How Long Do Pending Transactions Take To Post

Published on: 01/27/2022

If you notice a pending transaction on your credit card, you may wonder what your account balance really is. How much money is in your bank account and how much credit is truly available to you? We’ll explain what pending transactions are, how long pending transactions take to post, and how to cancel a pending transaction.

What is a pending transaction?

A pending transaction is a transaction that hasn’t been completely processed yet. It impacts your available credit. For instance, if you have $2,000 in available credit and reserve a hotel room for a pre-authorization of $120, your available credit will drop to $1,880, even though you have yet to be charged.

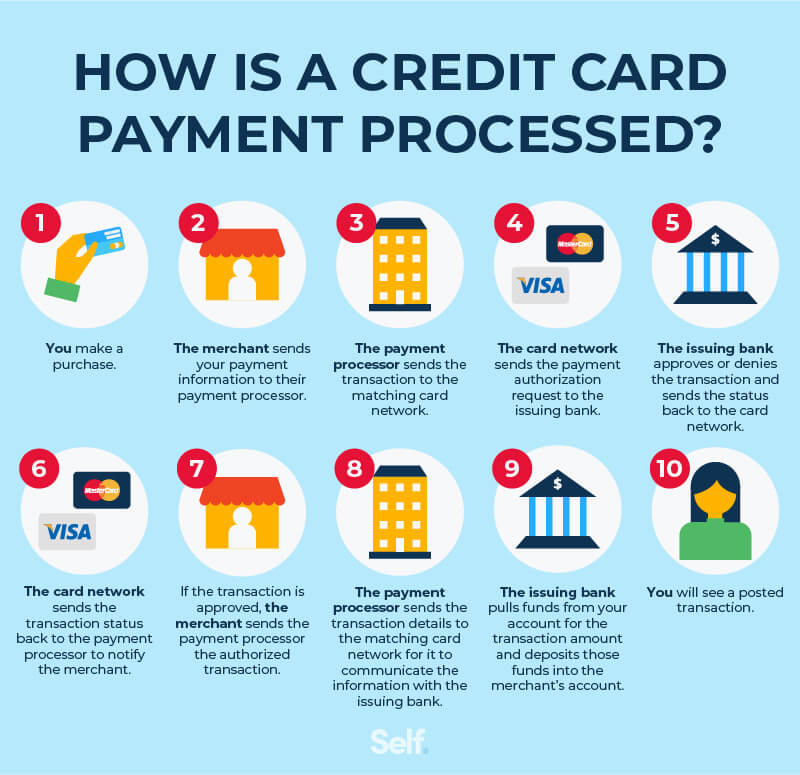

When you authorize a purchase by using your debit or credit card, the merchant sends a request to your bank to release the funds. Once the bank releases the funds, the transaction is no longer pending. It becomes a posted transaction.[1]

Pending transactions become posted when they’re approved.

Reasons why you may have a pending transaction

Pending charges may involve transactions for which the amount hasn’t been finalized — for example, if you tipped at a restaurant.[2]

Another example is a hold placed on your credit card. This might be done to guarantee a booking or used as collateral by a car rental company. Such a hold covers the cost of any potential damage and is released when the car is returned undamaged.

If you choose to pay with the same card you used to make your reservation, your balance will change once the transaction has posted. In some instances, however, you may choose to use a different payment method than the card you used to secure your reservation. In this case, the hold will be lifted, and your available credit will be restored to its previous level.

How long do pending transactions take to post?

A credit card transaction is generally pending for one to five business days.

Bank of America says a pending transaction on debit cards can take three to five business days to post. The time depends, to some extent, on how the debit card is used. Transactions via phone, the internet, or mail order tend to take longer to post.[3]

How to cancel a pending transaction

If you want to cancel a pending credit card or debit card transaction, your first instinct may be to call your bank or financial institution and ask them to block it. But you’re more likely to succeed if you ask the merchant with whom you made the transaction to reverse it. This is because your bank generally can’t do anything about a pending transaction until it has been posted.

