How to Get Your Chase Overdraft Fees Waived

Published on: 02/20/2023

Overdraft fees can feel like a double whammy: You find out you don’t have enough money in your account and you also have to pay an extra charge. If you recently noticed an overdraft fee on your bank statement, you may wonder if you can have it removed. While the cost of overdraft fees varies by financial institution, Chase bank charges $34 per transaction as of October 2022.[1] Overdraft fees can really add up in the long run, so it helps to know how they work.

In this guide, we explain how overdraft fees occur, how to try to get overdraft fees waived and how to avoid overdraft fees in the first place.

Table of contents

- What is an overdraft fee?

- What is Chase’s overdraft limit?

- How to get your Chase overdraft fees waived

- How many overdraft fees can be waived?

- How to avoid a Chase overdraft fee?

- What happens if you don’t pay an overdrawn account?

- Read over your bank account’s policies

What is an overdraft fee?

An overdraft fee occurs when you don’t have enough money in your bank account to pay for the entire transaction. Instead of declining the transaction, the bank will cover the amount for you. For customers who don’t have overdraft protection, the financial institution may charge a non-sufficient funds (NSF) fee instead.

Chase uses these terms interchangeably, but not all banks do. Overdraft and NSF fees represent different banking scenarios that both result from your attempt to complete a transaction without enough money in your account. The difference is:

- In an overdraft, the bank covers the amount to enable the transaction to go through, and then charges you an overdraft fee.

- In an NSF, the bank declines the transaction and charges you an NSF fee.[2] Typically, this occurs with checks and Automated Clearing House (ACH) transactions, but Chase uses this term interchangeably with overdraft to mean using more money than you have in your account.[3]

You may see non-sufficient funds referred to as insufficient funds as well. Regardless of the terminology — overdraft fee, NSF fee, or insufficient funds fee — for Chase, they all refer to you getting charged $34 anytime you overdraw your account by more than $50.

Overdraft fees vary by bank and each bank has its own policy on covering overdrafts. In the case of Chase Bank, Chase does not guarantee overdraft coverage in all cases. If Chase does not authorize an overdraft, your transaction will be declined. However, Chase covers overdrafts in three ways, but some require enrollment to receive coverage.[1]

- Chase Standard Overdraft Practice: Automatically included with all accounts except Chase High School Checking, Chase Secure Checking and Chase First Checking, Standard Overdraft Practice may pay, for a fee, overdraft transactions at the bank’s discretion based on your account history, your deposits and the transaction amount.[4]

- Chase Overdraft Assist: In addition to the Standard Overdraft Practice, Chase also offers automatic enrollment into Chase Overdraft Assist for all checking accounts, excluding Chase High School Checking, Chase Secure Checking and Chase First Checking. This additional protection charges no overdraft fees if you’re overdrawn by less than $50 at the end of the business day or overdrawn by over $50 at the end of the business day but bring it down to being overdrawn by less than $50 by the end of the next business day. You also aren’t charged an overdraft fee for having your transaction declined or returned unpaid or for items less than $5.[5]

- Chase Overdraft Protection: You can enroll into this optional service that allows you to select a backup account, like a savings account or another checking account, to pay for any overdraft transactions that occur on your checking account.[5]

- Chase Debit Card Coverage: If you sign up for this service, Chase will authorize and pay overdrafts for everyday debit card purchases such as groceries, gasoline or dining out. You can turn this coverage on or off, depending on how you prefer Chase to handle your overdrafts.[5]

While overdraft services may cover the transaction amount, the bank may still charge you an overdraft fee. Overdraft protection protects you from overdrawing your account, not from being charged a fee. So you might want to opt out of overdraft coverage to prevent the bank from charging you the $34 overdraft fee. However, if Chase doesn’t cover the transaction, you will have your transaction declined.

What is Chase’s overdraft limit?

Chase will not charge you more than three overdraft fees per business day, or a daily maximum of $102.[1]

Chase will not charge you an insufficient funds fee in the following circumstances:[4]

- If your debit card transaction or ATM cash withdrawal request is declined.

- If the transaction is $5 or less.

