What Is a Credit Sweep and What to Do Instead

Published on: 01/26/2026

A credit sweep refers to an action taken by a credit repair company that claims to “sweep” your credit report and dispute all negative items at one time. The sweep will claim the items are fraudulent, usually as a result of identity theft.

However, unless all items on your credit report are fraudulent (which is improbable), a credit sweep is illegal. While credit card fraud statistics show that fraud cases continue to increase, a credit sweep is not the answer.

It’s important to note that any action performed by a credit repair company can be done on your own. This can save you thousands of dollars in fees. If your credit needs a clean-up, you can dispute individual issues and fix errors on your credit report yourself, for free.

Key points

- What is a credit sweep? Credit sweeps are illegal schemes where companies claim they can dispute all negative items on your credit report at once by falsely claiming fraud or identity theft, but they only work if everything on your report is actually fraudulent.

- You can dispute credit report errors yourself for free by requesting your free annual (or weekly) credit reports from AnnualCreditReport.com, identifying inaccuracies, and sending written dispute letters to the credit bureaus, who must investigate within 30 days. However, keep in mind that you cannot have legitimate items removed from your credit report.

- Credit repair companies face strict regulations under the Credit Repair Organizations Act and Telemarketing Sales Rule, including prohibitions on charging fees before services are fully performed and requirements to provide written contracts with cancellation rights.

Table of contents

- How credit sweeps work

- Are credit sweeps legal?

- Alternatives to credit sweeps

- How to fix your own credit

- Your legal rights with credit repair services

- Credit repair vs. building credit

How credit sweeps work

Credit sweep programs typically promote the ability to remove negative items on your credit report by disputing every single item on your credit report. Often, these companies charge high fees for this service.[1]

A credit sweep is not a wise strategy for credit repair. As mentioned, it only works if all the items on your credit report are fraudulent, which is rarely the case. You also must be able to prove identity theft with a police report. If some items are not fraudulent, a credit sweep is illegal.[1]

If you approach a credit repair company and they demand upfront payment or seem to be withholding information, do not engage with them. These actions are prohibited by the Credit Repair Organizations Act and are clear indications that such a company is not on your side.[2]

Line of credit sweep vs. credit sweep

Before going further, it is essential to understand a key terminology difference. A credit sweep is not the same as a line of credit sweep. The latter refers to an automatic transfer of excess checking account funds into a line of credit. This is done to pay down debts from idle funds automatically.[3]

A line of credit sweep is an arrangement between a bank and a customer, usually a corporation, much like any other account service. Credit repair agencies do not handle these.

Are credit sweeps legal?

A credit sweep is illegal in most cases.

Common credit sweep scams

By their nature, credit sweep scams target vulnerable people. Often, these credit repair scams promise many impossible results that the average customer won’t understand.

- Removing negative information immediately: Common credit repair scam services often promise to perform a “full credit sweep” to remove negative information from your credit report. This can’t be done. In most cases, negative items will remain on your credit history for up to seven years, or between seven and ten years for bankruptcies.

- Opening a new credit history: Beware of any services that claim to open a new credit history. This is identity fraud, and you will get caught.[1]

Fortunately, unsavory credit sweep services can be easy to spot. Avoid businesses that require an upfront payment. Watch out for blank paperwork that demands your personal information. And always avoid businesses that claim to repair your credit quickly. Credit repair is never fast, even when done correctly.[4]

Alternatives to credit sweeps

There are no genuine alternatives to credit sweeps. However, there are strategies you can use to clean up your credit. They include:

- Sending a pay-for-delete letter: You negotiate, asking that negative marks be removed in exchange for paying your debt.

- Goodwill letter: You request that a negative mark be removed as an act of goodwill. This may work if you have a good credit history or it was a minor oversight that caused the mark.

- Disputing inaccurate information: It’s important to check your report for errors that could lower your credit score.

Credit bureaus usually resolve legitimate disputes in 30 to 45 days.[5] If negative marks can’t be removed, they will remain on your credit report for seven years.

How to fix your own credit

Instead of turning to a company to repair your credit, you can take care of it yourself. Any legitimate credit repair strategies that a company can do, you can also do yourself for free. If you have incorrect items due to identity theft or other inaccurate entries on your credit report, you can dispute these with the credit bureaus.

Note that credit repair is not a strategy for removing legitimate negative items.[6]

Review your credit report

By law, everyone can get a free credit report from each nationwide credit reporting agency every 12 months.

You can visit annualcreditreport.com.[7] If an item you dispute comes back as an error, the credit bureau must give you the result in writing and a free copy of your credit report. This does not count as your free annual report. [8]

Dispute errors on your credit report

With diligent monitoring of your credit report, you can catch mistakes early, and doing so can help alert you to other issues, including possible identity theft. If you find an error, you must dispute it with the credit reporting companies — Equifax, Experian and Transunion.

You will have to make the dispute in writing. You can use template letters, but the content is relatively straightforward. Your dispute letter should include:

- Your complete contact information.

- The credit report confirmation number.

- The account numbers in question.

- The specific item(s) or transactions in question.

- Explanations about why the items are wrong, plus any further documentation to support your claim.

- A specific request that the information is corrected or removed (whichever applies to your situation).

