How Many Bank Accounts Should I Have and Which Types?

Published on: 01/18/2022

How many bank accounts should you have? That’s a simple question, but the answer depends on a number of factors, including whether you’re married, what kind of accounts you have, how many different purposes they serve, and how easy they are to track.

It’s helpful to take each of these factors into consideration before you decide whether to open a new account and what kind of account it should be.

How many bank accounts should I have?

Start with a checking account to pay the bills. It’s also a good idea to have an emergency fund to cover expenses for 3-6 months and a savings account for specific short-term goals, such as saving up for a car or a house in the near future. As an added benefit, you’ll earn modest interest with a savings account (although there are ways to earn more interest if that’s your primary goal).

If you’re saving for long-term goals however, you may want to explore investment or retirement accounts since these may earn more interest (though they also come with risk).

If you’re married, you may want a joint checking account for the family’s monthly expenses and separate checking accounts for each spouse’s personal spending. There’s no right or wrong answer when it comes to navigating finances as a couple, so do what works best for you.

To start out, that’s a minimum of two accounts. But there are other kinds of accounts to consider and you may want to open multiple of the same type of account to serve different purposes. For example, you could open one checking account to cover rent and bills and another to cover discretionary spending.

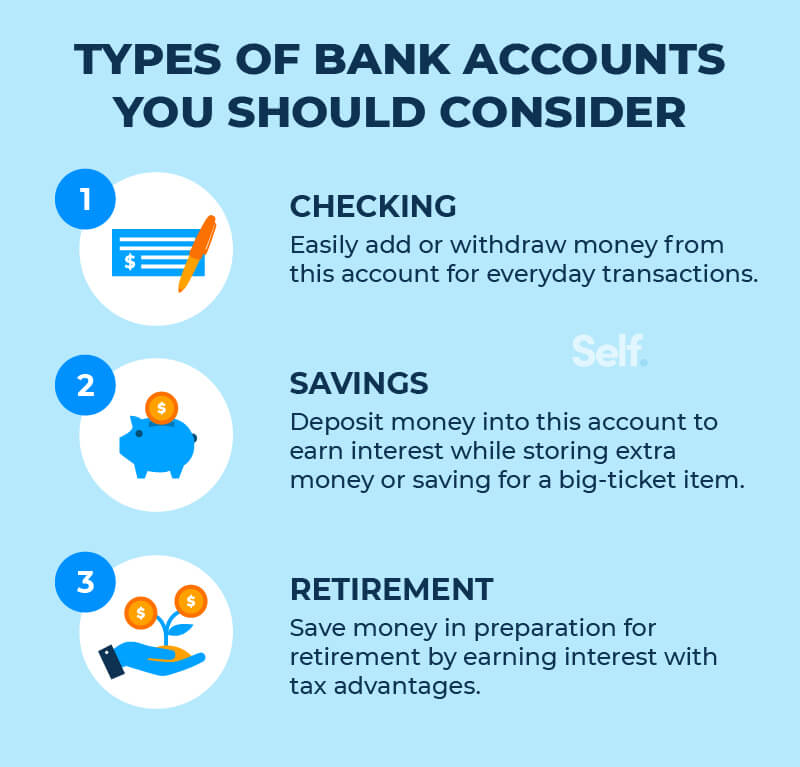

Types of bank accounts

There are specific types of checking and savings accounts. Certificates of deposit, health savings accounts, money market accounts, and retirement accounts are just some types of accounts offered by banks and other financial institutions.

1. Checking

When checking accounts were introduced, you could use them in one of two ways: You could withdraw money to pay for something in cash or you could write a check. But the way checking accounts are used has changed. ATMs and debit cards allow customers to withdraw money directly or pay for goods and services without using currency or writing a check.

Many people use checking accounts so they have money at their fingertips for everyday expenses like paying monthly bills or shopping for clothes. Sometimes, people choose to open multiple checking accounts.

As mentioned above, a married couple might want three checking accounts: a joint checking account and two individual accounts. If you run your own small business, you might want a business account, and even if you don’t, you might consider one checking account for paying bills and another for recreational spending to assure that you have enough capital for essential purchases.

Having separate accounts for these purposes can assure you have enough money to cover your monthly bills and other periodic expenses such as property taxes.

