Turn everyday bills into better credit

Rent and Bills Reporting is a fast, easy and no-debt way to build credit.

No credit check

Fast results

Featured in:

A new, fast way to build credit

Grow your score

Average gains hit 25 points.*

Positive reporting

Missed payments will not be reported.

Fast results

Credit updates in as little as a few days.***

Free rent reporting

Your rent builds credit at no extra cost.

Build credit with everyday payments

1

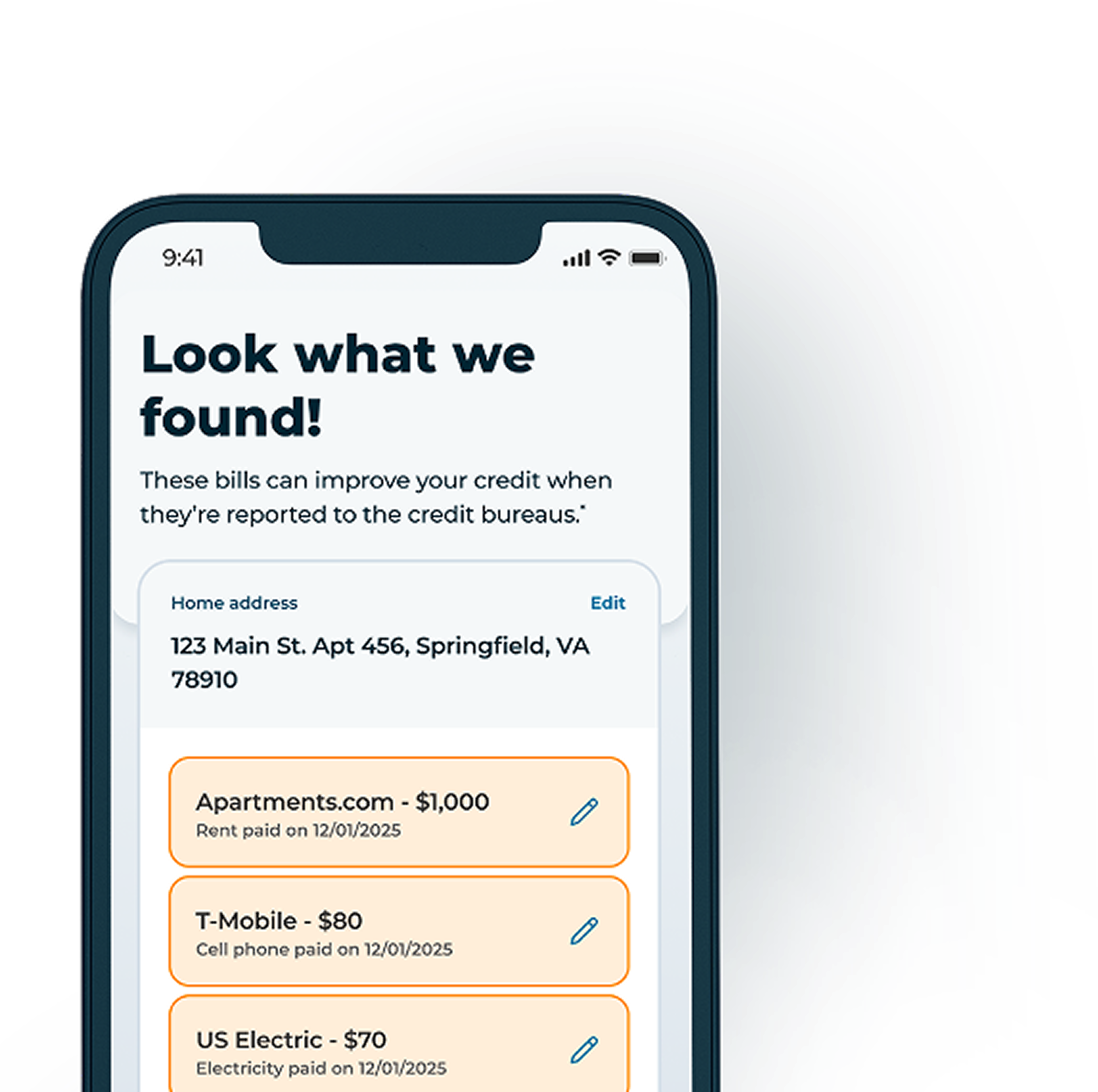

Link your accounts

We automatically find rent and bill payments made from your bank, card, and other methods.

2

Select your bills

Decide which ones to report. The more bills you report, the stronger your credit.

3

Build credit fast

We report your payments to the credit bureaus — usually within 36 hours.***

Report rent for free, or add more bills for $6.95/month

Rent Reporting

Free

- Report rent payments to Equifax, TransUnion and Experian

- Add a positive record to your credit profile

Rent and Bills Reporting

$6.95/mo

- Report rent payments to Equifax, TransUnion and Experian

- Report utility and phone bills to TransUnion

- Add up to 5 positive records to strengthen your credit profile

- Track changes to your credit report with real-time alerts

Over 1.1 million people have reported bills with Self

In September I started at a 500 credit score, now it’s December and I’m at 608. My bills being counted is a big help.

I've only been reporting my rent and utility payments for 2 months but I absolutely love it because I actually get credit for doing something I already do every month without fail.

Self has been a great experience. Now I can look forward to buying a house and a car that I have dreamed of. All of this is made possible by paying my monthly bills on time. I greatly appreciate it. Thank you so much.

Frequently asked questions

Rent and Bills Reporting adds your on-time rent and bill payments to your credit history. Because payment history makes up 40% of your VantageScore® credit score, these positive payments can strengthen your credit over time.

Customers who report their bills see an average credit score increase of 25 points.*

Customers who report their bills see an average credit score increase of 25 points.*