10 Essential Budget Categories for Your Financial Needs

Published on: 01/02/2026

When creating a budget, it’s important to consider the different budget categories to include in your plan. Not only do these categories give you a better snapshot of your overall personal or household expenses, but they also help you identify where you can afford to spend more and where you should spend less to meet your financial goals.

Key points

- Budgeting for your monthly expenses can help you keep track of your spending and ensure important costs are accounted for every month.

- Housing, transportation, and food typically represent the largest household expense categories, with recommended percentages ranging from 28-33% for housing and 10-20% for savings and debt payments.

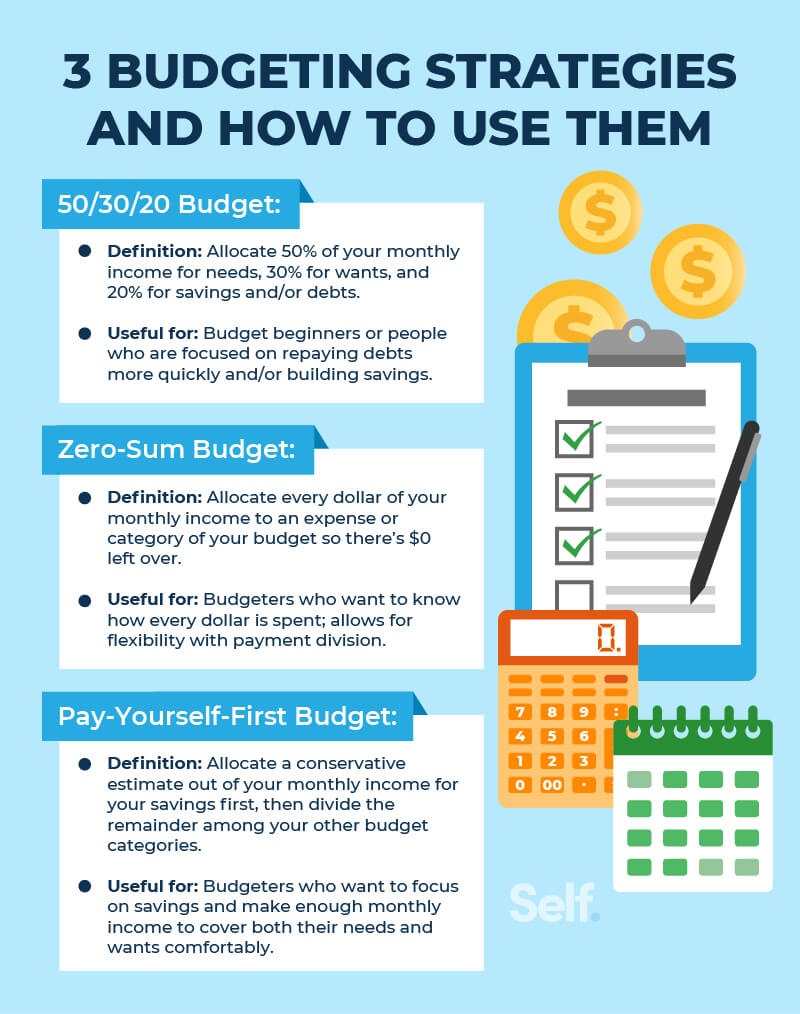

- Popular budgeting methods include the 50-30-20 rule, zero-sum budgeting, and the pay-yourself-first budget.

Here are 10 essential budget categories to consider including in your plan:

1. Mortgage or rent

2. Food

3. Transportation

4. Utilities

5. Subscriptions

6. Personal expenses

7. Savings and investments

8. Debt or student loan payments

9. Health care

10. Miscellaneous expenses

1. Housing

Deciding how much to spend on housing, whether you rent or own, depends on two important factors: your income and your debt.

How much should you budget?

One common rule of thumb is to spend about 30% to 33% of your income on housing. This figure includes renters or homeowners insurance, utilities, and property taxes. [1]

Another benchmark worth considering is the 28/36 rule, which takes into account both expenses and debt. Under this rule, your housing expenses shouldn’t be higher than 28%, and your total debt obligations shouldn’t be higher than 36% of your income.[2]

What does this include?

