How Voluntary Repossession Impacts Your Credit

Published on: 08/28/2025

A voluntary repossession, also called voluntary surrender, is one of two kinds of repossession that can occur if you can’t make your auto payments. The other is an involuntary repossession in which your lender forcibly takes your vehicle.

You initiate a voluntary repossession by reaching out to your lender and returning your car, this may help you avoid some of the fees associated with involuntary repossession. The lender sells it and puts the money towards your outstanding balance. It’s important to understand that you may still owe money.[1]

If you’re struggling to make auto payments, you may be considering voluntary repossession. However, make sure you understand the consequences and weigh the alternatives. A voluntary repossession can harm your credit and you may still owe an outstanding balance to your lender or a collection agency.

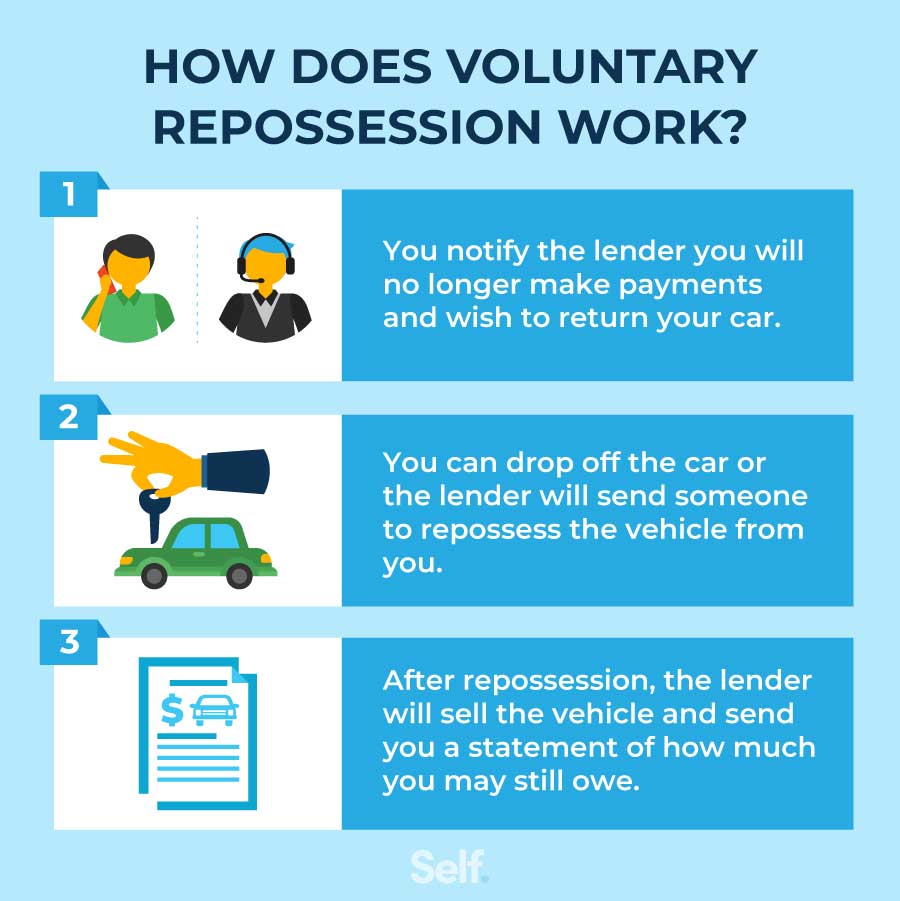

How does voluntary repossession work?

To initiate a voluntary repossession, contact your lender and tell them you’d like to surrender your vehicle. Choose a time and place to return your vehicle and keys, including any spare sets. (This saves the lender from calling a tow truck to take possession of the car.) Make sure to document who you meet with, their contact information, and the date and time. Sign a surrender agreement, which should state your outstanding loan balance. It could be beneficial to keep a copy for your own records.[2]

The creditor will resell your vehicle in an auction sale, with the auction proceeds going toward what you owe. You’ll then owe your balance minus what the car was sold for. This is known as the deficiency balance or shortfall.The lender may also add administrative fees and costs associated with selling the collateral to the total deficiency balance.[3]

If you don’t pay the deficiency balance, the lender may be able to take you to court to seek a deficiency judgment. State laws differ: This can only occur in a state where deficiency judgments are recognized for auto loans and provided the vehicle was sold for a fair price.[2]

How voluntary repossession affects your credit

While it’s impossible to know precisely how much a repossession will affect your credit, you’ll likely see a significant decline. This is because your payment history is the largest single factor in determining your FICO® score, counting for 35%. Repossessions, like missed payments, fall into this category.[5]

It may lower your credit score

Missed payments or late payments may cause your credit score to drop when you fall behind on your auto loan. There are several ways a repossession can damage your FICO® Scores. Before a repossession even happens, missed or late payments can significantly hurt your score, since payment history is the most influential factor in FICO® scoring.

