “How Do Collections Affect Your Credit?” https://www.myfico.com/credit-education/faq/negative-reasons/should-i-pay-my-collections. Accessed January 20, 2023.

- Cornell Law School. “Implied warranty of habitability,” https://www.law.cornell.edu/wex/implied_warranty_of_habitability. Accessed January 20, 2023.

- Cornell Law School. “Constructive eviction,” https://www.law.cornell.edu/wex/constructive_eviction. Accessed January 20, 2023.

- U.S. Courts. “Servicemembers' Civil Relief Act (SCRA),” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/servicemembers-civil-relief-act-scra. Accessed January 20, 2023.

- RentCafe. “Step‑by‑Step Guide: How to Break a Lease Early,” https://www.rentcafe.com/blog/renting/step-by-step-guide-break-the-lease-early/. Accessed September 26, 2025.

- myFICO. “Do You Need a Credit Score to Rent an Apartment?,” https://www.myfico.com/credit-education/blog/credit-score-to-rent-apartment. Accessed September 5, 2025.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).