Preapproved vs. Prequalified Credit Card Offers

Published on: 10/10/2022

Preapproved and prequalified credit card offers help you understand your chances of being approved for a credit card before you even apply. This allows you to compare various credit card options without impacting your credit score.

Also known as prescreened offers, preapproved and prequalified offers may arrive unsolicited via email, phone or mail. You can also actively seek out prequalification on your own to find the best credit cards for you. While the terms preapproved and prequalified are often used interchangeably, this article helps you understand the differences as well as the pros and cons of prescreened credit card offers.

Table of contents

- What is a prequalified credit card offer?

- What is a preapproved credit card offer?

- What’s the difference between prequalified and preapproved?

- Pros of preapproved and prequalified offers

- Cons of preapproved and prequalified offers

- How prequalified offers and preapproved offers impact your credit score

- How to opt out of prescreened offers

- Build your credit

What is a prequalified credit card offer?

Prequalified credit card offers indicate that you meet initial eligibility criteria to become a cardholder. Customers typically initiate the prequalification process themselves by providing financial information — such as income, housing costs and other assets — to potential lenders.

After a brief review of this financial information, credit card issuers will let you know how likely you are to qualify and what rates and fees might apply. With your consent, the lenders may also conduct a soft inquiry (or soft pull) on your credit report, which won’t affect your credit score. At this point, a lender may make a firm offer of credit provided you meet eligibility requirements.[1]

What is a preapproved credit card offer?

Like a prequalified offer, a preapproved offer indicates that you may fit the eligibility requirements for a certain credit card. In the preapproval process, the lender generally initiates the inquiry into the customer’s credit profile.

Lenders may approach credit bureaus to request lists of individuals meeting certain criteria. Alternatively, they may also provide the bureaus with a list of their own current customers to see who qualifies for other products.[1]

Preapproved credit card offers basically serve as an invitation to apply for credit cards for which the lender thinks you qualify. If you have a good to excellent credit history, for example, credit card companies may be willing to offer you a card. However, preapproval does not guarantee that you will be approved if you apply for that credit card. Because the offer depends on an additional credit check, you may be denied if there were recent changes which didn’t appear in the initial check on your credit, such as an increase in debt. Additionally, the credit card company will need financial information that isn’t listed on your credit report. So you may not be approved if items, such as your income, fail to meet their requirements.[2]

