How to Avoid Paying Interest on Credit Cards

Published on: 07/14/2022

If you’ve ever paid less than your credit card balance, you’ve likely had to pay interest. Essentially, you are paying for the privilege of borrowing money. The quicker you pay off your balance, and the lower you keep it, the less interest you’ll pay.

Paying down your balance isn’t just good for your pocketbook. It can be good for your credit score.

How does credit card interest work?

Credit cards are a form of revolving credit, under which you can borrow as much money as you want up to a credit limit set by your lender. If you don’t pay the whole balance off each month, though, your debt will grow, thanks to interest. For example, if you pay $200 of your $500 balance, you’ll have $300 of debt left — plus whatever interest accrues.

With credit cards, interest accrues based on the annual percentage rate, or APR, which we’ll discuss in more detail below. Most credit cards compound your interest daily based on your daily interest rate—your APR divided by 365. Compound interest is calculated based on your original principal and any interest you’ve accumulated up to that point.[1] That means you’ll be paying interest on top of interest and that the amount you owe will grow every day.

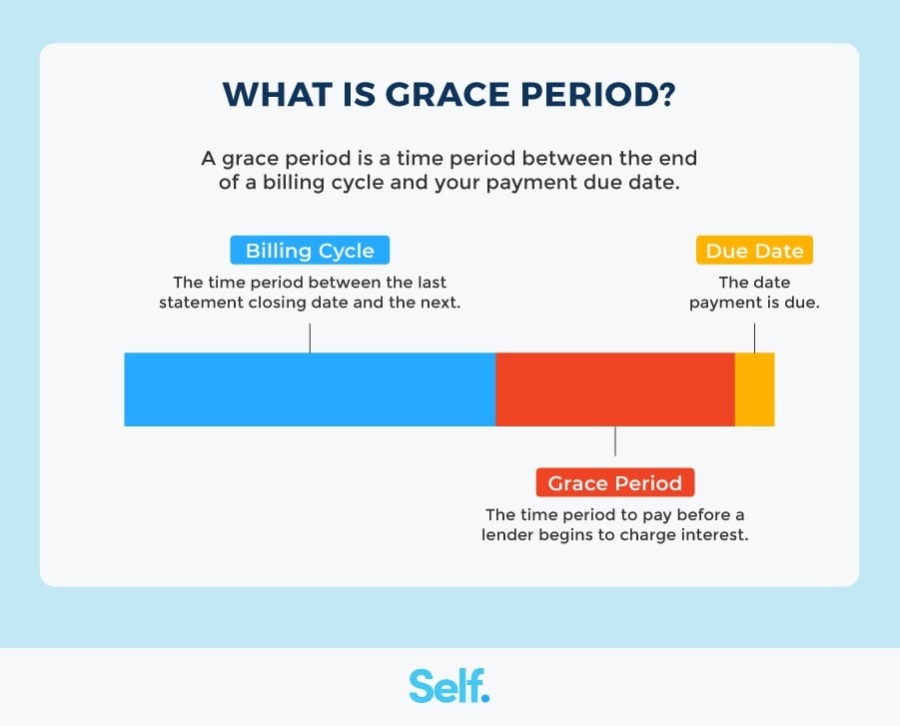

What is a grace period?

The grace period on your credit card account is the period of time between the end of a billing cycle and when your payment is due. The grace period ends on your due date. During this time, you may not be charged interest or late fees as long as you pay your balance in full. Credit card companies must also provide your credit card statements to you at least 21 days before your due date.[2]

Credit card grace periods typically only apply to new purchases. Most credit cards don’t provide a grace period on cash advances or balance transfers.

What happens if you don’t pay before your grace period ends?

If you pay off your balance in full during your grace period (by your due date), you won’t end up paying any interest on the purchases you made during that statement period.

However, if you fail to pay off your balance in full, interest on the unpaid balance will be an additional charge to your account, which can increase your balance. In this situation, your current balance and any new purchases you make from that point forward will continue to accrue interest.

How to avoid credit card interest charges

There are a few things you can do to avoid credit card interest charges, which will not only save you money but can help you build credit and improve your personal finances.

Pay off your balance in full each month

If you pay your credit card bill in full by the payment due date, you will not be charged interest or late fees. Even if you can’t pay off the entire balance, you can minimize the amount of interest you’ll pay by making more than the minimum payment.

Each credit card issuer has its own method of calculating your minimum payment. Some card issuers use a formula that takes between 1% and 3% of your total statement balance, including interest and fees.[3] For instance, if your minimum payment was 3% of a $1,000 statement balance, your minimum payment would be $30.

Other card issuers calculate your minimum payment as a smaller percentage of your statement balance and add the accrued interest and fees separately. If you have a low balance, you may have to pay a fixed minimum balance instead of a percentage of your statement balance.[3]

According to the Credit CARD Act of 2009, card issuers are required to disclose on your statement how long it will take to pay off your balance if you are only making minimum payments.[4] Make sure to check your statement and understand how long it will take to pay off the debt.

Even if you can’t afford to pay your credit card balance in full, making more than the minimum payment will reduce the interest you’re paying and the amount of time it takes to pay off your debt.

