How Many Car Payments Can You Miss Before Repossession?

Published on: 08/03/2025

A missed car payment may not seem like a big deal, but as soon as you miss one payment, depending on your lender and your state laws, your car can be repossessed. In many states, a lender can repossess a vehicle when you default on your loan or lease, and this can happen when you miss one payment.[1]

So if you think you are going to miss a payment, contact the lender as soon as possible to make a plan. To understand general lender policies and repossession laws, this article discusses the details about car repossession and what you can do if you miss a car loan payment.

When can your car be repossessed?

Depending on your state’s laws and your loan agreement, the repossession process can begin after you miss just one car payment, which is when you’re considered delinquent.[2]

While one delinquent payment may not trigger a repossession, contacting the lender to resolve the situation early can help you to avoid these negative impacts on your finances and credit:

- Late fees: If you miss a payment, creditors may offer a grace period, commonly 10 to 15 days, before charging a late fee.

- Negative marks on your credit: After 30 days of nonpayment, loan providers will report your delinquency to credit bureaus, which can impact your payment history and thus negatively affect your credit.

- Sending your account to collections: After 90 days, lenders may consider your account in default. Some lenders may consider it in default even earlier, as early as 30 days. If this happens, your account may be sent to collections in an effort for the lender to collect what you owe.

[2]

How many days can you be late on a car payment?

When you’re leasing or financing a car, your account can be considered delinquent as soon as you miss one payment. Default refers to missing payments anywhere from 30 days and beyond, although lenders may have different timelines before they consider your account in default — some may wait 90 days, others may wait longer, but others may wait less than 90 days. Missed payments can negatively affect your credit and may make it more difficult to get approved for future credit.[2]

Car repossession laws vary by state

In states like Alaska, Arizona, California, Connecticut, Delaware, Florida, Georgia, Illinois, and Minnesota, lenders can begin the repossession process immediately after your first missed payment. Some states, including Iowa, Kansas, Maine, Missouri, Nebraska, South Carolina, and Wisconsin, require lenders to give borrowers a grace period of up to 20 days to make their payments current, which is referred to as a "right-to-cure" notice.[3]

The table below shows full details of the states that require right-to-cure and other notices to be given before a repossession. Be sure to check the current laws in your state as this information can change.

|

State |

Right-to-Cure/Notice Requirements |

|

Connecticut |

Notice of intent required at least 10 days before scheduled repossession |

|

Idaho |

10 days notice to make payments current |

|

Indiana |

Must notify sheriff before or within 2 hours of repossession |

|

Iowa |

"Right to cure" notice granting 20 days to correct issue; if served once in last year, need not serve again |

|

Kansas |

"Right to cure" notice required |

|

Kentucky |

Notice of right to repossess required before repossession |

|

Louisiana |

"Right to cure" notice after 10 days late stating amount owed and payment date (only once per year) |

|

Maine |

"Right to cure" notice after 10 days late (only once per year) |

|

Maryland |

Discretionary notice at least 10 days before repossession (contract dependent); may require registered mail within 5 days and retain vehicle 15 days |

|

Massachusetts |

Default notice giving 21 days to reinstate; after 3+ notices, no more required |

|

Missouri |

"Right to cure" notice with at least 20 days to bring account current |

|

Nebraska |

"Right to cure" notice with at least 20 days wait period |

|

Rhode Island |

Notice required (one per year obligation) |

|

South Carolina |

"Notice of Right to Cure" giving 20 days (contract dependent) |

|

South Dakota |

Notice before repossessing/selling (contract dependent) |

|

West Virginia |

May be required to send notice (contract dependent) |

|

Wisconsin |

"Right to cure" notice with at least 15 days wait period |

|

District of Columbia |

Required to give at least 10 days notice before repossession |

Source [3]

What to do if you missed a car payment

If you do miss a car payment, don’t panic. Take these steps to see if you can get back on track.

1. Evaluate your loan terms

Check the terms of your loan if you aren’t familiar with them. Dig up whatever paperwork you got from the lender and look for information on late fees, grace periods and the total loan balance.[2]

If you can’t find your lender’s policy regarding late fees and when they get added to your balance, call your lender and ask for the details about how late payments affect your loan terms.

Consider whether you’ve been late with payments previously. If this is a rare occurrence, you can follow the next step, but if you continue making late payments or not paying at all, you might evaluate whether the car loan matches your financial situation. If the car loan is hampering your finances, it might be time to consider other options with your lender.

2. Budget according to your loan payment

Budgeting can help you not only take care of the overdue loan payment but also make adjustments so that you can make on-time payments until the end of the loan. Create a budget that makes up for the missed payment, cutting expenses where you need to.

