Should You Apply for a Loan Online or In Person?

Published on: 12/06/2022

You can apply for a personal loan in two ways: from an online lender (non-bank lender) or a brick-and-mortar financial institution, but one option may work better for your financial situation than the other. While you might prefer the convenience of applying online or speaking with someone face-to-face, you have a few more things to consider than just convenience when you compare applying for a loan online vs in person.

Both application methods have pros and cons that should be considered before you choose how to apply for a loan. So in this article, we explain how online loans and in-person loans work, when each might be the best choice for your situation and how to weigh your options.

Key takeaways

- Online loans may involve a faster approval process than in-person loans.[1]

- You may receive favorable rates and terms from in-person lenders if you’re an existing bank customer.[2]

- You may be subject to scammers online.[3]

- Shop around for loans and consider APR, fees, rates, terms and penalties.[4]

Table of contents

- How does an online loan work?

- How does an in-person loan work?

- When to consider an online loan

- When to consider an in-person loan

- Weigh your options

How does an online loan work?

Online lenders technically aren’t the same as a brick-and-mortar bank that also have a website. Online lenders are typically viewed as non-bank lenders which can’t accept deposits. These online lenders can only offer loans, lines of credit or credit cards.[2]

So loans with online lenders allow you to complete the entire borrowing process without needing a brick-and-mortar bank.[5] Although on-line lending is available from both online lenders as well as traditional banks that have online application sites.

Applying for an online personal loan is meant to be easy and quick, streamlining the ordinary loan application process you experience at your local bank branch. The process for applying for a loan online involves:

- Submitting prequalification requests

- Determining your available loan options

- Deciding which loan offers the best parameters for your needs

- Filling out the online loan application with the necessary information and documents[6]

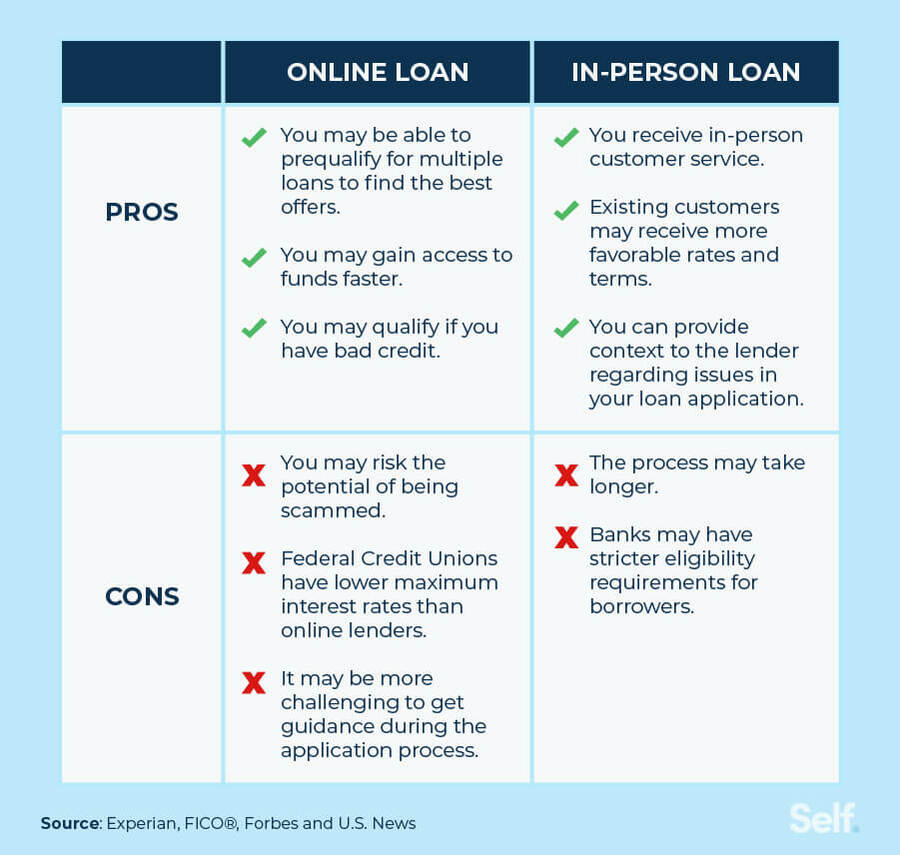

Pros and cons of an online loan

Like any financial product, online loans have advantages and disadvantages. Here are some of the main pros and cons of online loans.

