Debt

What Is A Balance Transfer and How Does It Work?

What Is A Balance Transfer and How Does It Work?October 2, 2022

What is a balance transfer? Find out how it works, its benefits, and when to consider using one to reduce credit card debt. Read more.

What Your Zodiac Sign Says About Your Spending Habits

What Your Zodiac Sign Says About Your Spending Habits September 26, 2022

Everything from a person’s upbringing to their current situation plays a role in their financial journey, but we’ve decided to take it a step further and look to the stars for some clarity when it comes to our spending habits. Read more.

How To Pay Your Credit Card Bill

How To Pay Your Credit Card BillSeptember 21, 2022

We'll explain how to pay your credit card bill in multiple ways, what to do if you have credit card debt, and how to automate your credit card payments. Read more.

Reasons To Avoid A Long-Term Auto Loan

Reasons To Avoid A Long-Term Auto LoanSeptember 6, 2022

Long auto loans can seem smart since you're lowering your monthly payment, but be careful. We'll explain the risks and benefits of long-term auto loans. Read more.

How To Deal With Debt Collectors

How To Deal With Debt CollectorsAugust 26, 2022

It’s important to know how to deal with debt collectors when they contact you, what your rights are, and what to do if you can’t pay your debt right away. Read more.

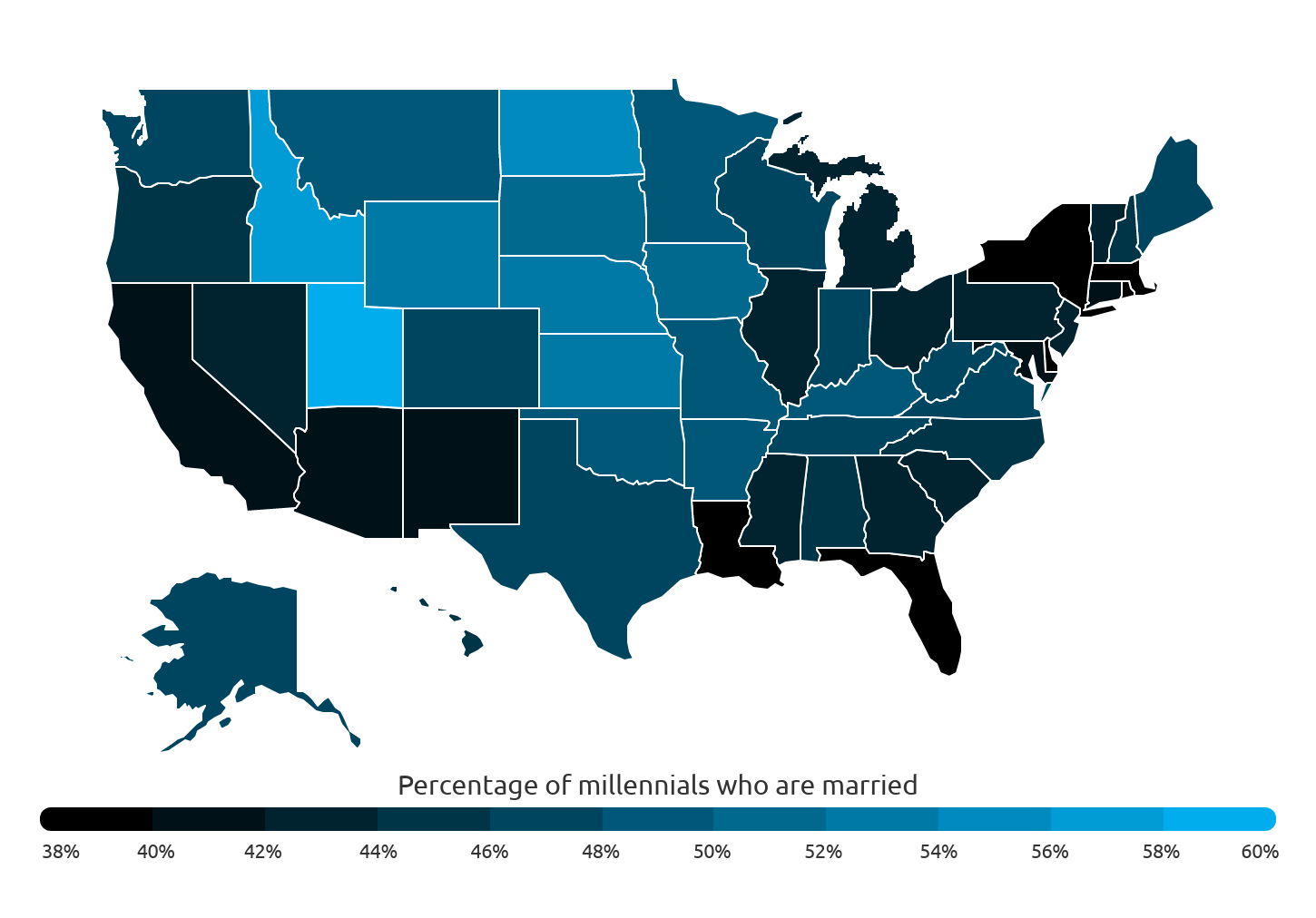

Cities Where Millennials Are Getting Married

Cities Where Millennials Are Getting Married August 18, 2022

With a host of factors correlating to millennials’ marital status, marriage rates for the generation also vary by geography. Here are the metros with the highest millennial marriage rates. Read more.

What Is a Billing Cycle and Can You Change It?

What Is a Billing Cycle and Can You Change It? August 16, 2022

A billing cycle is the period of time between the last billing statement and the current statement. We'll explain how it works and how it impacts you. Read more.

Should I Pay Off Debt or Save Money First?

Should I Pay Off Debt or Save Money First?August 3, 2022

It's tough to decide whether to pay off debts or save money first, but we've got some insights to help you make the best choices for your financial future. Read more.