How to Remove Late Payments from Your Credit Report

When you open a credit card or take out a loan, you agree to repay the creditor a certain amount by a certain date each month. Miss this due date, and you’ll probably have to pay a late payment fee. And depending on when you bring the account current again, you might also discover a late payment the next time you check your credit report.

Once you fall 30 days or more behind on your payment, a creditor can report your account as late to the credit bureaus. Unfortunately, that new negative entry could inflict serious damage on your credit scores.

If the late payment information on your credit report is incorrect, you should be able to get it removed. But if the record is accurate, that late payment might be stuck on your credit report for up to seven years.

There are strategies you can try if you are interested in learning how to remove late payments from credit report history. Just be aware that they are long shots. On the bright side, all hope isn’t lost even if that missed payment sticks around for a while. You can make other positive credit moves to potentially offset the bad credit score impact, at least to some degree.

How to handle incorrect late payments

Have you ever checked your credit report and found something that didn’t belong there? It’s bad enough when you have credit issues thanks to a mistake or a financial setback. But when your credit score drops because of an error, it can be maddening. After all, you’re the one that’s paying for someone else’s mistake. However, it is possible to learn how to get late payments removed.

Fortunately, Uncle Sam has your back in this situation. The Fair Credit Reporting Act (FCRA) regulates the credit reporting agencies and the companies who report information to them (known as data furnishers). This federal law gives the borrower the right to dispute any inaccurate information that appears on your credit reports.

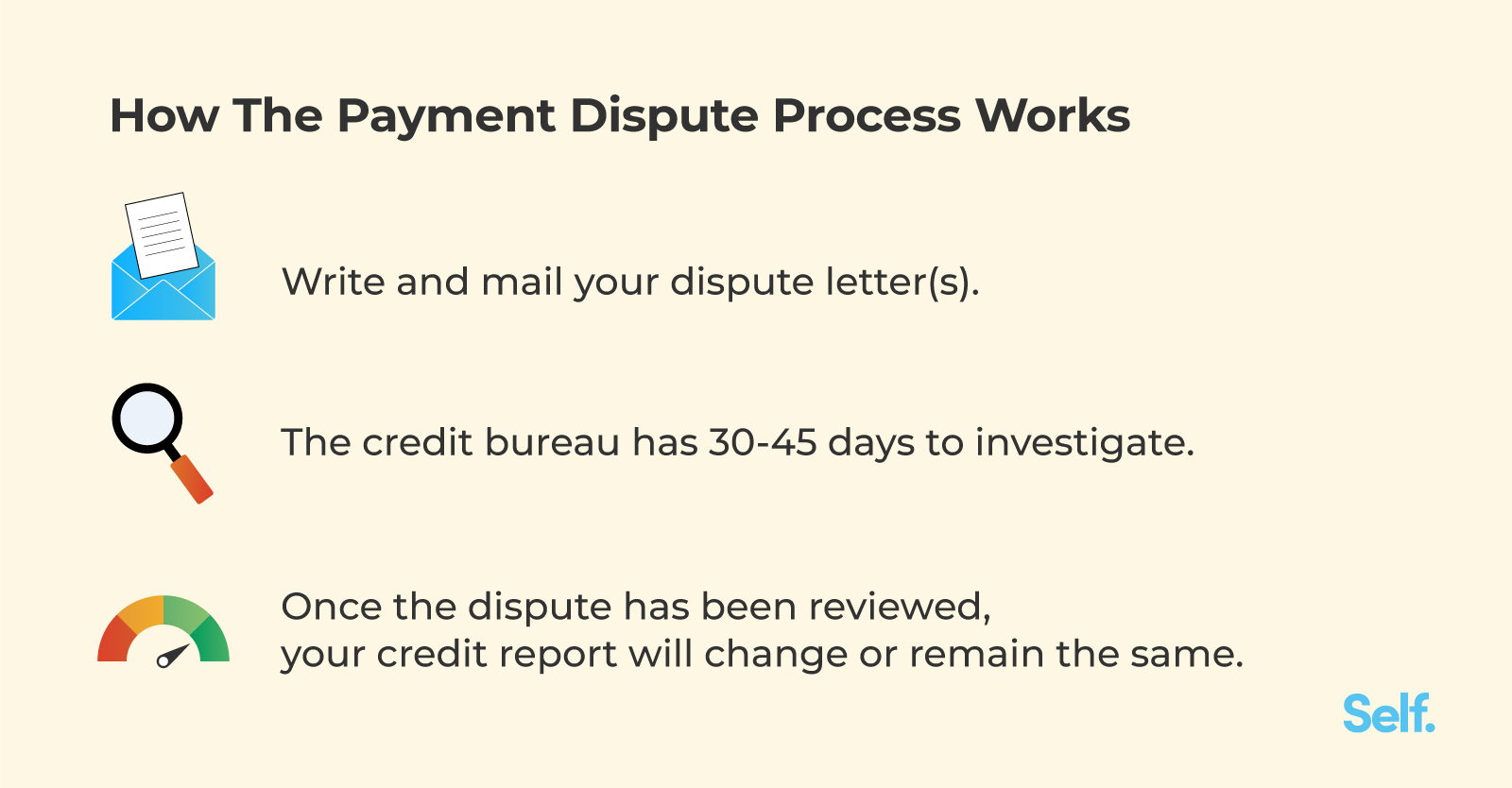

Here’s a simplified overview of how the dispute process works.

