The Best Loans for Bad Credit

Published on: 11/03/2022

When you’re strapped for cash, a low credit score can make it harder to be approved for a traditional loan, but you may still have loan options, such as personal loans or credit builder loans.

In this article, we explain what lenders consider to be bad credit as well as the best loans for bad credit, so you can choose the right loan regardless of your credit score or circumstances.

Table of contents

- What is considered bad credit?

- Types of bad credit loans

- Where to get loans if you have bad credit

- How to choose the best loan for your needs

- How to apply for a loan with bad credit

- Will a loan help my credit score?

- Improve your credit for the future

What is considered bad credit?

Your credit score, also known as your credit rating, depends on the scoring model. Generally, lenders consider a FICO® score below 580 and a VantageScore below 500 as bad credit, which means you may not even get approved for a loan.[1] If you do get approved, typically, the lower your credit score, the higher you can expect your interest rate to be, thus directly correlating to a higher annual percentage rate (APR).

FICO® and VantageScore represent the two most commonly used scoring models. Each scoring model considers information reported to the three main credit bureaus — Experian, Equifax, TransUnion — and weighs the data slightly differently. However, the main components that make up your credit score include payment history, credit limit used, length of credit history, credit mix, and new credit.[2][3]

The example below shows a range of APRs based on credit scores for a personal loan of $5,000 for 36 months — as the credit scores get higher, the lender may offer a lower interest rate. Just like each scoring model weighs factors differently, various lenders rate credit scores and applicable APRs in different ways. Wells Fargo defined the following credit score ranges differently than FICO®.[4][5]