Enroll in autopay

Autopay authorizes the credit card issuer to automatically deduct your payment from your checking account on a date of your choosing that falls on or before your due date. Enrolling in autopay helps prevent late payments. Be sure to review your creditor agreement to determine when the payment will post so you can be sure that your payment authorization date will ensure you are not late.

Late payment fees can be as much as $28 or $39.[5] If monthly payments are 30 days late or more, they can be marked as delinquent on your credit report and damage your credit score.

Be wary of balance transfers and cash advances

The type of transaction is an important factor to consider when trying to avoid interest charges. Interest policies tend to be different for balance transfers and cash advances than for credit card purchases.

Transferring a balance from a high-interest credit card to a lower-interest card can help you quickly pay down your debt, especially if there’s an interest-free (0%) introductory rate. However, most introductory rates will terminate if you miss a payment. Make sure to read the fine print: Some introductory rates apply only to the amount transferred, not to any purchases made during the intro phase, so new purchases may accrue interest at a higher rate.[6]

Additionally, most lenders charge a fee for balance transfers, which may be 3% to 5% of the amount you’re moving over.[6] If you’re charged a 4% fee to move $2,000, it will cost you $80. Run the numbers to assure a balance transfer can save you money and eliminate or reduce your interest. Promotional periods on balance transfers are typically short and can expire within six to 12 months, so be mindful that if you can’t pay off the balance before the promotional period ends, you may be charged a much higher interest rate once the balance transfer period ends.[7]

Cash advances allow you to borrow cash against your credit limit. They begin accruing interest immediately, in addition to coming with a fee. Depending on your card issuer, you may be charged a cash advance fee, which is typically 3% or 5% of your cash advance amount. For example, a $200 cash advance with a 5% fee will cost you $10.00.[8]

If you need to borrow money, do your research to determine if there are lower interest and fee options.

How do credit scores affect your interest rate?

Credit card issuers typically charge higher interest rates to people with lower credit scores, so you can save money on interest by keeping your credit scores up.

Making your payments on time is one way to boost your credit score: Your payment history is the biggest factor in determining your FICO® score, counting for 35%. Late payments can stay on your credit report for up to seven years, so it’s important to make your payments on time.

It’s also essential to keep your credit utilization ratio low. This is the amount you owe on all your credit cards compared to your total credit limit, and it counts for 30% of your FICO score. It’s considered best to keep your credit utilization ratio at 30% or below, and for an excellent credit score, at no more than 10%.[9]

Understand your APR

According to the Federal Reserve, the average APR for most credit cards in the U.S. is 14% to 16% on all accounts, and banks usually charge somewhere between 12% and 24% (although some can be higher).[10]

To calculate your daily APR on a credit card, start with your current balance and APR as listed on your monthly statement. Divide that by 365 days. This will give you your periodic rate, which you can then multiply by your balance.[11] For instance, if you have a $1,000 balance and your APR is 15%, you would divide 0.15 by 365 and multiply the result by 1,000 for a daily APR charge of 41 cents. Remember, compound interest is calculated based on your principal and interest sum.

When shopping for credit cards, be mindful that everyone’s shopping habits are different and what may be best for you may not be for someone else. Some credit cards offer rewards or cash back on purchases, while other cards are catered more towards travelers. With a bit of research, you can find one that benefits you the most. Be on the lookout for any fees that may apply, look for lower interest rates, and try to steer clear of high-APR credit cards.

Sources

- Investopedia. “Compound Interest,” https://www.investopedia.com/terms/c/compoundinterest.asp. Accessed January 31, 2022.

- Consumer Financial Protection Bureau. “What is a grace period for a credit card?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-grace-period-for-a-credit-card-en-47/. Accessed January 31, 2022.

- U.S. News. “How Credit Card Issuers Calculate Your Minimum Payment,” https://money.usnews.com/credit-cards/articles/how-credit-card-issuers-calculate-your-minimum-payment. Accessed January 31, 2022.

- CNBC. “Here’s what happens if you only pay the minimum on your credit card,” https://www.cnbc.com/select/what-happens-if-you-only-pay-the-minimum-on-your-credit-card/. Accessed June 27, 2022.

- U.S. News. “What Happens When You Pay Your Credit Card Late?” https://money.usnews.com/credit-cards/articles/what-happens-when-you-pay-your-credit-card-late. Accessed January 31, 2022.

- Experian. “Balance Transfer Credit Cards,” https://www.experian.com/blogs/ask-experian/credit-education/balance-transfer-credit-cards/. Accessed January 31, 2022.

- Experian. “What Happens After a Balance Transfer?” https://www.experian.com/blogs/ask-experian/what-happens-after-a-balance-transfer/. Accessed January 31, 2022.

- CNBC. “What is a cash advance and how do they work?” “https://www.cnbc.com/select/what-is-a-cash-advance-and-how-do-they-work/. Accessed June 27, 2022.

- CNBC. “Does a $0 balance on your credit card make your score go up?” https://www.cnbc.com/select/what-is-a-good-credit-utilization-ratio/. Accessed January 31, 2022.

- Forbes. “What Is A Good Credit Card APR?” https://www.forbes.com/advisor/credit-cards/what-is-a-good-apr-for-a-credit-card/. Accessed January 31, 2022.

- Chase. “How to calculate credit card APR charges,” https://www.chase.com/personal/credit-cards/education/interest-apr/how-to-calculate-credit-card-apr-charges. Accessed January 31, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).