When You Should (and Shouldn't) Increase Your Credit Limit

Published on: 02/14/2022

Depending on your financial situation and credit score, increasing your credit limit can be advantageous. However, there are also times when you may want to avoid making any changes to your lines of credit. Here’s when you should increase your credit limit and when you shouldn’t.

Table of contents

- When Should I Increase My Credit Limit?

- When Shouldn't I Increase My Credit Limit?

- How to Get a Credit Limit Increase

- Benefits of Increasing Your Credit Limit

- Downsides to Increasing Your Credit Limit

- Credit Limit Increase vs. New Card

- Can You Lower Your Credit Limit?

When should I increase my credit limit?

When you should increase your credit depends on your situation and your specific goals. When it comes to your credit score, it’s not your credit limit that matters, but your credit utilization ratio: the amount of debt you have overall in relation to your total credit limit on all your cards.

The ideal credit limit will vary from person to person. You may want to have more available as an emergency backup, or you may want to keep your total credit low so you’re not tempted to rack up large amounts of debt. [1] Either way, keeping your debt low in relation to your credit limit is the key to maintaining a good FICO® credit score.

With this in mind, you might want to consider increasing your credit limit if your income has increased, if your credit score has risen, or if you’ve had a major life event that has impacted your spending.

After your annual income has increased

If you’ve just gotten a raise, you can alert your credit card company by updating your income on your account. In many cases, if you’re in good standing, the company will raise your credit limit based on this information alone. [2]

When your credit score has recently gone up

If your credit score has recently gone up, it’s a sign to your credit card issuer that you’re managing your credit and you are likely a safe risk for handling it more successfully. A good credit score on the FICO scale is 670 or more, while very good credit is in the 740-799 range, and excellent credit is 800 or more.

After major life events that impact spending

If you’ve just purchased a home and need to buy furniture, or your life has changed in some other way that you foresee needing to access more credit, then it’s a good time to seek an increase in your credit limit. You might also need a boost if you’ve gotten married or welcomed a new child.

It's important to remember that increasing your credit limit doesn't mean building up your debt. Building up too much debt on your card in relation to your credit limit can hurt your credit score.

When shouldn't I increase my credit limit?

While mostly positive, a credit limit increase can potentially harm your credit score. Thus, there are times when you may want to avoid asking for one.

If your credit cards are already maxed out

If your credit cards are maxed out, it’s not the time to ask for more credit. For one thing, having your credit cards at their limit can be an indication that you’re not managing your credit well. If they’re maxed out because of an unforeseen crisis, it’s time to start paying them down, rather than asking for more credit. This is because your credit utilization rate will be high, thus causing a negative effect on your credit score. It will also give lenders pause about granting you more credit.

When you have a bad credit score

If you have a low or bad credit score, lenders may be unlikely to approve you for new credit. Under the FICO scoring system, anything between 580 and 670 is considered fair, and scores of 579 and below are “very poor.” Prospective borrowers with scores in these ranges may be considered subprime borrowers and have a harder time getting loans. Those who do will probably face higher interest rates and increased fees, which can add to your debt load.

If your income has recently decreased

If your income has recently gone down, you’ll have less ability to meet your debt obligations than before. Lenders will also have less reason to trust you with new debt based on what they will see as your reduced ability to pay.

If you just got a new card or increased your credit limit

If you have recently been approved for a new credit card or have had a credit limit increase, asking for another card or increase too soon afterward probably isn’t a good idea. Lenders may worry that you have more debt obligations than you can manage. What’s more, putting in too many credit applications in a short period of time can damage your credit because each such application—known as a hard credit inquiry or “hard pull”—will likely drop your credit score by a few points.

How to get a credit limit increase

There are two ways to get an increase on an existing credit card. You can ask for one or you can receive one at the discretion of the lender.

Ask for a credit increase

There are a couple of ways to ask for a credit line increase. You can call the number on the back of your card and request one by phone, or you may be able to request an increase online.

Receive an automatic credit limit increase

Your credit card company may automatically increase your credit limit—even if you don’t ask for it. An automatic increase will likely happen if you’ve been responsible about managing your credit. Lenders will look favorably on you if you have been consistent with on-time payments while still using your credit card regularly.

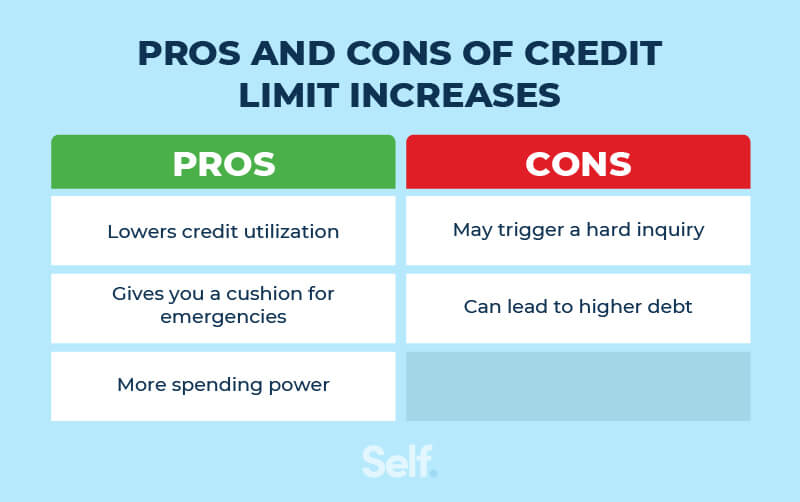

Benefits of increasing your credit limit

By itself, increasing your credit limit will have a positive impact on your credit score. This is because it will lower your credit utilization rate (CUR).

