How to Write a Credit Dispute Letter (With Templates)

Published on: 05/08/2023

Finding an error on your credit report can be extremely stressful. The best course of action for credit report errors is to file a credit report dispute. If you’re looking for guidance on how to dispute errors on any of your credit reports, or how to write a credit report dispute letter, you’ve come to the right place.

Fixing credit report errors may impact your credit score. However, a positive or negative impact isn’t guaranteed: Any change to your score depends on your unique credit history, the type of errors you’re dealing with and what credit scoring model is used.[1] Regardless, to keep your credit file accurate, it’s important to dispute any errors you catch. Keep in mind that only legitimate errors can be corrected — accurate negative information can’t be removed.

In this article, we explain how to write a credit dispute letter by providing easy-to-follow templates and instructions on what to include, as well as where to send your letter when it’s ready.

Table of contents

- What is a credit dispute letter?

- What information can you dispute on your credit reports?

- What information can’t you dispute on your credit reports?

- How do you write a credit dispute letter?

- How do you find errors on your credit report?

- Will disputing information impact my credit score?

- Where do you send your credit dispute letter?

- How long does it take to dispute errors on your credit report?

- Why is it important to correct errors on your credit reports?

What is a credit dispute letter?

Whether you’re trying to build your credit, repair your credit or just clean up your credit report so that potential lenders see only accurate information, a credit dispute letter is a letter that you write to correct information on your credit reports. You typically send the letter to the credit reporting company or credit bureau that reported the error or omission. The letter should explain what information you think is wrong and why. Also include any documents that support your dispute.[2]

You get a credit report from each of the three credit bureaus — Equifax, Experian and TransUnion — so you may need to write and send a letter to each one that reported the error. Additionally, the Consumer Financial Protection Bureau (CFPB) recommends that you write to the company or lender, known as the information furnisher, that provided the wrong information to the bureau in the first place.[3]

What information can you dispute on your credit reports?

You can dispute any inaccurate information that appears on your credit report. Here are some of the common types of credit report errors to look out for and dispute.[4]

- Identity errors: These errors either misidentify you by getting your personal information wrong or include accounts that belong to a different person with a similar or same name as you. You also could have accounts on your report that aren’t yours as a result of identity theft.

- Incorrectly reported account statuses: These errors misstate the status of your accounts, like reporting closed accounts as open or accounts you’ve paid on time as delinquent or late. You might also see an identical debt listed more than once.

- Data management errors: These errors involve reinsertion of incorrect information after it was corrected. You should also look out for the same accounts that appear multiple times with different creditors listed, especially if you’re dealing with an account in collections.

- Balance errors: These errors misstate your account balances, including balances you currently carry, like credit card debt, or your credit limit.

What information can’t you dispute on your credit reports?

You can’t have negative items removed from your credit report if they’re legitimate. If a credit repair company offers to have accurate negative information removed from your report for a fee to restore your credit, it may be a scam.[5]

Here are the most common negative items you might find on your credit report, and how long each stays on your report:

- Late payments: Seven years

- Bankruptcies: From the date the bankruptcy was filed, seven years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies

- Foreclosures: Seven years

- Collections: Seven years from the date of delinquency

- Public record: Seven years[6]

How do you write a credit dispute letter?