Interest-bearing

An interest-bearing checking account allows you to earn a modest amount of interest. The interest should be treated as a perk, similar to what you get on cash-back accounts. If you’re opening an interest-bearing checking account just for the interest, you’re likely to be disappointed because the yields are so low.

Many of these accounts give you an annual percentage yield (APY) of 0.1% or lower.[1] Compare that to certificates of deposit, for example, which can have an APY ranging from 0.4% to more than 1%.[2] Rates vary, so it pays to shop around and do your research.

For instance, Consumers Credit Union in Illinois offers APYs of 2.09%, 3.09%, or 4.09% on balances as high as $10,000 if you qualify under minimum deposit and spending requirements. If you make fifteen debit card transactions a month at Quontic Bank, you can earn 1.01% without paying any monthly fees on balances up to $1 million.[3]

Student

If you’re a student, you can often qualify for a checking account with fewer fees and restrictions. You may be able to find student accounts that don’t require monthly maintenance or ATM fees, and that carry a next-day grace period for overdrafts. Different banks offer different perks.

BB&T will waive its outside-ATM fee twice a month on student accounts, and U.S. Bank will do it four times per billing cycle. PNC will refund your first overdraft fee and Discover (which isn’t specifically targeted to students) doesn’t charge an overdraft fee at all.[4]

2. Savings

As with checking, you might want to have two savings accounts: think about them as a rainy day fund and a dream fund.

The rainy day account is the emergency fund that you only touch if something goes wrong. For example, major home repairs or unexpected medical bills. Your dream fund is for long-term goals like a vacation or down payment on a home.

High-yield

If you don’t care about having access to a physical bank, you can take advantage of high-yield savings accounts, which are generally offered by banks that operate exclusively online.

Banks without a brick-and-mortar presence can afford to offer higher interest rates because they don’t have the same operational expenses that are associated with maintaining a physical building (insurance costs, utilities, etc.).

In the age of digital banking, this isn’t as much of a downside as it used to be. Online banks still offer a variety of services that you’ll find at traditional banks, ranging from direct deposit to autopay. You can still check your account balance and transfer money with online savings accounts. Plus, most don’t charge you monthly maintenance fees.[5]

Certificate of deposit

If you don’t need access to your money for a while, you can earn a relatively high interest rate by choosing a certificate of deposit.

With a regular savings account, you can still access your money at any time (although you may be limited to a certain number of transactions each month). That’s not the case with a CD. With a certificate of deposit, the bank is paying you to hold your money for a specific period of time.

That period can be as short as a month or as long as ten years. At the end of that time, referred to as the maturity date, you can access your money along with the interest the bank has paid you.

As with savings accounts, online banks tend to pay better rates, but it pays to check around for the best bank.

3. Retirement

Retirement planning is another vehicle for saving. This time with a specific goal in mind. When it comes to planning for your retirement, you have several options that may have tax advantages.

Individual retirement account (Roth or traditional)

IRA stands for “individual retirement account,” and there are two main options from which to choose: the traditional IRA and the Roth IRA. The main difference comes down to taxation.

With a traditional IRA, you don’t pay taxes on contributions until you withdraw your money in retirement. But you can’t touch it in the meantime, either. You have to pay fees and penalties if you pull the money out before you’re 59½ and you have to start withdrawing it by age 70½ if you were born before July 1, 1949 or 72 if you were born after June 30, 1949.

A Roth IRA, by contrast, taxes your money at the time you contribute it, so you won’t have to pay taxes when you withdraw it in retirement. Similar to a traditional IRA, you will have to pay penalties if you withdraw the money before you reach the age of 59½

You can rollover money from a 401(k) account into a Roth IRA plan, but there will be tax consequences. If you rollover a 401(k) into a Traditional IRA, there will not be tax consequences. Make sure rollovers occur within 60 days to avoid getting penalized.

You can have more than one IRA, but IRAs carry contribution limits, and if you have more than one, the yearly limit applies to all of them combined, not each one individually.[6]

Yearly total contribution limits to all your traditional and Roth IRAs for 2021 are $6,000, or $7,000 if you’re 50 or older.[7] In addition, there are IRA and other retirement plans for small businesses.[8]

401(k)

One main advantage of a 401(k) plan is that many employers offer matching contributions, giving you more principal to earn interest on. You choose to commit a certain percentage of each paycheck to your IRA — say 6% — and your employer may contribute a dollar-for-dollar match up to a certain percentage (for example, 3%).

