How Much Money Should I Have Saved by 30?

Published on:

It’s never too early to start saving for emergencies or retirement, but the question is, how much? There isn't a specific number someone should have saved by 30, but there are general guidelines.

Even if you’re a 30-year-old who hasn’t started saving yet, there’s still time, and no amount is too small.

How much should I have saved in an emergency savings account?

It’s important to have a separate emergency fund for unexpected expenses, such as car accidents, home repairs and medical bills. A good rule of thumb is to have a minimum of three to six months’ worth of expenses saved in an emergency savings account.[1]

To calculate how much you need in an emergency fund, add up all your bills (utilities, rent, car payment, insurance, etc.) and regular expenses such as food and gas. Then, multiply by three to get the minimum amount to save for your emergency fund.

For example, if your monthly expenses are $1,500, you should have a minimum of $4,500 saved for three months’ worth of expenses and $9,000 saved for six months’ worth.

How much should I have saved for retirement?

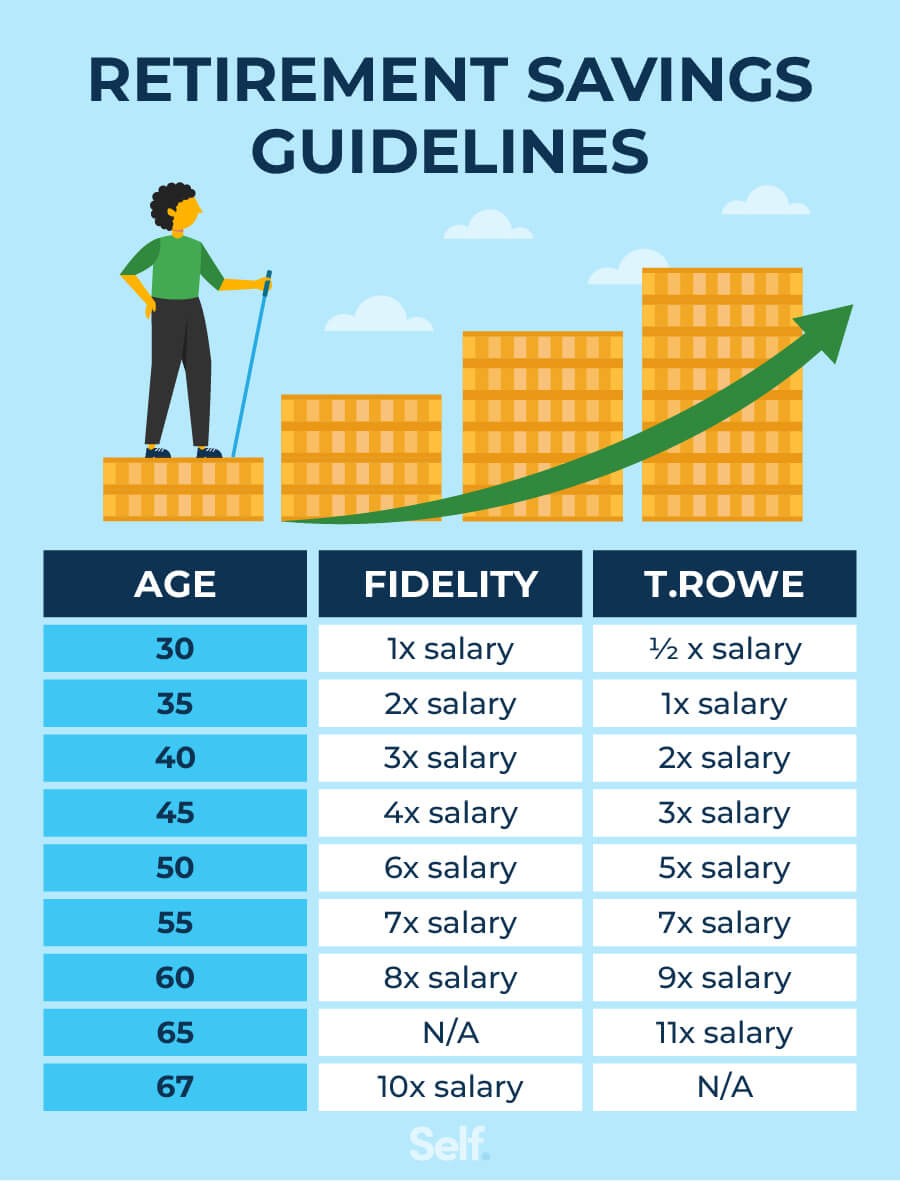

Everyone’s retirement plan is different. The amount of money you need to save will depend on several factors, including when you started saving, how much money you make, your cost of living, and your target retirement age. Here are general guidelines.

