How to Read a Credit Card Statement

Published on: 11/11/2025

Your credit card statement is a monthly accounting of all your credit card activity for that month.

It includes all your relevant account information as of the closing date of your statement, including:

- The statement period

- Your balance as of the end of the previous statement period

- Your credit limit

- Interest rate on purchases and cash advances

- Your available credit

- Your payment due date

- Your minimum payment

- Transactions during the statement period, including purchases and payments

- Interest charges (if applicable) during the statement period

Your statement will also explain important credit card terms such as fees and penalties and how they’re applied, grace period terms, and how interest is calculated. [1]

How to read your credit card statement, step-by-step

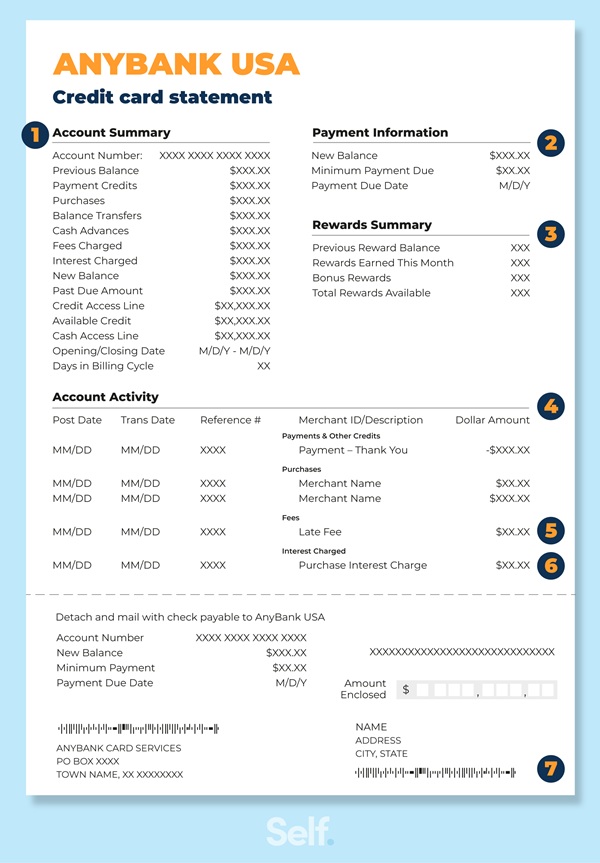

Below, we’ll talk through a typical credit card statement and what you can expect to find on it.

1. Summary

This section includes your statement period. These are the dates your statement covers. Your statement date is the last day of that statement period.

Typically, your statement date is also the date your bank will report your credit information to the credit bureaus. Paying off your balance right before the statement date is one way to show a low credit utilization ratio, which is an important factor in your credit score. [2]

This section also provides:

- A summary of all your transactions during your statement period. This includes a sum total of all your purchases, payments, cash advances, credits, interest paid, and fees paid.

- Your balance as of the beginning of the statement period

- Your total credit limit

- Remaining (unused) credit available as of the statement date

- Your balance as of the statement date [3]

There are typically two types of balances: purchases and cash advances. This is important because cash advances are typically charged a higher interest rate than purchases. They are also not generally eligible for a grace period. [4]

2. Payment Information

This section tells you the amount needed to pay off your balance (as of the statement date), as well as the new balance. This is the sum total of purchases, cash advances, and payments during the statement period.

This section also includes the payment due date, and the minimum payment necessary to keep your account in good standing.

By law, credit card issuing banks must set your payment due date on the same date every month. The due date must be at least 21 days after your statement's closing date. If you miss a payment deadline, you could be charged a late fee. [5]

3. Rewards Summary

If your credit card issuer has a rewards program, this section will summarize the awards earned during the statement period, and sometimes over the past year.

Some cards provide cash back rewards. Others have a points system that allows you to redeem points for travel benefits or other perks.

4. Transactions

This is a list of all your transactions during the statement period. Here you’ll find a breakdown of all of the purchases you have made in that billing cycle, listed by date.

Reviewing this section each month can help you identify transactions you don't recognize and report them to your credit card company, as they may be fraudulent.

5. Credit card charges

This section tells you how much interest, fees, and penalties your card has charged you during the month and for the year.

There are several types of possible charges on your credit card statement, some of which can include:

- Annual fee - Some credit cards charge an annual fee, which you pay when you first receive the card, and every year thereafter. This fee is often associated with secured and rewards cards, and can range from $50 to over $500 for premium reward unsecured credit cards.

- Late payment fees - Some card issuers charge late fees if you don’t pay at least the minimum payment by the due date. These can vary in cost, ranging from $30 for an initial late payment to $41 for subsequent late payments within six billing cycles.

- Cash advance fees - If you have used your credit card to withdraw cash, you could be charged an additional cash advance fee: usually 3% to 5% with a minimum $5 to $10 charge per cash advance of the amount you have withdrawn as cash.

- Balance transfer fees - You may be charged a balance transfer fee if you transfer a balance to your credit card; sometimes, credit cards can offer promotional balance transfer interest rates, which can be appealing. But you could be charged a fee between 3% and 5% of the amount you transfer, with a $5 to $10 minimum per transfer.