You are fully vested in whatever contributions you make, but some employers require you to be enrolled in a plan for a specified period before you’re fully vested in any matching contributions.

In 2021, employee elective deferrals were limited to $19,500, subject to cost-of-living adjustments, plus a $6,500 “catch-up” allowance for anyone 50 or older.[9]

As with IRAs, you have two options: You can pay taxes up front with a Roth 401(k), so your distributions on retirement aren’t taxed, or you can pay taxes when you withdraw your money at retirement with a traditional 401(k).

There’s also a SIMPLE 401(k) plan, designed for small businesses, under which an employer match is required, but contribution limits are lower. Employees are totally vested in all contributions immediately.[10]

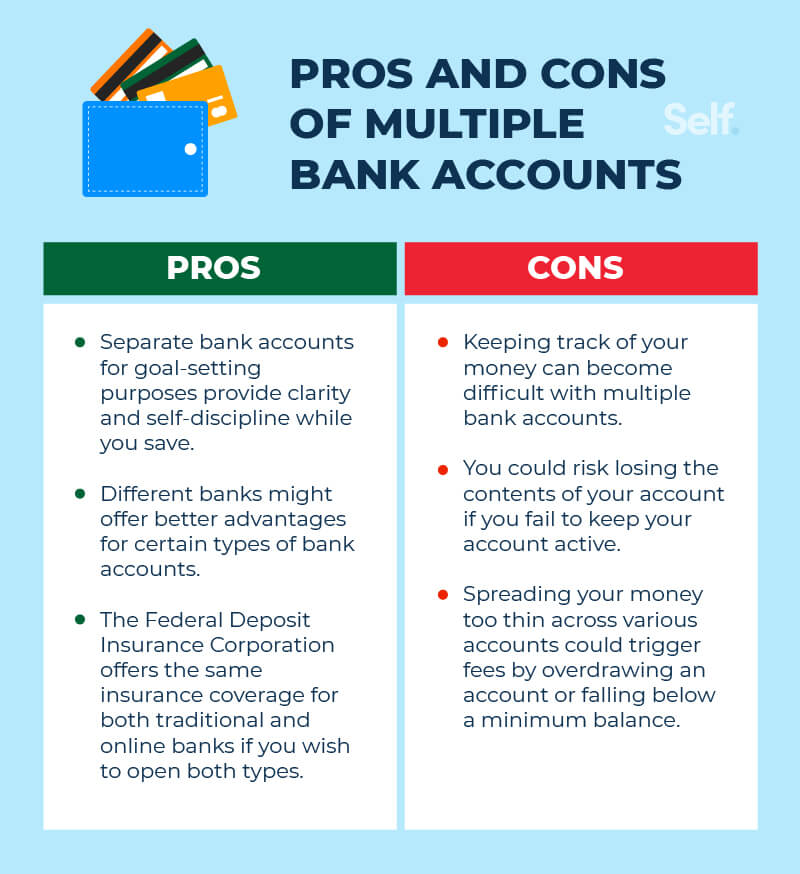

Pros and cons of having multiple bank accounts

Multiple bank accounts can give you flexibility and help you focus on meeting specific savings goals. On the other hand, having too many accounts can make it harder to track your money and can cause anxiety about whether there’s enough money in each account to avoid overdraft and minimum balance fees.

Pros

If you want to save money toward different goals, having separate bank accounts can create clarity and help you practice self-discipline. For example, if you have a personal checking account and a business checking account, you’ll be less tempted to dip into one if you need extra money for the other.

Another advantage of having several bank accounts is that there might be different advantages at different banks. One bank might offer you an interest-bearing checking account with free checks, for example, while another might offer you a better APY on its CDs or other investment accounts.

Perhaps you want the convenience of a brick-and-mortar bank for one account, and the higher interest rates offered by an online bank for another. Note: The Federal Deposit Insurance Corporation (FDIC) offers the same insurance coverage for both traditional and online banks.[11]

If you don’t like your old bank but don’t want to cut ties before making sure you’re comfortable with a replacement, you can keep your old account open until you find a new one that satisfies you.

