How Much Does Self Raise Your Credit Score?

Published on: 06/14/2021

Since everyone’s credit profile is unique, there’s no easy answer to the question “how much does Self raise your credit score?” But we have noticed some trends that may help you understand what to expect from your credit when using Self.

In this article, we’ll breakdown:

- How much does Self lift your credit?

- What this potential credit increase means and why it matters

- Why new credit builders may see higher increases than credit rebuilders

- Why you should focus on your credit profile, not just your credit score

Now let’s dive in.

How much does Self lift your credit?

The average credit score increase from a Self Credit Builder Account is 49 points,[1] though individual results vary.

This average is based on results from an analysis by Accion of 40,403 Self customers who completed the full term of their Credit Builder Accounts (12 or 24 months). This group of customers only included those who already had some kind of credit history, and did not include anyone who had no credit history. This analysis did not include customers who also had the Self Visa® Credit Card, since it was not yet generally available.

Remember that the impact of the Credit Builder Account varies based on your unique credit history and whether you pay on time and how long you keep it open. That means some rebuilders have seen higher score increases. Like Jernessa J., who says:

“Using Self, my credit score improved 70 points, which positioned me to be approved for other accounts, credit cards, etc., so that I could continue improving my credit score. My scores are now back over 700 and I am months away from achieving my goal of homeownership!”

What does a 32 point credit score increase mean?

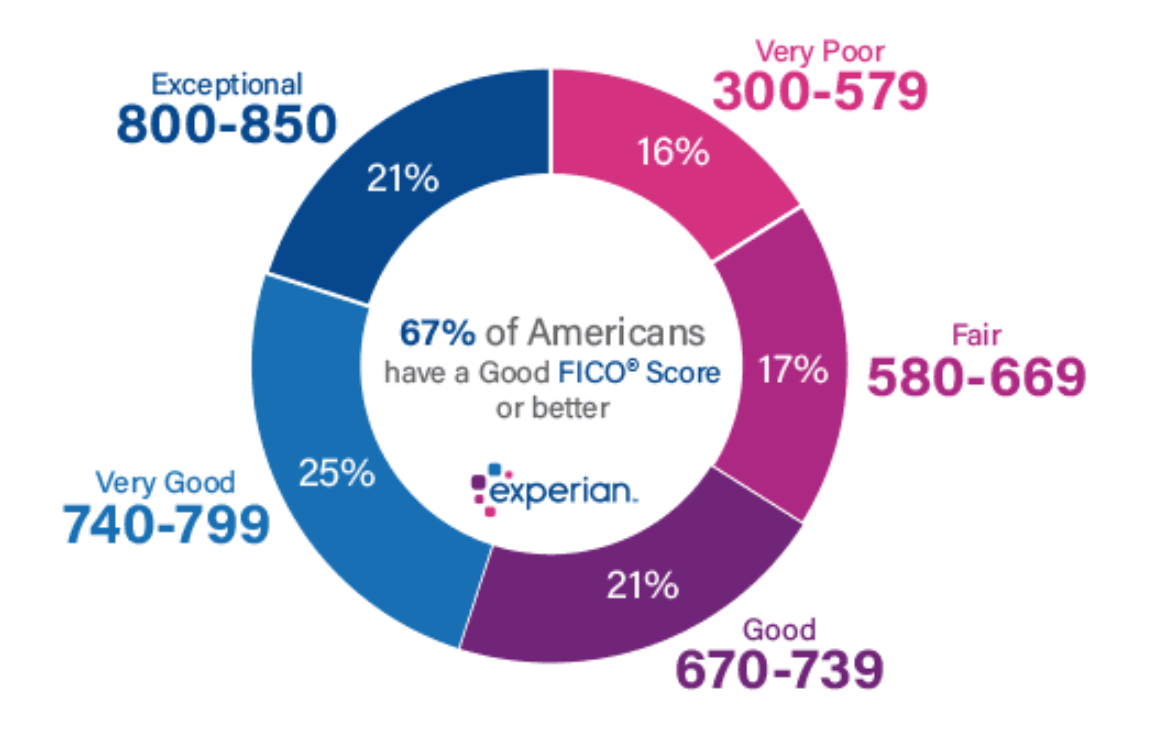

There are different credit score ranges, which the credit bureau Experian groups like this:[2]

If a score increase moves you up a credit score range, say from fair to good or very poor to fair, then you may get approved for more loans or credit cards than you did before, or you may be offered lower interest rates.

For example:

People with Good to Excellent credit have an average credit card interest rate of 19.35%, while people with a credit score below 670 have an average card rate of 23.87%.[3]

Depending on the amount of your credit card balance and how long you take to pay it off, that lower interest rate could save you hundreds, or even thousands, of dollars over time.

The savings doesn’t stop with credit cards either.

If you dream of owning a home someday, credit plays a key role in what type of home loan you could qualify for, and how much you’ll pay. The minimum credit score to qualify for a 3.5% down payment (instead of 10%) for a first-time home buyer loan is 580. Though some lenders have higher minimum score requirements.[7]

Calculate your potential savings on home or car loans using this handy calculator from FICO®.