Then readjust future budgets to ensure that the next loan payment doesn’t fall through the cracks. Financial experts generally recommend keeping total car expenses below 20% of your take-home pay, and this includes payments, insurance, and maintenance. [4]

3. Discuss options with your lender

If you still find yourself unable to make your payments — even if it’s the first time you will miss — reach out to your lender. Be proactive by discussing the situation and asking about the possibility of longer-term options, such as refinancing your car loan for a longer term to lower your payment. Although you will pay a higher interest rate and more interest overall, changing the term of the loan may help you afford the payments. This may work better if you think you may miss a payment but haven’t missed it yet.

You might even be able to ask the lender to change the date of your payment so that it will sync with the same date you get paid. This step may make it easier to stay on top of payments.[5][6]

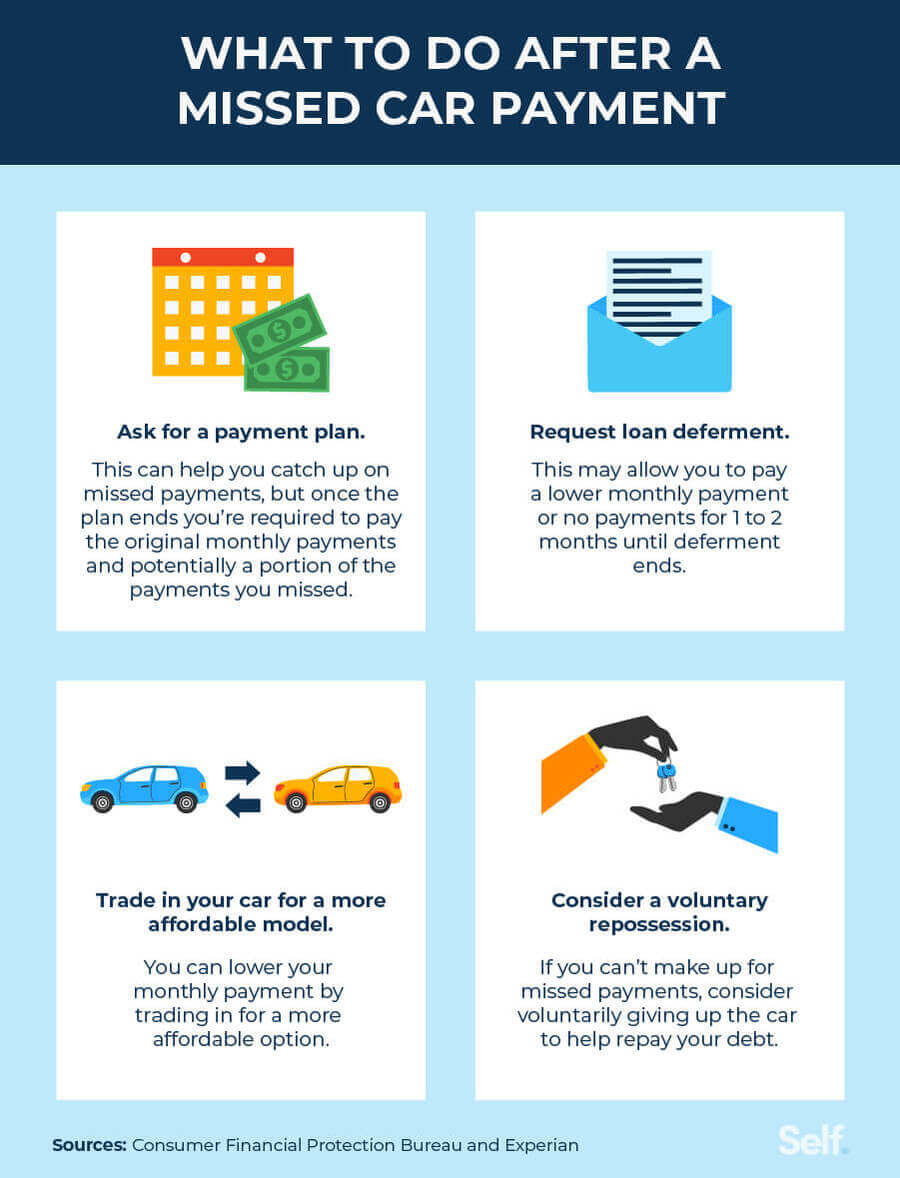

You can discuss these additional options with your lender if you start missing payments:

- Ask for a payment plan. A payment plan may get you back on track after you miss a car payment, so your lender may see this as a mutually beneficial option. This may also be a good time to adjust your due date, if possible, to coincide with when you get paid.[6]

- Request a loan deferment. A loan deferment would reduce the monthly payments you owe or allow you to take one to two months off making payments, which will help you get your finances in order and possibly avoid car repossession. It may make it easier to make regular payments once the deferment ends. You may need to write a hardship letter to the lender to explain why you need this option.[6]

- Trade-in your car for a more affordable model. If you realize that you just can’t afford this vehicle or your financial picture has drastically changed since you took out the loan, consider trading in the car for a less expensive one. Keep in mind that it may be difficult to do this if your car loan is “upside down” (you owe more money on it than it is worth).[6][7]

- Consider a voluntary repossession. This option should be considered as a last resort if you are behind on car payments. However, if you need the money that was going to your loan payments, reconsider how much you really need that car and what some alternatives might be. Keep in mind that getting out of a car loan with a voluntary repossession will leave a negative mark on your credit and you may still owe money to your lender.[1]

How do late car payments impact your credit score?

