How Long Should You Keep Your Credit Card Statements?

Published on: 03/29/2022

It is always a good idea to hold on to your financial documents. Your credit card statements are no exception. But just how long do you need to keep your credit card statements? This article will answer that, plus how to properly dispose of your documents when the time comes.

Keep in mind that you can access digital credit card statements through your online bank portal. The length of time online statements are available varies by bank, so make sure to check with yours.

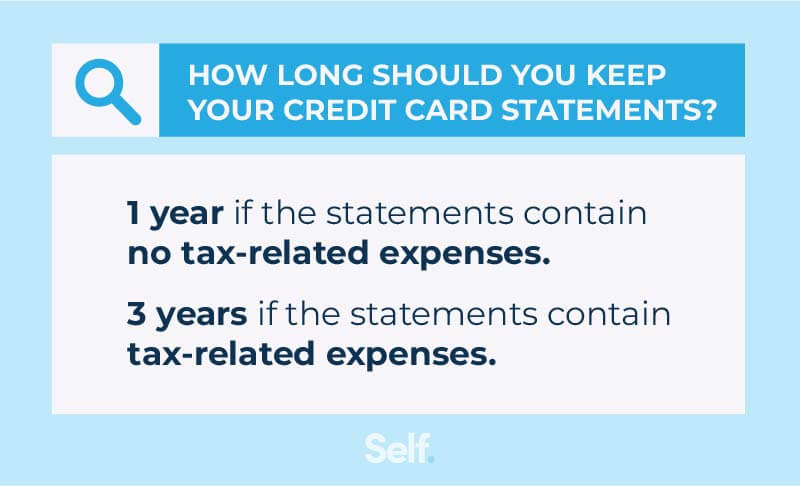

How long should you keep your credit card statements?

Determining how long to keep credit card statements starts with looking at their contents.

If there are tax-related expenses on your statements, you should keep those statements safe for three years. Though the IRS can audit the past seven years of anyone’s finances, they can only do so without reason during the first three years. After that, they can only do so if they believe you to be underreporting. [1]

Keeping your statements for three years helps to ensure you have all the necessary documentation should you be audited. If your finances carry a high risk of audit, keep your statements for the full seven years.[2]

Keep statements with no tax-related expenses for 1 year. This includes your day-to-day finances and purchases. This time frame gives a good reference for normal activity on your account. Keep in mind, the Fair Credit Billing Act requires that any statement errors be disputed within 60 days to ensure your protection.[3]

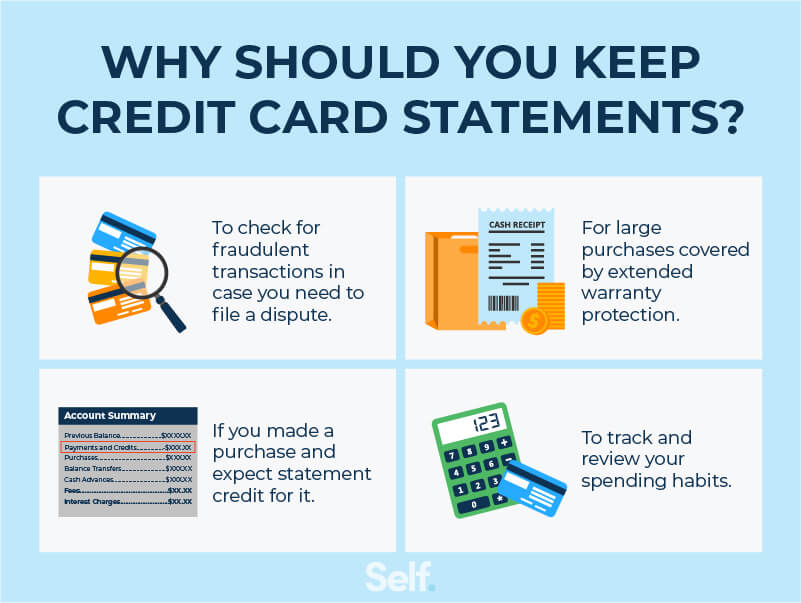

Keeping certain credit card statements allows you to:

- Check and verify random credit card receipts or transactions.

- Verify large purchases covered by extended warranty protection.

- Have proof of purchase for returns or chargebacks.

- Monitor your spending habits from one month to another.

Why you should keep credit card statements

Whether you save paper statements or you access your statements through an online account, it is important to keep your history handy.