Cons

The most obvious drawback of having multiple accounts is that it can be harder to track your money.

You also might put yourself at risk of spreading yourself too thin. The more accounts you have, the thinner your cushion will be with each one. As a result, you’re more likely to trigger fees by overdrawing an account or falling below a minimum balance.

Managing multiple bank accounts

Another thing to watch for is your exposure to fraud. The more potential points of contact you have, the more opportunities hackers and thieves will have to exploit. (The flipside, however, is that you’ll be vulnerable for a smaller amount in each account since you aren’t keeping all your money in one place.)

If you do decide to open multiple accounts, it’s a good idea to reduce your exposure by making a separate password for each one.

Additional tips for managing multiple bank accounts include:

- Avoid transfer fees by minimizing the number of times you move your money between accounts.

- Track your activity using an app or spreadsheet — you don’t have to use pen and paper anymore. There are plenty of digital spreadsheet programs available.

- Keep your accounts active to avoid the risk of losing the contents. Accounts are typically considered to be unclaimed or abandoned if you haven’t used them (made a deposit or withdrawal) in a period of three to five years, depending on the state in which you live.[12]

How do bank accounts impact my credit?

Closing an account won’t hurt your credit in and of itself, but if you close an account that has a negative balance — and then don’t pay it — that debt can be referred to a collections agency and go on your credit report.

Other than that, banks don’t report your activity to the three major credit bureaus, because how much or how little you have in your account has nothing to do with how much debt you have and how reliable you are about paying it.

There are steps you can take if you want to protect your bank accounts from creditors. While building credit can help you keep more money in your accounts by reducing the amount of interest you have to pay, your account balances do not factor into your credit history or credit score.

Research, then decide

Opening additional bank accounts can help you with focused budgeting and discipline, but it can increase your risk of spreading yourself too thin and make it more difficult to track your money.

There are sound reasons to open multiple accounts. Among them are the benefits of differentiating between short-term and long-term goals and expenses with specialized checking and savings accounts; taking advantage of high interest rates at different banks; planning for retirement; and putting money aside for a small business.

Whatever your reasoning, do your research before you choose accounts in which to deposit your money, and if you have questions, consult with a financial professional. When done properly, having a few different accounts can help you balance your priorities and maximize your returns.

Sources

- U.S. News. “Best Checking Accounts – September 2021,” ttps://money.usnews.com/banking/checking-accounts. Accessed September 13, 2021.

- Forbes. “Best CD Rates Of September 2021,” https://www.forbes.com/advisor/banking/best-cd-rates/. Accessed September 13, 2021.

- Forbes. “6 Types Of Checking Accounts,” https://www.forbes.com/advisor/banking/types-of-checking-accounts/. Accessed September 13, 2021.

- Investopedia. “Best Student Bank Accounts,” https://www.investopedia.com/best-student-bank-accounts-4799707. Accessed September 13, 2021.

- Business Insider. “There are 6 types of saving accounts, and the best option for you depends on how and when you want to access your money,” https://www.businessinsider.com/personal-finance/types-of-savings-accounts. Accessed September 13, 2021.

- Investopedia. “Can I Have More Than One IRA?” https://www.investopedia.com/ask/answers/160.asp#citation-1. Accessed September 13, 2021.

- IRS. “Retirement Topics — IRA Contribution Limits,” https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Accessed September 13, 2021.

- IRS. “Choosing a Retirement Solution for Your Small Business,” https://www.irs.gov/pub/irs-pdf/p3998.pdf. Accessed September 13, 2021.

- IRS. “Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits,” https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits. Accessed September 13, 2021.

- IRS. “Choosing a Retirement Plan: SIMPLE 401(k) Plan,” https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-simple-401k-plan. Accessed September 13, 2021.

- FDIC. “FDIC Consumer News — Winter 2016,” https://www.fdic.gov/consumers/consumer/news/cnwin16/insuranceq&a.html. Accessed September 13, 2021.

- Offices of the Comptroller of the Currency. “When is a deposit account considered abandoned or unclaimed?” https://www.helpwithmybank.gov/help-topics/bank-accounts/opening-closing-inactive-bank-accounts/inactive-accounts/inactive-unclaimed.html. Accessed September 13, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.