Payday Loans vs. Personal Loans: The Key Differences

Published on: 11/21/2022

You’ve heard of payday loans, and you’ve heard of personal loans, but how exactly are they different? To put it simply, payday loans are short-term loans — usually due your next payday — with a very high cost and low borrowing limits, typically less than $500. On the other hand, personal loans tend to offer a wide range of amounts — from just a few hundred dollars to tens of thousands — loan terms that range from months to years and interest rates that, as of November 2022, can be anywhere from 4% to 36%, according to Forbes Advisor.[1]

Because payday loans have such high costs for small amounts of quick cash, if you need a small loan amount, you might consider payday loan alternatives, such as family and friend loans, lending circles, or peer-to-peer loans.

If you’re considering loan options and need to understand the main differences between payday and personal loans, this article breaks down what a payday loan is, what a personal loan is, the key differences between them and the advantages and disadvantages of both.

Table of contents

- What is a payday loan and how does it work?

- What is a personal loan and how does it work?

- Differences between payday loans and personal loans

- The pros and cons of payday loans

- The pros and cons of personal loans

- Payday loan alternatives

What is a payday loan and how does it work?

A payday loan is a high-cost, short-term loan that offers small borrowing amounts to individuals often with poor or no credit history. If you get a payday loan, you typically must repay it on your next payday or when you receive money from another regular source of income, such as government benefits or a pension.

Lenders require you to provide a post-dated check for the entire amount or other authorization to electronically debit the funds from your savings account or checking account where you get paid or government benefits are deposited on certain dates to guarantee repayment by the due date. If they attempt to withdraw their repayment when you don’t have enough money in your account, you may incur overdraft fees.[2] [3]

Payday loans are designed with low eligibility requirements so that you can easily get cash fast, often the same day you apply. However, lenders usually offer only a small amount of money through these high-cost loans, such as $500 or less, and APRs can near 400 percent, making these loans extremely expensive for borrowers.[2] [3]

What is a personal loan and how does it work?

A personal loan is an installment loan where you receive a sum of money upfront and must pay it back, including interest, over the loan’s term. A personal loan works differently than a payday loan: the annual percentage rates (APRs) are lower, the loan amounts can be over $500, and depending on the size of your loan request it may take a little longer to get approved. You can apply for personal loans online or at a local financial institution. They may be a good option for people with good credit who want to pay off another debt or make a big-ticket purchase and who don’t need the money in a day or two. With this option, you typically receive a lump sum at once and then repay the loan with monthly payments spread out over a set period of time, usually months or years.[4] [5]

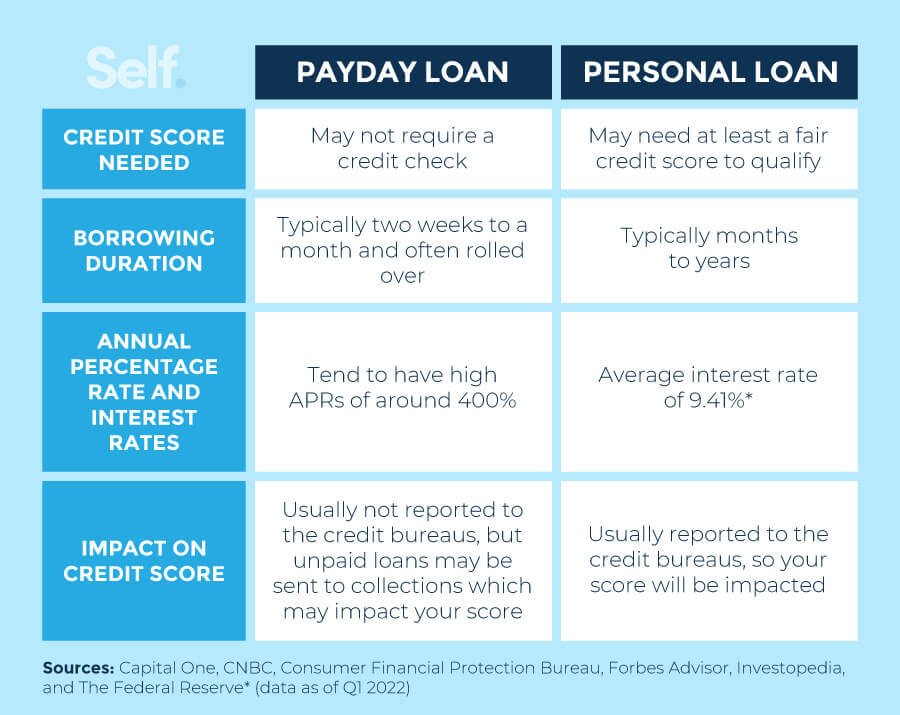

Differences between payday loans and personal loans

Before deciding which loan option works best for you, consider the differences between each and how that impacts your financial situation. These sections discuss certain factors such as the credit score you need for each, the borrowing duration, the average interest rates and each loan’s relative impact on your credit score.

