What to Do If You’re Denied a Secured Credit Card?

Published on: 12/28/2022

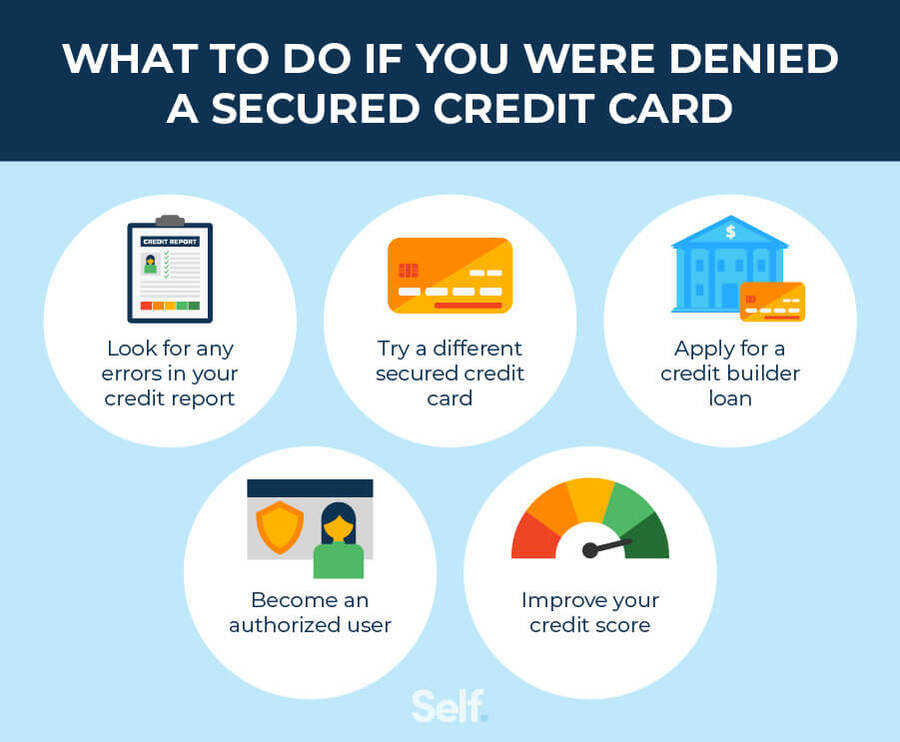

If you were denied approval for a secured credit card, you can take a number of steps to improve your chances of being accepted in the future.

If you have poor credit, you can use a secured credit card to build credit. You back these cards by making a cash security deposit into a secure certificate of deposit or savings account equal to the card’s credit limit, reducing the lender’s risk. However, not everyone becomes approved for these cards.

You can use the information in this article to understand what options you may have to access a secured credit card even if you have been previously denied.

Why your secured credit card was denied

If you’ve been rejected for a secured card, the credit card issuer should have sent an adverse action notice explaining why you don’t qualify.[1] The following sections explain some common reasons you can be denied.

Unable to verify identity

In some cases, your application could be rejected simply because the card issuer was unable to verify your identity or address. Make sure to check whether you mistyped information, changed your address or failed to include other pertinent new personal information such as a legal name change.

Negative items on your credit report

A credit card company may deny your application because of negative items on your credit report or a history of financial issues[2] such as:

- Bankruptcy

- Repossessions or foreclosures

- Debt collections

- Late payments on loans or credit cards

Inability to meet the income requirement

Some financial institutions may have an income requirement that must be met for certain applicants. This can help reassure creditors who may question your ability to repay a debt, especially if you have a poor credit history and are considered a high risk.

What to do if your application was denied

If your application was denied, you may have options for moving forward. The following sections help you consider which options work for your situation, such as working to improve your credit score, applying for a different secured card, or checking out a credit builder loan.

Look for any errors in your credit report

One of the first things you should probably do is check your credit report for any errors that might occur. You can order free credit reports from each of the three major credit reporting bureaus through annualcreditreport.com. If you want to check it more than annually, you can also order a separate copy from each of the three major credit bureaus (Equifax, Experian, and TransUnion, and they cannot, by law, charge you more than $13.50 for a report.[3] If you find errors, you can dispute them; doing so successfully may improve your credit score.

Become an authorized user

If you have a family member or trusted friend with good credit, you can ask that person whether they’d be willing to add you to their credit card account as an authorized user. An authorized user can make purchases on this credit account if they are given a credit card, but only the primary cardholder is legally responsible for making payments.

