How To Build Credit Without a Credit Card

Published on: 08/24/2022

If you want to build credit, chances are you’ve been advised to apply for a credit card. But maybe you’re having trouble qualifying for a credit card or you simply don’t feel ready for one.

Fortunately, using a credit card isn’t the only way to establish a credit history. In this article, we’ll discuss six ways to build credit without a credit card.

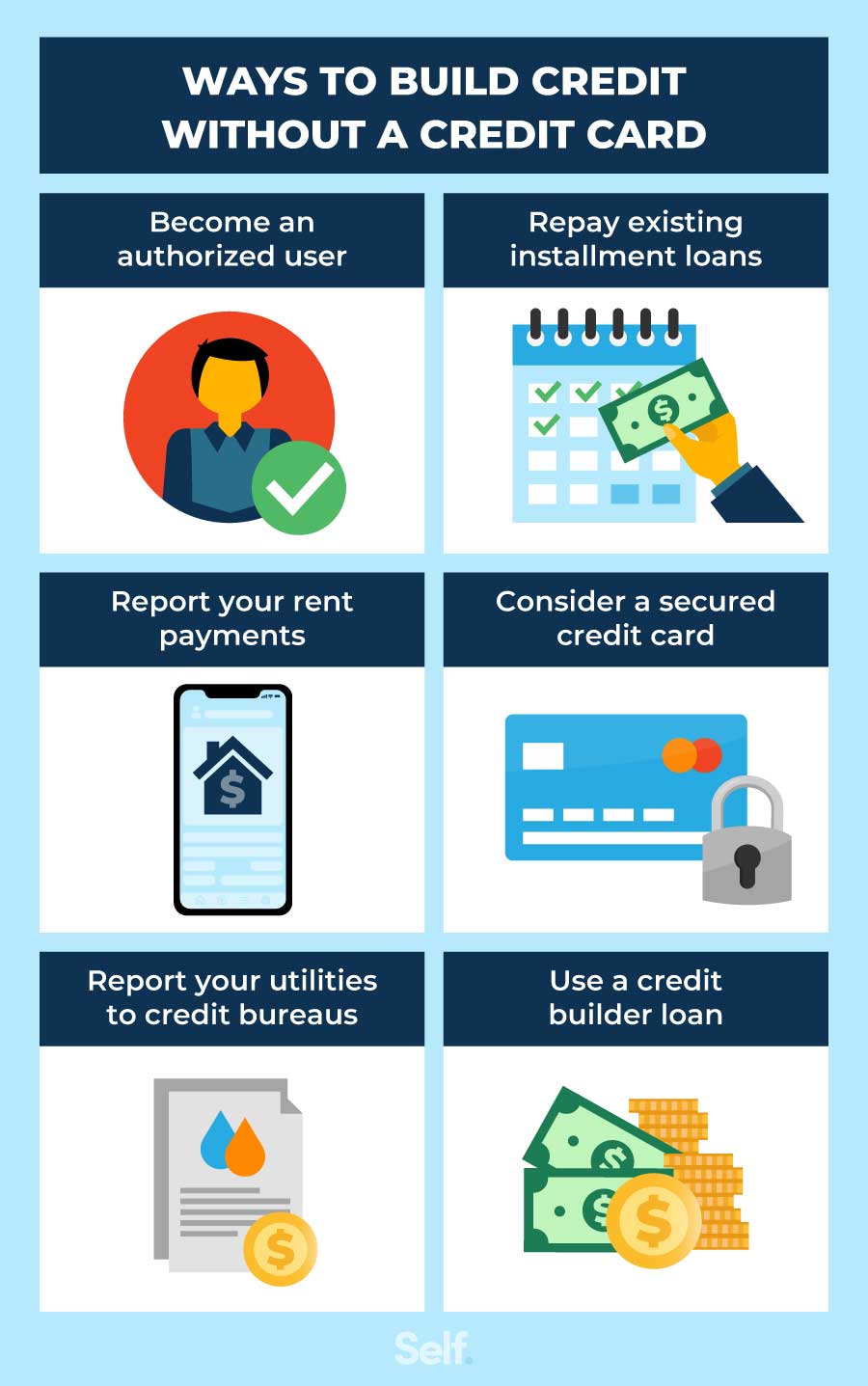

Ways to build credit without a credit card

Your credit history involves a lot more than just how you use your credit card. It’s a full credit profile: a comprehensive overview of how you handle your money. It includes your record as a borrower on installment loans (like car loans and student loans) and whether you’ve paid those credit accounts on time.

Your credit history is used as a basis for determining your credit score, which in turn helps credit card issuers and other lenders assess your ability to handle credit and pay back loans. If you don’t have a credit history, lenders don’t know if you’ll pay back your future loans.

Here are some ways you can build credit without a credit card.

1. Become an authorized user

Applying for a credit card account on your own can be daunting if you don’t have a credit history. Fortunately, you don’t have to go it alone.

An authorized user is a secondary account holder: someone who has access to the account, but does not own it. This is different from a joint account holder; any joint account holder is considered a primary user.[1]

If a family member, legal guardian, or trusted individual has good credit, ask them if they’ll add you as an authorized user. This account will appear on your credit report and might benefit your credit score if bills are paid on time and the lender reports you, not just the primary card holder, to the bureaus. Before you ask someone to let you piggyback on their account, make sure they’re a responsible user. If they have bad credit, they won’t help you achieve a good credit history.

Because an authorized user has no legal responsibility to make payments on the account, the cardholder might not want you to actually make purchases with the card. The good news is, even if they don’t give you the credit card in your name associated with the account, being an authorized user might still help your credit.

2. Repay installment loans

When you borrow money through an installment loan, you receive a lump sum of money that you pay back over time with fixed amounts and regularly scheduled payments.