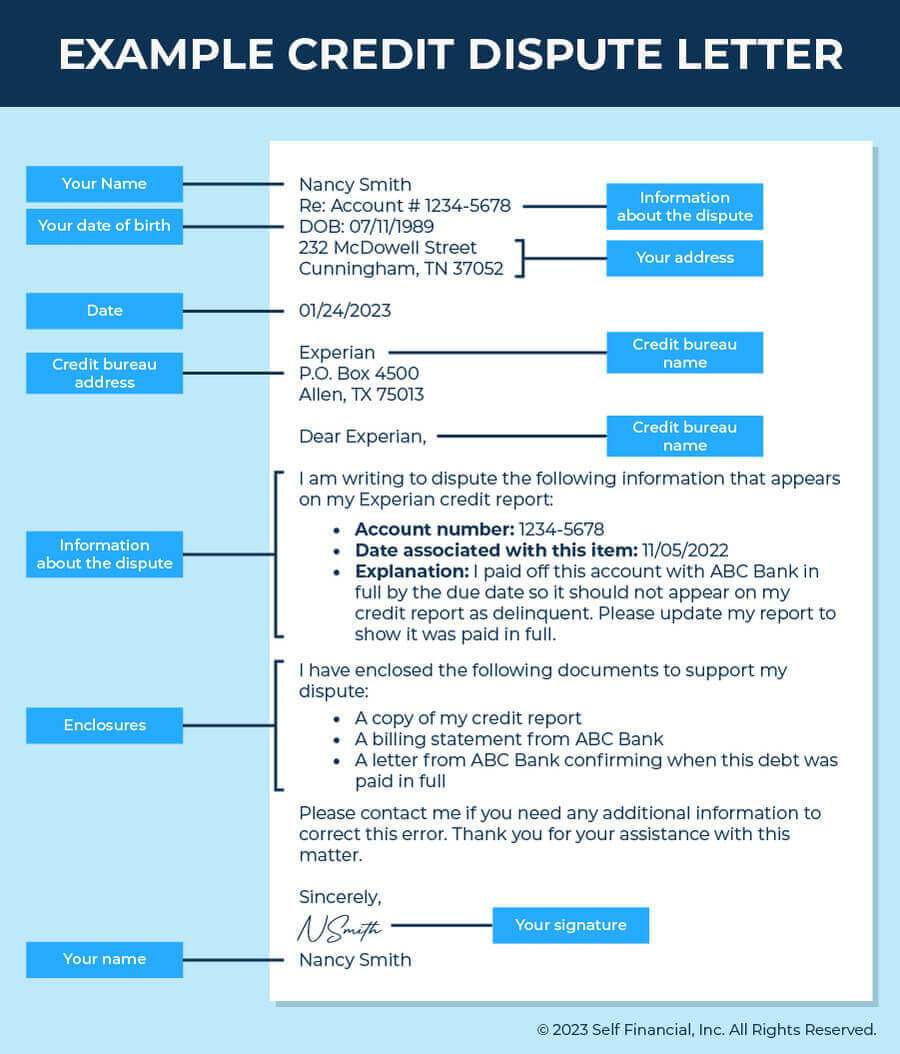

Writing a credit dispute letter involves several important parts: the information in the letter, the supporting documentation you include and where and how you send the letter. Here’s how to go about writing and sending a credit dispute letter for both the credit bureaus as well as the information furnisher, broken down step by step.

What information do you need to include?

Make sure you include the following information in your dispute letter:

- Personal information — your full name, consumer report/ID number, date of birth, address and contact information. It’s optional to include your driver’s license number and social security number.

- Company information — the name of the credit bureau or information furnisher and its address.

- Details about the dispute

a. If writing to a credit bureau — your account number, date of disputed information, explanation of what’s wrong, company that provided the information and the type of information being disputed.

b. If writing to the information furnisher — name of the credit report (i.e., which credit bureau), the disputed items you’d like corrected, date of the disputed information and explanation of what’s wrong. - Enclosures — list of supporting documents included with the letter (use copies, not the originals) [2], [3]

Credit dispute letter templates

You can legally dispute information on your credit report for free. The Fair Credit Reporting Act (FCRA) gives consumers the right to dispute information for free and requires that the credit bureau and the company that supplied the incorrect information correct it for free as well. Section 609 of the FCRA addresses your right to request copies of your credit reports and information that appears on them.[7]

You don’t need to purchase a template to create your letter — you can use the letter templates we’ve provided for you for free below. The CFPB also provides sample letters and instructions on how to write to credit bureaus and information furnishers on its website.

Here’s a sample to base your letter off of:

[Your name]

[Your account number]

[Your date of birth]

[Your address]

[Date]

[Credit bureau name]

[Credit bureau address]

Dear [credit bureau name],

I am writing to dispute the following information that appears on my [credit bureau name] credit report:

- Account number: [. . .]