| Credit score category | Credit score range | APR |

|---|---|---|

| Poor | Below 620 | 18.75% |

| Fair | 621-699 | 16.25%–18.75% |

| Good | 700-759 | 13.74%–16.25% |

| Excellent | 760 and above | 9.9%–12.49% |

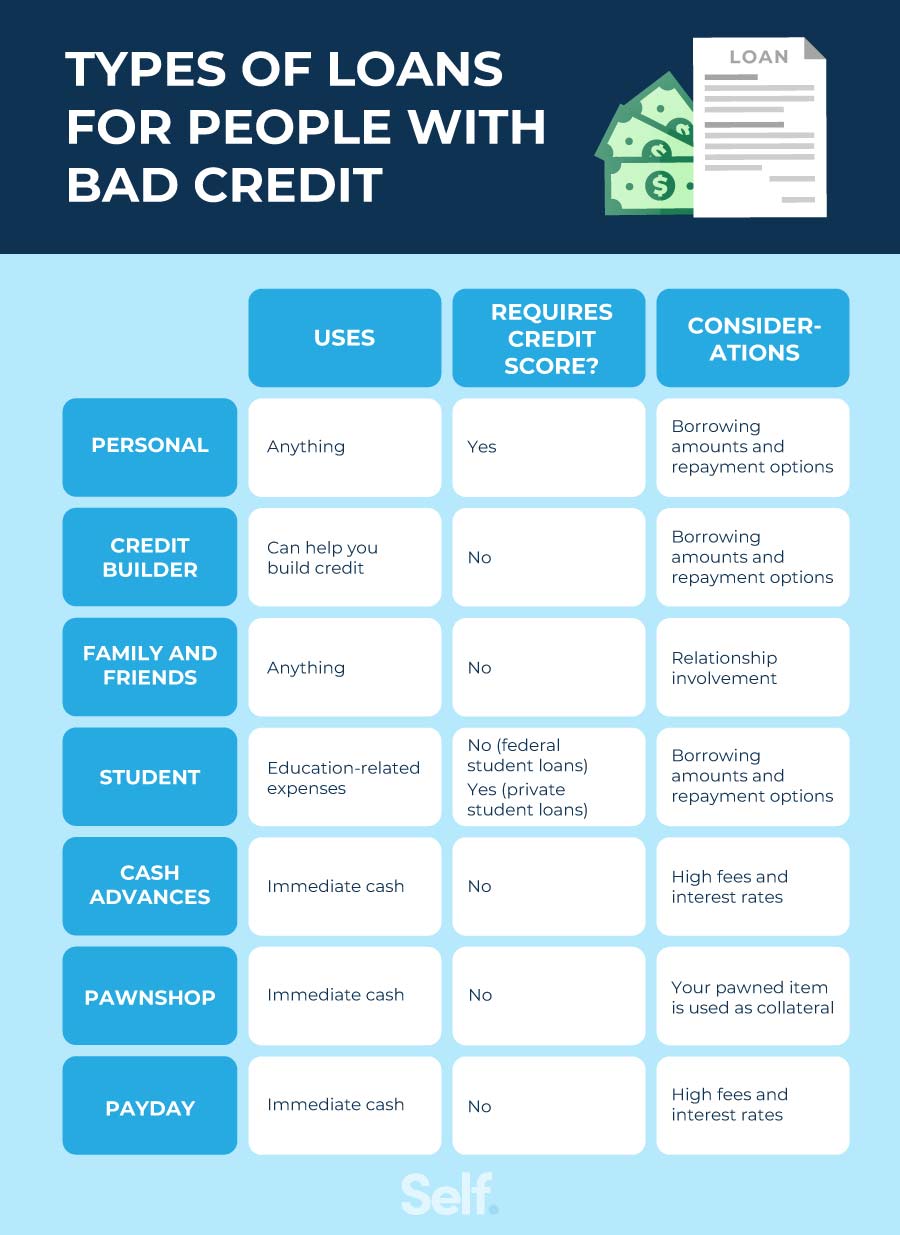

Types of bad credit loans

The following sections break down the different types of loans you can consider when you have bad credit. In addition to your credit score, lenders look at your debt-to-income ratio, your spending behavior, and the type of loan you’re applying for when assessing your creditworthiness for these types of loans.

1. Personal loans

Personal loans provide borrowers with a lump sum of money that can be used for a variety of expenses, and they come in two forms:

- Secured: With secured loans, you offer the lender collateral to secure the loan. The lender will still pull your credit report to evaluate your application. If approved, the lender charges interest and in some cases fees, both of which make up your annual percentage rate (APR). Because you offer the lender something of value upfront — cash or bank account or valuable item — you have an incentive to pay the loan. Otherwise, the lender can seize the asset you put up for collateral if you don’t pay according to the terms of the loan. Additionally, because you put up something valuable as collateral, lenders have less risk than with an unsecured loan, which may mean you may also get a lower interest rate compared to what you may be offered with an unsecured loan.

- Unsecured: When you take out an unsecured loan, lenders also perform a hard credit inquiry to evaluate your credit history and your likelihood to pay back a loan. If approved, lenders offer you the money outright. The lender has no collateral in case you default on the payments. They charge you interest and in some cases fees that combine to make your APR. Because these loans have no collateral, nothing for lenders to seize if you default on the loan, the cost of borrowing typically is higher, resulting in higher interest rates.[6]

If you have excellent credit, lenders may offer you a lower interest rate, but even if you have poor credit or no credit history, you still may find lenders that cater specifically to your financial situation.[7]

The best personal loans you can qualify for may be found with online lenders who list their minimum credit score clearly on their site. Armed with that information, you can know whether a loan company might consider you for a personal installment loan before you fill out an online application and undergo a credit inquiry.

2. Credit builder loans

A credit builder loan doesn't work like a traditional loan. Instead of getting your loan proceeds upfront, you make monthly payments that get deposited into a savings account or certificate of deposit (CD). Once you’ve made all of your payments on the loan, the service provider will give you the loan proceeds minus interest and fees. Making each loan payment on time and in full helps build your credit since each payment is reported to one or more of the major credit reporting bureaus.

You can open a Credit Builder Account through Self to build both credit as well as savings (minus interest and fees). While a credit builder loan doesn’t give you money to spend right away, it may be a good option to help build credit and it may increase your chances of being approved for other types of loans with better rates in the future.

3. Family and friends loans

When all other options have been exhausted, some people turn to their family or their friends, especially if they have a bad credit score or no credit history. Unlike finding a co-signer to meet a lender’s requirements, family members or friends offer these loans to you without the traditional loan structure, such as a credit check or loan application.[8]

Although these loans are informal and between people who know each other well, they shouldn’t be structured informally or entered into lightly. These informal loans carry serious risk. You could ruin your relationship if you can’t pay back the loan, and if you’re the lender, you have to consider that you may never get paid if the loan goes into default since you have little recourse to enforce the informal agreement. As the borrower, you also don’t get the benefits of having such a loan impact your credit at all, and as the lender, you lose access to the funds you’ve lent someone.

However, if you and your lender, who is your family member or friend, decide that this arrangement can work for your situation, you should agree on a structure and draw up a contract that includes: loan amount, repayment schedule, pay-off date, interest to be charged, defaulting penalties and so on.

4. Student loans

Some financial aid for undergraduate college tuition is awarded in the form of loans that must be repaid with interest. Federal student loans are backed by the government, but you can also get loans from private financial institutions. However, if you need help paying your tuition, consider federal student loans before a private student loan, especially if you have bad credit.

