Credit Report Example: How To Read and Understand Yours

Published on: 04/11/2022

Monitoring your credit report can help you improve your credit score and spot inaccurate information or identity theft.

A section of federal law called the Fair Credit Reporting Act (FCRA) entitles you to a free copy of your credit report once a year.[1] But once you have that in hand, what then? This article will share a credit report example and help you understand how to read your free credit report.

Our sample credit report provides tips on how to read each section. Whether you want to check on the status of a car loan or student loans, identify negative items on your credit report, see whether you have any liens against you, or find information to help you deal with a collection agency, this is a good place to start.

Table of contents

- Sample credit report

- Sections of your credit report

- How to access your credit report

- What is a credit report used for?

- What if there is an error on your credit report?

- What is the difference between a credit report and a credit score?

- Check your credit report regularly

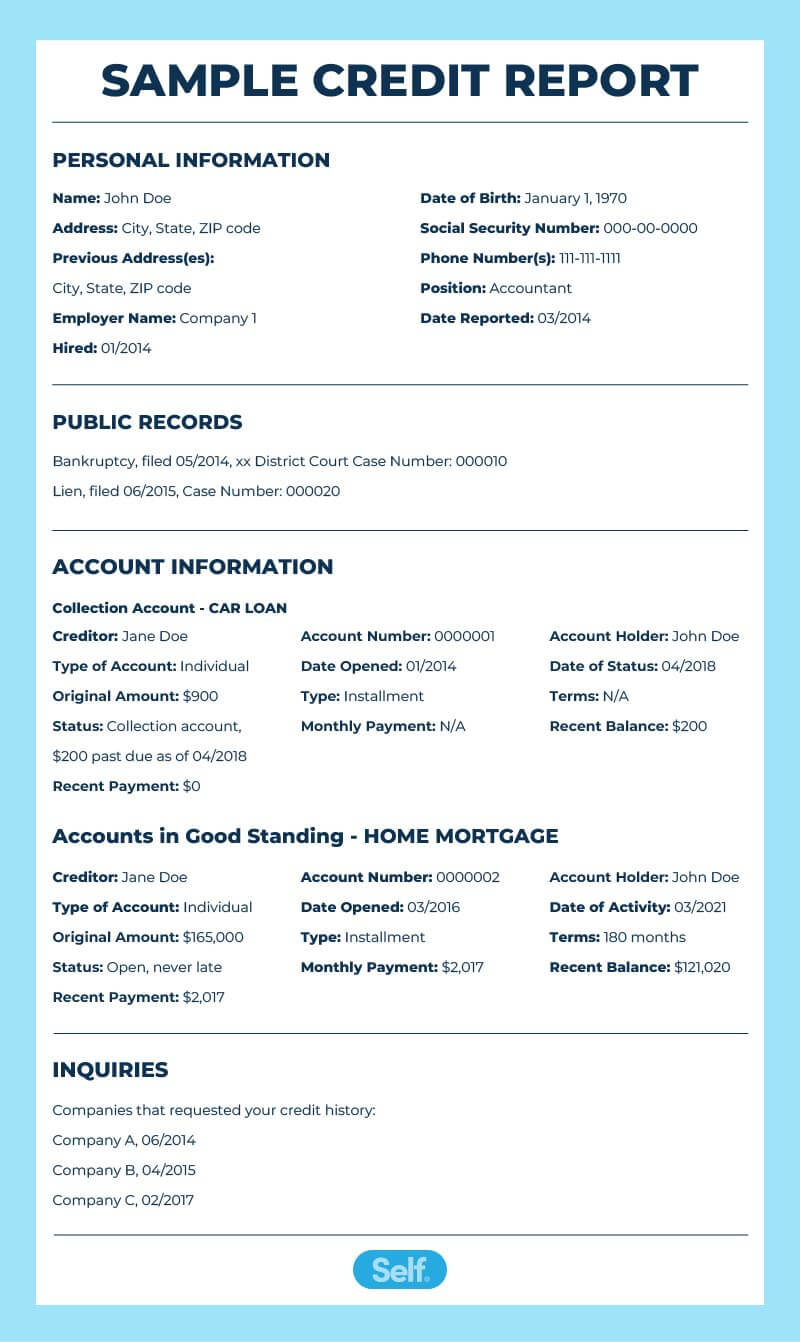

Sample credit report

Three major credit reporting agencies (Equifax, Experian and TransUnion) track and compile your credit history into a credit report that includes: personal information, public records, account information, and inquiries.

