How Much of Your Paycheck Should You Save Each Month?

Published on: 02/01/2022

Living from paycheck to paycheck is a reality for many Americans. Nearly two-thirds (63%) were doing so at the end of 2020.[1] With so much money going toward day-to-day expenses—and, in some cases, debt—saving money can be a big challenge.

Even so, there are ways to save money a little at a time. Smaller adjustments can add up over time, and with patience and consistency, you can see your savings grow.

What percentage of your paycheck should you save?

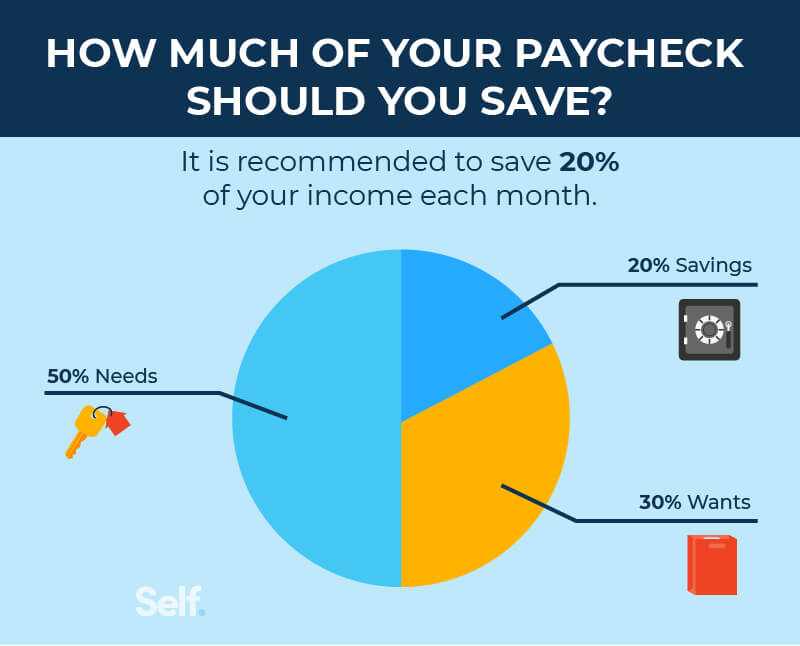

So, how much of your paycheck should you save? Many sources recommend saving 20% of your income each month. This is based on the 50/30/20 rule: 50% of your paycheck is dedicated to things you need, 30% to things you want, and the remaining 20% to savings and investments.[2]

Although 20% is a good benchmark, it’s not a hard-and-fast rule. What’s important is to start saving what you can, even if it’s 5% or 10%.

To determine what’s realistic for you, consider what must go towards bills and other necessities. Missing bill payments can hurt your credit score and cost you money in the long run because it can lead to higher interest rates on future loans. That can negate some of your efforts to build up savings.

Subtract what must go towards bills and other necessities from your take-home pay. See what you have leftover, and allocate that to wants and savings. Savings are not built in isolation, but in conjunction with living expenses such as rent/mortgage payments, groceries, utilities, transportation, and credit card payments.

What are your savings goals?

When creating a savings plan, everyone’s savings goals are different. As you set out to identify yours, it can be helpful to ask a few questions. First, what are you saving your money for? And second, when do you want to accomplish this goal?

This will keep you focused by giving you both something to shoot for and a time frame in which to accomplish it.

1. For emergencies

It’s important to have an emergency fund just in case something happens. You never know when you may be faced with financial adversity such as job loss or an unexpected expense like car repairs, medical bills, or the need to replace your roof or HVAC system.

A Federal Reserve survey in 2020 found that 45% of laid off respondents would have to put an expense of more than $400 on credit, borrow money from a friend or family member, take out a loan, sell something, or they simply would be unable to pay. [3]

If you can put away savings ahead of time, you can avoid tapping your credit—and paying interest on top of your principal—or reluctantly taking other actions when those emergencies hit. Consider starting an emergency fund and putting money aside in a high-interest savings account, so it’s earning interest instead of just sitting there. Good high-yield savings accounts can earn annual percentage yields (APY) of 0.4% to 0.6%. [4]

2. For big purchases

Not all savings need to be for a rainy day. You can save for things you want, too. For example, you can start saving money to purchase that new laptop you’ve always wanted. Some purchases could be short-term savings goals, while others might be part of long-term savings plans.

Examples of big purchases include:

- Saving $3,000 for a down payment on a car (within three years)

- Putting aside $200 each month until age 30 for a down payment on a house

You can also set a goal of paying down debt by paying off your student loan, car loan, credit card debt, or other obligation.

3. For retirement

Retirement will come sooner than you think, so it’s a good idea to be prepared, and the faster you begin building your nest egg, the better. If you can do so when you first leave school and start earning a paycheck, you’ll have time for your money to grow through compounding interest. [5]

If your company offers a 401(k) retirement plan with an employer match, it’s an opportunity worth considering. Some employers may match your contributions dollar-for-dollar up to 3% of your income; others may make a partial match up to a certain percentage. [6] That’s essentially free money. A 401(k) plan allows you to save and invest with pretax money in a retirement account, so you don’t pay taxes on those funds until you withdraw them in retirement.

Other retirement savings vehicles include a Roth IRA, a traditional IRA, and fixed annuities. You can set specific goals. For instance, Fidelity recommends saving one year’s worth of salary by age 30, three times as much by age 40, six times your salary by age 50, and eight times by the time you’re 60. [7]

Still, your idea of a comfortable retirement may look different than someone else’s. Some people want to downsize and live a minimalist lifestyle in retirement, while others want to splurge on things they couldn’t do or have when they were working. Writing the great American novel and exploring the world take different amounts of money. Thus, it’s important to set your savings goals in accordance with what you want and need.