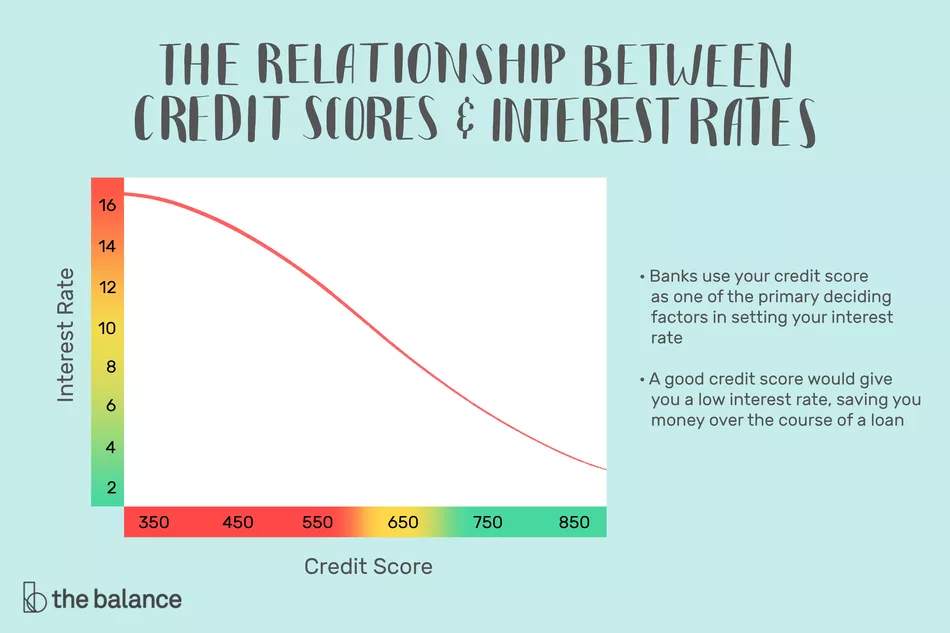

Put another way, the higher your credit score, the lower your interest rates tend to be, as this chart shows.[4]

Why new credit builders may see higher increases than credit rebuilders

When you have no credit history, you don’t have bad credit history either. So you start with a clean slate.

That means once you access credit, you could potentially go from zero credit to a good credit score in as little as 6 months. To do that, you will need to have at least 1 open and active credit accounts, make all your payments on time, keep card balances low, and don’t open too many new credit accounts in a short time.[5] (Learn how long it takes to build credit.)

Some Self customers who had no credit history before using Self have shared how they reached a credit score in the mid 600s in just over 6 months. Walter B. is one such customer who says Self:

“Helped me get from no credit to 600 in about 9 months….This is a great stepping stone for people in credit trouble or just starting out.”

Focus on your credit profile, not just your credit score

Sharita Humphrey, award-winning Certified Financial Education Instructor and former Self customer, says:

When it comes to building your credit, it’s not just about the credit score, it’s about your credit profile.

What she means is that while your score matters, it’s the habits you build and the information on your credit reports that count the most.

You want your credit report to prove to potential lenders that you borrow responsibly, pay back what you owe, and can handle your financial commitments.

How to use Self to build your credit profile

The Self dashboard, email reminders, app notifications and educational materials are meant to strengthen the positive financial habits you need to build and maintain your credit for the long haul.

There are other benefits to building your credit with Self, such as:

- There’s no credit score required and no hard credit pull to get started.

- Build credit with all 3 major credit bureaus.

- Build payment history, which equals 35% of your credit score.[6]

- Get the opportunity to access Self’s secured credit card, which affects even more factors in your credit score.Once you have the card, you may be able to increase your credit limit and earn unsecured credit limit increases.

- Build savings (minus interest and fees) to use toward your goals.

- Self’s available online or via mobile app.

Bottom line?

While your credit score’s important, and likely the reason you searched for Self in the first place, there are other benefits to using Self you shouldn’t overlook while building your financial dreams.

Ready to build your credit profile? Sign up for Self today.

Already have a Self account? Learn how you could access the Self Visa® Credit Card.

Sources and Notes

- Individual results may vary. Average credit score change using VantageScore 3.0 based on a sample of 40,403 Self customers who started their accounts in 2017 or 2018 and completed the full term of their Credit Builder Accounts in 2019. Sample excludes customers who started with no credit history. Results show that customers with a starting credit score of 600 or below were more likely to see positive score change results.

- Experian Chart

- The Balance: Credit Card Interest

- The Balance: How Credit Influences Your Interest Rate

- FICO: Credit Score Requirements

- FICO: Credit Score Factors

- FHA requirements

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to increase economic inclusion by helping people build credit and savings so they can build their dreams. Connect with her on Linkedin or Twitter.

All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A., Member FDIC, Equal Housing Lender or Atlantic Capital Bank, N.A., Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to ID verification and consumer report review and approval. Results are not guaranteed. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus, which may negatively impact your credit score. This product will not remove negative credit history from your credit report. All loans subject to approval. All Certificates of Deposit (CDs) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or Atlantic Capital Bank, N.A., Member FDIC. The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender.

Review provided by customer to Self Financial Inc. d/b/a Self or Self Lender, directly. The testimonials above are related to individual experiences or results. Individual results may vary.