Why Your Apple Card Application Was Denied and What to Do

Published on: 01/18/2022

Some people will be denied when applying for an Apple Card. If you are one of them, you might be wondering why you’ve been denied and if you can reapply.

We’ll discuss how insufficient credit history and other factors impact your Apple Card application and how to fix them for future credit applications, including next steps if you’re not approved.

What are the Apple Card requirements?

Apple lists six specific requirements to obtain an Apple Card:

- Be at least 18 years old, depending on your residency

- Be a U.S. citizen or lawful resident with a residential address (not a PO Box) or military address

- Sign in to iCloud using your Apple ID

- Use two-factor authentication with your Apple ID

- Lift a freeze on your credit report, if you have one

- Be able to verify your identity using a driver’s license or state photo ID if necessary[2]

What is the credit score required to get an Apple Card?

Apple doesn’t actually approve or deny your application for an Apple Card. Goldman Sachs issues the card.[2]

Goldman Sachs considers your FICO® Score 9 as a key factor in determining whether you qualify for an Apple Card. FICO® scores range from 300 to 850. A score higher than 660 is considered favorable for being approved.[3]

That number is at the high end of the “fair” category on the FICO® scoring scale. FICO® considers anything between 580 and 669 “fair.” Scores from 670 to 739 are “good.” Credit scores of 740 to 799 are considered “very good,” and 800 to 850 are “exceptional.” Anything below 579 is considered “very poor.”

Goldman Sachs cautions that other credit scores, such as those supplied by VantageScore, may not be predictive of approval.[2]

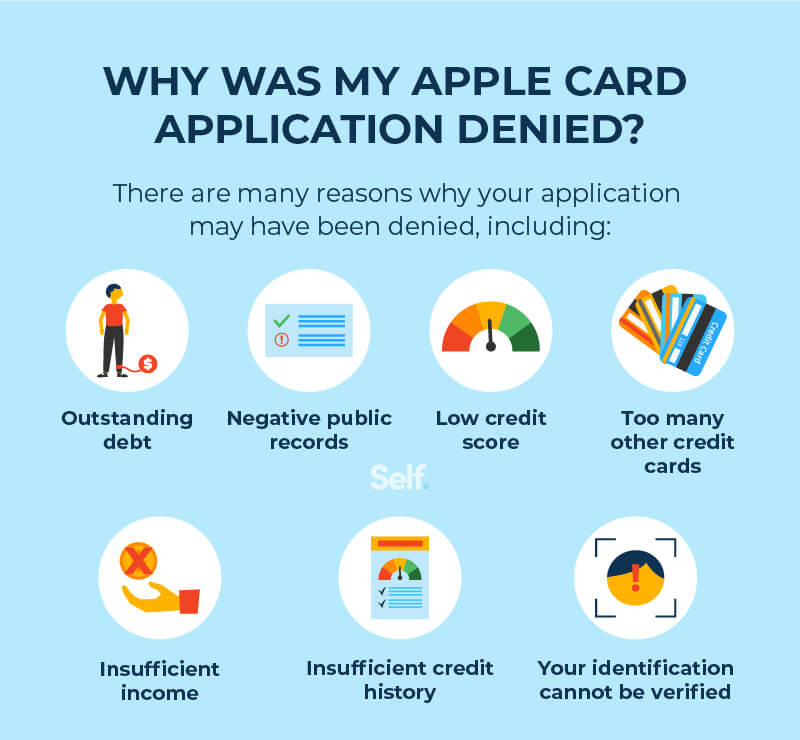

Why was my Apple Card application denied?

In addition to your credit score, Goldman Sachs considers other factors in evaluating creditworthiness. The income you report on your application is one important factor.[2] There are others, too:

- Late payments: Have you been late on payments? Being on time is the most important element in your credit score. FICO weighs it at 35%.

- Credit history: Have you applied for too much credit recently? Do you have a thin credit history that makes you seem like a risk to lend to?

- Credit utilization ratio: Is your debt too high compared to your credit limit? Your credit utilization ratio counts for 30% of your FICO score.

Goldman Sachs also looks at whether you have negative public records. These can include bankruptcies, tax liens and repossessions.[2]

If your Apple Card application was denied due to insufficient credit history or a low credit, there are steps you can take to build your credit so that lenders understand that you’re not a risk.

Learn more about why credit card applications get denied.

What does insufficient credit history mean?

The term “insufficient credit history” may appear on an Apple Card application, but don’t become alarmed at this. It doesn’t mean you have payments that are more than 30 days past due or have other negative marks in your credit file. It simply means there isn’t enough credit data on you to determine a credit score.

It could mean that you may not have enough credit accounts. Lenders want to see that you have different kinds of credit accounts and debt obligations to ensure you can manage them all effectively. This is called your credit mix.

It’s also a factor in determining your credit score.

Still, it can keep you from being approved. When this happens, credit card issuers simply can’t tell if you are a good credit risk or a bad credit risk. Don’t panic. There are ways to address this issue.

How to fix insufficient credit history

There are several ways to fix insufficient credit history, but it won’t happen overnight. The fact is that building credit takes time, and if you’re just starting out, you will have to be patient.

Part of your credit score is the length of your credit history, which accounts for 15% under the FICO system. This includes the average age of the accounts on your credit report. It also factors in the age of your oldest account and when you opened your most recent one.