If your loan goes into default, it will be reported separately on your credit reports. The lender will also report that your vehicle has been repossessed. If you have a remaining balance and can’t pay it, the lender may send the debt to a collection agency, which could result in a separate collection account being added to your credit reports.[6]

A default remains on your credit report for 7 years

A voluntary repossession is a loan default, which may harm your credit score and can remain part of your credit history for up to seven years. That seven-year period begins from the date of the first missed payment that led to the default.[3]

Even if your debt is sold to a collection agency, it’s treated as a continuation of your account with the original lender. If you owe a balance on your account and a court renders a judgment against you, you will not only have to pay, but your credit history may suffer.[7]

It’s likely difficult to receive a new loan

Because a vehicle repossession affects your credit score, you may be less likely to get a new loan for a replacement vehicle — or other kinds of loans. If you are able to obtain a loan, lenders or auto finance companies are likely to charge you a higher interest rate because they may see you as a risk for defaulting on the loan. Repossession can also mean paying higher insurance rates. [8]

Knowing your rights for voluntary repossession

A lender must not breach the peace

Under some state laws, a lender must not breach the peace when repossessing a vehicle. This generally means:

- Threatening or using physical force

- Removing a vehicle from a closed garage without permission

- Continuing with repossession after you have resisted or refused to allow the repossession

Source [8]

All of the above may be deemed as breaching the peace. If a lender does breach the peace, you may have the right to claim damages or a defence, which may lessen the amount you eventually owe after the sale of your vehicle.[8]

You can get access to your belongings

If you have belongings stored in your car, it may be best to get in touch with the lender as soon as possible to arrange a time to retrieve your property.

Document the items you left in the vehicle and their estimated value. If the lender asks for payment to retrieve your personal property, then you should consult an attorney.[8]

You may be able to pay to get your car back

Some states allow you the right to get your vehicle back from the lender after repossession. These laws provide a time period that allows you to make up overdue payments, as well as additional costs to reimburse the lender for the repossession process. This process is known as curing or reinstating your loan.[8]

Pros and cons of voluntary repossession

Voluntary surrender can help you in certain ways, but it won’t save you from some of the consequences of having your vehicle repossessed.

Pros of voluntary repossession

- Avoid stress and embarrassment of an involuntary repossession.

- You may pay lower lender repossession costs, fees for repossession agents, towing, or any other costs the lender may incur as part of the process.

- You won’t be unknowingly caught without transportation and will be able to choose when the car is returned.

Source [6]

Cons of voluntary repossession

- You may owe a deficiency balance whether the repossession is voluntary or involuntary. Once your car is repossessed it will be sold at auction. If the car is auctioned for less than you owe, you are responsible for the balance.

- If you can’t pay the difference, the creditor may take you to court or turn the account over to a collections agency.

- A car repossession will have a negative impact on your credit score, and can stay on your credit report for seven years, even though the repossession was voluntary.

Source [6]

Alternatives to voluntary repossession

Repossession is typically a last resort. It costs you money, credit, and, of course, the use of a vehicle you may need for transportation to and from work. In light of the consequences of any repossession — voluntary or forced — it’s worth exploring alternatives.

Negotiate with your lender

The first step should be contacting your auto lender, dealership, or financial institution to help manage your loan. Your lender may be willing to negotiate a new payment plan. Extending the terms of your loan could leave you with smaller monthly payments, but it could increase the amount of interest you pay.

Explaining your situation and reiterating your willingness to work toward repaying the loan may persuade the lender to help you come up with a plan that benefits you both.[9]

Refinance your loan

You may want to see whether you qualify for a lower interest rate or an extension on a repayment period. Alternatively, you could explore debt consolidation by taking out a new loan that you use to pay off your vehicle loan along with other debts you owe.

Sell your car

If your loan payment is more than you can afford, you may want to consider selling your car, especially if your vehicle has high resale value. Check resources like Kelly Blue Book to understand what your car is worth.

You should also talk to your lender because they own the car title until you pay your remaining balance. If you cannot pay the balance, along with any fees, penalties, and interest, the lender may not agree to transfer the title. This is why it’s important to understand if your car is worth enough to cover the loan balance and any related fees.

Is it possible to get a voluntary repossession removed from your credit report?

You can only remove inaccurate information from your credit report, so if your vehicle has been repossessed and reported to the three major credit bureaus, it can remain on your credit history for up-to seven years.

Whether your car is repossessed or you can’t continue to make loan payments on your car loan, your credit is likely to suffer. Although most negative marks remain on your credit report for seven years, they count for less the older they get. Meanwhile, you can work on rebuilding your credit so you can improve your financial situation and, in time, qualify for a new vehicle loan at a reasonable rate.

Sources

- Equifax. "What Is Repossession?" https://www.equifax.com/personal/education/personal-finance/articles/-/learn/what-is-reposession/.

- Experian. "What Is Voluntary Repossession?" https://www.experian.com/blogs/ask-experian/what-is-voluntary-repossession/.

- Investopedia. “Deficiency Balance,” https://www.investopedia.com/terms/d/deficiency-balance.asp.

- Cornell Law School. “Deficiency Judgment,” https://www.law.cornell.edu/wex/deficiency_judgment.

- myFICO. "How a Repossession Can Affect Your FICO® Score," https://www.myfico.com/credit-education/blog/repossession-fico-score.

- Capital One. "What Is Voluntary Car Repossession?" https://www.capitalone.com/cars/learn/managing-your-money-wisely/what-is-voluntary-car-repossession/1516.

- Experian. “Repossession and Voluntary Surrender on Credit Report,” https://www.experian.com/blogs/ask-experian/repossession-or-voluntary-surrender-will-remain-for-seven-years/.

- Consumer Financial Protection Bureau. "What Happens if My Car Is Repossessed?" https://www.consumerfinance.gov/ask-cfpb/what-happens-if-my-car-is-repossessed-en-865/.

- Consumer Financial Protection Bureau. "Worried About Making Your Auto Loan Payments? Your Lender May Have Options to Help," https://www.consumerfinance.gov/about-us/blog/worried-about-making-your-auto-loan-payments-your-lender-may-have-options-to-help/.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).