4. For investing

Some of the best kinds of investment pay you compound interest. This means the interest you earn is added to the balance of your principal, which then earns more interest on top of that. So, you earn interest on top of interest on top of principal. [8] You can see how this adds up, especially over a long period of time.

If you decide to invest in stocks through a brokerage, there are a couple of types of accounts you can use. In a cash account, an investor pays the full amount for the securities (stock or bond investments) purchased. In a margin account, the brokerage firm can lend you money to purchase securities, with your portfolio acting as collateral on the loan. [9]

Stocks, bonds, mutual funds, real estate, annuities, life insurance, and a host of other investment options are available to you. You can even invest online. Or, you could invest money in a business or into your own talents. Be sure to consult with a financial advisor if you are not sure where to start or need more assistance.

What if you can’t save as much as you want?

Sometimes, living paycheck to paycheck is all that you can do at the moment, especially if you are paying off credit card debt, bills, student loans, and other lenders. Loan repayments can make it difficult to save money.

It can be hard to create a financial plan for yourself. You may even consider taking out a loan to achieve your goals, rather than working toward them by building savings—or even getting a loan to pay off money you owe. However, it can help to ask yourself some questions before you do so, such as: why you need the money, what kind of debt you hope to pay off (if you’re taking out a loan to pay off debt), whether you can afford it, and how much you’ll be paying in interest.

Instead, you may be able to avoid taking out another loan by making some changes to increase your savings. Here are some ideas:

Budget based on your lifestyle

One possible course of action is reducing your expenses by changing your personal spending habits.

Some ideas include:

- Eating out less often.

- Reducing your leisure budget by either doing fewer things or choosing less expensive activities, such as riding a bike, walking, or playing with your dog.

- Cutting back on subscriptions you don’t use or need, such as apps, online services, news sources, and streaming services. (Consider cutting out services that may overlap with each other first.)

- Resist making impulse purchases.

- Track your spending using a budget app and/or bank account notifications.

Pay down your high-interest debt

Look at the types of debt you have, and develop a strategy for paying them down. If you have high-interest credit cards, see if you can pay them off or transfer the balance to a lower-interest card (but be aware that balance transfer fees may offset any savings you gain).

Regardless, it’s a good idea to pay more than the minimum due each month so you can pay off your balance faster. This is a form of saving because you’ll be saving money on interest that will accrue in larger amounts the higher your balance.

You might want to choose either the avalanche method (paying off the highest interest loans and credit cards first) or the snowball strategy (paying off the smallest amounts first) to pay down debt. The avalanche method will save you money in interest if you can stick to it, but the snowball strategy can keep you motivated by helping you see progress as you go.

Start small

Open a bank account (savings or checking account) with a high interest rate. Set up direct deposit so you’re not tempted to spend money you have in hand, and don’t make withdrawals. Seek the highest savings rate you can find.

Invest a few dollars or set some cash aside. Start a side hustle or ask for overtime to make some extra money, and dedicate your extra earnings to your savings. Gather stored belongings you don’t need for a yard sale. Clip coupons and look for sales on items you were going to buy anyway, then put the money saved doing this away in savings.

If you need more ideas, consider seeking financial advice from a financial planner or tax advice from a tax professional. In fact, another way you can save money is by maximizing your tax deductions.

Create a savings plan

Developing a savings plan is an effective way of improving your personal finance. Other steps you can take include building credit by keeping your debts manageable and making payments on time, and seeking out the lowest possible interest rates. There are many ways to save money and build savings. Set goals and determine the kind of action to take that provides the best way to achieve your objectives.

Sources

- CNBC. “63% of Americans have been living paycheck to paycheck since Covid hit,” https://www.cnbc.com/2020/12/11/majority-of-americans-are-living-paycheck-to-paycheck-since-covid-hit.html. Accessed December 20, 2021.

- CNBC. “Use the 50-30-20 rule to be smarter and more successful with your money,” https://www.cnbc.com/2021/05/11/how-to-follow-the-50-30-20-budgeting-strategy.html. Accessed December 20, 2021.

- Federal Reserve. “Report on the Economic Well-Being of U.S. Households in 2020 - May 2021,” https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-dealing-with-unexpected-expenses.htm. Accessed December 20, 2021.

- The Ascent: A Motley Fool Service. “Best Online and High-Yield Savings Accounts of December 2021,” https://www.fool.com/the-ascent/banks/best-savings-accounts/. Accessed December 20, 2021.

- CNN Money. “Ultimate guide to retirement,” https://money.cnn.com/retirement/guide/basics_basics.moneymag/index.htm. Accessed December 20, 2021.

- Forbes. “Retirement Basics: What Is A 401(k) Match?” https://www.forbes.com/advisor/retirement/what-is-401k-match/. Accessed December 20, 2021.

- Fidelity. “How much do I need to retire?” https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire. Accessed December 20, 2021.

- Forbes. “The Life-Changing Magic Of Compound Interest,” https://www.forbes.com/advisor/investing/compound-interest/. Accessed December 20, 2021.

- U.S. Securities and Exchange Commission. “Types of Brokerage Accounts,” https://www.investor.gov/introduction-investing/investing-basics/how-stock-markets-work/types-brokerage-accounts. Accessed December 20, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.