- Date associated with this item: [. . .]

- Explanation of item being disputed: [e.g., I paid off this account with ABC Bank in full by the due date so it should not appear on my credit report as delinquent. Please update my report to show it was paid in full.]

I have enclosed the following documents to support my dispute:

- [e.g., a copy of my credit report]

- [e.g., a billing statement from my creditor]

- [e.g., a letter from my creditor confirming when this debt was paid in full]

Please contact me if you need any additional information to correct this error. Thank you for your assistance with this matter.

Sincerely,

[Your name]

How do you find errors on your credit report?

You find errors on your credit report by checking your report and monitoring your credit regularly.

By law, you can check your credit report from each credit of the major credit bureaus once a year for free. You can access your free credit report at AnnualCreditReport.com. Because of the COVID pandemic, the three major credit reporting bureaus (Experian, Equifax and TransUnion) continue to offer free credit reports weekly through the end of 2023. [8]

If you find information that you think is wrong or incomplete on a credit report from one credit reporting agency, check your credit reports from the others to see if they show the same.[5]

Will disputing information impact my credit score?

Filing a dispute itself won’t impact your credit score, but if the outcome influences the data in your credit report, your credit score might be affected. Whether it causes your score to increase, decrease or stay the same depends on what information is disputed and how it’s resolved.[1]

For example, removing an incorrect late payment may impact your score because your payment history is a factor in how your credit score is calculated. However, updating your personal information (for example, to correct a typo) is unlikely to affect your score.

Where do you send your credit dispute letter?

Whether you’re sending a credit dispute letter to a credit bureau or to an information furnisher (like your bank, credit union, or credit card company), it’s best to send it by certified mail and ask for a return receipt. That way, you have a record that the letter was received.[2]

We’ve listed the contact information, including the mailing addresses, for the three major credit bureaus below, along with links to the forms you’ll need to complete and include to file a dispute with each.

If you’re also writing to the information furnisher and can’t find a dispute address on your credit report or online, be sure to contact them directly to ask for the correct address to send your dispute letter to.[9]

Experian

Here’s how to contact Experian to initiate a dispute:

Address:

P.O. Box 4500

Allen, TX 75013

Online: Experian online disputes

Phone: 888-397-3742[10]

Download the Experian dispute form.

Equifax

Here’s how to contact Equifax to initiate a dispute:

Address:

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374-0256

Online: Equifax online disputes

Phone: 888-378-4329[11]

Download the Equifax dispute form.

TransUnion

Here’s how to contact TransUnion to initiate a dispute:

Address:

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

Online: TransUnion online disputes

Phone: 800-916-8800[12]

Download the TransUnion dispute form.

How long does it take to dispute errors on your credit report?

Once you’ve filed a dispute with a credit bureau, the dispute process can take about a month. The bureau has 30 days to investigate it or up to 45 days if it’s a reinvestigation.[7], [9] The credit bureau can stop investigating the dispute if they consider your request to be “frivolous” or “irrelevant.” For example, they may deem your dispute irrelevant if you didn’t include enough supporting documentation or filed multiple disputes for the same issue. If they stop investigating your dispute, they need to notify you and explain why.[9]

What happens after you submit the dispute?

When you send a dispute letter to a credit bureau, the credit bureau and the company that provided the disputed information communicate. If the information furnisher finds that the information they reported is incorrect or incomplete, they must notify all three credit bureaus to correct your credit files.[9]

The credit bureau must, in writing, send you the results of your dispute. If the dispute leads to a change in your credit report, they also have to give you a free copy of your report, which doesn’t count as your free annual credit report.[9]

The credit bureau also has to send notices of the correction to anyone who received your credit report in the past six months. You can also ask them to send it to anyone who got a copy for employment purposes in the past two years.[9]

When you send a letter to the company that provided the information, they must let the credit bureau know it supplied the information being disputed, and the bureau must add a notice to your file. If the information furnisher finds the disputed information to be incorrect or incomplete, they’re obligated to tell the credit bureau to update or remove the information from your credit report.[9]

What should you do if the investigation doesn’t resolve your dispute?