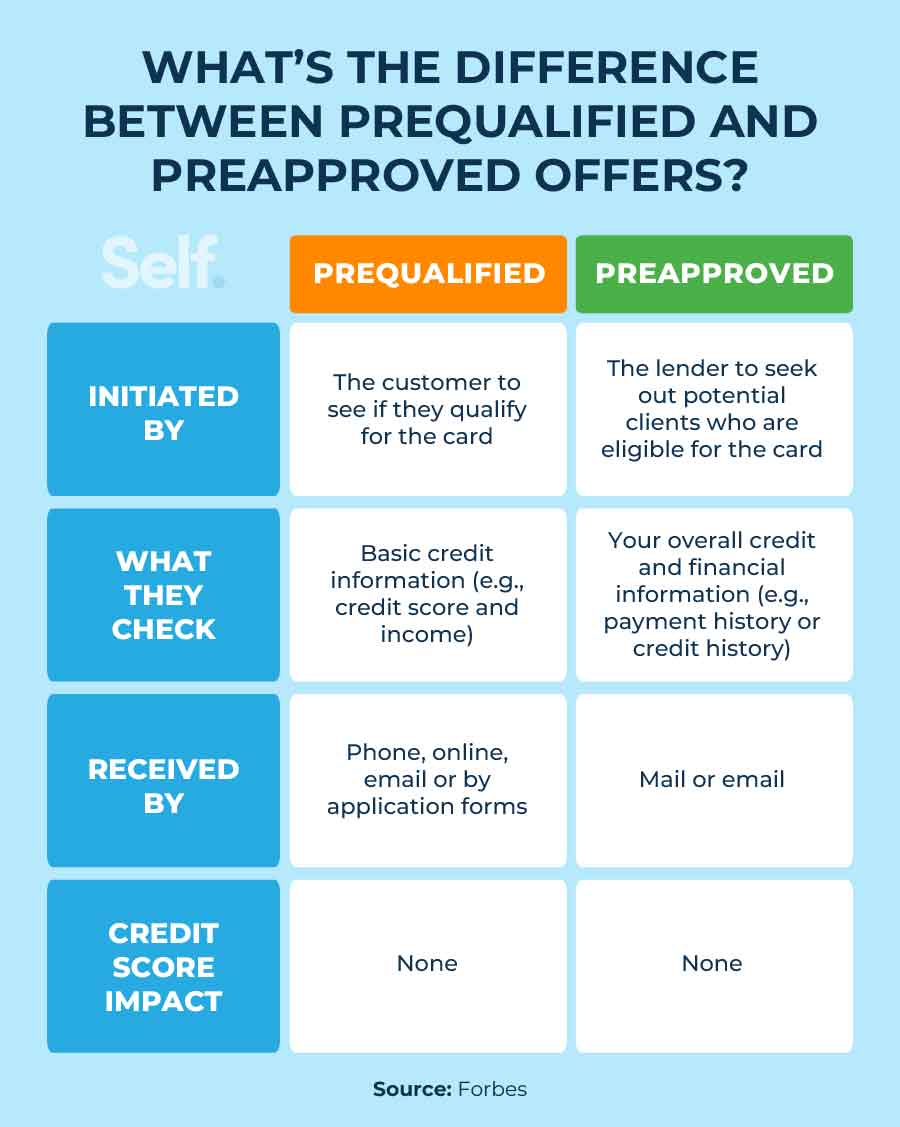

What’s the difference between prequalified and preapproved?

The terms prequalified and preapproved both refer to credit card offers based on prescreening customers, but a slight difference involves who initiates the process. In prequalification, customers usually begin the process by phone or online survey to see which credit cards will likely approve their application.[1]

In preapproval, on the other hand, lenders usually send offers to potential customers who they know already meet the eligibility criteria.[1] One important note: While these terms sometimes mean the same thing in the credit card world, they can have significantly different implications in the home-buying process when it comes to mortgage approval.

For example, a mortgage preapproval involves a more complex process, one that resembles the actual mortgage application process. Lenders ask you to submit documentation, and they verify your information, which gives you a better idea of how much you may be approved for as well as your interest rates. A mortgage preapproval shows sellers that your offer is genuine. On the other hand, the lender will give you a general idea of how much you can borrow based on your income, debt and credit for a mortgage prequalification.[2]

Pros of preapproved and prequalified offers

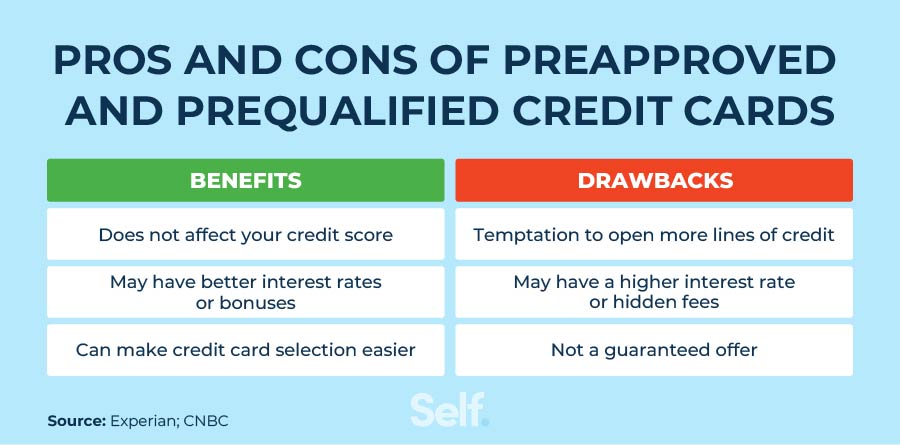

You may feel you’ve hit the jackpot when preapproved and prequalified credit card offers start rolling in. While you want to carefully evaluate how any offer affects your personal finances, prescreened offers may indeed provide a number of advantages.

Does not affect your credit score

One of the biggest benefits of prescreening is that it requires only a soft inquiry, so your credit score won’t take a hit. Applying for credit cards directly, on the other hand, usually results in a hard inquiry on your credit report, which could cost you a few points on your credit score.[3]

May have better interest rates or bonuses

Prequalified and preapproved credit card offers may even qualify you for better rates than what you currently have. Because lenders have already prescreened your financial history, they have a good idea of what they feel comfortable offering you — whether that means better interest rates, deals on balance transfers, travel rewards, cash back cards or other perks.[3]

Can make credit card selection easier

Credit card preapproval means you can save yourself the time, hassle and potential risk to your credit score that is usually involved in the credit card application process. The selection process may be even easier if you have good credit and find that multiple lenders approach you with preapproval offers.[3]

Cons of preapproved and prequalified offers

Just because you receive a preapproved or prequalified credit card offer doesn’t necessarily mean you should apply for it. You may want to evaluate your financial situation with the following cons in mind.