Pros

- Prequalification for multiple online loans at once: Shopping for online loans makes it possible to prequalify for multiple loans at once, making it easier to find the best loan terms and interest rates through soft inquiries that don’t require a credit check, rather than hard inquiries that may hurt your credit if you have too many in a short period of time and appear on your credit report.

- Faster access to funds: Online lending is generally much faster. Lenders can quickly assess your creditworthiness, allowing you to be approved within minutes, and you might even get the money on the same day or the next business day after you’re approved. Most loans, though, can take up to five business days to be funded.

- Ability to qualify with bad credit: An online loan may be a better first choice for those with limited or damaged credit history because some online lenders have more lenient requirements regarding credit scores. However, to mitigate the risk, you may pay higher interest rates.[2]

Cons

- Potential to be scammed: While there are many reputable online lenders, you may run into scammers that try to appear as legitimate companies. Some warning signs of scammers include them asking for payments upfront, guaranteeing you’ll qualify for the loan and not having a secure website.[3]

- Higher annual percentage rates than credit unions if you don’t have excellent credit: Although you may qualify for lower rates online if you have very good to excellent credit, that may not be the case if you have a lower credit score. For people with fair to poor credit, federal credit unions have lower maximum interest rates than online lenders and traditional lenders, so it’s important to shop around and evaluate all of your options for the best loan terms and interest rates.[7]

- May be challenging to get guidance for the application process: Applying for a loan online involves filling out forms and assessing factors like loan terms, fees, monthly payments and interest rates yourself, without getting to speak with a lender at a physical location if you have any questions. While you can always call or use the chat function, you won’t get the face-to-face interaction you could with a traditional lender.

Is an online loan safe?

Online loans are generally safe, and there are many reputable online lenders. When considering where to apply, make sure your lender is on the BBB. You can also look at reviews for lenders you’re considering and check if they’re registered to verify that they have a legitimate online presence.

If an online loan is a scam, the lender may

- Have an unsecured website: Scammers use unsecured websites to steal or compromise sensitive information, like your Social Security number.

- Lack a physical address: Reputable lenders should have a traceable physical address you can easily find so that they can respond to legal issues. If you can’t find the address on their site or anywhere online, you might not be dealing with a reputable lender.

- Not be registered in a state: Reputable lenders must be registered to operate their business, so you may be dealing with a scammer if you can’t verify their registration status.

- Pester you to take out the loan: Reputable lenders won’t pressure you into the terms of a loan if you’re not comfortable. A scammer would urge you to accept the terms so they can take your money.

[3]

How does an in-person loan work?

In-person loans allow borrowers to apply for a loan with their bank or credit union in person at a brick-and-mortar location. While the process may seem less convenient since you have to physically go to a bank or credit union, it allows you to meet with a loan officer face-to-face.

Just like online lenders, banks and credit unions vary with their application requirements and approval processes, but in addition to having a face-to-face option, some large banks, like US Bank, Bank of America and Wells Fargo, have departments for online lending, giving you the option to apply online if you so choose.[8],[9],[10]

The process for applying for a loan in person involves:

- Gathering necessary documents, like proof of identity, employer/income and residence

- Deciding how much you want to borrow, and how much you can borrow based on factors like your credit score

- Scheduling an appointment with your bank or credit union

- Going to the bank or credit union if you need help filling out the physical loan application or online form.[11]

Pros and cons of an in-person loan

As with online loans, in-person loans have advantages and disadvantages. Here are some of the main pros and cons of in-person loans.

Pros

- Immediate customer service: Applying for a loan in person allows you to ask questions and better understand the loan process by speaking directly with a lender or loan officer.