Write and mail your dispute letter(s). You can dispute an account with any of the three major credit bureaus online or over the phone. But mailing a physical letter is often best when you’re challenging the accuracy of an item on your credit report. The Federal Trade Commission (FTC) recommends sending disputes letters via certified mail, and requesting a return receipt. You can use the FTC’s free sample dispute letter template to simplify the process. Don’t forget to keep copies for your records.

The credit bureau investigates. Once you mail your dispute letter to Equifax, TransUnion, or Experian, it’s time to sit back and wait. The FCRA gives a credit reporting agency 30 days to investigate and respond to your dispute (45 days in some cases).

Your credit report changes. . .or it doesn’t. The credit bureau relays your dispute to the data furnisher as part of its investigation. If the data furnisher replies that the late payment information on your credit report is accurate, then the derogatory mark stays on your credit. If the data furnisher agrees with you, it will instruct the credit bureau to update your report and delete the late payment note. The late payment should also be deleted if the data furnisher fails to respond to your dispute. Regardless of the outcome—verification, update, or deletion—the credit bureau should send you an update.

The right to dispute is designed to protect you from incorrect credit reporting. But credit disputes don’t always work as planned. A FTC study from 2015 found that many consumers who disputed credit errors still had mistakes on their credit reports three years later.

If you dispute an incorrect late payment and that doesn’t fix the problem, you still have a few options:

- You can send another set of dispute letters to the credit reporting agencies, and include any proof you forgot to send the first time.

- You can call your creditor to try to fix the problem.

- Or, you can mail a dispute letter to the creditor directly.

How to handle accurate late payments

You can’t erase a valid negative item from your credit report just because you don’t like it. The FCRA lets the credit bureaus leave accurate late payment information on your credit reports for up to seven years. But there are potential ways to get a correct late payment removed from your credit report. If you are now wondering, “How often does my credit score update?"

Outdated late payments

Because the FCRA places a seven-year credit reporting time limit on late payments, it’s possible to have a delinquency on your credit report that’s accurate, but too old to be there. Once seven years from the date you paid late passes, the negative mark must come off your credit report.

When you review your credit reports for errors, it’s wise to also keep an eye out for outdated items. You can dispute late payments that are more than seven years old, even if you really did pay more than 30 days after your due date once upon a time.

Mention the fact that the late payment on your report is outdated in your dispute letter. Hopefully that will resolve the problem. If it doesn’t, you can follow up with more disputes to the credit bureaus. It may also be a good idea to reach out to your lender, loan servicer, or credit card company as well.

Goodwill removal

When a late payment on your credit report is both accurate and under seven years old, you probably won’t be able to get it removed from your credit report. According to the FCRA, that negative mark is allowed to be there.

But you can ask your creditor to remove the late payment early as a courtesy. And there are two ways it can work.

- Call your creditor and ask for a goodwill adjustment of your account.

- Mail a goodwill letter to your creditor.

Keep in mind, most creditors will not honor goodwill removal requests. Credit reporting is a voluntary process. But if a company does report data to the credit bureaus, the information it provides must be accurate.

Should you hire a credit repair company to remove late payments?

A credit repair company can’t do anything for you that you can’t do yourself. You have the right to send disputes to the credit bureaus on your own. You can also reach out to creditors to ask for goodwill removals of late payments.

Can you get late payments removed from credit reports? Maybe. Can a credit repair company get late payments removed? The answer is the same. There are no guarantees. If you come across a company that makes unrealistic promises, like the guaranteed deletion of negative credit information, you’re probably dealing with a crook.

These warnings aside, there is nothing illegal about hiring a reputable credit repair company to handle the dispute process for you. Some people prefer to outsource this type of work, or they want professional advice.

Just make sure to choose a company that follows the law and doesn’t advise you to do anything shady in an attempt to fix your credit problems. You don’t want to fall for a credit repair scam. If you’re unsure where to find an honest credit repair company, the National Association of Credit Services Organizations (NACSO) can give you a list of accredited members in your area.

If you hire a credit repair company, you should expect to pay fees for their services. But beware of any credit repair company that charges up front. This is a violation of federal law (the Credit Services Organizations Act). A legitimate credit repair organization will work on your behalf first, and charge you second.

