Does Afterpay Build Credit? Understanding Buy Now, Pay Later

Published on: 03/21/2023

Although it seems similar in some ways to a credit purchase, Afterpay may not help your credit history with the three main credit reporting agencies. Afterpay is a buy now, pay later service and app that allows its users to pay for items over time in four installments. Payments are made over six weeks, and participants are not charged interest if they pay what they owe in four installments.1

To get a better idea of how Afterpay impacts your credit history, this article shows you how Afterpay works and how it can affect your finances.

Key takeaways

- Afterpay is a buy now, pay later service that allows you to avoid paying interest by making four interest-free installments over six weeks.

- Afterpay does not report to the credit bureaus, so using Afterpay will not impact your credit score.

- Afterpay may request a soft pull on your credit report to determine a spending limit for you that fits within your financial situation, but this will not have any impact on your credit score.

Table of contents

- What is Afterpay?

- Does Afterpay build credit?

- Does Afterpay check your credit history?

- Does Afterpay charge interest?

- What happens if you miss payments?

- Which Buy Now, Pay Later platforms impact credit?

- Practice good credit habits

What is Afterpay?

Afterpay offers a payment plan that allows you to pay the purchase price of an item in four interest-free installments. Under this buy now, pay later (BNPL) option, you typically make the first payment upfront and pay the rest in three interest-free installments over time.[2] The company does not charge any fees when you pay on time, and it prevents you from making more purchases (and, therefore, going further into debt) if you have missed a payment.[3]

Afterpay offers a digital card that can be used when making point-of-sale purchases from participating brick-and-mortar retailers and through online shopping apps.[4] Payment options include domestic debit cards and credit cards as well as checking accounts from domestic banks, but Afterpay doesn’t accept payments from savings accounts or cards from overseas banks.[5]

Does Afterpay build credit?

Using Afterpay won’t help you build credit, because the company doesn’t report any payments you make to the three major credit bureaus. Fortunately, Afterpay won’t hurt your credit, either.

As of August 2022, credit bureaus do not factor payments made to BNPL companies into credit reports, but that could change. Credit bureaus are considering including such information. Equifax was the first to formalize a standard process for reporting BNPL services to credit reports and began classifying BNPL tradelines in 2022. This allows Equifax customers and scoring partners to see BNPL tradeline information and to decide how to use it in their decision-making processes.[6] However, for this information to appear, Afterpay and other BNPL companies would have to agree to supply that information to the credit reporting agencies.

Does Afterpay check your credit history?

Afterpay may conduct a soft credit check on new customers when they sign up. Although your application may be declined, soft inquiries or soft pulls do not affect credit scores.[7]

Does Afterpay charge interest?

Afterpay does not charge interest. However, the company may charge late fees if you don’t make your payments on time or your payment does not process and, after you are notified, you don’t make a manual payment. Afterpay sends you payment reminders so you can be sure you have money in your account to cover the payment.[8]

What happens if you miss payments?

If you haven’t paid an installment, you may be subject to a late fee once the grace period is over. Typically the grace period lasts 10 days after the due date unless your payment schedule or applicable state law specifies otherwise. The fee won’t be more than $8 per installment and also can’t be higher than the maximum allowed under state law. Additionally, the total late fees you will be responsible for on a single order won’t be more than 25% of the order value at the time of purchase.[9]

Which Buy Now, Pay Later platforms impact credit?