As mentioned, rent or mortgage payments are just the beginning.

If you’re a member of a homeowners’ association (HOA), you will need to consider dues. If you’re paying rent, you will also want to factor in renters insurance and how much you will need. Similarly, if you own a home, you will need homeowners insurance.

If you own your home, there are also maintenance costs to consider. You’ll also need to pay property taxes, which vary significantly depending on where you live. [3] The Massachusetts Institute of Technology (MIT) offers a cost-of-living calculator that can help you compare housing costs within the counties in your state.

2. Food

According to 2023 data from the U.S. Bureau of Labor Statistics, American households spent an average of $9,985 annually on food, including groceries and dining out. [4]

How much should you budget?

Government research from the Consumer Expenditure Survey shows that households spend an average of 12.9% of their total annual expenditures on food, including both food at home and food away from home.[4] Data from the U.S. Economic Research Service indicates that Americans spent an average of 10.6% of their disposable personal income on food in 2024.[5]

Based on the USDA’s 2024 recommendations, a single person aged 19-50 should spend $280.95-$431.15 per month for food at home.[6]

What does this include?

The household expense category generally includes groceries. Some people choose to include dining out in this category as well. However, if you spend a significant amount of money every month dining out, you may want to create another budget category for that to better understand your spending.

Research continues to show significant cost differences between home cooking and dining out. The cost differential remains substantial, with restaurant meals typically costing significantly more than home-prepared alternatives.[7]

3. Transportation

For most people, transportation ranks as the second-most-expensive budget category. According to 2023 BLS data, households spent an average of $13,174 annually on transportation.[4]

How much should you budget?

Transportation accounted for approximately 17% of total household expenditures in 2023, according to the Bureau of Labor Statistics.[4]

What does this include?

This includes the cost of your car payment (if you have one), as well as rideshare services, public transportation, gas, car maintenance (oil changes, tires, etc.), car insurance, taxis, parking fees, DMV fees, car rentals, and so forth.

Loyalty and membership programs like GasBuddy can save you money on fuel, and comparing and negotiating auto insurance premium costs can allow you to save on auto insurance.

Typically, financial experts recommend spending no more than 10% of your monthly take-home pay on your car payment.[8]

4. Utilities

Utility costs vary widely by state and continue to be affected by energy market fluctuations. According to 2023 BLS data, households spent an average of $4,625 annually on utilities, fuels, and public services. This figure is also included in the total housing budget above. [4]

How much should you budget?

Utilities accounted for approximately 6% of total household expenditures in 2023. [4]

Utility costs will vary depending on where you live and how large your household is. 8%-10% of your monthly income is a good benchmark.[9]

What does this include?

Utility costs include electricity, phone service, water, garbage services, natural gas, internet service, and cell service.

Saving money on utilities can be as easy as resetting your thermostat. You can save up to 10% a year on your cooling and heating costs by turning your thermostat back 7 to 10 degrees from its normal setting eight hours a day.[10]

Other ways to save include conserving water by taking short showers and using low-flow toilets, and saving on utility costs by insulating your home well, switching to LED lightbulbs, and using EnergyStar appliances. You can also shop around for internet and cell phone service or negotiate your existing plans.

5. Subscriptions

According to a 2025 survey, the average American household spends $37 a month on streaming services.

How much should you budget?

Subscriptions can be bundled under a personal and discretionary spending category, which experts recommend not to spend more than ten percent.[11]

What does this include?

Subscriptions can encompass a number of types of services, but they’re often forgotten about. The most common services people tend to use are streaming services, such as Netflix, Amazon Prime, Disney+ and Hulu. Other subscription services can be food-related, clothing-related or provide other kinds of entertainment.[12]

Prices on subscription services can increase without someone being aware. Many end up overspending on subscriptions they simply forgot to cancel after a free trial period. Therefore, it pays to revisit those commitments and cancel those you don’t use, or which may have increased in cost, exceeding what you’d budgeted.

6. Personal expenses

Monthly spending in this category will likely vary greatly from person to person, as everyone’s personal lives and needs are different.

How much should you budget?

Financial experts recommend spending between 5%-10% as an absolute maximum on personal expenses.[11]

What does this include?