Sections of your credit report

Here is a closer look at what you can expect to see in each section and what you should keep your eye on. Your credit report may look a little different than this example, depending on your individual credit history.

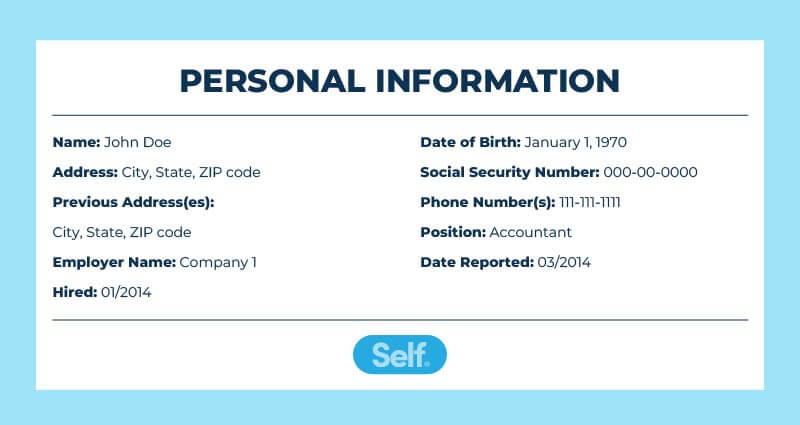

Personal information

This section details who you are, providing basic information identifying you specifically, including contact information. While this section does not factor into your credit score, it’s important to check that all information is current, otherwise you might be missing important correspondence or be a victim of identity theft. Identifying information can be such things as:

- Your name

- Date of birth

- Social security number

- Current address

- Previous address(es)

- Telephone numbers

- Employment information

Public record information

Public records that appear on your credit report are limited to financial records: things that could impact your creditworthiness. They don’t include criminal records, speeding tickets or other non-financial data.

Bankruptcy cases commonly show up on this portion of a credit report.[2] In the past, liens and court judgments were also included. Judgments and paid tax liens could remain on your credit report for up to seven years; unpaid tax liens could stay there permanently.

If you don’t have any negative public records, this section may not appear on your report.

If you do have a bankruptcy on your record in the past seven to 10 years, you can expect to see the following information on your report in this section:

- Bankruptcy type (Chapter 7, 11 or 13)

- Status

- Date filed

- How filed (individually or jointly)

- Reference number

- Closing date

- Court with jurisdiction

- Liability (amount you are legally responsible to pay)

- Exempt amount (amount claimed against you for which the court does not hold you legally responsible)

- Asset amount (dollar value of your personal assets used in the court’s ruling)

- Remarks (either from you or the court)