Fidelity suggests 1x your income

Fidelity Investments recommends saving 1x your salary by 30.[2]

At the end of 2021, the average annual salary was $49,920 for 25 to 34-year-olds and $58,604 for 35 to 44-year-olds.[3] So the average 30-year-old should have $50,000 to $60,000 saved by Fidelity’s standards.

Assuming that your income stays at $50,000 over time, here are financial milestones by decade.

| Age | Savings Goal | Amount Saved |

|---|---|---|

| 30 | 1x income | $50,000 |

| 40 | 3x income | $150,000 |

| 50 | 6x income | $300,000 |

| 60 | 8x income | $400,000 |

| 70 | 10x income | $500,000 |

These goals aren’t set in stone. Other financial planners suggest slightly different targets.

T. Rowe Price suggests 0.5x your income

T. Rowe Price’s benchmarks for households with incomes of $75,000 to $250,000 suggest that you should save 0.5x your income by 30. Assuming your household makes $75,000, you should have $37,500 saved by 30. Note that the numbers listed in the graphic above are the midpoints of these ranges.[4]

| Age | Savings Goal | Amount Saved |

|---|---|---|

| 30 | 0.5x income | $37,500 |

| 40 | 1.5x to 2.5x income | $112,500 to $187,500 |

| 50 | 3.5x to 6x income | $262,500 to $450,000 |

| 60 | 6x to 11x income | $450,000 to $825,000 |

| 65 | 7.5x to 14x income | $562,500 to $1,050,000 |

Save 15% of your pre-tax income annually

If you start saving early (around age 25), experts advise putting 15% of your pretax earnings towards your retirement savings.[5] If you make $50,000 per year, that means you should save $7,500 towards retirement.

If a 15% savings rate isn’t possible, that’s okay. Start small and as your income grows or your debt is paid off, begin to contribute more to your retirement accounts.

A long-term target is to save 10 times your preretirement annual income by age 67.[2] If your year’s salary is $50,000, that means you should have $500,000 saved for your retirement fund. But is $500,000 enough to sustain you? Let’s look at some scenarios that assume you’ll need living expenses for 26 years.

- If you saved $150,000, you could safely spend $5,700 a year.

- If you saved $300,000, you could safely spend $11,500 a year.

- If you saved $500,000, you could safely spend $19,200 a year.

- If you saved $1,000,000, you could safely spend $38,400 a year.

If you’ll only need about $19,200 a year, then $500,000 might be enough. This is a simplified example that doesn’t take into account inflation or compound interest. It’s helpful to test different scenarios using an online calculator to determine the right number for you.

In addition to what’s saved in your retirement accounts, consider other sources of retirement income like Social Security. The national average for Social Security benefits was $1,657 a month as of January 2022, with the maximum being $3,345. That amount would be payable to someone who earned the maximum taxable income, which was $147,000 in 2022, over a 35-year career.[6]

What types of savings accounts should I have?

There are several different types of bank accounts available for saving.

- Roth or traditional Individual Retirement Accounts (IRAs) are retirement-specific accounts. Roth IRAs and Roth 401(k)s tax you first and allow your investments to grow tax-free, so you don’t pay any taxes when you access your funds at retirement.

- 401(k) matching can increase your income. Many large employers offer company matches of 50 cents for each dollar you contribute up to 6% of your pay.[7] Check with your employer to see if they offer retirement match benefits and how you can take advantage of them.

- High-yield savings accounts offer higher interest rates and are useful for emergency funds or sinking funds.

- Money market accounts offer you interest rates similar to savings accounts but may share similarities to checking accounts, such as the ability to write checks or use a debit card.

