Personal Finance Blog

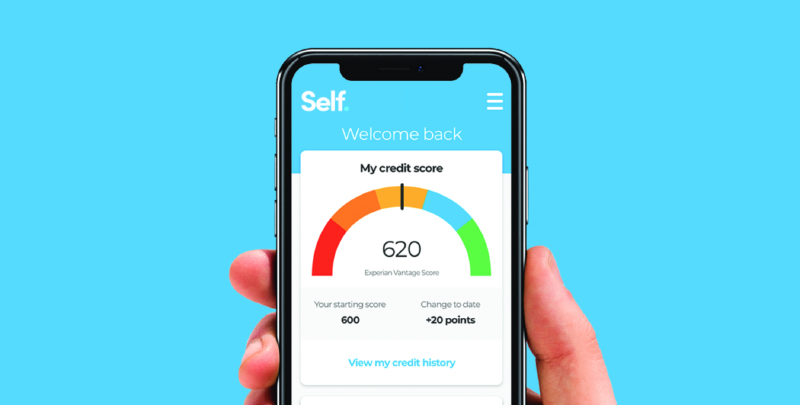

Can I Pay My Self Loan Off Early?

Can I Pay My Self Loan Off Early?November 28, 2025

Here's what you need to know if you want to pay your Self Credit Builder Account off early, straight from our experts. Read more.

How to Apply for a Credit Card Without Affecting Your Credit Score

How to Apply for a Credit Card Without Affecting Your Credit ScoreNovember 26, 2025

It is possible to apply for a credit card without it affecting your credit score, here are some important things you should know. Read more.

25 Facts About Credit and Credit Scores

25 Facts About Credit and Credit ScoresNovember 24, 2025

We’ll explain 25 facts about credit and credit scores to clarify any misconceptions and help you understand what it impacts. Read more.

Does Breaking a Lease Hurt Your Credit?

Does Breaking a Lease Hurt Your Credit?November 20, 2025

If you satisfy the terms of your lease, breaking it won’t affect your credit unless unpaid rent is reported to the credit bureaus or sent to collections. Read more.

Earned Wage Access: Self Cash

Earned Wage Access: Self CashNovember 19, 2025

If you need access to a cash advance to pay for an unexpected expense, Self Cash offers cash disbursements without needing a credit check. Read more.

Do Evictions Show Up On Credit Reports?

Do Evictions Show Up On Credit Reports?November 17, 2025

Evictions do not show up on credit reports. Here is everything to know about how they affect your credit score and how long they stay on your records. Read more.

Does Paying the Minimum Hurt Your Credit Score?

Does Paying the Minimum Hurt Your Credit Score?November 14, 2025

Making the minimum credit payment avoids late fees but may lead to higher utilization, which can affect your credit score. Read more.

What Credit Score Do You Need to Lease a Car?

What Credit Score Do You Need to Lease a Car?November 12, 2025

There’s no specific minimum credit score requirement to lease a car. Your approval requirements can vary from dealership to dealership. Read more.