Personal expenses can include things like your kids’ school supplies, daycare, clothing, pet care, gym memberships, trips to the barbershop or beauty salon, subscription services, and so forth.

One way to save money in this expense category is by planning. Life expenses change over time, for example, if you have children or you bring a new pet into your home. It’s important to be prepared for those added costs and make adjustments in your budget. Another way to save is by prioritizing. You may need to maintain a standard of dress on the job, but you might be able to take a pass on that expensive pair of new shoes.

Shop sales, but buy only what you need and came to buy. Impulse buys can be budget-killers, at the supermarket, department store, or online. Compare prices for things like child care, haircuts, and various personal care expenses.

7. Savings and investments

A budget tends to focus on day-to-day expenses rather than the long-term, but it’s important to save, too — whether it’s for a rainy day, a goal such as a wedding or a car, or for retirement. But how much of your paycheck should you save?

How much should you budget?

The general recommendation from financial experts is to save three to six months’ worth of your monthly living expenses for an emergency fund, but that’s not always feasible for every household. Financial experts also recommend allocating between 5%-10% of your monthly income for savings and investments.[11]

What does this include?

Savings (including emergency funds) and investments are recommended, but not always feasible to budget into someone’s monthly expenses. However, the traditional subcategories in this section include a traditional bank-based savings account, retirement funds, 401(k), Roth IRA, and investments.

If you’re struggling to save money, some ways to save include collecting loose change or rounding up the change on purchases you make, then depositing it in savings (some banks allow you to do this). Consider saving a percentage of what you earn, rather than a dollar figure; this way, if your income goes up, so will your savings. 401(k)s and Roth IRAs are important when it comes to saving for retirement, so starting small with an investment account when your budget allows can contribute positively to your financial future.

8. Debt or student loan payments

It’s important to include debt payments in your budget as well, whether you’re repaying a personal loan, tackling credit card debt, or paying off a student loan. Missed payments go on your credit report and hurt your credit score, so it’s important to stay on top of them.

How much should you budget?

Financial experts recommend allocating between 5%-15% of your monthly income to outstanding debts. Many people find that their budget can be quite tight if their monthly debt payments are more than 20% of their net income. It’s good practice to make sure you have money saved before you start paying down a lot of your debt. [11]

What does this include?

All types of debt, including credit card debt, should be factored into this budget category.

This can include things like student loans and auto loans, and the monthly payments combined should make up less than 15% of your net income. Anything more than that amount should be targeted to reduce first.

One method of paying off debt is the avalanche method, where you pay off obligations with the highest interest rates first. This saves you money on compound interest. Another option is the snowball system, in which you pay off the smallest debt first while making minimum payments on the others. Then, once that is paid off, you roll what you were paying on that into the next-smallest, and so forth.

9. Health care

As of 2024, the average premium for employer-sponsored family health coverage was $25,572, and the average worker contributed $6,296 towards the cost of family coverage.

For single coverage, the average deductible for covered workers in a plan with a general annual deductible is $1,787.

[13]

How much should you budget?

Healthcare accounted for approximately 8% of total household expenditures in 2023, according to the Bureau of Labor Statistics. [4] Depending on your medical needs, you may need to allocate more room in this budget category.

What does this include?

When budgeting for health care, you will want to take rising health care costs into account as well as changes in your own health needs from year to year. Healthcare costs continue to outpace general inflation, with health spending expected to grow at an average annual rate of 5.8% through 2033. These figures are based on national averages and will not necessarily be the same as your own costs. Health care costs can also increase so you should account for this in your budget as well. [14]

10. Miscellaneous expenses

Miscellaneous expenses are those that aren’t easy to categorize and might be very specific to your lifestyle.

What does this include?

In a miscellaneous budget category, you might include expenses related to a hobby or a one-time occurrence that you didn’t plan for.

Some expenses might be easier to adjust than others. The important thing is not to forget to include items that don’t fall neatly into any specific category, as they’re still expenses you should consider and may fit in this category for a given year or time period.