- More favorable rates and terms: Because you have established doing business with your bank or credit union, you may qualify for loyalty discounts or other special rates. So you may find better loan offers through a bank or credit union where you have a bank account.[2]

- Ability to provide context: Meeting with a lender face-to-face means you can talk about any issues in your loan application, giving you the opportunity to explain things like gaps in your credit history or why you might have a lower credit score, that might otherwise make the approval process harder.

Cons

- Longer application process compared to online loans: Applying for a loan in person involves going to a financial institution and either waiting to speak with someone or setting up an appointment. You may be able to complete an online loan application and be approved in the same amount of time.

- Stricter requirements: Banks may have stricter eligibility requirements for borrowers because they generally are subject to more regulations than online lenders.[2]

- Applicant eligibility: Credit unions typically only allow current customers to apply for loans. Credit unions usually require you to be a member so you may need to join the credit union if approved.

When to consider an online loan

An online loan may be the better option if you need to get a loan quickly. It may have advantages over the in-person loan process, like prequalification so that you know how much you can borrow and at what rate, the ability to shop for multiple loans at once or instant loan approval.

When to consider an in-person loan

If you have a solid existing relationship with a bank or credit union, or prefer to have guidance from a loan officer through the application process, an in-person loan may be better for you. While applying in person takes more time and steps, it allows you to interact face-to-face with the lender, providing immediate customer support and the opportunity to discuss your financial situation and negotiate. Because you do business with your bank and have an account, current bank customers may be offered special loyalty or other customer-only loan rates and terms from their banks.

Weigh your options

When deciding what type of loan you apply for, consider your personal finances. Then determine what application method is right for you. If you’re looking for speed and convenience, an online loan is likely to be the best choice. If your needs are more complex, and you have a good relationship with your bank, an in-person loan may be better to pursue. You should also consider certain metrics, like APR, fees, loan terms and rates, and penalties.

One of the best ways to get a loan is by having good credit. If you’re considering a loan but are afraid your credit history might get in your way, we can help. Self’s financial products can help you build your credit and give you the information you need to establish good credit habits.

Sources

- U.S. News. “How Long Does It Take To Get A Loan?” https://money.usnews.com/loans/articles/how-long-does-it-take-to-get-a-loan. Accessed July 20, 2022.

- FICO®. “Banks vs. Online Lenders: Which Option Should Borrowers Choose?” https://www.myfico.com/credit-education/blog/banks-vs-online-lenders. Accessed July 20, 2022.

- Experian. “Can I Trust Online Personal Loan Lenders?” https://www.experian.com/blogs/ask-experian/can-i-trust-online-personal-loan-lenders/. Accessed July 20, 2022.

- Experian. “Personal Loans: What To Know Before You Apply,” https://www.experian.com/blogs/ask-experian/personal-loans-what-to-know-before-you-apply/. Accessed July 20, 2022.

- Experian. “How Do Online Loans Work?” https://www.experian.com/blogs/ask-experian/how-do-online-loans-work/. Accessed July 20, 2022.

- Wells Fargo. “Personal Loans Application Checklist,” https://www.wellsfargo.com/personal-loans/checklist/. Accessed July 20, 2022.

- Forbes. “Credit Union Personal Loans: A Cheaper Way To Borrow,” https://www.forbes.com/advisor/personal-loans/credit-union-personal-loans/. Accessed July 20, 2022.

- U.S. Bank. “Personal Loan,” https://www.usbank.com/loans-credit-lines/personal-loans-and-lines-of-credit/personal-loan.html. Accessed July 20, 2022.

- Bank of America. “Home Mortgage Loans,” https://www.bankofamerica.com/mortgage/home-mortgage/. Accessed July 20, 2022.

- Wells Fargo. “Personal Loan FAQs,” https://www.wellsfargo.com/help/loans/personal-loan-faqs/#howdoiapplyforaloan. Accessed July 20, 2022.

- Forbes. “5 Personal Loan Requirements And How To Qualify,” https://www.forbes.com/advisor/personal-loans/personal-loan-requirements/. Accessed July 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).