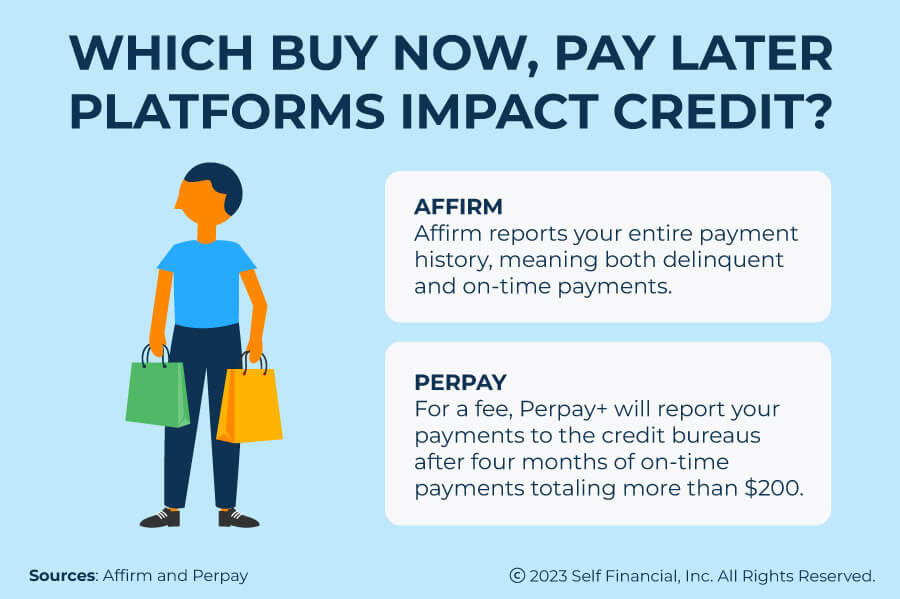

When it comes to impacting your credit score, not all BNPL platforms are created equal. While Afterpay does not currently affect your credit because it does not report activity to the credit bureaus, some platforms do alert credit reporting agencies:

Affirm

Affirm may report to Experian and may, in the future, report to other bureaus as well. However, Affirm points out that when it does report, it reports your entire payment history, including delinquent payments, not just the ones you make on time.[10]

Affirm’s BNPL service works differently from Afterpay. With Affirm, you can choose from different intervals for payments, but you may pay interest, depending on what product you choose. However, Affirm’s website indicates it has no extra fees.[11] Affirm offers different terms for each transaction based on your credit, although it claims its credit checks do not affect your credit score. The options offered depend on the amount of each purchase and can vary by merchant and state.[12]

Perpay

This service promotes “helping you build a positive payment history” by promoting its credit limit to Equifax, Experian and TransUnion as a new line of credit, but you only get the reporting by joining PerPay+, which costs a few dollars a month.[13]

You can still use the basic PerPay BNPL service without activating Perpay+ just by creating an account, getting a spending limit and choosing your payment schedule. However, all payments are processed from your paycheck on payday, and you have to shop on the Perpay marketplace to use the service.[14]

If you want to take advantage of the credit-building aspect of this service, within your account, you have the option to activate PerPay+ for a fee. Perpay+ will begin reporting payment activity to the credit bureaus after four months of on-time payments which exceed a total of $200. The upgraded service also reports your Perpay Spending Limit as a new credit line to all three major credit reporting bureaus. The cost of this service is added to your monthly payment balance but is free if you don’t have any orders you’re paying for.[13]

The three major credit bureaus have announced plans to accept BNPL data, but they are taking different approaches.[15] Equifax was the first to announce a formalized process for including this data on credit reports after performing a study that showed such data had the potential to improve FICO® scores. Equifax has implemented a new industry code so that BNPL has its own class and isn’t grouped with credit cards, mortgages and other traditional loans.[16]

Meanwhile, TransUnion announced a plan to include the data in credit files without making it available to credit-scoring companies such as FICO®.[17]

Practice good credit habits

You can’t pay for everything through BNPL providers, so it’s essential to practice good credit habits when using a credit card:

- Make on-time payments: Under the FICO® system, your payment history accounts for 35% of your credit score. Avoiding missed payments to lenders can be a valuable tool in avoiding bad credit.[18]

- Use your credit cards responsibly: Maintaining large balances on your revolving credit accounts, especially compared with your credit limit, may impact your score. According to FICO®, “amounts owed” on accounts (including your credit utilization ratio or CUR on revolving accounts) is worth 30% your credit score.[19]

- Pay down debt: Paying down debt can improve your CUR. FICO® considers the amount you owe on all your accounts, as well as on different types of accounts; how many of your accounts have balances; and the amount you owe on installment loans compared with the original loan.[19]

- Become an authorized user: Becoming an authorized user on a credit card can allow you to piggyback on their credit history. Make sure that the person who agrees to add you as an authorized user has been paying on the account as agreed, has had the account open for some time and maintains a low credit utilization ratio (CUR; the total debt balance on the card divided by total credit limit) with the card.[20]

- Use a credit builder loan: A credit builder loan operates differently than a traditional loan does: Instead of the borrower getting the money upfront and then following a repayment plan, you make payments first. You then receive the loan proceeds (minus interest and fees) once all the payments have been made.

