Should You Pay Your Credit Card in Full or Leave a Balance?

Published on: 02/27/2023

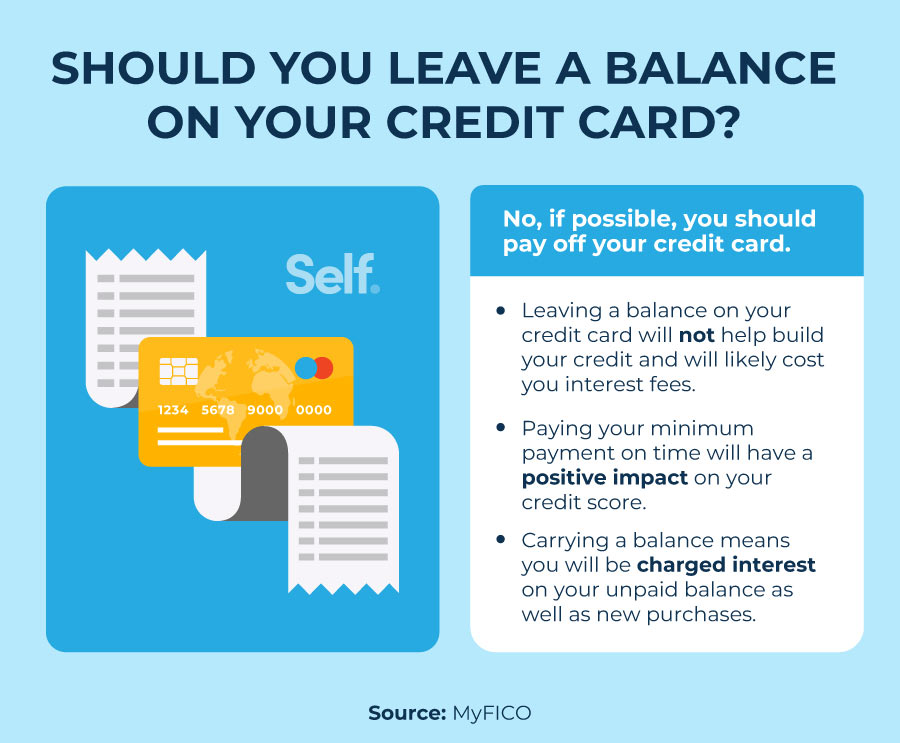

Leaving a balance on your credit card does not help your credit score. Although FICO® Scores always consider it positive when you make your minimum payment on time, these scores don’t consider whether you’re carrying a balance month to month. So leaving a balance doesn’t raise your score, but paying your balance may positively impact your credit and may help you to avoid accruing high interest charges.[1]

This post discusses how carrying a balance can impact your credit, as well as other considerations for building good credit card habits.

Should you leave a balance or pay off your credit card?

Leaving a small balance on your credit card will generally not help build your credit score. FICO® Scores don’t consider whether you carry a balance each month, but they do consider how much you owe overall, how high a balance you carry compared to your credit limit, and whether you pay on time. If you can afford to do so, paying your credit card bill in full by your due date may positively impact your credit.[1]

How does carrying a balance impact your credit?

Even if you can’t pay your full statement balance, credit card issuers consider it an on-time payment if you pay the minimum each month by your due date. Making regular on-time credit card payments can help your payment history and your credit score. Paying less than the minimum payment or paying late can negatively impact your credit. Your payment history is the most important factor for your credit score, making up 35% of your FICO® Score.[2]

Potential lenders who pull your credit report can see what balances your credit cards currently carry. If you have several credit accounts with balances, it may indicate to lenders that you pose a higher risk of overextending financially.[3] Credit card companies typically report your balances to the three major credit bureaus by the end of each billing cycle, generally within 30 to 45 days.[4]