With a federal loan, you have to pay back the loan plus interest regardless of whether you graduate, but federal loans do not perform an inquiry into your credit. You apply by filling out the FAFSA (Free Application for Federal Student Aid), and you have the flexibility to change your repayment plan after borrowing. If you qualify for subsidized federal student loans, these loans offer the feature of deferring the interest you accrue while enrolled at least part-time in school.[9]

The requirements to qualify for a private student loan are similar to other types of loans except for the fact that you must be enrolled in an educational institution and the lender may not accept all colleges and academic majors. Private student loans typically have higher interest rates than federal loans, and to qualify, you must apply directly with the lender who will perform a hard inquiry into your credit.[9]

5. Pawnshop loans

If you take items to a pawnshop, you may be able to get a pawnshop loan based on the value of the merchandise you present as collateral. The average pawnshop loan charges you fees and interest then gives you 30 to 60 days to repay the loan. If you don’t repay the loan, you may be able to extend it with extra fees and interest, or the pawnshop will keep your collateral and sell it to recoup the loss.[11]

6. Payday loans

These short-term, high-interest rate loans allow you to borrow in advance of your next paycheck by either giving the payday lender a post-dated check for the loan amount plus payment fees or by giving the lender authorization to debit the funds from your bank, credit union, or prepaid card account. The loans are typically limited around $500, although some limits range above and below that. Some states have laws in place that prohibit the loans to be any higher.[12] To qualify for this loan, you need a bank or credit union account, proof of income, and an ID showing that you are over 18 years of age.[13]

Payday loans charge fees instead of interest, and at first look, the fees may look reasonable. However, when you calculate those fees into an APR, the APR is extremely high. Because of their fees and short payback period, payday loans are extremely risky and should be avoided when possible.

Where to get loans if you have bad credit

If you’re looking for a secured or unsecured personal loan, the following institutions offer installment loans that cater to a variety of credit scores, even those with bad credit:

- Online lenders: You can often get a response quickly from online lenders, plus shopping around and comparing rates may be easier with lenders who are strictly online.

- Banks: You may have to personally visit a bank to effectively compare rates and terms, but you may be able to compare their minimum requirements online just as you would with online lenders.

- Credit unions: Because you usually must be a member to be in a credit union, they may know you and your situation better than a bank or online lender. Talking personally with someone at a credit union may help you find out more about rates and terms and what they can offer you specifically.

Each lender has its own established credit ranges that define everything from excellent credit to poor credit. Just as the credit ranges may vary, the interest rates they offer, loans fees, and thus the APRs, vary as well. Some lenders may be more strict than others so compare lenders carefully. Although you may find lenders with a low threshold of minimum requirements and terms for eligibility, you may also be paying an extremely high cost for those loans. So be sure to examine the loan terms carefully and not just the borrower requirements in your search.

