How Credit Works

Your credit score is impacted by many of the financial choices you make –from opening too many accounts to missing payments.

What seems to many to be a small, three-digit number can have a huge impact on your financial choices in life.

Your credit score is a gauge lenders use to evaluate your creditworthiness. It helps them decide not only whether you’ll be approved for things such as private student loans or mortgages, but also, and sometimes more importantly, how much you’ll pay for each of those loans.

To truly understand what affects your credit score, let’s take a look at what goes into it.

How is my credit score calculated?

Credit scores are calculated using a number of factors relating to how you use credit. These different credit score factors are weighted based on how important each of the categories is in determining how your score is calculated. Let’s take a look at some of the most important factors that affect your credit score:

Payment history

Your payment history is one of the most important things used to determine your credit score. It shows your track record of repaying funds that are lent to you either via a credit card, loan, or other type of credit agreement.

The payment history part of your credit score includes things like:

- Whether you have a history of making repayments on time for each of the credit accounts you have or have had in the past. If you miss payment deadlines, this will have a negative impact on your score.

- How late your payments were if you have made them late; the later your payments are, the more of a negative effect this will have on your credit score.

- If there are any items of public record against you such as foreclosures, bankruptcies, debt settlements, charge-offs, or liens against you. These can have some of the most serious negative impacts on your credit score.

- Whether any of your credit accounts have been sent to collections, indicating to lenders that you may pose a risk of not paying them back if they lend to you.

Amounts owed

The amounts you owe on your credit accounts are determined by how much debt you have compared to how much credit you have available. This can also be known as your credit utilization ratio. It’s generally a good idea to keep your credit utilization ratio below 10%.[1] This means that if you have a credit limit of $1,000, your balance should be under $100 and to maintain your score always try to keep it under $300. If you have multiple credit cards you should try to maintain these ratios across each card and all cards combined.

Things that have an effect on this portion of your credit score include:

- The percentage of your available credit you have used. People with a high credit utilization ratio will typically be seen as more of a risk to lenders.

- How much you owe across all your accounts, not just credit cards. This category also factors in how much you owe on specific types of accounts like car loans, installment loans and mortgages.

Length of your credit history

The amount of time that you’ve had credit accounts open can have an impact on your score. It’s helpful for creditors to see how long you have been using credit, the average age of your credit accounts, and how long you’ve been making consistent payments.

A longer credit history can be seen favorably by lenders, but this factor has less weight than others because someone with a shorter credit history can still demonstrate responsible credit use with on-time payments and low credit utilization.

New credit accounts

While opening a new credit account can have a minimal impact on your credit score, applying for a lot of new credit cards in a short space of time can indicate that someone is having issues with cash flow and needs to take multiple lines of credit to cover their expenses.

When you apply for a new credit account, the lender will often carry out a hard inquiry where they check your credit report. This differs from a soft inquiry such as when you check your own credit report. Hard inquiries can create a small drop in your credit score.

Credit mix

Your credit mix refers to the different types of credit accounts you have open. This plays a smaller role in determining your overall credit score, although having a good mix of different types of credit can have a positive effect on your score.[2]

Each of these factors will go into your credit report, which you can access for free once a year from the three credit reporting agencies at annualcreditreport.com. The information on your credit report is used to determine your credit score. Keep in mind your credit score can change multiple times throughout the year depending on your credit activity.