Late car payments may negatively impact your credit score. The more late payments you have and the longer they’re late, the bigger impact to your credit score. Furthermore, auto repossessions can stay on your credit report for seven years.[2]

What happens if your car gets repossessed?

Your car generally will get repossessed when you default on the loan, and your loan agreement states how this could happen, such as not making payments on time. The lender can repossess your car without notice or a court order, and they may even use electronic disabling devices to prevent the car from starting at all. Then the lender will try to sell the car to pay off the remainder of the loan.[1]

However, while the lender may have a right to take your vehicle, you have rights as well. Rules dictate what a lender can and can’t do when it comes to repossessions, according to the Consumer Financial Protection Bureau.[1][8]

The lender/servicer can:

- Take your car without going to court or notifying you.

- Sell your car to pay off the loan after repossession.

The lender/servicer can’t:

- Breach the peace (in some states meaning they can’t use physical force, remove the car from your closed garage door without consent, use threats or disturb neighbors).

- Take your car illegally (if you’ve made payments).

- Give you false balance information causing you to pay less than what is actually owed, thus resulting in a repossession.

- Keep your personal property found in the repossessed vehicle.

Even if your car is repossessed, you can buy back the car in one of two ways:

- Repay the amount you owe (including the entire remaining debt, repo costs, and payments that have passed the due date).

- Go to the sale of your repossessed car and bid on it.

Eliminate missed payments

Once you’ve settled the missed payment, you’ve only solved half the problem. The best way to avoid a repo in the future is to fix the issue with a long-term solution. First, determine if you even need a car or whether you could take the bus or carpool, or perhaps you could consider leasing instead. If you still feel like you need to own one, take the following steps during the car-buying process to help you stay on top of payments and avoid repossession:

- Determine a reasonable car loan budget. Evaluate your expenses for the month and determine how much you could afford in monthly payments for the principal, interest and car insurance and fuel.[4]

- Choose the most affordable option. Everyone wants the newest car model with the latest features, but allow your budget to be your guide and go with the option that’s most affordable.

- Shop around for the best rates. The car buying experience is a high-pressure situation, but resist the urge to go with the first dealership. Instead, shop around for the lowest price on the automobile and the best car loan interest rates.

- Evaluate loan terms before signing. Don’t just sign on the dotted line for a new loan without reading through the terms. Make sure you understand what you are signing to ensure you aren’t hit with surprise fees or rates. Ask a lot of questions before you sign to be sure you’re aware of how your loan contract works.

Missing a car payment is nerve-wracking, but it’s not the end of the world. If you take action now, you can mitigate the damage and learn some important financial lessons along the way. Self has great tools to help you become the master of your budget and build credit, which may help you improve your credit so that you can get better loan terms in the future.

Sources

- FTC, “Vehicle Repossession” https://consumer.ftc.gov/articles/vehicle-repossession

- Experian, “How Bad is it to Default on a Car Loan?” https://www.experian.com/blogs/ask-experian/how-bad-is-it-to-default-on-a-car-loan/

- World Population Review, “Vehicle Repossession Laws by State” https://worldpopulationreview.com/state-rankings/vehicle-repossession-laws-by-state

- National Debt Relief, “3 Months Behind on Car Payments” https://www.nationaldebtrelief.com/blog/financial-wellness/family-finances/3-months-behind-on-car-payments-how-to-avoid-repossession-and-regain-financial-control/

- Cars Direct, “Auto Loan Refinancing: How Does It Work?” https://www.carsdirect.com/auto-loans/car-refinancing/how-to-get-your-car-loan-refinanced

- Consumer Financial Protection Bureau, “Worried About Making Your Auto Loan Payments?” https://www.consumerfinance.gov/about-us/blog/worried-about-making-your-auto-loan-payments-your-lender-may-have-options-to-help/

- Experian, “How to Get Out of an Upside Down Car Loan” https://www.experian.com/blogs/ask-experian/how-to-get-out-of-an-upside-down-car-loan/

- Consumer Financial Protection Bureau, “CFPB Moves to Thwart Illegal Auto Repossessions” https://www.consumerfinance.gov/about-us/newsroom/cfpb-moves-to-thwart-illegal-auto-repossessions/

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).