Budgeting basics

Making a personal budget can help you develop a monthly cash flow that will tell you where your money’s going and whether you’re operating at a deficit or a surplus. You then may need to make adjustments to your budget Budgeting touches on all areas of your personal finance. But there’s no single method of creating a monthly budget. While this article has provided broad guidelines for spending categories, listed below are 3 different strategies to approach your budget.

The 50-30-20 budget method

Under the 50-30-20 method, you earmark 50% of your after-tax income for necessities, set aside 30% for your wants, and direct 20% toward savings and debt repayments. This enables you to create larger categories for a more general budget because you don’t need to be as detailed, but you can still determine where your money is going, broadly speaking.

On the negative side, the lack of detail could make it harder for you to prioritize specific expenses and identify which areas you need to cut.

Zero-sum budgeting

Zero-sum budgeting means starting your monthly budget from zero and assigning every dollar a specific purpose before you spend it. Instead of just looking at last month's expenses and making small adjustments, you examine each potential expense fresh and decide whether it truly deserves a place in your budget based on your current priorities and goals.

Pay-yourself-first budgeting

Pay-yourself-first budgeting means automatically setting aside money for savings and investments before paying any other expenses, including bills or discretionary spending. As soon as you receive income, you immediately transfer a predetermined percentage or amount to savings accounts, retirement funds, or other financial goals, treating these transfers as non-negotiable "payments" to your future self.

Your budget should always work for you

Your budget is a template for your financial life, both now and in the future. By understanding how much money you’re making and where you’re spending it, a comprehensive budget will help you pay your debts from the past, stay current on regular expenses, and plan for the future.

Whatever budgeting method you choose should further your general goal of financial well-being and the specific goals you set for yourself. Indeed, setting those goals — and creating a realistic plan to achieve them — is what the budgeting process is all about.

Sources

- Bank At First, “Thirty Percent Rule” https://www.bankatfirst.com/personal/discover/flourish/thirty-percent-rule.html Accessed September 18, 2025

- Bankrate, “What is the 28/36 Rule?” https://www.bankrate.com/real-estate/what-is-the-28-36-rule/ Accessed August 18, 2025

- Tax Foundation. “Property Taxes by State and County” https://taxfoundation.org/data/all/state/property-taxes-by-state-county/ Accessed August 18, 2025

- BLS, “Consumer Expenditures” https://www.bls.gov/opub/reports/consumer-expenditures/2023/ Accessed August 18, 2025

- U.S. Department of Agriculture, Economic Research Service. "Food Prices and Spending," https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/food-prices-and-spending. Accessed August 18, 2025.

- USDA Food and Nutrition Service. "Official USDA Food Plans: Cost of Food at Home at Three Levels, U.S. Average, January 2024," https://fns-prod.azureedge.us/sites/default/files/resource-files/Cost_Of_Food_Low_Moderate_Liberal_Food_Plans_January_2024.pdf. Accessed August 18, 2025

- Journey Foods, “Cooking at Home Vs Eating Out” https://www.journeyfoods.io/blog/cooking-at-home-vs-eating-out-whats-better Accessed August 18, 2025

- NerdWallet, “How Much Should My Car Payment Be?” https://www.nerdwallet.com/article/loans/auto-loans/much-car-payment Accessed August 18, 2025

- Money Management, “How Much Should You Be Spending on Utilities Each Month?” https://www.moneymanagement.org/blog/how-much-should-you-be-spending-on-utilities-each-month Accessed August 18, 2025

- Energy.gov. “Energy Saver,” https://www.energy.gov/energysaver/thermostats. Accessed August 18, 2025

- Credit Counselling Society, “Budgeting Guidelines” https://nomoredebts.org/budgeting/budgeting-guidelines Accessed August 18, 2025

- PC Mag. “How to Track and Manage Your Paid Subscriptions,” https://www.pcmag.com/how-to/track-and-manage-your-paid-subscriptions. Accessed August 18, 2025

- KFF. "2024 Employer Health Benefits Survey: Section 1: Cost of Health Insurance," https://www.kff.org/report-section/ehbs-2024-section-1-cost-of-health-insurance/. Accessed August 18, 2025.

- Centers for Medicare & Medicaid Services. "NHE Fact Sheet," https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data/nhe-fact-sheet. Accessed August 18, 2025.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.