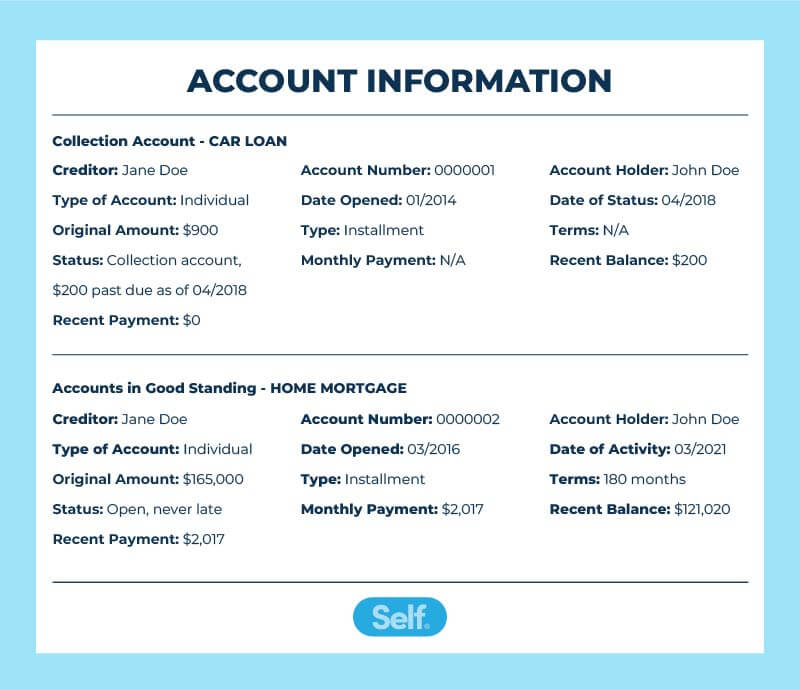

Account information

This section includes your credit history for different accounts, with details on each one. This may include the following information:

- Name of creditor

- Account number

- Type of account/person(s) responsible (individual or joint)

- Date opened

- Date of most recent activity

- Credit limit or amount of loan

- Status, which can include any of the following:

- Paid

- Charged off

- Open, never late

- Closed, never late

- Closed with accounts current

- Closed, with number of days delinquent

This section will also show the type of account for each entry, whether it’s an installment loan like a home loan, or a revolving account, like a credit card.

You can scan this section to determine whether you have late payments, or whether anything appears that seems suspicious. Charges you don’t recognize may be the result of fraud or identity theft; if so, it is worthwhile to dispute them as soon as possible to avoid further damage to your credit.

Inquiry information

Credit inquiries fall into two categories: hard and soft pulls. A hard inquiry is recorded whenever you apply for a line of credit, whether it is a credit card account, car loan, mortgage or another type of credit. Lenders will “pull” your credit report to check your credit information and see whether you qualify for a loan.

Each time this happens, a record of the hard inquiry goes on your credit report and affects your credit score. Hard pulls, also called “new credit,” account for 10% of your FICO® score. If you apply for the same kind of loan several times in a short period of time (within a 45-day window), it will typically count as just one hard inquiry, to reflect the fact that you were shopping around for the best rate on a car loan, for example. This hard pull would not detrimentally impact your credit.

Soft inquiries will appear on your credit report, as well. These include:

- Credit checks by prospective landlords seeking to determine whether to rent to you.

- Checks by potential employers (they are allowed to view your report).

- Your own request for your credit report.

- Requests made for marketing purposes, such as to extend offers of pre-approved credit.

- Credit checks made by current creditors to monitor your recent activity.

Both hard and soft inquiries remain on your credit report for 24 months, but only hard inquiries are reflected in your credit score.

How to access your credit report

Under federal law, you are entitled to access a free copy of your credit report once a year from each of the three main credit bureaus. You can order a copy of your credit report at annualcreditreport.com. This is the only authorized site for free credit reports.[3]

You can also order a copy of your credit reports by calling (877) 322-8228 or by downloading a form from annualcreditreport.com and sending it to Annual Credit Report Request Service, PO Box 105281, Atlanta, GA, 30348-5281.[4]

You can get a copy of all three credit bureaus’ reports at the same time, or you may request them separately at different times during the year to monitor them. After you have received your free copies, if you want additional reports later in the year, you can always request a copy from the bureau of your choice. They can’t charge you any more than $13 to provide it.[4]

What is a credit report used for?

Your credit report provides a comprehensive overview of your credit history that you can use to monitor where you stand and lenders can use to determine your creditworthiness.

A credit report can be used to evaluate whether or not to extend you credit, and if so, at what rate of interest. Businesses can use it as a factor in weighing whether to extend a job offer or offer you insurance, and landlords can consider its contents in deciding whether to rent to you.[1]

Credit reports are also used to determine credit scores compiled by Fair Isaac Corporation (FICO) and VantageScore, which use slightly different methods to compile their figures.

