Rent to Income Ratio: How Much Should You Spend On Rent?

Published on: 12/27/2021

In the United States, homeownership remains a distant dream for many. Housing costs are surging, [1] and the student loan debt crisis has limited young Americans from mortgage approvals. [2] And in major cities such as New York and San Francisco, the high cost of living makes buying a house all but impossible.

For many people, renting a house or apartment is a much more affordable option. Yet, as living costs are going up across the country, potential renters need to understand how much they need to satisfy apartment income requirements and remain within budget.

The rent to income ratio is a great rule of thumb for renters to ensure they make enough money to pay for rent and other needed expenses. This article will highlight the math behind the ratio, rent requirements, and strategies to reduce rent expenses.

What is the rent to income ratio?

The rent-to-income ratio is a formula based on monthly gross income. You can use it to determine if you can afford an apartment's monthly rent. Likewise, landlords use it to determine if a potential tenant can afford a rental property's lease. In basic terms, the ratio indicates how much of a person's monthly household income is spent on rent.

How to calculate rent to income ratio

Calculating the rent to income ratio is straightforward. First, a renter should take their monthly gross income and multiply it by a percentage. This percentage, typically 30 percent, is the amount set aside from their monthly paycheck for rent each month.

Consumerfinance.gov offers an online debt-to-income ratio calculator tool that helps with calculations and gives greater context on the maximum rent amount across various incomes. [3]

Specifically, rent is a large part of fixed monthly expenses, but it is not the only expense. For example, suppose you set aside 30 percent of your gross monthly paycheck for rent. That leaves 70 percent remaining for savings and other recurring monthly debt payments, such as car payments, student loans, credit cards, groceries, and subscriptions.

Although this calculation uses gross monthly income, understand that gross monthly income does not factor in state and federal taxes or other payroll deductions like health insurance. To find gross income for rent-to-income ratio calculation, look at a paycheck stub for the amount before deductions, not what was deposited. The income deposited into a bank account is usually the net income amount after deductions and taxes have been taken out. [4]

This distinction matters because renters use their net income, or take-home pay, to pay for their monthly expenses. Depending on payroll deductions, there can be hundreds of dollars difference between gross and net income on each paycheck. Therefore, keeping rent at 30% or less of gross income ensures enough money left to pay for other monthly responsibilities.

How much should I spend on rent?

Depending on who asks the question, how much a person should spend on rent will have a different answer. Various circumstances such as higher costs of living areas, existing debt obligations, and total monthly income vary for each person. Ultimately, it comes down to how much the renter can afford to spend on rent each month.

Rent is a staple expense each month. But, unlike other fixed payment terms, like credit cards, a rent payment typically isn’t reported to credit bureaus. So, unless you miss your payments and the bill goes to collections, rent does not impact your credit score and is only going to provide housing.

A common rule is that a renter should spend 30% or less of their income on rent. However, given the increased rent in high-cost areas, this may not be possible for every household. Some may even need to allocate 40%-50%, even when choosing affordable options. [5]

What is the 30% rule?

The 30% rule, which has long been an industry standard, is based on the 1969 Brooke Amendment on public housing requirements. The United States Housing Act Amendment stated that rent prices for public housing couldn’t exceed 25% of a tenant’s income. [6]

Fifty years later, it has become a demanding standard to achieve. Today, individuals are saddled with inflation and financial burdens that renters did not experience in 1969. This burden includes high student loans interest and payments, 401k contributions, and dependent costs.

These days, the 30% rule is still in use across the rental industry. But, experts now recommend that renters take their specific circumstances into account. [5] For example, 30% of a paycheck has a different impact for single individuals with no dependents and low debt obligations than for a family of five with high student loans and credit card payments.

This disparity is why the Housing Choice Voucher Program (formerly known as Section 8) uses family size and total annual gross income to determine eligibility for housing vouchers. The renter in a voucher program must contribute a minimum of 30% of their income towards rent. The government assistance program pays the difference as long as the renter stays at an approved housing rental. [7]

Due to inflation, including the rising cost of housing in many places throughout the United States, many people ask: Is Section 8 outdated? And by extension, is the 30% rule outdated?

