International Credit Reporting: The United States vs. United Kingdom

Published on: 06/28/2019

While credit scoring systems in the United Kingdom and the United States are similar in many ways, there are some significant differences. While a credit score might seem like something that should easily travel with you across the pond, the frustrating truth is it doesn’t – meaning you have to start building credit from scratch if you immigrate.

Why are credit systems different from country to country? According to Equifax UK:

“This is partly due to having different data protection laws in different countries, and also the fact that agencies will hold information that relates to addresses in that particular country.”

Here are some of the major differences – and similarities – between the UK and US credit systems.

Table of Contents

- How lenders and bureaus identify you

- The differences between credit bureaus

- Credit scoring ranges and models used

- How lenders use your credit score

- Whether closing an account helps or hurts

- The impact of income and savings on credit

- Hard vs soft credit inquiries

- Financial associates vs. cosigners

How lenders and bureaus identify you

In the UK, lenders and credit bureaus verify your identity by using the information from your electoral register. This register contains the personal information of everyone who is registered to vote in public elections. It includes your name and address, date of birth and an electoral number, and is used to determine what constituency you are in and where to send ballot cards.

Unlike in the UK, you get no direct financial benefit from registering to vote in the US. Instead, lenders and credit bureaus use your Social Security Number (SSN) to identify you. A Social Security Number is a nine-digit number issued to US citizens, permanent residents and temporary residents.

This number should never be shared with anyone and is a unique identifier that identifies you for cases of employment, credit access and monitoring, transactions with financial institutions and more.

To find out more about Social Security Numbers and the role they play in building credit and filing taxes in the US, check out the blog on “Can You File Taxes Without a Social Security Number?”

The credit bureaus – same but different

The major bureaus in the United Kingdom are Experian, Equifax and TransUnion.

The major bureaus in the United States are Experian, Equifax and TransUnion.

Yes, they are the same companies operating on both sides of the pond. However, your UK credit history does not translate to the US, and vice versa.

In both countries, these credit bureaus collect information about your credit history and credit behaviors, as well as personal information. However, that’s pretty much where the similarities stop. Among other things, how these bureaus interact with and provide information to lenders differs between the two countries.

Perhaps the most noticeable difference when it comes to the interaction between lenders and credit bureaus? Credit scoring – how it’s used, how it varies, and the credit scoring ranges themselves.

Credit scoring ranges and models used

The best way to explain the difference in credit scoring and the models used, which could easily be a novel unto itself, is to break it down, country-by-country. Let’s start with a reminder about how your credit score works in the UK.

Credit scoring in the UK

In the UK, lenders often have their own credit scores based on their own models and don’t use the scores provided by the credit bureaus. The scores and ratings at the credit bureaus are, instead, almost strictly used for educating the consumer about their credit.

According to Experian UK:

“Each company may consider different information when working out your score, depending on their criteria and what data they have access to. They may also differ in how they see your information – for example, a certain record on your report could look negative to some companies and positive to others, depending on what they’re looking for in a customer. So, your score will probably vary between the different credit reference agencies and companies.”

Nowhere is this variation more obvious than if you look at the scoring systems from bureau to bureau in the UK.

“There’s no such thing as a universal credit score, each credit score is created by lenders or credit reference agencies as a way of measuring an individual’s creditworthiness. Scores from different sources will be calculated using different formulas and criteria. They will also be rated on different scales, e.g. 1 to 700 or 1 to 1000. This is why you might get 500 on one scale and 700 on another, even if the information provided is the same,” the Equifax UK website mentions in their post on understanding credit score ranges.