Because your credit history isn’t established overnight, time is required to improve this aspect of your credit history. Still, there are steps you can take that can start making a difference sooner — even if you have no credit at all.

Open a credit account with a secured credit card

If you have little or no credit, you’ll need to have a credit card to start building it. But as we’ve seen with Apple Card, it can be a challenge to get a credit card company to approve you without a payment history.

Applying for a secured credit card can be a good way to establish your credit. The credit card is “secured” by a deposit you make in a linked account, which can be as little as $200.

The deposit is used as collateral to ensure you make your payments, and it doesn’t come into play unless you miss payments. Then and only then is the deposit tapped.

But the point is to make your payments, and as you do, you’ll be building credit toward the point that your credit history will no longer be “insufficient.” Learn more about how to use secured credit cards to build credit.

Always pay your bills on time

Paying your bills on time is the best way to build credit because on-time payments account for the biggest percentage of your FICO score. In fact, your payment history counts for more than one-third of your score. Among the five factors FICO considers, it counts for as much as the bottom three combined which are length of credit at 15%, new credit at 10% and credit mix at 10%.

As mentioned above, making payments on time isn’t just about your credit card. It can include non-debt obligations such as rent and utility payments. If you have student loans or car payments to make, those count, too.

Carefully consider applying for new credit

The better your credit mix, the more it will help your credit. This counts for 10% of your FICO score, so applying for different kinds of credit can help. But it’s important to do so judiciously.

Making too many credit applications in a short period can be a red flag to lenders that you can’t handle the debt you’ve already got.

Ask friends or family to add you as an authorized user on their credit card

You also can build credit with the help of a family member or friend. If the person approves, you can essentially piggyback on their card by being added as an authorized user. If the cardholder pays his or her bills on time, you will benefit, because that positive activity will show up on your credit report.

But you should be sure the person has good credit and a history of acting responsibly. If not, any negative marks that show up on their credit report will wind up on yours, too. By the same token, if you make charges irresponsibly that leave the cardholder unable to pay on time, both of your credit scores will suffer.

Authorized users aren’t the same as joint cardholders. They can’t ask for increased credit limits, make balance inquiries or redeem rewards.

Regularly monitor your credit

Monitoring your credit can help you fix an insufficient credit history by making sure all the positive credit information you’ve been accumulating is recorded.

In addition, knowing what’s on your credit report can help you to weed out inaccurate information. Under federal law, you’re entitled to a free copy of your credit report once a year. It’s worthwhile to make use of that opportunity because errors on credit reports aren’t uncommon.[6]

Fraud and identity theft are also risks. If you know what to look for on a credit report, you can spot items that you don’t believe you’re responsible for and dispute them with the credit bureaus. Removing inaccurate negative marks will help you build good credit.

You can order a copy of your credit report at annualcreditreport.com.

Does a denied credit card application hurt my credit score?

When you apply for a credit card, it will show up on your credit report as a hard inquiry. This will likely cost you a few points on your credit score. It will happen whether your application is approved or denied, and the difference won’t show up on your credit report.[4]

A high number of recent credit applications is a negative factor when applying for an Apple Card or any line of credit.

Can I reapply for the Apple Card?

The answer is yes, but you have to go through a process. Goldman Sachs offers a program known as Path to Apple Card for those who have been declined but wish to reapply for an Apple Card. The program itself is not an application, but if you complete the program, you will be invited to apply for the Apple Card again.[5]

By enrolling in the program, you authorize Goldman Sachs to obtain your credit reports from TransUnion and other major credit bureaus (Experian and Equifax), as well as third-party sources.

Goldman Sachs will set goals for you and design a personal program with steps to take to improve your credit. You will get monthly emails to track your progress. Once you achieve your goals, you will be invited to reapply for the Apple Card.[3]

Denial isn't the end of the line

If you’ve applied for an Apple Card and are denied because of insufficient credit or a low credit score, there are a number of ways to build credit. In general, the better your credit history, the lower your interest rates will be and the more available credit you’ll be offered.

In order to position yourself to reapply for the Apple Card, you’ll need to sign up for the Goldman Sachs program that will give you the steps you’ll need to take. (As an added bonus, you’ll be improving your overall personal finances in the process.) Then, with some work and patience, you can receive an invitation to apply again.

Sources

- Apple. “Fees don’t help you. So we don’t have them.” https://apply.applecard.apple/301/. Accessed September 21, 2021.

- Apple. “How your Apple Card application is evaluated,” https://support.apple.com/en-us/HT209218. Accessed September 21, 2021.

- Apple. “Apple Card,” https://www.apple.com/apple-card/financial-health. Accessed September 21, 2021.

- Experian. “Do Rejected Credit Applications Affect Your Credit Scores?” https://www.experian.com/blogs/ask-experian/does-getting-rejected-affect-your-credit-score. Accessed September 21, 2021.

- Goldman Sachs. “Path to Apple Card Terms of Use,” https://www.goldmansachs.com/terms-and-conditions/Path-to-Apple-Card-Terms-of-Use.pdf. Accessed September 21, 2021.

- Consumer Reports. “More Than a Third of Volunteers in a Consumer Reports Study Found Errors in Their Credit Reports,” https://www.consumerreports.org/credit-scores-reports/consumers-found-errors-in-their-credit-reports-a6996937910. Accessed September 21, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.