With sufficient documentation of your finances, you can more easily spot identity theft and other issues. Identity theft affects 1 in 20 people in the country. That leads to yearly losses of nearly $20 billion.[4]

Keeping your credit card statements safe provides a concrete record of your finances. Even if you are never a victim of identity theft, you can use your statements to verify:

- Tax expenses.

- Proof of payment in case of a dispute.

- Recent payments, deposits, or purchases.

- Evidence of identity theft or credit/debit card fraud.

Of course, you shouldn’t just throw your documents in a desk drawer and forget about them.

How to store documents

If you prefer keeping hard copies of bank and credit card statements and tax documents, keep them in a safe place and keep them organized. Use a fireproof filing cabinet and be sure to open it every few weeks to air it out and prevent mold.

If you prefer saving your documents digitally, you may store them and organize them in a secured folder. You can also use an external hard drive or thumb drives to store your data.

How should you dispose of credit card statements?

Once your one-year to seven-year window has passed, you can safely dispose of your credit card statements. Once you are sure the transactions on your statements are final or you’ve passed the point of being audited, use a shredder to destroy paper copies. For digital copies, keep them in a secure file.

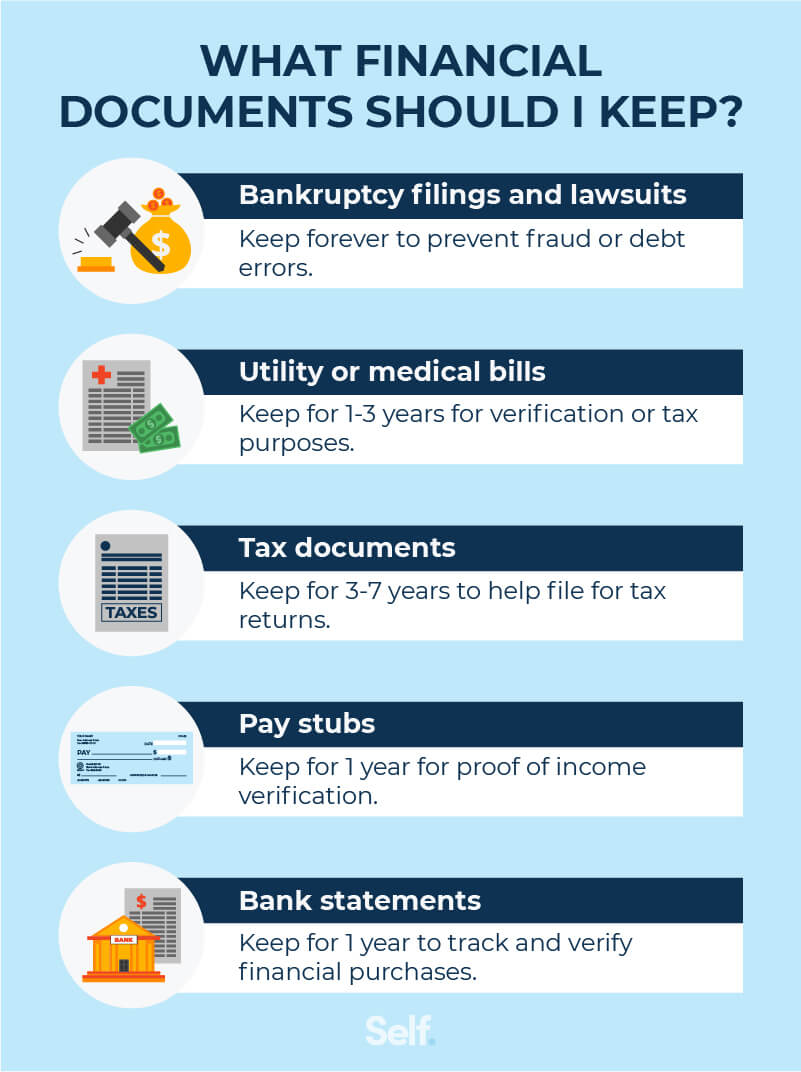

Other financial documents to keep

As mentioned earlier, credit card statements are not the only documents you should save. Several important pieces of data should be kept safe for various lengths of time.

Bankruptcy filings

Keep your bankruptcy papers throughout your life. Some creditors may come back and attempt to collect on a debt related to your bankruptcy you possibly might not be responsible for.