Common types of installment loans include:

- Student loans

- Auto loans

- Mortgages

Installment loan payments, as described above, are typically reported to the credit bureaus. Your loan agreement details the fixed amounts that you agreed to pay back at regular intervals, typically months, so making on-time payments for the agreed-upon amount can elevate your credit score. However, making late payments or paying on time but paying less than the full amount can hurt your credit score, so be sure to maintain a good payment history and make monthly payments on time.

If you don’t have a credit history and need to take out a loan, you might be approved with a co-signer. A co-signer is a person with good credit history, usually a spouse or parent, who agrees to be responsible for the loan if you default. They’re equally liable for the debt as you, even if they never personally benefit from the loan.

When you take out an installment loan with a co-signer, it will show up on both of your credit reports. If you make payments on time, your credit score should start to grow within six to 12 months.

3. Report your rent payments

Typically, landlords do not report rental payments to the major credit bureaus, but if they do, your monthly on-time payments can help in the same way on-time payments to credit card companies do.

If your landlord does not report rent, you can pay a third-party service like LevelCredit to verify each rent payment and report them to a credit bureau. There is usually an activation fee and a regular monthly fee when tracking your monthly rent payment with these tools.

Keep in mind that rent payments aren’t factored in to all credit scoring models. VantageScore and FICO® 9 and 10 use them. However, FICO® 8, which is a common scoring model, does not.[2]

4. Consider a secured credit card

You may consider starting with a secured credit card to build credit. A secured card is backed by an upfront cash deposit that’s equal to your credit limit. This deposit is used as collateral to reduce the risk to the bank issuing the credit card. As long as you make at least your minimum payments on time, your deposit won’t be touched, and by making those payments, you’ll be building credit.

(Any kind of secured debt is a debt that is backed with collateral unsecured debts do not involve collateral and are typically granted based on creditworthiness alone. If you do not have a credit history, starting with a secured credit card with collateral may be a good way to help you build credit.)

5. Report your utilities to credit bureaus

Another option that can help build your credit is having your utility payments reported to the credit bureaus. Utilities typically do not report to the bureaus. This free service reports your payment history on your cell phone, utilities, and even Netflix® to the credit bureaus.

6. Use a credit builder loan

You can also build credit without a credit card by using a credit builder loan, which Self offers. A credit builder loan is an installment loan that is designed specifically to help people build good credit. It differs from a traditional loan in one key way. With a traditional loan, you get the money up front. With a credit builder loan, you don’t get it until after you have made every loan payment minus fees and interest.

How long does it take to build credit without credit history?

It can take up to six months after opening an account to calculate a credit score.[3] Before your score can be calculated, you must establish credit history.

Credit scores are calculated by the Fair Isaac Corporation (FICO®) and VantageScore. According to FICO®, FICO® scores are used by 90% of top lenders.[4] If you want to know your exact FICO® score, you may be able to get it for free through Experian or a lender who participates in the FICO® Open Access Program, or you can purchase it from the FICO® website.[5][6]

Strategies to build your credit

As you begin to build credit, there are several things to keep in mind, including how your credit scores are determined. (About 4 in 10 Americans don’t have any knowledge of how their credit score is calculated.)[7]

- Pay your bills on time: On-time repayment counts for 35% of your FICO® score.

- Consider your credit utilization: Your credit utilization is the second most important factor, counting for 30% of your score. This is the ratio of the debt on all your revolving credit accounts divided by your total credit limit. Financial experts recommend keeping your credit utilization ratio below 30%.

- Start early: The next factor in your FICO® score is the length of your credit history, which counts for 15%, so the longer you continue making your payments on time, the better your chances of having good credit.

- Diversify your credit mix: It helps to have several different types of credit, because your credit mix counts for 10% of your score. This means it can help to take out a student loan or personal loan, for example, to improve your credit mix. You don’t need a credit card to do that.

- Avoid too many hard inquiries: A hard inquiry occurs when a lender pulls your credit report to understand if they should grant you a loan or credit card. This can cause your score to drop by a few points. However, multiple hard pulls can add up. An exception is if you’re loan shopping for a mortgage or auto loan for example– multiple credit inquiries in a short period count as a single hard inquiry, but the length of the period (anywhere from 14 to 45 days) depends on the scoring model.

Understanding how credit works can give you insights into how to establish it. By following these strategies, you can build credit without a traditional credit card. And once you do, you’ll be on the road to qualifying for that credit card.

Disclaimer: LevelCredit is owned and operated by Self, a financial tech company that helps offers credit builder loans and secured credit cards.

Disclosure: FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Experian. “What Rights Do You Have As an Authorized User on a Credit Card?” https://www.experian.com/blogs/ask-experian/what-rights-do-you-have-as-an-authorized-user. Accessed February 17, 2022.

- How Can You Get Credit for Paying Rent?,” https://money.usnews.com/credit-cards/articles/how-can-you-get-credit-for-paying-rent. Accessed August 4, 2022.

- Experian. “A Beginner’s Guide to Building Credit,” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-to-build-credit/. Accessed February 17, 2022.

- FICO. “FICO scores are used by 90% of top lenders,” https://www.ficoscore.com/about. Accessed February 17, 2022.

- MyFICO. “Your FICO Score, from FICO,” https://www.myfico.com/. Accessed February 17, 2022.

- FICO® Score. “Where to Get Your FICO® Score,” https://www.ficoscore.com/where-to-get-fico-scores#OpenAccess. Accessed August 4, 2022.

- CNBC. “About 4 in 10 Americans ‘have no idea’ how their credit score is determined,” https://www.cnbc.com/2019/01/04/about-4-in-10-americans-have-no-idea-how-credit-scores-are-determined.html. Accessed February 17, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).