- If you have an account overdrawn by $50 or less at the end of the business day or if you have an account overdrawn by more than $50 but you bring it to overdrawn by $50 or less at the end of the next business day.

- If you received authorization for a debit card transaction when your account still had a sufficient available balance.

- If your check or ACH is returned unpaid. However, if a previously returned check or ACH is presented again and paid, Chase may charge an insufficient funds fee.

Starting in 2022, Chase gave customers an extra day to bring their account balance to $50 or less overdrawn to avoid an overdraft dee. The bank expanded the timeframe from the end of the business day to the end of the next business day. Chase also announced that as of 2022, customers can use their pay that comes by direct deposit up to two business days early.[6]

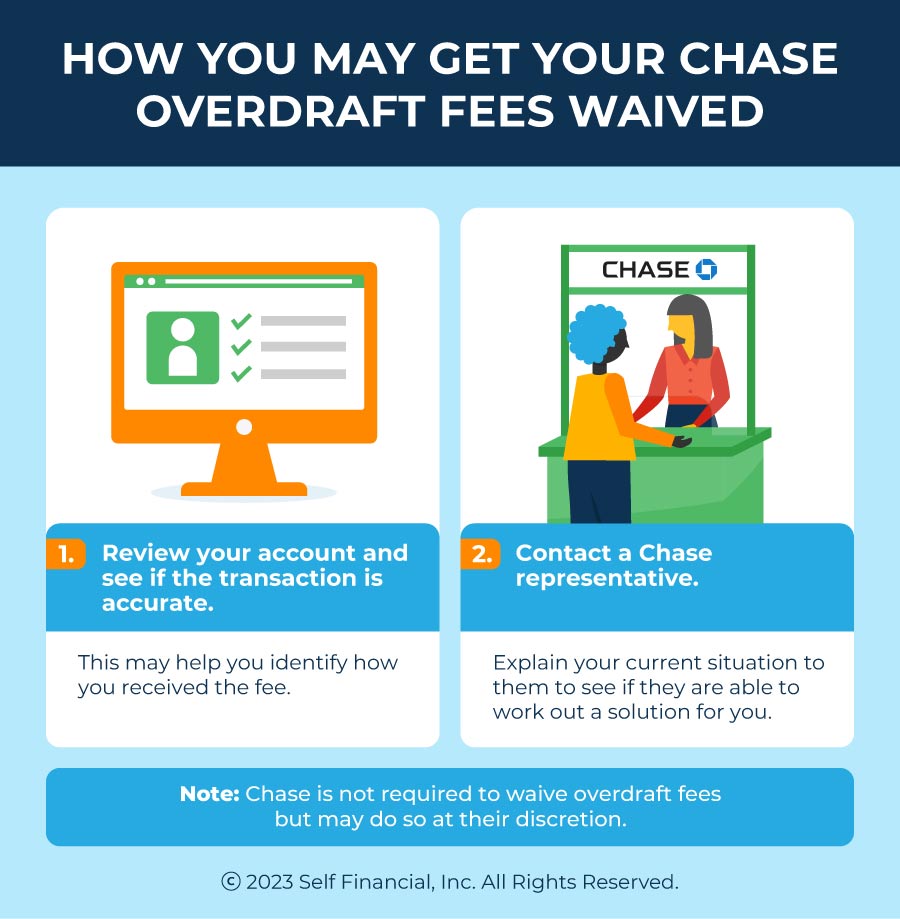

How to get your Chase overdraft fees waived

If you want to get a Chase insufficient funds fee refund, consider taking the following steps:

1. Review your account and see if the transaction is accurate

Before contacting a Chase representative, review the overdrawn account to confirm that you made the transaction and that the information is accurate. This can help you identify when and why you received the charges, and may make it easier to resolve when you talk to a Chase representative.

If you notice a transaction that you did not make, it may mean that someone has gained access to your account and has made fraudulent purchases. Contact your bank’s customer service number immediately.[7]

2. Contact a Chase representative

After confirming the details of the transaction, contact Chase customer service directly to discuss the overdraft fees. You can visit a local branch in person, send an email or call a representative and explain your situation to them to see if they can work with you to remove the fees. The best number to get in touch with Chase is 1-800-935-9935.[1]

You could say something like this:

“Hi, I noticed there was an overdraft fee charged to my account. I’m a long-term customer and this is the first time I’ve received this fee. Is there a possibility that it can be waived?”