Bankruptcy documents also help keep a list of all your debts in case the debt collector does claim that you owe them a debt. Two documents to keep are your bankruptcy petition and discharge papers to prove your debts were discharged and that you no longer owe those debts.

Utility or medical bills

Keep copies of your utility and medical bills for at least a year for similar reasons. These are typically low-risk expenses, especially utility bills, but keeping a paper trail is sensible no matter the situation.

If you’re self-employed, you may be able to expense some of your utility costs.

Save medical bills for one year to ensure proof of payment, especially if you have set up a payment plan. Insurance policies may adjust and require proof of a procedure after the fact. Plus, there could be an error at some point in the process, and paper copies can help you prove payment or verify medical procedures, dates, and costs.

Tax documents

The IRS recommends keeping tax returns and other tax documents for three to seven years. Some people like to keep their documents for up to two years past paying that year’s taxes. But since the IRS can audit up to six years’ worth of finances, it makes sense to hold on to your documents for the full seven years.[5]

Like other financial records, tax documents are useful for:

- Filing taxes (especially if there have been employment or family changes).

- Avoiding and recognizing tax fraud.

- Income verification purposes.

Different tax situations have different statutes of limitation. Make sure you’re keeping your documents for the appropriate period of time for your specific situation. And remember, there is no harm in keeping your documents indefinitely.[6]

Paycheck stubs

Paycheck stubs should be kept for one year. If you get direct deposits, these will be highlighted as such on your statement. You can print these out as documentation of your paycheck.[7]

Keeping your paystubs allows you to:

- Check if you’ve been paid correctly.

- File taxes accurately.

- Provide proof of income for rental agreements.

- Verify your W-2 and annual Social Security statement.

Like bank and credit card statements, keep your stubs as both physical and digital copies. Scan them into your phone and save them with your other important documents. If you leave your job in less than one year, don’t throw your paystubs away. Wait until you have filed all taxes based on that employment.

Bank statements

While bank and credit card statements are issued to you monthly, they both serve different purposes. A bank statement will show the total ending balance of each deposit and withdrawal you’ve made to your account, while a credit card statement will show you a summary of all your charged transactions and the total outstanding amount owed to your creditor.

Keep your bank statements for one year. They showcase the majority of your personal financial transactions. You should also keep your monthly statements handy to:

- Check for any random errors or fraud.

- Check your deposits to help fill out your W-2 form for tax purposes.

- Track mortgage payments, student loans, and charitable donations.

- Check for any business expenses.

It just makes sense to keep your financial history close at hand. Most financial institutions use online banking programs that allow you to search for specific date ranges. These statements can be saved and printed for additional protection.

Financial documents are important

You should be saving all of your financial documents. Make digital copies and hard copies of your statements and other paperwork. If you’re working to rebuild your finances, start taking prudent steps to protect yourself. Credit counseling services will often want to view your important financial documents, and keeping them safe shows dedication to improving and protecting your financial health.

Sources

- Consumer Reports. “How Long Should I Hold On To My Old Bills & Other Documents?” https://www.consumerreports.org/consumerist/how-long-should-i-hold-on-to-my-old-bills-other-documents/. Accessed January 4, 2022.

- Forbes. “How Long Should I Keep My Credit Card Statements?” https://www.forbes.com/advisor/credit-cards/how-long-should-i-keep-my-credit-card-statements/. Accessed December 7, 2021.

- Experian. “How Long Should Your Keep Bank Statements” https://www.experian.com/blogs/ask-experian/how-long-should-you-keep-bank-statements/. Accessed December 28, 2021.

- Experian. ‘How Common is Identity Theft?” https://www.experian.com/blogs/ask-experian/how-common-is-identity-theft/. Accessed December 7, 2021.

- IRS. “How long should I keep records?” https://www.irs.gov/businesses/small-businesses-self-employed/how-long-should-i-keep-records. Accessed December 7, 2021.

- Forbes. “How Long Do I Need To Keep Old Tax Returns?” https://www.forbes.com/sites/davidrae/2020/07/14/how-long-do-i-need-to-keep-old-tax-returns/?sh=1b2a46536927. Accessed December 7, 2021.

- Kake. “Toss or Keep?: How Long Should You Keep Pay Stubs?“ https://www.kake.com/story/40957281/toss-or-keep-how-long-should-you-keep-pay-stubs. Accessed December 7, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.