If you have a high overall credit card balance compared to your total available credit, this may also negatively affect your credit score. Your credit utilization ratio (CUR) — your total revolving credit debt divided by your total credit limit on revolving accounts — impacts your amount owed factor, which makes up 30% of your FICO® Score.[3] According to FICO®, some financial experts suggest maintaining a credit utilization ratio below 30%, but also say that keeping it below 10% may offer the best chance to help you build and maintain a good credit score.[5]

Carrying a balance can be expensive

Credit card companies may offer a grace period between the end of a billing cycle and the date your payment is due. If your credit card offers a grace period, you can avoid paying interest or late fees as long as you pay your balance in full by the statement due date. If you carry over a balance, however, the card issuer will charge interest on any unpaid balance as well as on any new purchases in the new billing cycle.

Because of high interest rates, credit card interest charges can get expensive quickly. Adding interest charges to your balance can increase the total amount of credit card debt you owe. If you increase your credit card debt, you risk having a high utilization rate, and you may end up having trouble making your minimum payment, both of which have the potential to negatively impact your credit score.[6]

Grace periods typically only apply to new purchase transactions and not cash advances or checks issued by your card company. If you don’t pay on time and in full, you may lose your grace period for the month that you don’t pay in full and the following month.[6]

Building good habits with your credit card

Building a strong credit history takes time, but the following tips can help you take positive steps to improve your personal finances.

Establish a positive payment history

By paying off your credit card in full or at least making the minimum payment each month, you can work to build a strong payment history that may help your credit score. The largest factor in your credit score calculation, payment history makes up 35% of your FICO® Score.[2]

The importance of payment history helps explain the negative consequences if you stop paying your credit cards. If you stop paying your minimum balance, pay less than your minimum balance or pay late, all of these actions negatively impact your credit.

Reduce your amounts owed

Although on-time payments of just the minimum payment still count as positive payment history, your credit card balance will be reflected in your credit report. Potential lenders and credit scoring models may evaluate whether you have many accounts with balances owed on them as well as your credit utilization ratio (CUR), your total revolving balances divided by your total credit limits. Your CUR impacts your amounts owed, the second largest factor of your FICO® Score, making up 30% of your score.[3]

Although you may pay off your credit cards in full each month, your credit report may show a balance on your credit cards even if you know you paid in full and have a zero balance on each card. The last statement’s balance typically gets reported and shows up on your credit report. So keeping your use of credit low each month is the best way to lower both your CUR and your total amounts owed, which means you may also see your credit score go up.[3]

Keep your grace period

If you pay your bill in full and on time each month, you generally won’t lose your grace period. Credit card companies must provide your credit card statements to you at least 21 days before your due date. If you don’t pay your entire balance by the date indicated, you may lose your grace period for the month that you don’t pay in full and for the month after.[6]

Avoid interest charges

Credit card companies typically charge interest or your current APR if you carry your balance over to the next month, which means you’ll be paying extra on top of the unpaid balance you owe. By paying your credit card off in full by the due date, you can avoid paying interest charges and any late fees.[6]

Build your credit

If you have high balances on your credit card, have made more than a few late payments or find yourself with generally bad credit, you are probably looking to get back on track financially. Self has a variety of tools that may help you improve your credit. Our resources and information can help you better understand how your financial decisions can affect your credit.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- MyFICO. “Is Carrying Credit Card Balances a Good Strategy to Increase Your FICO® Scores?” https://www.myfico.com/credit-education/blog/carrying-credit-card-balances-myth. Accessed on November 10, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed on January 24, 2023.

- MyFICO. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed on November 10, 2022.

- Experian. “Why Is the Credit Card Balance on My Credit Report Different?” https://www.experian.com/blogs/ask-experian/why-is-the-credit-card-balance-on-my-credit-report-different. Accessed on November 10, 2022.

- MyFICO. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed on November 10, 2022.

- Consumer Financial Protection Bureau. “What is a grace period for a credit card?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-grace-period-for-a-credit-card-en-47. Accessed on November 10, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).