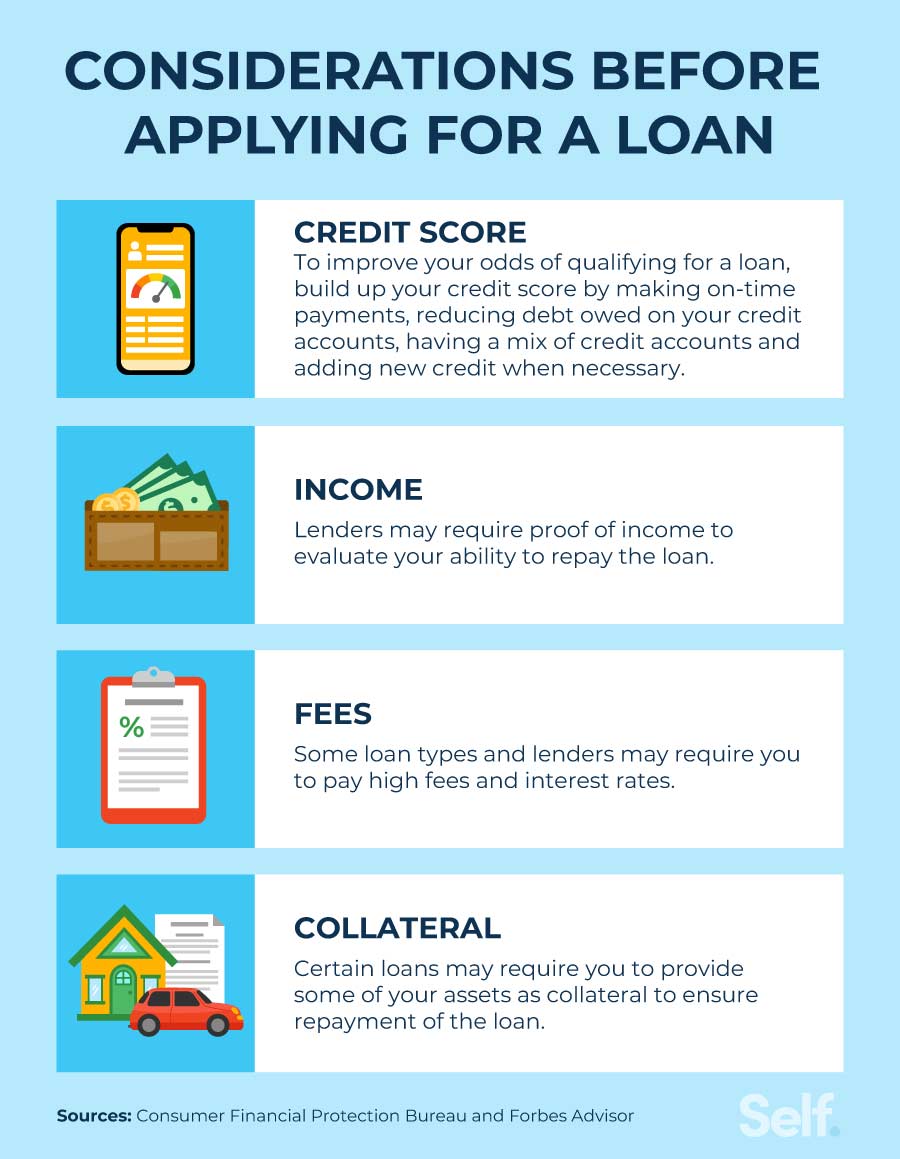

How to choose the best loan for your needs

You may benefit by shopping around when you need to secure a personal loan with bad credit. Many financial institutions like banks and credit unions extend unsecured personal loans, and some lenders cater specifically to people with bad credit or no credit history. However, rates and fees can vary from lender to lender. So carefully evaluate the loan terms and customer reviews for each lender and avoid loans that require money from you without a contract or that offer a variable instead of fixed rate.[14]

When you need a personal loan, you can shop around, review the FAQs on the lender’s website and ask yourself the following questions to determine if you might pre-qualify and to help you choose the best loan for your needs:

- Do you meet the minimum eligibility requirements? All lenders have requirements that customers must meet before they are approved for a loan. These may include minimum requirements for income, debt-to-income ratio and credit score. If you do meet the minimum requirements, you’re ready to ask yourself the next question.[14]

- Are the interest rates and fees affordable? The answer to this question may depend on if you meet the minimum credit score requirements. The cost of bad credit can result in higher interest rates because lenders typically use your credit score to calculate the interest rate and fees associated with your loan. If these costs fit your budget, you can ask yourself the next question.

- Are the repayment terms reasonable? Typically, the longer it takes to pay back the loan, the higher your interest rates may be. While term lengths vary, longer repayment periods can mean you end up paying more over the life of the loan due to total interest even though your monthly payments are low. Shorter repayment terms mean eliminating your debt sooner but you may need to make a higher monthly payment.[14]

How to apply for a loan with bad credit

When shopping around for loan rates, you may wonder what the difference is between becoming prequalified or preapproved. The terms may mean different things, depending on the lender and credit product, and some lenders may even use these terms interchangeably. However, both terms typically mean that a lender has evaluated your credit at some level to see whether you may qualify for a loan or credit product, and neither term means you’re guaranteed to be approved.[15]

You might initiate getting prequalified by submitting a prequalification application listing your basic financial information The lender then makes a soft inquiry into your credit to evaluate your application and informs you of whether you are prequalified. Although the prequalification process doesn’t confirm approval, it does allow you to gauge your chances for possible approval as well as check out the rates and fees while you compare different lenders.[15]

Preapproval may refer to either getting preapproved online for a credit card or prescreened, unsolicited offers for loan or credit products. Preapprovals are no guarantee that you’ll qualify, but you can apply for these offers after you receive them, which typically means authorizing a hard credit inquiry. Generally, each pre-approval counts as one hard inquiry, but if lenders make several hard inquiries into your credit within a short timeframe, such as 14 days, most credit scoring models treat it as only one inquiry. After the 14-day timeframe, and depending on the credit bureau, each pre-approval can count as one hard inquiry, which can, temporarily, decrease your credit score by more points.[15]

To apply for a loan with bad credit, follow these steps to maximize your results:

- Check your credit score and determine what size loan payment you can make. If you know your credit score, you can narrow down which lenders to approach based on their minimum requirements, plus you can see where you fall in their credit ranges, which determines your APR. Then look at your expenses and your budget to figure out how much of a loan payment you can afford without overextending yourself.