Credit score needed

- Payday loan: Payday loans don't require good credit or any credit at all because the payday lender generally doesn't conduct a credit check. They rely on your paystub or other financial records to prove that you have income coming in to pay it off.[3]

- Personal loan: Personal loans generally require strong credit scores of at least 600 to qualify, so it’s possible you can qualify with a fair or good score.[4]

Borrowing duration

- Payday loan: Payday loans have short borrowing durations because they are designed to be repaid in one lump sum. The goal is to pay the loan back on your next paycheck.[2]

- Personal loan: A personal loan is a longer-term option that allows you to gradually pay the loan off over several months to multiple years, depending on the size of the loan, which is usually a lot more than a payday loan.[6]

APR and interest rates

- Payday loan: Payday loan APRs (the annualized yearly cost of your loan fees) can be staggering. Some state laws restrict payday loan fees, but when fees are added, typically around $15 for every $100 you borrow, that two-week loan may cost you upwards of nearly 400% in some cases.[2]

- Personal loan: Interest rates tend to be more reasonable for these longer-term loans. The average interest rate for a personal loan in Q1 of 2022 was 9.41% for a 24-month personal loan.[7]

Impact on credit score

- Payday loan: Payday loans usually aren’t reported to the three major credit bureaus, so it would not usually show up on your credit or impact your score either positively or negatively.[9] However, if you don’t pay back the loan and the debt goes to collections, it could impact your credit score.

- Personal loan: Personal loans may be reported to the three major credit bureaus, affecting key FICO® credit score factors, such as:

- Payment history: Making on-time payments may help improve your score by giving you some positive additions to your payment history, but late payments or defaulting on the loan may have the opposite effect.

- Credit mix: Because personal loans are installment loans, adding one or a new type of installment loan to your credit mix may show lenders that you can handle different types of credit well, provided you pay on time.

- Credit utilization: Keeping your credit utilization low may help show lenders that you handle your credit well and don’t overextend yourself. Because your personal loan is an installment loan, not revolving credit, it doesn’t get factored into your credit utilization. However, if you do pay down your revolving credit with your personal loan and keep the lines of credit open, you help reduce your credit utilization, which may have an impact on your score.

- Hard inquiries: Typically, lenders perform a hard inquiry into your credit for a personal loan, which may drop your score by a few points initially. While you may recover from a single hard inquiry, attempting to secure loans from several different lenders in a short period of time may have a negative impact to your credit score.

[8]

The pros and cons of payday loans

Before you apply (or decide against this option altogether), consider these pros and cons of payday loans.

Payday loan pros

- Quick cash: You can usually get a payday loan in a relatively short period of time after stepping up to the counter or going online and filling out an application, as long as you have all of the required documentation.

- Usually doesn’t require a credit check: Because payday loans typically require no credit check, you can apply even if you have poor credit or no credit.

[10]

Payday loan cons

- High APR: Payday loan APRs (the total yearly cost of your loan, which includes the fees) are huge — sometimes as high as 400%. The APR typically outpaces that of a personal loan.

- Continuous debt cycle: If you cannot pay back the loan by your next payday, the loan will roll over with a fee, and you may find yourself struggling to dig out. This may result in a dangerous cycle of debt.

- Short loan terms: You may need cash quickly, but a payday loan requires you to pay it off quickly, too. If your next payday needs to fund other bills, leaving you no wiggle room, you may need an option with longer repayment terms so you can spread your payments out.

- Fees: Typically, you are charged anywhere from $10 to $30 per $100 you borrow, but $15 is a typical fee. If you can’t repay in one lump sum by the next payday, the fees get added again and the loan becomes due the next payday keeping you in a cycle of debt.

[2]

The pros and cons of personal loans

You should also think about the pros and cons of personal loans, which are quite a bit different from that of payday loans.

Personal loan pros

- Small to large loan amounts: You have more options when it comes to loan size, and you may have the option to get either a smaller loan or a larger one, as opposed to payday loans which are typically small.