If you have received Chase overdraft fees before, you could highlight other reasons why you’re a good customer, such as pointing out that you rarely have a negative balance on your account, always pay maintenance fees on time (if applicable) or have a steady, consistent flow of income through direct deposit that typically keeps you from overdrawing your account.

How many overdraft fees can be waived?

Because each branch makes its own decision about fees, contact your local branch directly to see how many overdraft fees you can have waived. If you find yourself frequently getting hit with overdraft charges or other common bank fees, try to monitor your accounts more closely and set up online banking alerts to notify you when your account reaches a certain minimum balance or is overdrawn.[3]

How to avoid a Chase overdraft fee?

The following practices can help you avoid getting hit with a Chase insufficient funds fee.

- Add money to your account so that you are overdrawn by $50 or less by the next business day. If you do so by 11 p.m. ET (8 p.m. PT) on the next business day, Chase won’t charge overdraft fees.

- Monitor your spending and bank accounts. Knowing how much money comes in and goes out — including when automatic payments post — can help you avoid most bank overdraft fees.

- Keep sufficient funds in your bank account. If you have enough money to cover all your transactions, you won’t have to worry about receiving an insufficient funds charge.

- Turn on overdraft alerts. Online or via the Chase app, you can sign up to receive alerts by email, text message and push notification when your account is overdrawn.[8]

What happens if you don’t pay an overdrawn account?

If you’re wondering whether an overdraft affects your credit score, know that overdrafts don’t appear on your credit report. However, they may eventually impact your credit score if you don’t pay what you owe. If you end up not paying the overdraft fees or the amount overdrawn, the bank may close your account and send it to collections. This could make it more difficult for you to open checking accounts in the future.[9]

Any time an account goes into collections, it may appear on your credit report as a delinquency and may stay there for up to seven years. So paying your overdrawn balance and applicable fees before an account is closed and sent to collections may help you avoid a negative impact to your credit score.[9]

Read over your bank account’s policies

When you unexpectedly get hit with an overdraft fee, it can feel a bit overwhelming. To better avoid overdraft fees in the future, look over your bank or credit union account policy to understand what charges may come up that can impact your personal finances. You can usually find your account policy sheet online or by contacting your financial institution directly.

Sources

- Chase. “Overdraft and Overdraft Fee Information for Your Chase Checking Account,” “https://www.chase.com/content/dam/chasecom/en/legacy/ccpmweb/shared/document/chase_consumer_A9_english_web.pdf. Accessed on October 22, 2022.

- Forbes. “Overdraft Fees Vs. NSF Fees: What’s The Difference?” https://www.forbes.com/advisor/banking/overdraft-fees-vs-nsf-fees. Accessed on October 22, 2022.

- FDIC. “Overdraft and Account Fees,” https://www.fdic.gov/resources/consumers/consumer-news/2021-12.html. Accessed on October 22, 2022.

- Chase. “Standard Overdraft Practice,’ https://www.chase.com/personal/checking/overdraft-services/standard-overdraft-practice. Accessed on October 22, 2022.

- Chase. “Overdrafts: What you need to know,” https://www.chase.com/personal/checking/overdraft-services. Accessed on October 22, 2022.

- JPMorgan Chase & Co. “Chase helps more than two million customers avoid overdraft service fees,” https://www.jpmorganchase.com/ir/news/2021/chase-helps-more-than-two-million-customers-avoid-overdraft-service-fees. Accessed on October 22, 2022.

- Chase. “Having concerns about a merchant charge to your debit or credit card?” https://www.chase.com/personal/credit-cards/dispute. Accessed on October 22, 2022.

- Chase. “FAQs,” https://www.chase.com/personal/checking/overdraft-services/faqs. Accessed on October 22, 2022.

- Experian. “Does an Overdraft Affect Your Credit Score?” https://www.experian.com/blogs/ask-experian/does-an-overdraft-affect-your-credit-score. Accessed on October 22, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).