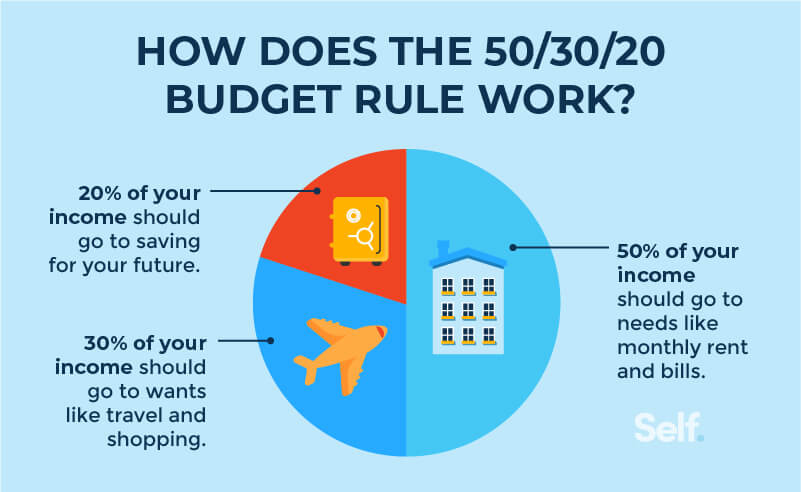

What is the 50/30/20 rule?

The 50/30/20 rule is an alternative to the 30% rule. This budget rule originated from Senator Elizabeth Warren. First, it recommends that 20% of net pay go towards existing debt or be put into savings if there is no debt. Then, 50% should go to necessary expenses, which include your rental housing expense, food, and healthcare. The remaining 30% is for luxuries. [8]

Proponents of this rule argue that it more correctly highlights the present needs of people today and can also be adjusted based on individual obligations. For example, if a high-interest debt is more of an issue, the 30% luxury fund allocation can help pay it down. In addition, by using this rule, renters can better envision how much their rent payments will affect the other necessary areas of their life.

Why do landlords use the rent-to-income ratio?

Landlords also use-rent-to income ratio to determine if a potential renter makes enough money to afford rent. Generally, landlords use 30% of a prospective tenant's gross annual income. [9] The math looks like this: (gross yearly earning / 12) x 0.3. For example, a renter making $70,000 per year will have a monthly rent-to-income allowance of $1,750.

Property managers use this calculation to avoid risk and determine if a potential renter meets rent requirements. But, renters can also use it to determine if they can afford an apartment’s rent.

A shortcoming of this formula is that it doesn’t account for other debts or necessary expenses. Say a renter with a rent-to-income budget of $1,750 finds a location for $1,500 a month. That rent is within the rent-to-income budget, but if they have other financial obligations, such as credit card bills and child care expenses, they may find themselves running short on money and having to choose what to cut.

What are common income requirements for renting an apartment?

Another way to look at the 30% rule is that a renter's monthly income should be three times their monthly rent. However, even when they meet this requirement, there are other screening processes a potential renter must pass.

Most landlords run a credit check on prospective renters to ensure that they have a history of paying bills on time. Of course, it is possible to get an apartment when you have bad credit. But poor credit makes it less likely the landlord will approve the renter. Rejection can be a stark reminder for potential renters to fix their credit.

Landlords might also review previous rental history to check for any evictions. In addition, landlords can request a tenant screening credit and background check to look for criminal records. A personal reference might also be required, and for renters bringing a pet, a landlord might request vaccination records.

Do I have to make exactly 3 times the monthly rent?

Since the Brooke Amendment, the 30% and “3 times the rent rule” has persisted. [10] This standard is mainly due to its ease of use. And it typically works. Although there are exceptions, generally, when a renter doesn't make at least three times their rent, there is a good chance they might, at some point, be unable to afford rent.

Of course, there are always exceptions. For example, landlords might require an income of three times the maximum rent for anyone living on the property, including roommates. Sometimes, a cosigner’s income can be used to fill this requirement for renters such as students. This is often done as a safety net for the landlord. A proven and dependable guarantor can convince a landlord to approve a lease, even if a renter doesn’t meet the 30% rule.

Does rent affect credit score?

Regarding the impact of rental history on building existing credit history, landlords usually don’t report rent to credit bureaus. For rental agreements, a landlord might run a check on a potential tenant’s credit report. But, unless a landlord runs a hard credit check, this should not negatively impact a credit score.