How different scoring models calculate credit scores

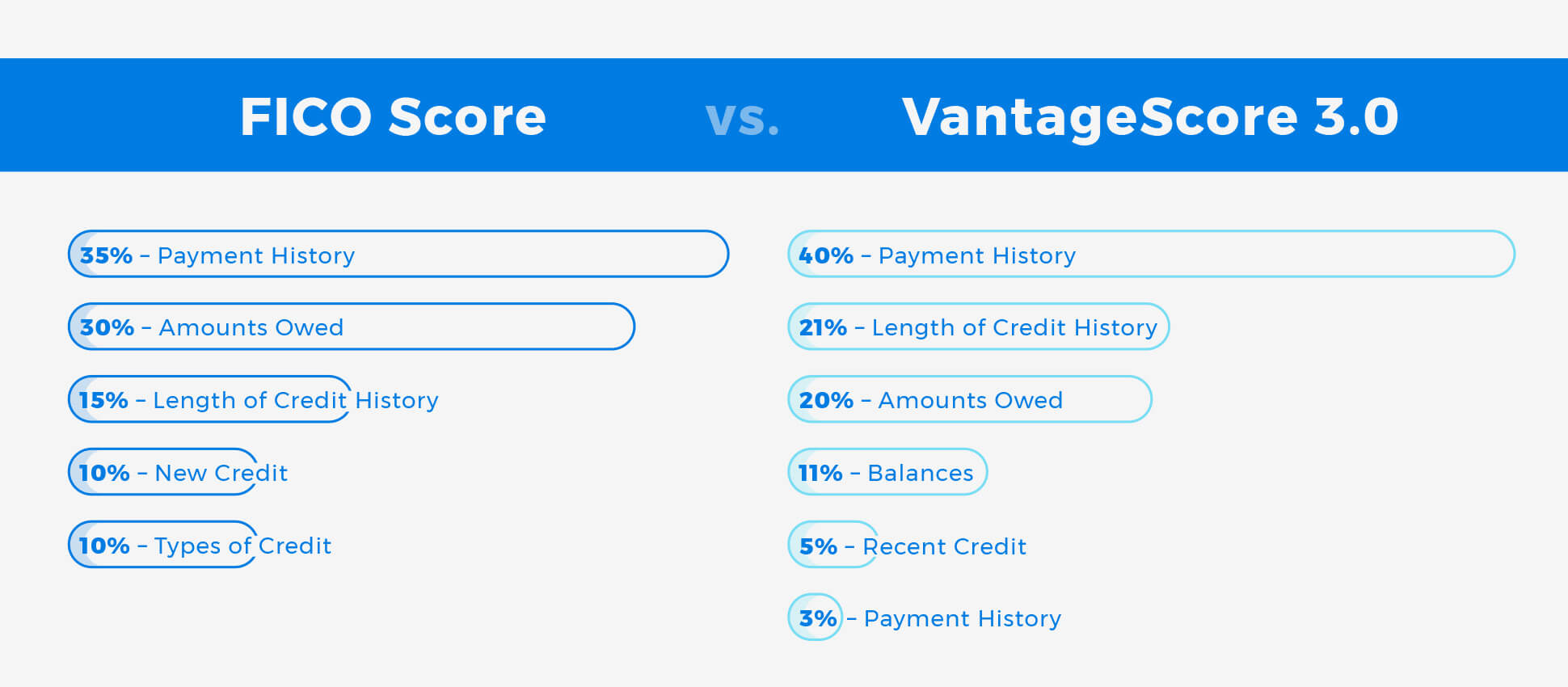

While both FICO® and VantageScore rely on the same basic categories to establish credit scores, they place slightly different emphasis on certain categories.

- Payment History - 35%

- Amounts Owed - 30%

- Length of Credit History - 15%

- New Credit - 10%

- Types of Credit - 10%

The VantageScore 3.0 model uses slightly different criteria to calculate credit scores. It includes six factors as opposed to FICO’s five, and places different emphasis on each of these factors.

- Payment History - 40%

- Length of Credit History - 21%

- Credit Utilization - 20%

- Balances - 11%

- Recent Credit - 5%

- Available Credit - 3%

Sources

- Credit Utilization Ratio - Experian https://www.experian.com/blogs/ask-experian/what-should-my-credit-card-utilization-be/#:~:text=A%20good%20rule%20of%20thumb,good%20credit%20score%20or%20better

- What’s in Your Credit Score? - FICO https://www.myfico.com/credit-education/whats-in-your-credit-score