What to Know About Minimum Payments and Your Credit Card

Published on: 11/14/2019

It’s not uncommon for someone to receive their first credit card statement and decide it’s best to just make the minimum payment. After all, it’s often a wise and frugal strategy to just pay the minimum amount necessary, such as when you need to make a new purchase.

However, credit cards are different, and the “minimum payment” amount listed on your statement can be a confusing thing. Let’s take a closer look at what you need to know about minimum payments and your credit cards so you can make the right decisions when you receive your monthly statements.

What is a credit card’s minimum payment amount?

Every credit card statement shows two important payment amounts:

- Your statement balance

- Your minimum payment amount

Your statement balance is the current balance on your card at the end of your statement period.

The minimum payment is simply the least amount you can pay without being considered delinquent or in default, or having a late or missed payment reported on your credit report.

Credit card issuers calculate your account’s minimum monthly payment amount in different ways.

Some use a flat percentage, usually between 1% and 5% of the current statement balance. So if your statement balance is $5,000, and the minimum payment is 2% of your statement, then it will simply be $100.

Other card issuers use a percentage of the statement balance, plus new interest charges accrued and any late fees. In either case, the minimum payment is usually either a fixed amount or one based on the calculation, whichever is higher.

For example, the Chase Freedom’s cardholder agreement states:

“We will calculate the minimum payment as the larger of: 1) $25 (or total amount you owe if less than $25); or 2) the sum of 1% of the new balance, the periodic interest charges, and late fees we have billed you on the statement for which your minimum payment is calculated.”

So if your balance is greater than $25, then your minimum payment will always be at least that amount, or 1% of your balance, plus interest and late fees.

What if you fail to make the minimum payment?

Making the minimum payment is critical to maintaining a good credit score, not to mention remaining in good standing with your credit card issuer.

If you fail to make the minimum payment, you could face several consequences, starting with late fees and additional interest charges. Most credit card issuers will even impose a higher penalty interest rate when you fail to make the minimum payment on or before the due date.

Your late payment could also be reported to one or more of the three major consumer credit bureaus, although many credit card issuers will wait until your payment is at least 30 days late before doing that.

Since timely payments are the most important factor that makes up your credit score, having a late payment can be extremely detrimental to your score.

Finally, many credit cards won’t give you the rewards you’ve earned, or let you redeem existing rewards, if you fail to make the minimum payment on time. This is true even if your payment is just a few days late, or if you just pay a little bit less than the minimum payment.

If for some reason you’re struggling to make the minimum payment on one of your credit cards due to financial reasons, there are a few things you can try to come up with the necessary funds.

Your first step should be to stop using the card to make new charges. Make every effort you can to conserve your money, stick to a budget, or raise additional funds to make the minimum payment.

If all your efforts fail, pay as much as you can towards the minimum and contact the card issuer to let them know you’re struggling to make the payment on your credit card debt and why. Some issuers might be willing to work with you, especially if you are a longstanding customer or have a record of on-time payments.

Finally, consider seeking the assistance of a nonprofit credit counselor who can help you to find ways to manage your debt. The National Foundation for Credit Counseling is a resource you can use to find a credit counseling agency in your area.

Why you should always pay more than the minimum

The only positive side to paying just the minimum is that you’ll have additional funds available in the short term. If you have a credit card with a 0% APR promotional financing offer for purchases – and you have the money available – it can actually make sense in this specific situation to just make the minimum payment.

Otherwise, there are many downsides to paying just the minimum on your credit cards. If you just make the minimum payment required, then it will take you the maximum possible time to pay off your charges. You’ll also end up paying the maximum possible amount in interest charges.

Remember, the annual percentage rate (APR) on your credit card only applies if you don’t pay the balance off in full each month.

By only paying the minimum amount, you could end up paying mostly interest (not paying the debt down) while more interest continues to add up.

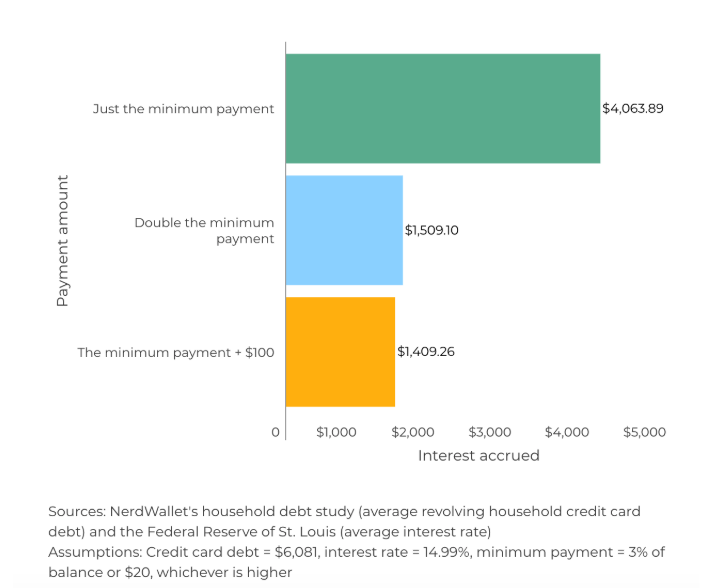

To illustrate this, here’s how much interest you’d accrue on $6,081 debt with a 14.99% interest rate if you pay the minimum amount, double the minimum amount, or the minimum payment plus $100 each month…

While it appears you’re paying a lower amount, the opposite is actually true once you take into account the cost of interest charges.

Another consequence is that your credit score can suffer as your debt-to-credit limit remains high. After making your payments on-time, your amounts owed is the next most important factor in your credit score.

By paying more than the minimum payment each month, you’ll reduce the amount of time it takes you to pay off your balance, and consequently the amount of interest you’ll end up paying. You’ll also reduce the amount you owe, which can improve your credit score.

If you pay your entire statement balance in full, every month, you’ll actually avoid interest charges completely. That’s because nearly all credit cards offer an interest-free grace period, which waives interest charges when you pay your entire statement balance before the due date.

Other ways to minimize interest charges

Since not everyone can completely avoid interest by paying their balances in full, there are a few ways that you can minimize what you do pay.

Not only should you pay as much as possible each month, you can also make multiple payments. Since credit card interest is based on your account’s average daily balance, any time you act to reduce your balance, you’ll save money on interest charges.

In fact, there’s no penalty for making multiple payments throughout your statement cycle. So if you receive a paycheck, or other funds before or after your statement’s due date, then you can make additional payments to your credit card company in order to lower your average daily balance and your interest charges.

Bottom line

It’s best to think of your credit card’s minimum payment due only as something to be paid in a worst case scenario.

By making a larger payment, you’ll owe less in interest, pay off your debt sooner and could enjoy a higher credit score. The more you learn about how minimum payments work, the easier your decision will be the next time you view your monthly credit card statement.

About the author

Jason Steele has been writing about credit cards and personal finance since 2008, poring through the terms and conditions of credit card agreements to understand the minutiae of how these products work. His work has appeared on Yahoo, MSN, HuffingtonPost and other major news outlets. In his free time, Jason’s a commercial pilot. He graduated from the University of Delaware with a degree in History.