Whether you’re new to credit or trying to rebuild your credit, we can help. Self provides tools and resources to build healthy credit habits.

Sources

- Afterpay. “Financial wellness is a tap away,” https://www.afterpay.com/en-US/how-it-works. Accessed on August 2, 2022.

- Afterpay. “When will my first payment be taken?” https://help.afterpay.com/hc/en-us/articles/115003811446-When-will-my-first-payment-be-taken-. Accessed on August 2, 2022.

- Afterpay. “What happens if I can’t make a payment on-time?” https://help.afterpay.com/hc/en-us/articles/900001507483-What-happens-if-I-can-t-make-a-payment-on-time-. Accessed on August 2, 2022.

- Afterpay. “Where can I shop In-Store using Afterpay Card?” https://help.afterpay.com/hc/en-us/articles/900001340323-Where-can-I-shop-In-Store-using-Afterpay-Card-. Accessed on August 2, 2022.

- Afterpay. “How do payments work?” https://help.afterpay.com/hc/en-us/articles/360016052892-How-do-payments-work-. Accessed on August 2, 2022.

- Equifax. “Buying Into the Concept of ‘Buy Now, Pay Later’,” https://www.equifax.com/newsroom/all-news/-/story/buying-into-the-concept-of-buy-now-pay-later-/. Accessed on August 2, 2022.

- Afterpay. “Does Afterpay conduct credit checks?” https://help.afterpay.com/hc/en-us/articles/4487846176793-Does-Afterpay-conduct-credit-checks-. Accessed on August 2, 2022.

- Afterpay. “Is there a cost to using Afterpay?” https://help.afterpay.com/hc/en-us/articles/218320423-Is-there-a-cost-to-using-Afterpay-. Accessed on August 2, 2022.

- Afterpay. “Installment Agreement - USA,” https://www.afterpay.com/en-US/installment-agreement. Accessed on August 2, 2022.

- Affirm. “Reporting to credit bureaus,” https://helpcenter.affirm.com/s/article/reporting-to-credit-bureaus. Accessed on August 2, 2022.

- Affirm. “What is Affirm?” https://helpcenter.affirm.com/s/article/what-is-affirm. Accessed on November 15, 2022.

- Affirm. “About prequalifying,” https://helpcenter.affirm.com/s/article/about-prequalifying#prequalified-vs-credit-limt. Accessed on August 2, 2022.

- Perpay. “Perpay+ FAQs,” https://help.perpay.com/en/articles/4622325-perpay-faqs. Accessed on November 15, 2022.

- Perpay. “How It Works,” https://help.perpay.com/en/articles/450206-how-it-works. Accessed on November 15, 2022.

- Consumer Financial Protection Bureau. “Buy Now, Pay Later and Credit Reporting,” https://www.consumerfinance.gov/about-us/blog/by-now-pay-later-and-credit-reporting/. Accessed on August 2, 2022.

- Equifax. ‘Buy Now, Pay Later’ Credit Reporting, https://www.equifax.com/newsroom/all-news/-/story/-buy-now-pay-later-credit-reporting/. Accessed on August 2, 2022.

- Forbes. How The Big Three Credit Bureaus Are Using Buy Now Pay Later Data, https://www.forbes.com/advisor/personal-finance/transunion-equifax-experian-buy-now-pay-later-credit-report/. Accessed on August. 2, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on August 2, 2022.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed on August 2, 2022.

- MyFICO. “How Do I Go About Building My Credit History?” https://www.myfico.com/credit-education/faq/improving-a-score/building-credit-history. Accessed on August 2, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).