Make sure that the primary cardholder has a record of on-time payments and a low credit utilization rate (CUR, the total of your revolving credit balances divided by the credit limit of those revolving accounts). If they have a high CUR or negative payment history, it may hurt your credit score.

You may see this process referred to as “piggybacking” on another person’s credit. When you become an authorized user, the account goes on your credit report as long as the card issuer reports authorized users. If the account has on-time payments and a low CUR, it may help you to build your credit until your credit score is good enough to qualify for a secured credit card.[4]

Try a different secured credit card

If you’ve been declined due to negative information in your credit report, wait at least three to six months before applying for another secured credit card. Too many applications submitted within a short period of time can damage your credit. So allow yourself as much time as you can before applying again and use that time to understand and address what it may take to get approved the next time. While you’re waiting to apply for another card, research different secured credit cards that may better fit your credit profile so that you can apply to the one that is best for your financial situation.[5]

Apply for a credit builder loan

A credit builder loan, offered by banks, credit unions or through Self, allows you to improve your credit without a credit card. Specifically designed to build credit, you don’t get your money when you’re approved for the loan. Instead, the lender holds the loan amount in a secure bank account or certificate of deposit to be released to you once you’ve paid off the loan, minus interest and fees. Lenders report your on-time payments to the credit bureaus, allowing you to build credit. Be aware lenders will also report late payments so be sure to pay-on time in order to improve your score. Also, not every lender reports to all three bureaus. Make sure to understand which bureaus your lender reports to and find a lender that reports to all three if possible.

Pay bills on time

Your payment history makes up the biggest factor in your credit score for FICO® scores[6] as well as VantageScore® models[7]. For whatever bills you do have that get reported to the credit bureaus — revolving credit as well as installment loans — on-time payments impact your credit score the most. If you do have missed payments, do your best to bring them current because paying your bills on time may help your score and show lenders that you pay back what you owe.

If you struggle to make payments on time, consider trying one or all of the following:

- Use automatic payments. Scheduling automatic payments can help make sure you pay your bills on time, provided you have the cash in your bank account to do so.

- Pay down your bills. Having bills looming can make paying them off feel overwhelming. So prioritize the bills by following the snowball method or avalanche strategy for paying down debt. With these strategies, you focus on paying off smaller debts first (snowball) or debts with the highest interest rate (avalanche).

- Budget for your bills. Budgeting gives you a plan. If you can set up a plan that sets aside money each month for your bills, you know where your money is going and how much you have to spend to pay down existing debt.

How much is a secured credit card deposit?

The amount of money you deposit in a secured credit card account can vary widely. Generally, deposits can be as little as $200 and as much as $2,500. If you want to be approved for more available credit, you typically need to put more money in the account to secure it.[8]

Try the secured Self Visa® credit card

Self offers an innovative approach to secured cards with its secured Self Visa® credit card. To be eligible for this secured card, follow these steps:

- Sign up for the Self Credit Builder Account. It’s a loan in a bank-held Certificate of Deposit (CD) that you pay off in monthly installments. This credit builder loan differs from a traditional loan. You don’t get a lump sum of money upfront. Instead, after you make all the loan payments, you get the savings you built, minus interest and fees. The payments also get reported to the credit bureaus to help you build credit while you build savings.

- Make three, on-time monthly payments.

- Have $100 or more in your Credit Builder account savings progress to secure your card and set your limit.

- Have your account in good standing.

- Not previously having the Self Visa ® credit card

You can use your Self credit card wherever Visa credit cards are accepted.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- Experian. “What Is an Adverse Action Letter?,” https://www.experian.com/blogs/ask-experian/what-is-an-adverse-action-letter/. Accessed May 5, 2022.

- Investopedia. “Negative Information,” https://www.investopedia.com/terms/n/negative-information.asp/. Accessed May 5, 2022.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed August 18, 2022.

- Forbes. “How Credit Card Piggybacking Works,” https://www.forbes.com/advisor/credit-cards/how-credit-card-piggybacking-works/. Accessed May 5, 2022.

- Experian. “How Long to Wait Between Credit Card Applications,” https://www.experian.com/blogs/ask-experian/how-long-to-wait-between-credit-card-applications/. Accessed April 25, 2022.

- MyFICO. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed August 18, 2022.

- VantageScore. “ The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed August 18, 2022.

- CNBC. “Everything you need to know about getting a secured credit card,” https://www.cnbc.com/select/how-secured-cards-work/. Accessed April 25, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).