- Get prequalified and compare offers. Lenders combine your interest rate, origination fees and other charges for your loan into your total APR. Check to see which lender has loan terms that fit your budget, and evaluate the loan terms for things like grace periods, charges like late fees and other things items that affect how the loan fits within your financial situation.

- Choose a lender and complete a formal application. When you’ve narrowed your selection, begin the formal application process, which involves providing your Social Security or ITIN number and other details about your financials, such as your income. At this stage, the lender will conduct a hard inquiry to check your credit.

- Wait for a loan decision. The loan approval process can take hours, if applying online for a payday loan, or days, when applying for a secured personal loan, depending on the lending institution.

Will a loan help my credit score?

Depending on how you handle your loan, a loan can either negatively or positively impact your credit score. If you use a personal loan to pay off credit cards, you can reduce your credit utilization ratio, and making timely payments can help you create a positive payment history, which is the biggest factor that goes into calculating your credit score.[16]

Missing a payment or making a late payment may negatively impact your credit score since it affects your payment history, which is the most important factor when calculating your credit score.[17]

Improve your credit for the future

Before taking out any type of loan, weigh the pros and cons to choose the right loan type for your circumstances. You can work on building your credit by considering a credit builder loan through Self. That way, you’re building your credit history and savings (minus interest and fees) at the same time.

Debt consolidation or credit counseling may be an alternative if you need a loan due to existing debt. You can also find other tools and tips through Self to build your credit to give yourself a better chance at securing a loan when you need it.

Sources

- CapitalOne.com. “What is a Bad Credit Score?” https://www.capitalone.com/learn-grow/money-management/what-is-a-bad-credit-score/. Accessed on April 27, 2022.

- myFICO. “What’s in My FICO Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed on April 28, 2022.

- Forbes Advisor. “What Is A VantageScore?” https://www.forbes.com/advisor/credit-score/what-is-vantagescore/. Accessed on May 4, 2022.

- Wells Fargo. “Personal Loan Rate and Payment Calculator,” https://www.wellsfargo.com/personal-loans/personal-loan-calculator/. Accessed on April 27, 2022.

- myFICO. “What is a Credit Score?” https://www.myfico.com/credit-education/credit-scores. Accessed on September 9, 2022.

- CNBC. “Here’s the difference between secured and unsecured loans,” https://www.cnbc.com/select/secured-loans-vs-unsecured-loans/. Accessed on May 11, 2022.

- CNBC. “Applying for a personal loan with poor credit? Here’s what you should know,” https://www.cnbc.com/select/applying-for-personal-loan-poor-credit/. Accessed on April 29, 2022.

- Forbes Advisor. “Family Loans: Benefits And Pitfalls Of Borrowing From—Or Lending To—Family,” https://www.forbes.com/advisor/personal-loans/family-loans/. Accessed April 29, 2022.

- Federal Student Aid. “Federal student loans for college or career school are an investment in your future.” https://studentaid.gov/understand-aid/types/loans. Accessed April 29, 2022.

- Forbes Advisor. “Payday Loans Vs. Cash Advance Loans: What To Know And How To Avoid Them,” https://www.forbes.com/advisor/personal-loans/payday-loans-vs-cash-advance/. Accessed May 5, 2022.

- Experian. “What Is a Pawnshop Loan?” https://www.experian.com/blogs/ask-experian/what-is-pawn-shop-loan/. Accessed April 29, 2022.

- Consumer Financial Protection Bureau. “What is a payday loan?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan. Accessed April 29, 2022.

- Consumer Financial Protection Bureau. “What do I need to qualify for a payday loan?” https://www.consumerfinance.gov/ask-cfpb/what-do-i-need-to-qualify-for-a-payday-loan. Accessed on May 12, 2022.

- CNBC. “10 questions to ask before you take out a personal loan,” https://www.cnbc.com/select/questions-before-taking-out-personal-loan/. Accessed on April 28, 2022.

- Experian. “Pre-Qualified vs. Pre-Approved” What’s the Difference?” https://www.experian.com/blogs/ask-experian/pre-approved-vs-pre-qualified-whats-the-difference/. Accessed on April 28, 2022.

- Experian. “How Does a Personal Loan Affect Your Credit Score?” https://www.experian.com/blogs/ask-experian/how-does-a-personal-loan-impact-your-credit/. Accessed April 29, 2022.

- Experian. “Can a Personal Loan Hurt My Credit Score?” https://www.experian.com/blogs/ask-experian/can-personal-loan-hurt-credit-score/. Accessed April 29, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).