It’s useful to capitalize on employer matching opportunities and tax-advantaged accounts, which can lower your taxable income and help you avoid paying taxes on interest. More on that below.

How to save more money

Even if you haven’t saved anything by the time you’re 30, you still have plenty of time. Start with an emergency fund and then consider retirement and other savings goals.

If you have the money to start a retirement fund, make sure to research how to best allocate funds at 30. T. Rowe Price suggests 0% to 10% bonds and 90% to 100% stocks because younger people have a higher risk tolerance and stocks may provide larger returns over time.[8] Here are a few additional tips to optimize your savings.

Create a budget

Creating a budget is an essential first step. A detailed budget with specific categories — such as utilities, transportation, rent, food, health care and savings — can give you a clearer picture of how much you’re spending and where you can cut back.

If you’re not sure how to allocate your income, try the 50/30/20 method where 50% of your income goes towards needs, 30% wants, and 20% savings.

Use debt repayment strategies

The more debt you have, the more interest you pay. There are multiple strategies you can use to help pay down your debt, whether it’s student loan debt, a mortgage, or credit card debt. The debt snowball method suggests that you make minimum payments on all debts, but put more money towards the smallest debt first. Once you’ve paid that one off, move on to the next smallest debt. This helps you see tangible progress as you check debts off your list.

Another popular repayment strategy is the debt avalanche method in which you make minimum payments for all debts, but put any extra money towards your highest interest loan. This will save you money on interest in the long run.

Utilize tax-advantaged accounts

A tax-advantaged account is any account that has tax benefits. This includes tax-exempt and tax-deferred accounts. By contributing to these types of accounts you reduce your taxable income and don’t pay taxes on the interest that accrues. Examples of tax-advantaged accounts include Roth IRAs, 401(k)s, flexible savings accounts (FSAs), and health savings accounts (HSAs).[9] If you have an employer-sponsored 401(k) make sure to check how much your employer matches.

Generate multiple streams of income

If you’d like to put more money towards savings, try a side hustle or gig work. Even if you can only dedicate a few hours a week to food delivery or ridesharing, that income adds up.

It’s not too late to start

Saving money can help prepare you for the worst (unforeseen emergencies) and the best (a great retirement). Even if the savings goals outlined by Fidelity and T. Rowe feel out of reach, just remember that any form of saving is a good first step toward reaching your financial goals.

Tackle a money-saving challenge or explore apps that can help you save. There are plenty of tools at your disposal that can help you build toward a bright financial future.

Sources

- Wells Fargo. “Saving for an Emergency” https://www.wellsfargo.com/financial-education/basic-finances/manage-money/cashflow-savings/emergencies/. Accessed March 21, 2022.

- Fidelity. “How much do I need to retire?” https://www.fidelity.com/viewpoints/retirement/how-much-do-i-need-to-retire. Accessed February 28, 2022.

- U.S. Census Bureau. “QuickFacts,” https://www.census.gov/quickfacts/fact/table/US/SEX255219. Accessed March 21, 2022.

- T. Rowe Price. “Are My Retirement Savings on Track?” https://www.troweprice.com/financial-intermediary/us/en/insights/articles/2021/q4/are-my-retirement-savings-on-track.html. Accessed April 27, 2022.

- Forbes. “How Much Should You Save For Retirement?” https://www.forbes.com/advisor/retirement/how-much-to-save-for-retirement/. Accessed February 28, 2022.

- U.S. News. “How Much You Will Get From Social Security,” https://money.usnews.com/money/retirement/social-security/articles/how-much-you-will-get-from-social-security. Accessed February 28, 2022.

- Investopedia. “What Is a Good 401(k) Match?” https://www.investopedia.com/articles/personal-finance/120315/what-good-401k-match.asp. Accessed June 21, 2022.

- T. Rowe Price. “Retirement Savings by Age: What to Do With Your Portfolio in 2022,” https://www.troweprice.com/personal-investing/resources/insights/retirement-savings-by-age-what-to-do-with-your-portfolio.html. Accessed June 21, 2022.

- Investopedia. “Tax-Advantaged,” https://www.investopedia.com/terms/t/tax-advantaged.asp. Accessed February 28, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).