Finally, don’t hire a credit repair company if there isn’t room for the cost in your monthly budget. You don’t want to put yourself in a financial bind by taking on an extra monthly payment you can’t afford.

How much will my credit score increase if late payments are removed?

Understanding how late payments affect credit is complicated. A new late payment won’t lower your credit rating by a specific number of points. So, figuring out how much your score might increase when that same negative information is removed from your credit history can be a challenge. So, now you may be wondering, “how often does my credit score update?

Scoring models, like FICO and VantageScore, look at your entire credit report when they calculate your credit risk score. They don’t consider late payments or anything else in a vacuum. For this reason, negative credit items affect different people in different ways.

If a late payment shows up on an otherwise clean credit report, the impact of that delinquency might be severe. All of a sudden, you’re going from a low-risk consumer to someone who recently didn’t pay their bill as agreed. But if your credit report is already riddled with problems, adding one more late payment to the mix might not change your risk profile much at all. Your score was already on the lower side because your credit risk was higher.

The impact a late payment has on your credit report vs score also changes depending on when it happened. A late payment in the last 12 months demonstrates a higher level of credit risk than a late payment from four years ago.

Someone who recently paid late might still be in the middle of a financial hardship. That person would be statistically more likely to make more late payments in the future. By the time a late payment is close to seven years old and about to be purged from your report; however, it’s probably affecting your score a lot less than it did in the beginning.

Can you offset the impact of a late payment?

You may not be able to remove a late payment from your credit report before its seven-year expiration date. But you try to improve your credit in other ways in the meantime. Taking credit-positive steps like responsibly using a credit builder card might counterbalance the impact that a late payment has on your score.

Here are five potential ways to improve your credit.

1. Pay down your credit card debt.

Did you know that running up a high balance on your credit card (as it related to your credit limit) could potentially harm your credit score? Your credit card utilization rate, also called your balance-to-limit ratio, can have a significant impact on your credit rating.

Lower credit utilization rates are better for your credit scores. From a statistical perspective, lower credit card utilization indicates that you’re less likely to pay a bill 90+ days late in the next two years. (That’s how scoring models judge credit risk.)

So, paying down credit card debt has the potential to give your credit scores a boost. You can save a ton of money in interest when you eliminate expensive credit card debt as well.

2. Dispute credit report inaccuracies.

The late payment(s) on your credit reports might be correct, but what about everything else? You won’t know unless you review your three credit reports from Equifax, TransUnion, and Experian from time to time.

As you review your reports, keep an eye out for any red flags (like potential identity theft) or other mistakes. Credit inaccuracies have the potential to lower your credit scores. So, it’s unwise to ignore errors when they appear on your credit report. Remember, the FCRA allows you to dispute any item on your credit report that’s incorrect.

3. Consider opening new accounts.

Depending on the rest of your credit report, opening a new positive account or two might benefit you. You can consider a credit builder loan, like those offered by Self. Or, if you already have a credit builder loan or other installment account, a secured credit card might be the better way to go.

Of course, there’s no guarantee that adding a new account will raise your credit score. And, if you pay late or run up a high balance-to-limit ratio on a credit card, your new account might backfire and hurt your score rather than help it. Nonetheless, there are many cases where opening a new account and developing good credit habits with it have yielded positive results.

4. Become an authorized user.

A family member or friend might consider adding you as an authorized user to an existing credit card account. If the account has a positive payment history (aka no late payments) and a low credit utilization rate, there’s a chance it could benefit your credit reports.

But there’s a catch, or rather two of them. First, the account needs to show up on your credit reports to have a chance of helping you. Not all credit card issuers will report authorized user accounts to the credit bureaus.

The second potential issue with authorized user accounts is that they could hurt your credit in some situations. Getting added to a well-managed credit card could potentially help you. But if you’re added to an account with negative information (or if the primary cardholder pays late or maxes out the card after adding you to it), your scores might suffer.

Just remember, as an authorized user you’re not liable for the account. If the account becomes a problem instead of a perk, you can ask your loved one to remove you from it.

5. Improve your financial habits.

Avoiding credit mistakes, like late payments or running up high balances on your credit cards, won’t exactly improve your credit scores. But it could help you protect them from additional damage.

In addition to obvious credit mistakes, you should be careful of other lesser-known pitfalls, too. For example, applying for a bunch of new credit in a short period of time might hurt you. You also want to avoid closing unused credit cards in most cases, so that you don’t accidentally increase your overall credit utilization level.

Finally, watch out for unpaid medical bills or other types of debts that could potentially find their way onto your credit reports as collection accounts if you ignore them.

About the author

Michelle L. Black is a leading credit expert with over 17 years of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting and debt eradication. See her on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).