Although there are services a landlord can use to report on-time payments, it is not the norm. Paying rent isn’t typically seen as a method to build credit. The most current FICO model (FICO 9) does include rent payments. But, currently, this model is not in high use.

If a renter has bad credit or no credit, there is still a chance that a landlord might approve their application. The first step they should take is to inform the landlord about their specific financial situation. Renters should warn potential landlords about what they might see on a credit report.

Specific credit circumstances can impact a credit score, but not so much the ability to pay rent, such as student loans and medical debt. Renters could also offer a higher initial security deposit to secure a location. Of course, a renter will need to have that money upfront, but it is an option.

How to reduce rent expenses

There are several ways for renters to reduce rent. Negotiating with your landlord about the price of rent should be done before signing a lease. Once the lease documents are finalized, there is little chance that rent will ever decrease.

Make a list of what matters and which amenities are essential. For example, trash pickup, extra utilities, and even pool access can bump up the rent. On the other hand, paying extra for an on-site gym and jacuzzi room might not be needed for renters who just need a safe place to sleep and relax. Likewise, if there aren’t pests and the apartments are clean, perhaps the outside facade doesn’t need pristine landscaping.

Having roommates can mitigate high rent costs. However, more people means a higher annual salary is required to pay rent. So, renters will have to do the math to account for cost and space.

Finally, find small ways to reduce costs by saving on utilities, like turning off the air conditioning and switching off lights when they aren’t in use. While these don’t directly contribute to rent, they do impact your living expenses.

The bottom line

There is no exact way to answer how much anyone should spend on rent when it comes down to it. Though the definition of rent-to-income ratio may be outdated, landlords still use it as the industry standard.

In general, it is ideal for renters to plan on rent taking up 30% of their paycheck. Staying within this budget helps ensure that renters can afford housing costs and other monthly bills and obligations.

Before renting, it is a good idea to have a good credit score and previous leasing history, if possible. If needed, getting a credit builder loan or having a cosigner or friends split the bill could help too.

Sources

- Bloomberg. “U.S. Housing Prices Jump the Most in More than Three Decades.” https://www.bloomberg.com/news/articles/2021-06-29/u-s-housing-prices-surge-the-most-in-more-than-three-decades. Accessed October 20, 2021.

- Fox Business. “35% of millennials say student loan debt is preventing them from buying a home: survey”. https://www.foxbusiness.com/personal-finance/millennials-student-loan-debt-buying-a-home. Accessed October 20, 2021.

- Consumerfinance.gov. “Debt to Income Calculator” https://files.consumerfinance.gov/f/documents/cfpb_your-money-your-goals_debt_income_calc_tool_2018-11_ADA.pdf. Accessed August 17, 2021.

- Indeed. “What Is Gross Monthly Income? Definition and Examples” https://www.indeed.com/career-advice/career-development/what-is-gross-monthly-income/. Accessed August 17, 2021.

- New York Times. “What's the new thinking on how much of your income should go toward rent? And specifically, which kind of income (gross, net) should I be using for that calculation?” https://www.nytimes.com/ask/answers/monthly-budget-rent-income. Accessed August 17, 2021.

- US Department of Housing. “US DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT MAJOR LEGISLATION ON HOUSING AND URBAN DEVELOPMENT ENACTED SINCE 1932” https://www.hud.gov/sites/documents/LEGS_CHRON_JUNE2014.PDF. Accessed August 17, 2021.

- US Department of Housing. “Housing Choice Voucher Program Section 8 | HUD.gov / US Department of Housing and Urban Development”. https://www.hud.gov/topics/housing_choice_voucher_program_section_8. Accessed August 17, 2021.

- CNBC. “How to follow the 50-30-20 budgeting strategy”. https://www.cnbc.com/2021/05/11/how-to-follow-the-50-30-20-budgeting-strategy.html. Accessed August 17, 2021.

- American Apartment Owners Association. “Rent to Income Ratio: Calculation Guide for Landlords”. https://www.american-apartment-owners-association.org/property-management/rent-to-income-ratio. Accessed August 17, 2021.

- CNBC. “Here’s how much of your income you should be spending on housing”. https://www.cnbc.com/2018/06/06/how-much-of-your-income-you-should-be-spending-on-housing.html. Accessed August 24, 2021.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.