Here’s a breakdown of the credit scoring ranges in the UK…

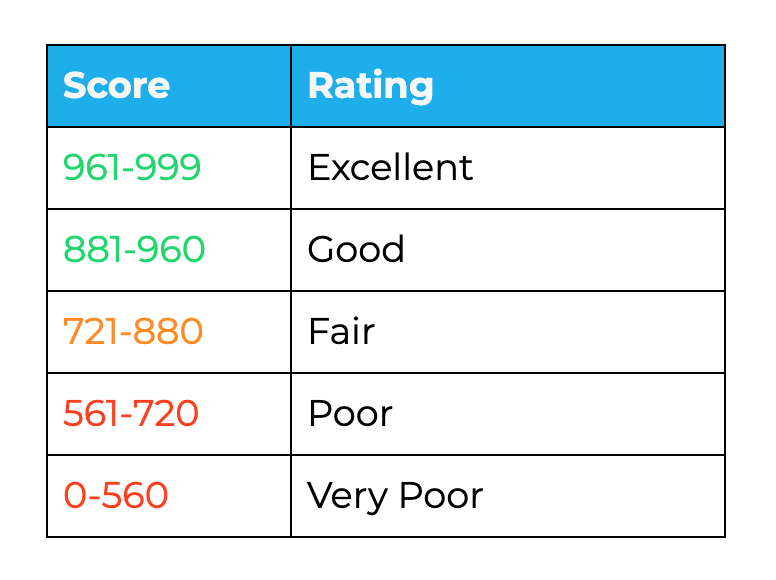

Experian UK Credit Score

Range: 0-999

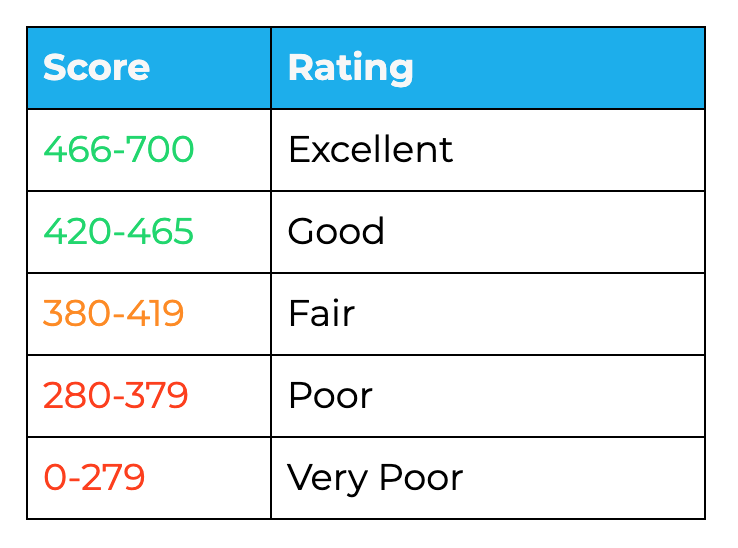

Equifax UK Credit Score

Range: 0-700

TransUnion UK Credit Rating

Range: 1-5

It’s important to note though, that TransUnion recognizes a difference between your credit rating and your credit score. We’ll get to that in a minute.

Difference between credit rating and credit scoring

From there, the differences get even more pronounced, since, according to TransUnion UK, there’s also a difference between your credit rating and your credit score in the UK:

“Don’t get your credit rating confused with your credit score. While they are similar, they’re not exactly the same and how your credit score is assessed by lenders is for them to determine, based on the information in your credit file.”

The TransUnion credit rating system in the UK provides simply an indication of the type of credit risk you might pose to lenders, based on the following factors:

- How much you owe

- Your payment history (including late payments)

- The length of your credit history

- Bankruptcies and insolvencies

- Electoral registry information

- Your financial associates

These elements are, for the most part, very similar to what goes into your US credit score, with a few minor differences.

While credit bureaus in the UK share many differences, these bureaus do agree on a few things when it comes to maintaining a positive credit history and credit score, as evidenced by the following factors that impact your credit score on the Equifax site:

- Info on credit report (ie how much available credit you’re using)

- Payment history on credit accounts

- Hard inquiries/when/how often you apply for credit

- Public records (electoral register and county court judgments)

US credit scoring ranges and models

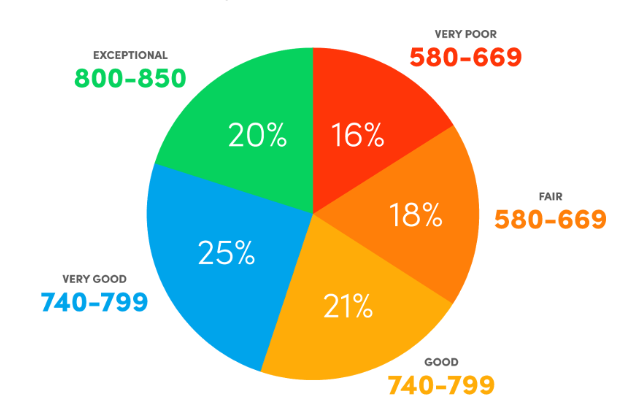

In the US, however, the credit score ranges are similar across credit reporting agencies, and your credit score does impact lending decisions. Here, credit scores range from 300-850 at each of the three major credit bureaus (Experian, Equifax and TransUnion), with the highest number being the best your score can get.

Here’s an idea of what “good” looks like when it comes to U.S. credit scores, according to Experian.

While there are different types of scoring models used in the US (including various versions of the FICO score and the VantageScore), the FICO model is used by roughly 90% of lenders. The major scores however, all use the 300-850 scale.

“The FICO Score helps lenders make accurate, reliable and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used, broad-based risk score; the FICO Score plays a critical role in billions of decisions each year,” credit expert Barry Paperno says.

While some of the newer credit scoring models are starting to incorporate things like rent or utilities payments, in general, only certain accounts factor into your credit score in the US. These accounts typically include:

- Credit cards (secured and unsecured)

- Personal loans

- Auto loans

- Mortgage loans

- Certain other loans

Unlike in the UK, where utilities and rent are commonly taken into account when modeling your credit, these accounts do not typically report in the US. Even some loan products here (usually predatory in nature) do not report to the credit bureaus.