Lowers your credit utilization

Your credit utilization ratio is one of the major factors used in calculating your credit score. Under the FICO system, it accounts for 30% of your score, which is second only in importance to your payment history (35%).

Experts advise you to keep that figure at 30% or lower, though 10% or lower is ideal. [3]

How to calculate your credit utilization rate

Your credit utilization rate is calculated based on your total credit limit and total debt. Those numbers are for all your credit cards put together.

Say, for example, you have $1,000 in debt on four cards, and a total of $7,000 in credit on those cards. You can figure out your credit utilization ratio by dividing your debt total by your overall credit limit. In this case, your CUR would be 14.2%.

Gives you a cushion for emergencies

Having a higher credit limit can increase your spending limit as well. This can be useful if you have an emergency, like a medical bill or car repair, or need to make a larger purchase.

Downsides to increasing your credit limit

Trying to increase your credit limit at the wrong time can cause problems. What you do with the increase can damage your credit, too, if you end up accumulating too much debt.

Can trigger a hard credit pull

A hard inquiry or hard credit pull occurs when a lender pulls your credit report from one of the three major reporting bureaus (Equifax, Experian, and TransUnion) to check on your creditworthiness. A hard inquiry does not always occur when you request a credit increase. It varies from lender to lender, so ask before requesting an increase if you’re unsure.

Can lead to more debt accumulation

Increasing your credit limit alone will not cause you to accumulate more debt. It’s possible to avoid this entirely by controlling your spending and making a strong budget. However, for people who have a difficult time sticking to a budget and are tempted to treat credit like cash, the risk of accumulating more debt is very real.

Credit limit increase vs. new card

If you’re seeking to increase your credit, you can do so on an existing card or you can apply for a new line of credit. Which course you choose (should you decide on either) depends on a few factors.

Asking for a credit increase on a card you already have has a couple of advantages. First, it may not trigger a hard inquiry, so it will not affect your credit. Second, it may be easier to get a credit increase than it would be to qualify for a second credit card.

On the other hand, if you only have one credit card currently, it might be helpful to apply for a second card. Getting a second credit card, or a different type of credit card, can help show lenders that you can handle more than one line of credit responsibly. It can enhance your credit mix, which accounts for 10% of your credit score under the FICO system.

Can you lower your credit limit?

Credit card companies can not only increase your credit limit, they can lower it, too. They can even lower it to the point that you have no more available credit and can’t make any more charges until you pay off a portion of your balance. [4]

Credit card issuers will generally lower your credit limit if they think you may not be able to manage your existing limit. You might have begun to miss payments, or perhaps your income level was reduced.

A lender doesn’t need your permission to lower your credit limit. However, a lender cannot charge you a fee for going over a new reduced limit until 45 days after giving you notice of the reduction.

How a credit limit decrease affects your credit score

A reduction in your credit limit can hurt your credit score by raising your credit utilization ratio. If you go from utilizing 70% of your available credit to 100%, it will impact your overall CUR. How much it does so depends on a number of factors such as how many credit cards you have and what your ratio of debt to credit limit is on those other cards when they’re all added together.

If you see your credit limit being lowered and are worried about the effect that has on your CUR, you have some options available.

If you are in good standing, you can contact your lender and ask to have your former limit reinstated. Alternatively, you can contact another lender with whom you are a cardholder and ask for additional credit, that is, an increase in your credit card limit there. If these options both fail, you can consider applying for a new line of credit elsewhere.

These are options for the short term. In the long term, you can increase your credit limit by building credit. You can also check your credit report for any signs of fraud or errors and dispute them and, by doing so, potentially raise your credit score.

Decide if a credit limit increase is right for you

If you have a high credit card balance or a good deal of credit card debt, it can be tempting to ask for more credit. Whether this is a good idea or not for your overall personal finance depends largely on your situation. The total amount of your debt, your ability to pay it off, changes in your income, and a desire to increase your credit utilization rate are all factors worth considering.

Sources

- Forbes. “How Much Credit Should I Have, And Does It Impact My Credit Score?” https://www.forbes.com/advisor/credit-score/how-much-credit-should-i-have. Accessed October 11, 2021.

- CNBC. “When to ask for a credit limit increase,” https://www.cnbc.com/select/when-to-ask-for-a-credit-limit-increase. Accessed October 11, 2021.

- CNBC. “Does a $0 balance on your credit card make your score go up?”

- https://www.cnbc.com/select/what-is-a-good-credit-utilization-ratio. Accessed October 11, 2021.

- Consumer Financial Protection Bureau. “Can my credit card issuer reduce my credit limit?” https://www.consumerfinance.gov/ask-cfpb/can-my-credit-card-issuer-reduce-my-credit-limit-en-74. Accessed October 11, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program and has taught workshops for nonprofits in NYC.