The merchant, however, can cancel the transaction by contacting your bank or card issuer.

If, on the other hand, you don’t recognize the pending transaction and believe it was made fraudulently, you should contact your bank or card issuer immediately. You will probably be asked to cancel your card and have a new one issued to you.

PayPal transactions work a little differently. If the email or phone number you’ve sent a payment to doesn’t belong to someone with a verified PayPal account, you can use the “Activity” section of your account to cancel the payment. Scroll down to find the payment you want to void. Then click the word “Cancel” and confirm by clicking the “Cancel Payment” button.[4]

Unfortunately, many forms of PayPal transactions can’t be canceled because they’re processed immediately. If you sent a payment that requires the recipient to actively claim it, you may be able to get your money back. PayPal will cancel any payment that goes unclaimed after 30 days and puts the money back in your account.[4]

Disputing a posted transaction

If you are unable to cancel a pending transaction, you still have the option of disputing the transaction once it has posted. You may want to do this if you were charged for something you don’t recognize (potential fraud), charged for something you did not receive, or if the item was damaged.

First, try contacting the seller. If the goods are damaged or were not received, the seller may refund your money or issue a replacement. If you do contact the seller, keep a dated record of whom you spoke with and, if you reach an understanding, check your credit card statement to ensure your account has been credited properly.

If the seller does not issue a refund, you can ask for a chargeback from your credit card issuer by initiating a dispute. If you decide to dispute an error and seek a chargeback, you need to notify your debit card or credit card issuer of the problem within 60 days of the date you received the first statement on which the charge appears.[5]

Once the dispute has been filed, the card issuer (such as a bank) will decide whether it’s valid and, if so, will pass it on to the larger card network — MasterCard, Visa, Discover, American Express, etc. — which may approve a temporary credit to your account. From there, the network will either require your card issuer to pay or forward the dispute to the merchant’s bank.

The merchant can agree with or dispute the chargeback. The card network decides who will pay.[6]

With PayPal transactions, the chargeback process is similar, but there’s a processing fee of up to $20. Other PayPal remedies are a dispute, which is settled between a merchant and the buyer, and a claim, for which PayPal determines the outcome. There is no processing fee for either of these actions. You can also work with your bank to reverse an unauthorized transaction.[7]

Monitor your available credit

Pending transactions don’t have to be a mystery to cardholders. Sometimes, there’s a delay between when you make a purchase and the time that your transaction posts.

You can use mobile banking apps to check your balances in real time and see whether you have enough money in your account to cover your purchases.

If you understand how pending transactions work, you can know how much money or credit you have available to you and plan accordingly. You can also know when it’s appropriate and how to challenge or dispute a charge, whether it’s in pending status or posted. With this understanding, you can feel confident that you’re managing your money well and monitoring it accurately.

Sources

- Federal Deposit Insurance Corporation. “FDIC Law, Regulations, Related Acts” https://www.fdic.gov/regulations/laws/rules/6500-580.html. Accessed November 12, 2021.

- Capital One. “Why might I see a charge showing as pending?” https://www.capitalone.com/support-center/bank/pending-charge. Accessed October 6, 2021.

- Bank of America. “Debit Card FAQs,” https://www.bankofamerica.com/deposits/debit-card-faqs/. Accessed October 6, 2021.

- Business Insider. “How to cancel a PayPal payment if the receiver has not yet claimed it,” https://www.businessinsider.com/how-to-cancel-paypal-payment. Accessed October 6, 2021.

- Federal Trade Commission. “Sample Letter for Disputing Credit and Debit Card Charges,” https://www.consumer.ftc.gov/articles/sample-letter-disputing-credit-and-debit-card-charges. Accessed October 6, 2021.

- CNBC. “What is a chargeback—and how to dispute credit card transactions,” https://www.cnbc.com/select/what-is-a-chargeback. Accessed October 6, 2021.

- PayPal. “Disputes, claims, chargebacks, and bank reversals.” https://www.paypal.com/us/brc/article/customer-disputes-claims-chargebacks-bank-reversals. Accessed October 6, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.