- Payments get reported: Although reporting payments to the credit bureaus can be an advantage if you make on-time payments, it can also be a disadvantage if you make late payments or default on the loan.

- Fixed payments: You can easily budget for personal loan monthly payments because they are at a fixed amount spread out over a specific period of time.

[11]

Personal loan cons

- Fees and penalties: Personal loans can have fees and penalties, so be sure to read the fine print. Depending on the lender, in addition to interest, you could have application fees, late fees when you don’t make your payments on time, origination fees when you first take out the new loan or even prepayment penalties for trying to pay your loan off early.

- Could take out more than you can afford to repay: Personal loans can be quite large, so you may be tempted to take out a large one that you may later find is difficult to pay back.

- Long loan term: With a longer time to repay the loan, you may be able to spread out your payments, making them more affordable in the short term, but because you have a longer term, you end up paying more interest in the long run. Additionally, if your financial circumstances change before the loan term is up — perhaps you lose your job or end up with a costly medical bill — you may have trouble making payments.

- Higher interest rates if lower credit score: Unlike payday loans, because your lender will run a credit check, if you have a lower credit score, you may not get approved and if you do you may pay higher interest rates.

[5]

Payday loan alternatives

If you don’t qualify for a personal loan but a payday loan doesn’t seem right for you, you have other options. You may want to consider some alternatives:

- Family and friends loan: Borrowing from family and friends typically means no fees or interest, although you risk damaging relationships if you can’t pay it back.

- Payday alternative loan: Credit unions offer payday alternative loans, which gives the borrower more time to pay it off and at lower rates.

- Lending circles: Lending circles may offer better terms for short-term, small loan amounts, although you may need to be a member for a while before you're eligible.

- Peer-to-peer loan: Peer-to-peer loans have grown in popularity, matching borrowers with potential investors offering loans.

- Credit card cash advance: If you already have a credit card, you can usually get a cash advance on it. However, these tend to be high cost as well because of APRs and fees. To understand what it may cost you, check the terms in your cardholder agreement.

[12]

No matter what your financial situation is or what type of loan you want, you have options. Make sure to evaluate the pros and cons based on your financial situation.

Sources

- Forbes. “Best Personal Loan Rates of November 2022,” https://www.forbes.com/advisor/personal-loans/personal-loan-rates/. Accessed November 14, 2022.

- Consumer Financial Protection Bureau. "What is a payday loan?" https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567. Accessed July 19, 2022.

- Investopedia. "What Are the Basic Requirements to Qualify for a Payday Loan?" https://www.investopedia.com/ask/answers/102814/what-are-basic-requirements-qualify-payday-loan.asp. Accessed July 19, 2022.

- Forbes. "5 Personal Loan Requirements To Know Before Applying," https://www.forbes.com/advisor/personal-loans/personal-loan-requirements. Accessed July 19, 2022.

- Investopedia. "How to Apply for a Personal Loan," https://www.investopedia.com/articles/personal-finance/010516/how-apply-personal-loan.asp. Accessed July 19, 2022.

- CNBC. "10 questions to ask before you take out a personal loan," https://www.cnbc.com/select/questions-before-taking-out-personal-loan. Accessed July 19, 2022.

- Federal Reserve. "Consumer Credit - G.19," https://www.federalreserve.gov/releases/g19/current/default.htm. Accessed July 19, 2022.

- Experian. "How Does a Personal Loan Affect Your Credit Score?" https://www.experian.com/blogs/ask-experian/how-does-a-personal-loan-impact-your-credit. Accessed July 19, 2022.

- Consumer Financial Protection Bureau. "I heard that taking out a payday loan can help rebuild my credit or improve my credit score. Is this true?" https://www.consumerfinance.gov/ask-cfpb/i-heard-that-taking-out-a-payday-loan-can-help-rebuild-my-credit-or-improve-my-credit-score-is-this-true-en-1611. Accessed July 19, 2022.

- Experian. "What Is a Payday Loan and How Does It Work?" https://www.experian.com/blogs/ask-experian/how-payday-loans-work. Accessed July 19, 2022.

- Forbes. "How Do Personal Loans Work?" https://www.forbes.com/advisor/personal-loans/how-do-personal-loans-work. Accessed July 19, 2022.

- Experian. "10 Alternatives to Payday Loans," https://www.experian.com/blogs/ask-experian/payday-loan-alternatives. Accessed July 19, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).