If the investigation doesn’t resolve your dispute, you can ask for a statement of the dispute to be included in your credit file and summarized in future reports. You can also request that they send the statement to anyone who recently received a copy of your report, but the credit bureau may charge a fee to do this.[9] This only applies to disputes submitted to credit bureaus, not to disputes submitted only to information furnishers.[13]

Why is it important to correct errors on your credit reports?

Correcting errors on your credit reports ensures that the information accurately represents your credit history, and that you get an accurate credit score since scoring models base their score on information contained in your report. Whether it’s on-time payments or accounts in good standing, it should be reflected accurately in your credit report. At the same time, you shouldn’t get dinged for negative items that aren’t yours.

Inaccuracies on your credit report can affect whether you can apply for different types of credit, from credit cards to loans and mortgages, as well as whether you can get a job, a place to live or insurance.[9] Credit report errors can also be indicators of identity theft, which could harm both your credit and your finances overall.[9]

Taking steps to improve your finances can feel scary, especially when it’s something major like filing a credit report dispute. But in the end, you’ll be glad you did. Your credit report is important — it shows potential lenders how you handle your accounts, and helps them assess if you’re likely to repay what you borrow — so keeping it accurate is crucial.

And if you need help navigating credit, Self is here to support you with tools and resources every step of the way.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Experian. “Can Disputing Credit Report Inaccuracies Lower Credit Scores?” https://www.experian.com/blogs/ask-experian/can-disputing-credit-report-inaccuracies-lower-credit-scores/. Accessed February 2, 2023.

- Consumer Financial Protection Bureau. “How do I dispute an error on my credit report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed February 2, 2023.

- Consumer Financial Protection Bureau. “Sample letters to dispute information on a credit report,” https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/sample-letters-dispute-credit-report-information/. Accessed February 2, 2023.

- Consumer Financial Protection Bureau. “What are common credit report errors that I should look for on my credit report?” https://www.consumerfinance.gov/ask-cfpb/what-are-common-credit-report-errors-that-i-should-look-for-on-my-credit-report-en-313/. Accessed February 2, 2023.

- Equifax. “Can You Remove Negative Information from Your Credit Reports?” https://www.equifax.com/personal/education/credit/report/removing-negative-information-from-credit-report/. Accessed February 2, 2023.

- myFICO. “Chapter 7 & 13:How long will negative information remain on my credit report?” https://www.myfico.com/credit-education/faq/negative-reasons/how-long-negative-information-remain-on-credit-report. Accessed February 2, 2023.

- Federal Trade Commission. “Fair Credit Reporting Act,” https://www.ftc.gov/system/files/ftc_gov/pdf/545A-FCRA-08-2022-508.pdf. Accessed February 2, 2023.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed February 2, 2023.

- Federal Trade Commission. “Disputing Errors on Your Credit Reports,” https://consumer.ftc.gov/articles/disputing-errors-your-credit-reports. Accessed February 2, 2023.

- Experian. “Fraud FAQs,” https://www.experian.com/blogs/ask-experian/credit-education/preventing-fraud/fraud-faqs/. Accessed April 25, 2023.

- Equifax. “How to Dispute Credit Report Information By Mail,” https://www.equifax.com/personal/help/mail-in-credit-report-dispute/. Accessed February 2, 2023.

- TransUnion. “Dispute Your Credit Report by Mail or Phone,” https://www.transunion.com/credit-disputes/dispute-your-credit/mail-or-phone. Accessed February 2, 2023.

- Consumer Financial Protection Bureau. “What if my dispute is ignored or I disagree with the results of a credit report dispute?” https://www.consumerfinance.gov/ask-cfpb/what-can-i-do-if-i-disagree-with-the-results-of-a-credit-report-dispute-en-1327/. Accessed February 2, 2023.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).