What if there is an error on your credit report?

If you do find errors in your credit report, it is important to dispute them so they do not damage your credit score and affect your ability to obtain loans and/or favorable interest rates.

Errors can come in many forms, in addition to the transposed numbers and personal identity issues already discussed. Account balances may be off, closed accounts may still appear as open, accounts may be duplicated (so you get dinged twice for late payments, for example), payments may not have been recorded, or a bankruptcy may not be marked as discharged.

If you find an error in your credit report, you can dispute it yourself by contacting the credit bureau where the error appears. It is helpful to gather supporting documentation, such as letters from creditors showing correct amounts and account statuses, bankruptcy discharge papers, deferment or forbearance agreements, or police reports and FTC identity theft reports in the case of fraud.

You can file a dispute online or by mail. Once you’ve made your report, it’s a good idea to follow up with creditors and credit bureaus to ensure the errors have been fixed.

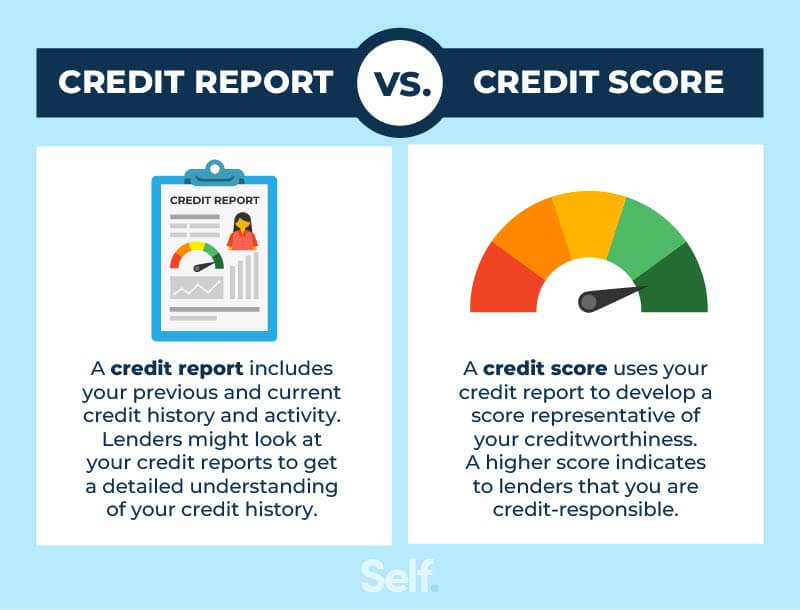

What is the difference between a credit report and a credit score?

It’s common to confuse your credit report with your credit score, but they are two different things. A credit report is a comprehensive record of your credit history. Your credit score, by contrast, is simply a three-digit number that measures how well you manage your credit.

FICO and VantageScore use your credit reports to help determine your credit score. They weigh different factors slightly differently. For instance, FICO weighs your payment history most strongly — it accounts for 35% of your total score — followed by your amounts owed in relation to your overall credit limit (credit utilization) at 30%. VantageScore, on the other hand, views your total credit usage as the most important factor in determining your credit score, followed by your credit mix and experience.

The credit reporting bureaus also have their own scoring systems, but more lenders use the FICO score than any other system.

Check your credit report regularly

Obtaining a copy of your credit report is a good first step to understanding where you stand and what you need to address in your personal finances. The next step is understanding your report so you can know what issues to address and which ones to dispute, if necessary. It will also give you an idea of any patterns in your spending and monthly payment habits you may want to address.

Bookmark this article if you have any questions about how to interpret your credit report in the future.

Sources

- Federal Trade Commission. “Free Credit Reports,” https://www.consumer.ftc.gov/articles/free-credit-reports. Accessed December 31, 2021.

- Experian. “Public Records That Can Appear in Your Credit Report,” https://www.experian.com/blogs/ask-experian/public-records-that-appear-on-your-report/. Accessed December 31, 2021.

- Federal Trade Commission. “Get My Free Credit Report,” https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report. Accessed December 31, 2021.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed December 31, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.