- Foreign transaction fees - If you use your card outside of the U.S. or you buy something online in a different currency, you might be charged a fee, typically 2% to 3% of the amount spent. [6]

6. Interest charge calculation

This section breaks down exactly how your bank calculates the interest charges on your purchases. It addresses both purchases and cash advances. Understanding exactly how your credit card calculates interest rates can help you stay on top of any credit card debt.

The interest on your credit card is the cost of borrowing money, typically expressed as an annual percentage rate (APR). You’ll usually be charged interest on your credit card bill if you carry a balance from one billing cycle to the next instead of paying off your statement balance each month.[7]

7. Payment coupon

If you receive your credit card statement in the mail, it will contain a paper coupon to send with a check if you are paying your bill by mail. All of the payment information you need will appear on the coupon, and it should also come with an envelope for you to send the slip and payment check to your credit card company.

Daily vs. monthly compounding interest

Check your statement disclosure to see how often your interest compounds over time. The more often your interest compounds, the faster interest will accrue; most cards have daily compounding, meaning interest is calculated and added to your balance each day based on its average daily balance. [8]

If your annual percentage rate is 18%, your daily periodic rate is 18% / 365 days per year, or 0.0493% per day.

Credit card grace periods

Your credit card grace period runs from your statement closing date through your payment due date listed on your statement.

Not every card has a grace period. But if your card does, and you are not carrying a balance, you won’t be charged interest on new purchases if you pay off your entire statement balance by the payment due date. If you don’t pay your balance in full by the due date, you will have to pay interest on the unpaid portion of the balance, and you’ll also be charged interest on any purchases in the new billing cycle.

According to the Consumer Financial Protection Bureau, credit card companies are required to make sure that you receive your credit card bill at least 21 days before the payment is due.

Keep in mind that grace periods typically only apply to purchases and not cash advances. If you take out a cash advance from your credit card, the interest will typically start accruing as of the date of the transaction. [9]

Credit card statement FAQs

What’s the difference between statement balance and current balance?

Your statement balance shows how much you owe on the last day of that billing cycle, including purchases, interest, fees, and any outstanding balances in the billing cycle. Your current balance, on the other hand, represents all of the purchases, interest, fees, and unpaid balances in real-time whenever you check your credit card account.

For example, if you purchased a new jacket after your statement balance was calculated, that would form part of your current balance, not the statement balance. [10]

How do you dispute errors on your credit card statement?

If you spot an error or a fraudulent transaction on your credit card statement, you should call your credit card company straight away using the number on your statement or the back of your credit card. Billing errors usually need to be reported within 60 days of receiving the first bill, and many credit cards will give you zero-liability fraud protection. [11]

What is the closing date on a credit card?

The closing date on your credit card is the last day of your card’s billing cycle. Your credit card statement will be generated at the end of the closing date, and payments will be due at least 21 days later. If you fail to pay the minimum payment on your credit card before the due date, you might have to pay a late fee. [5]

Bottom line

Your credit card statement contains key information about your credit card account, including when your payments are due, how much available credit you have left, and any additional fees you might have to pay. It’s important to read your credit card statement each month and make sure you understand what you need to pay and when; this can help you avoid paying additional interest and fees.

Sources

- Equifax, “How to Read a Credit Card Statement” https://www.equifax.com/personal/education/credit-cards/articles/-/learn/how-to-read-credit-card-statement/ Accessed May 29, 2025

- Experian, “What is a Credit Utilization Ratio?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization-rate/ Accessed May 29, 2025

- Discover, “How to Read a Credit Card Statement” https://www.discover.com/credit-cards/card-smarts/how-to-read-a-credit-card-statement/ Accessed May 29, 2025

- MyFICO, “Cash Advance Fine Print” https://www.myfico.com/credit-education/blog/cash-advance-fine-print Accessed May 29, 2025

- Discover, “Credit Card Closing Date” https://www.discover.com/credit-cards/card-smarts/credit-card-closing-date/ Accessed May 29, 2025

- Experian, “9 Common Credit Card Fees” https://www.experian.com/blogs/ask-experian/understanding-credit-card-fees/ Accessed May 29, 2025

- Capital One, “How Does Credit Card Interest Work?” https://www.capitalone.com/learn-grow/money-management/calculate-credit-card-interest/ Accessed May 29, 2025

- Experian, “Is Credit Card Interest Compounded Daily?” https://www.experian.com/blogs/ask-experian/is-credit-card-interest-compounded-daily/ Accessed May 29, 2025

- CFPB, “What is a Grace Period for a Credit Card?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-grace-period-for-a-credit-card-en-47/ Accessed May 29, 2025

- Bankrate, “Statement Balance Vs Current Balance” https://www.bankrate.com/credit-cards/advice/statement-balance-vs-current-balance/ Accessed May 29, 2025

- Bankrate, “How to Read Your Credit Card Statement” https://www.bankrate.com/credit-cards/advice/guide-to-reading-your-monthly-statement/ Accessed May 29, 2025

About the author

Becca has over 10 years of experience as a content writer, working across various industries including finance, digital marketing, education, travel, and technology. Her work has been featured in publications including Forbes, Business Insider, AOL, Yahoo, GOBankingRates, and more.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).