You will also want to enclose a copy of your credit report. Highlight the items in question and send the copy along with your letter. You can also send these letters to the furnisher of your credit information. These can include banks, credit card companies, and landlords. Often, these entities will be contacted by a credit reporting company during the error claim investigation.[9]

You can also contact the credit reporting agencies by phone and via their websites, but having everything in writing creates a paper trail for you to hold on to.[9]

Once an agency receives a dispute, it has 30 days to complete its investigation. They will forward your information to the business that reported your credit information. They then must investigate the matter at the source and report back to all three reporting agencies.[8]

All results must be sent back to you in writing. Credit bureaus will also send correction notices to anyone who received your credit report; they must send notice of the correction to anyone who got a copy for employment purposes during the past two years, if you ask them to.[8]

Your legal rights with credit repair services

In some situations, hiring a credit repair service can be worthwhile. Extensive fraud or erroneous information can be time-consuming and confusing to address. In cases such as these, reputable services can act as your representative and remove all illegitimate credit items, but you will often be charged for these services.

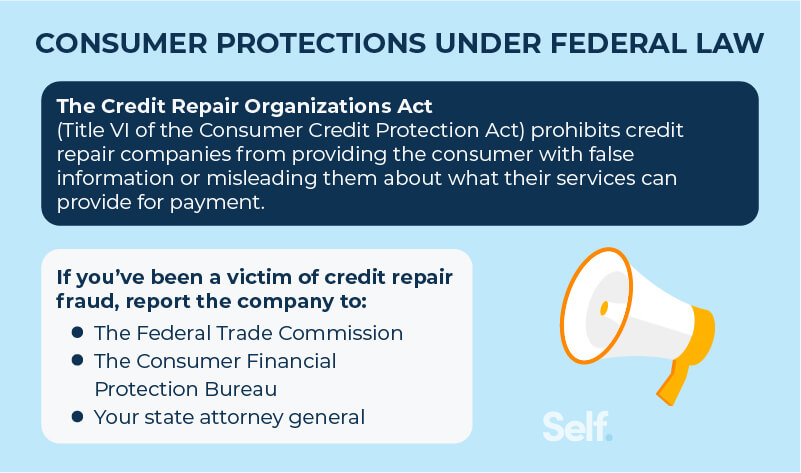

If you do choose to hire a credit repair company, know that there are laws protecting you including the Telemarketing Sales Rule (TSR) and the Credit Repair Organizations Act (CROA).

Under the CROA, a company can’t charge for credit repair until six months after the desired results and if your credit isn’t repaired, it is illegal for them to accept payment.[2] Under both the TSR and the CROA, it is also illegal for these companies to use any deceitful practices. This includes withholding information and providing wrong information. It is also illegal for an entity to ask you to sign away your CROA rights. These rights can’t be forfeited. Any documents you sign saying otherwise are worthless. [2]

Despite the laws, there are still bad actors, and the Consumer Financial Protection Bureau has sued many credit repair companies for deceptive practices. Always look out for the common signs of an illegitimate credit repair company. And always remember: even legitimate companies take the same actions that an individual can — they just charge you for the service, but you could do it yourself for free.[6]

How to report a credit repair company

If you suspect you have dealt with a credit repair company that is using illegal practices, you should report them.

- First, report the fraud to the Federal Trade Commission. Their website guides you through the process. The report is delivered directly to the FTC, where it is investigated.[11]

- After this, contact your state’s attorney general. They are the highest level of consumer protection in each state. As such, they can go after these organizations directly.

- Additionally, reach out to your state’s consumer protection offices and report the suspected scam activity.[12]

Credit repair vs. building credit

What is the difference between credit repair and building credit?

The answer is easier than you might think. Credit repair focuses on repairing incorrect information or past mistakes. Building credit focuses on making smart credit decisions moving forward. This means keeping credit utilization low, making all payments on time, and checking your credit report for any errors.

Smart credit usage won’t fix your negative credit history immediately. It doesn’t remove any old negative items from your report. However, your credit improvement will be reflected in your credit report, and lenders will be able to see your consistent work.

Sources

- Bankrate, “What is a Credit Sweep?” https://www.bankrate.com/personal-finance/credit/what-is-a-credit-sweep/. Accessed November 25, 2025.

- Consumer Financial Protection Bureau. “Don't Be Misled by Companies Offering Paid Credit Repair Services,” https://files.consumerfinance.gov/f/documents/092016_cfpb_ConsumerAdvisory.pdf. Accessed November 25, 2025.

- Investopedia. “Credit Sweep Definition,” https://www.investopedia.com/terms/c/credit-sweep.asp. Accessed November 25, 2025.

- New York City Consumer and Worker Protection. “Beware of Credit Repair Scams,” https://www1.nyc.gov/site/dca/consumers/credit-repair-scams.page. Accessed November 25, 2025.

- Experian. “How Do Credit Repair Companies Work?” https://www.experian.com/blogs/ask-experian/how-do-credit-repair-companies-work/. Accessed November 25, 2025.

- Experian. “Credit Repair: How to “Fix” Your Credit Yourself,” https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/credit-repair/. Accessed November 25, 2025.

- Experian. “How Do I Get a Paid Collection Off My Credit Report?” https://www.experian.com/blogs/ask-experian/how-do-i-get-a-paid-collection-off-my-credit-report/. Accessed November 25, 2025.

- Federal Trade Commission Consumer Information. ”Disputing Errors On Your Credit Reports,” https://www.consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed November 25, 2025.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed November 25, 2025.

- Federal Trade Commission. “Credit Repair Organizations Act,” https://www.ftc.gov/enforcement/statutes/credit-repair-organizations-act. Accessed November 25, 2025.

- Federal Trade Commission. “Report Fraud to the FTC,” https://reportfraud.ftc.gov/#/. Accessed November 25, 2025.

- Federal Trade Commission Consumer Information. “Fixing Your Credit FAQs,” https://www.consumer.ftc.gov/articles/fixing-your-credit-faqs#report. Accessed November 25, 2025.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.