Temptation to open more lines of credit

A preapproved or prequalified credit card offer may look too good to pass up. If you receive multiple such offers, it may tempt you to apply for more credit cards than you need. Not only can having more credit cards result in more future debt, but simply applying can damage your credit score. In most cases, every time you apply for a new credit card, it results in a new hard inquiry on your credit report. Applying for several at once in a short period can negatively affect your credit score.[4]

May have a higher interest rate or hidden fees

All credit card offers come with strings attached — interest rates, limited-time offers, annual fees and more. Prequalified offers are no exception. Examine the details and compare the cards not just for their introductory offers but to also determine how they affect your financial situation in the long term.

Credit card offers may offer a 0% or low APR for a limited time after which a higher APR kicks in, or if you have bad credit, you might receive a subprime credit card offer that comes with hidden fees. Also weigh low APR offers against the perks or rewards of other cards. You know your financial situation best — you may want a lower APR, but you may be losing on rewards and perks that you can really use.[5]

Not a guaranteed offer

While prescreened offers help you determine your chances of qualifying for a credit card, they don’t guarantee approval. When you apply for a credit card, even a preapproved one, lenders will want to take a more thorough look at your creditworthiness. In addition, creditors may look into other factors such as your current employment status, income and housing costs. If they find anything they don’t like, they may still deny your application. In this case, your credit score may go down without a new credit card to show for it.[6]

How prequalified offers and preapproved offers impact your credit score

Because they are considered a soft check on your credit history, prequalified and preapproved offers don’t impact your credit score. Applying for a credit card, however, requires a hard pull and will likely lower your credit score. Fortunately, this drop is usually temporary and credit scores typically rebound quickly.[6]

How to opt out of prescreened offers

While many customers take advantage of prescreened credit card offers, some may decide they don’t wish to receive them at all. The Fair Credit Reporting Act (FCRA) gives you the right to opt out of receiving firm (preapproved/prescreened) offers. You can opt out for five years or permanently by calling 1-888-567-8688 or visiting OptOutPrescreen.com.

Although your request becomes effective with the major credit bureaus within five days of submission, it may take some time before you see a reduction in the offers you receive. Keep in mind that opting out won’t stop all solicitations and offers, such as those sent by politicians, local merchants, charities and professional associations.[7]

Build your credit

Navigating the nuances of preapprovals and prequalified offers may seem overwhelming, but you don’t have to maneuver your credit decisions alone. When it comes to building and understanding credit, Self offers straightforward products, such as the Credit Builder Account that walk you through your first steps to building credit.

Disclosure: FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Forbes. “Pre-Approved Vs. Pre-Qualified For Credit Cards: What’s The Difference,” https://www.forbes.com/advisor/credit-cards/pre-approved-vs-pre-qualified-for-credit-cards-whats-the-difference/. Accessed on May 20, 2022.

- Experian. “What Is a Preapproved Credit Card Credit Offer?,” https://www.experian.com/blogs/ask-experian/what-is-a-preapproved-credit-card-offer/. Accessed on May 20, 2022.

- Experian. “What Are the Benefits of a Preapproved Credit Card?,” https://www.experian.com/blogs/ask-experian/should-i-accept-apreapproved-credit-card/. Accessed on May 20, 2022.

- Experian. “Can You Apply for Two Credit Cards at Once?,” https://www.experian.com/blogs/ask-experian/can-you-apply-for-two-credit-cards-at-once/ Accessed on May 20, 2022.

- CNBC.com. “This is how credit card companies select you for special offers,” https://www.cnbc.com/select/qualify-new-0-percent-apr-offers/. Accessed on May 20, 2022.

- CSNBC.com. “Prequalified vs preapproved: What you need to know about your approval chances for a credit card,” https://www.cnbc.com/select/prequalified-vs-preapproved-credit-cards/. Accessed on May 20, 2022.

- Federal Trade Commission. “Prescreened Credit and Insurance Offers,” https://consumer.ftc.gov/articles/prescreened-credit-insurance-offers. Accessed on May 20, 2022.

- myFICO. “What is a Credit Score?,” https://www.myfico.com/credit-education/credit-scores. Accessed September 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).