It’s also important to keep in mind that lenders do not necessarily report to – or receive information from – all three credit bureaus. So if you have a question about whether or not your US credit account will report to the credit bureaus, and which of the bureaus it will report to specifically, be sure to ask. Ultimately, to gain access to the most competitive credit products in the US, it’s important to build credit at all three reporting bureaus.

How do you do this? A good starting point is to understand the five factors that go into your US credit score. These vary slightly from score model to score model, but in general are found across all scoring models. Here they are in order of importance:

- Payment history

- Amounts owed

- New credit applications and hard inquiries

- Length of credit history

- Types of credit used

For more on how to build credit in the US, be sure to check out our blog post on “5 Ways New Immigrants Can Build American Credit”.

How lenders use your credit score

In the US, the credit bureaus provide lenders with access to your credit score, though it’s up to the lender which bureau they pull your score from. While your credit score is not the only thing that determines a lender’s perception of your credit worthiness, it does have an impact.

Unlike the UK, where each lender has their own separate scoring model, in the US, most lenders use some version of either the FICO score or VantageScore models, with roughly 90% of lenders using the FICO model.

While the scoring range (300-850) is the same across the major bureaus, the specific scoring model could vary slightly, impacting that score from bureau to bureau and lender to lender.

Whether closing an account could help or hurt

In the UK, there’s a bit of a discrepancy between whether or not closing your accounts could help or hurt, depending on the lender. As mentioned previously in this post, what some lenders in the UK may view as a positive, others may view as a negative, so it depends on the lender.

According to Equifax UK, “Close any unused credit accounts, as having a large overall credit limit may be viewed negatively by lenders.”

TransUnion UK also recommends that you close down outdated credit cards and cancel old agreements. However, Experian UK urges the opposite:

“Try to keep old, well-managed accounts. Credit scoring looks at the average age of your bank accounts, so try not to chop and change too much.”

In the States, no matter which scoring model or bureau you’re looking at, the experts agree – keep your old accounts open where possible, since the length of your average credit history counts for 15% of your FICO credit score.

Having a large overall credit limit, compared to the amount of credit you use, is also considered a positive in the States, even though having a large credit limit is sometimes viewed negatively in the UK.

Neither credit system counts income or savings

“It’s worth noting that your Experian Credit Score won’t be affected by things like your income, savings, employment, or health expenses, because this information isn’t recorded on your credit report. However, companies may ask questions about these factors when you apply for credit, and may use these details when calculating their own version of your score,” Experian UK mentions in a consumer guide.

The same holds true for credit scoring in the US. While individual lenders will factor in your debt-to-income ratio (the percentage of debt you have as opposed to how much money you make) when making lending decisions, this ratio does not play a role in determining your credit score.

In the US, a general rule is to keep this debt-to-income ratio to below 30% if possible. Otherwise, lenders might view you as having too much debt to responsibly and reliably pay back what you owe them.

Hard vs. soft credit inquiries are the same

Whether you live in the US or the UK, hard and soft credit inquiries are the same in both.

A hard credit inquiry happens whenever you apply for a new line of credit. In the States, the number of credit applications you complete within a given time period counts for 10% of your FICO credit score.

Each time you have a hard inquiry on your credit report, it drops your credit score by at least a few points.

In both countries, you must give your consent before a company can do a hard inquiry (sometimes known as a hard pull) on your credit.

A soft inquiry happens when either you or a company reviews your credit score or report for educational purposes only, and not in order to make lending decisions. This type of inquiry does not impact your credit score.

Financial associates vs. cosigners - similar but different

In the UK, a financial associate means someone you share either a bank account or credit account with, whether that’s a spouse or someone else.

According to Experian UK, a financial associate’s credit history doesn’t appear in your credit report, but lenders can view it when you apply for credit. This is because your financial associate’s circumstances may impact your ability to repay what you borrow.

“Lenders could take a financial associate’s financial behaviour into account even if you’re applying for new credit on your own. If your associate has poor credit history, this could potentially impact your ability to obtain a new credit agreement,” Equifax UK writes.

In the US, a cosigner is someone who specifically signs up for a loan with you. For example, you and your spouse take out a mortgage together, or your parent cosigns on a car loan with you that you might not qualify for on your own.

In the case of a cosigner, only their behavior on your joint credit account impacts your personal credit, not their financial behavior in general.

So while the account you have with them could impact your overall credit score and credit history, as long as your cosigner manages your joint account responsibly, their behavior on their other credit accounts will not impact a lender’s decision regarding whether or not to extend you credit.

The similarity between financial associates and cosigners? In both cases, you’re entrusting someone else with power over your credit. So choose these people wisely. (See more about how cosigning affects your credit.)

Final thoughts

While credit systems in any country can seem confusing if you don’t understand their nuances, it’s important to understand how best to be financially successful in your new home. That way, you’re more able to take advantage of premium financial products and services, and be less susceptible to predatory or less favorable options.

About the author

Lauren Bringle is an Accredited Financial Counselor® and Content Marketing Manager for Self and editor of their blog.